KGrif

On the twentieth of October, Hawaiian Airways (NASDAQ:HA) introduced that it reached an Air Transport Providers Settlement or ATSA with Amazon (NASDAQ:AMZN). By some business followers, this was seen as a stunning transfer. On this report, I’ll talk about why this transfer is smart but additionally why it has some unlucky components for buyers together with timing.

The Settlement Define

An excellent start line is that below the ATSA, Hawaiian Airways will present crews and upkeep for as much as ten Airbus A330-300 transformed freighters. These jets are owned by Amazon and will likely be subleased and operated by Hawaiian Airways for which it should obtain a compensation that consists of a month-to-month fastened payment per plane, a compensation per block hour and a compensation per departure. Relying on the wants of Amazon, extra plane might be added and the settlement may be prolonged past the present eight years which are agreed on. The ten plane will likely be added over the course of 2023 and 2024.

Diversification of Operations for Hawaiian Airways

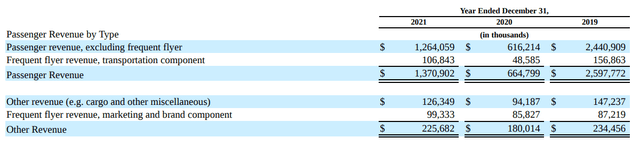

Hawaiian Airways revenues (Hawaiian Airways )

Hawaiian Airways is an airline with a particular enterprise case. Its prime goal is to attach Hawaii with the world and try this profitably. In that sense, Hawaiian Airways is similar with Emirates that connects Dubai to the world. Variations, nevertheless, additionally exist as Dubai is a transit-hub and sticking to the reality the corporate at occasions has not cared a lot about profitability placing its connecting perform on the prime of the precedence record.

Throughout the pandemic, Hawaiian Airways realized a lesson as did many different airways. The corporate will depend on tourism with robust markets within the Asia-Pacific area and through the pandemic these income streams dried up. Passenger income dropped from $2.6 billion to $664.8 million, and it wasn’t till just lately when Japan began easing journey restrictions that issues began to look considerably higher for Hawaiian Airways for the long term. As fleets have been grounded, the stomach cargo income stream additionally dried up partially offset by greater charges on cargo that was nonetheless being transported. In 2021, cargo revenues have been up $19.9 million however down $1.1 million in comparison with pre-pandemic ranges.

So, the lesson that Hawaiian Airways realized is that diversification gives some stability and stomach cargo is just not at all times accretive to that stability and different areas akin to dedicate freighter operations must be thought of. Whereas an actual income is just not given the wording from the 8-Okay counsel that the income potential for the 8-year settlement is round $1.8 billion:

Future vesting relies on funds to be made by Buyer Mum or dad or its associates both below the ATSA or usually with respect to air cargo or air charters, excluding business passenger service (“Certified Funds”), as much as $1.8 billion of Certified Funds within the combination.

Why Accomplice With Amazon?

So, diversification performs an necessary position for Hawaiian Airways to even think about doing this. The corporate believes it has been chosen by Amazon due to its on-time efficiency and I do imagine that with important expertise working the Airbus A330-200, they’re effectively positioned to function the Airbus A330-300P2F fleet.

The massive query, nevertheless, is why would you select Amazon as a accomplice. The reply is twofold. The primary cause is that if you happen to have a look at anticipated e-commerce progress, Amazon is your accomplice of alternative actually. The second cause is that this gives a low CapEx alternative to diversify the enterprise. We’ve seen different airways leaping on the cargo hype through the pandemic prettying up a cargo fleet, however that leaves you with the CapEx for these plane and all associated market fluctuations.

The partnership with out the CapEx burden ought to present extra streamlined revenues and margins as value objects akin to gasoline and sublease prices are basically handed via to Amazon. In some sense that gives stability to the enterprise and shields margins considerably. The CapEx that can principally be to strengthen upkeep capabilities and tooling and arrange a crew base on mainland US.

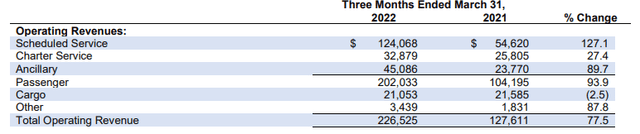

Solar Nation Airways outcomes (Solar Nation Airways)

The outcomes of Solar Nation Airways, which additionally flies for Amazon does present the steadiness of the cargo enterprise being simply reasonably decrease despite the fact that there have been main value and topline fluctuations if the airline could be absolutely uncovered to the market dynamics. Solar Nation Airways presently derives round 10% of its income from cargo. It’s too early to know what the Hawaiian Airways will likely be, however the income stability pushed by passthrough components, sustained demand and progress for e-commerce over the long term gives for a compelling diversification for Hawaiian Airways.

Shareholders Are Paying The Package deal

What ought to be saved in thoughts is that in terms of corporations of scale, it’s unlikely that they will be offering you with a serious margin alternative. That signifies that if Hawaiian Airways desires to make it work, they actually need to execute extraordinarily effectively on their dedication and price plans, which may in the end appeal to extra enterprise and produce prices down even additional. Both method, Amazon is a dream accomplice if you happen to have a look at the prospects of e-commerce however as a celebration that’s attempting to manage logistics prices, they is likely to be a troublesome social gathering to please.

What I discover considerably odd is the timing of the announcement. Hawaiian Airways shares posted a 8.88% acquire after it made the partnership with Amazon public and that’s all good and stuff, however one may wonder if this was the perfect time to announce it. The outlook for airways is usually good as I’ve been seeing within the recent earnings season and whereas I imagine the Amazon settlement will likely be good for the inventory, what I’m not liking so much is that Amazon additionally has been given 9.4 million warrants of which 6.3 million warrants are valued at $14.71, which is already 4.2% below right now’s market value. Not an enormous low cost, however Amazon is given a chance to purchase shares in actually low cost and for the reminder of the three.15 million warrants, a 30-day transferring common at October 2025 or the consummation of the primary tranche of shares is finalized. Hawaiian Airways presently has 51.4 million shares excellent, and basically issuing warrants to Amazon will dilute shareholders by as a lot as 18%.

Not directly, that is an unlucky arrange as a result of shareholders get diluted as warrants are vested and exercised and it places Amazon able of being the client in addition to the consumer. They’ve curiosity in shopping for shares at a low value and protecting costs on their contracts low. One can result in the opposite and with that in thoughts it’s not a arrange I’d be very pleased with. In some sense, there’s a $1.8 billion income potential and Hawaiian Airways is paying Amazon, its buyer, to unlock that potential by diluting shareholders. If share costs roughly double to $30 per share, for $950 million in revenues Amazon may train over $187 million value of warrants and in the end personal 15% of the corporate. Amazon is understood for taking stakes in its logistics companions and not directly they’re aligned of their goals, however I’ve a tough time seeing why taking a 15% stake on the expense of present shareholders is an effective factor because it offers Amazon extra energy in negotiations for observe up agreements and contracts.

Conclusion: Massive Alternative For Hawaiian Airways Inventory, Amazon Has The Scale Leverage

I do imagine that this might in the end be a very good transfer for Hawaiian Airways, however the alternative for Amazon to accumulate inventory is just not essentially good for buyers who might be diluted by 18% that means that to ensure that this to be actually a very good transfer for buyers the contribution to earnings ought to exceed the speed of dilution.

For Amazon inventory, I don’t see main value actions however this settlement suits in a broader try to maintain a diversified logistics chain wherein it makes an attempt to maintain prices down and placing your eggs in numerous baskets making each social gathering compete for contracts and possibilities of warrant train helps Amazon pushing down the costs.