Leon Neal

Thesis

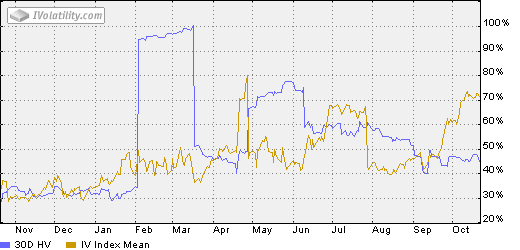

Meta Platforms (NASDAQ:META) is scheduled to announce its Q3 earnings report (“ER”) after market shut on Wednesday, October 26, 2022. Traders are already on the sting given the turbulence surrounding the inventory, and the anticipated ER has despatched its implied volatility (“IV”) within the choices market to be close to a 52-week peak as you may see from the next chart. Its present IV (the orange line) shouldn’t be solely near a 52-week peak however has already diverged considerably from 30-day historic volatility (the blue line).

Supply: IVolatility.com

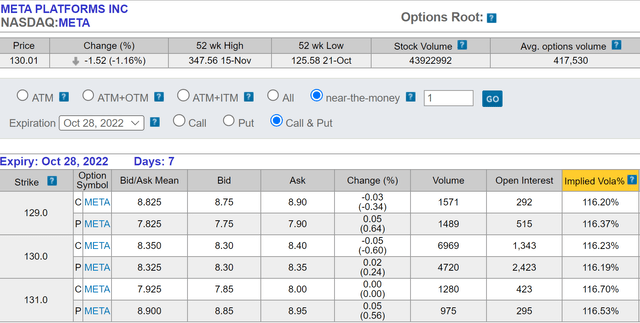

Such heightened volatility has created a possibility to purchase the shares at $122 or receives a commission 6.4% in a single week (by Oct 28, 2022) as you may see from the subsequent chart beneath. Its Oct 28, 2022 put possibility with a $130 strike value is now buying and selling round $8.32 (which interprets into 6.4% of $130). So should you write such a put and the inventory value rises above $130 on Oct 28, then the put possibility expires nugatory and you’d have the ability to make 6.4% in a single week, not a foul return for a short-term commerce.

Alternatively, if the inventory value dips beneath $130 on Oct 28 the put is exercised, you then would successfully purchase the inventory at about $122 ($121.68 to be exact = $130 – $8.32). And subsequent, you will note that such an entry value is an efficient deal for long-term holding too.

Supply: oic.ivolatility.com

Lengthy-term development projection

As detailed in my weblog article, the long-term development charge of our enterprise is ruled by two components solely – ROCE (return on capital employed) and reinvestment charge. Extra particularly,

Lengthy-term development charge = ROCE * Reinvestment Price

And subsequent, we are going to discover out each parameters one after the other. First, let’s analyze its ROCE. For a enterprise like META, as detailed within the article, I thought-about the next objects capital really employed:

Working capital, together with payables, receivables, stock. These are the capitals required for the every day operation of their companies. Gross Property, Plant, and Gear. These are the capitals required to really conduct enterprise and manufacture their merchandise. Analysis and growth bills (a necessary expense for a enterprise like META).

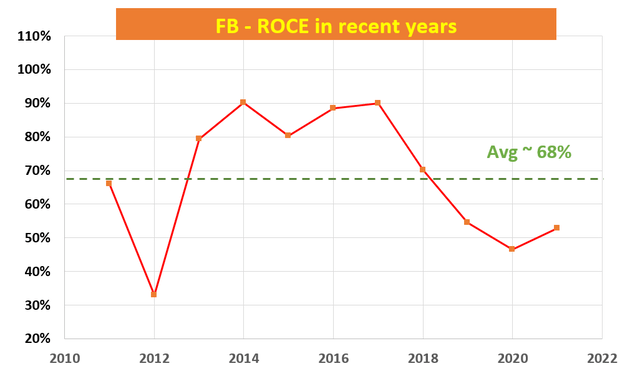

Primarily based on the above concerns, META’s ROCE over the previous 10 years is proven beneath. As might be seen, its ROCE was at an impressively excessive stage from 2014 to 2017, hovering between 80% to 90%. Then as competitors intensified and development slowed, its ROCE declined to the present stage of round 55%. All informed, its long-term common ROCE is 68%. And in tandem with its ROCE decline lately, its valuation plummeted. Nonetheless, the best way I see it, the market overacted to its ROCE decline. To place issues in perspective, the ROCE of the FAAMG group is roughly 50%~60% lately. And a 68% common ROCE is nothing to be sneered at.

Supply: writer and Looking for Alpha.

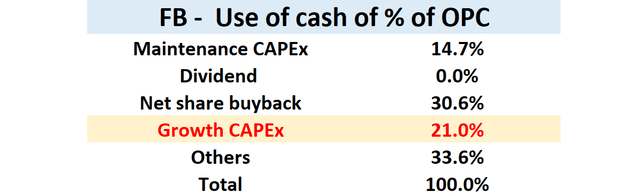

Subsequent, let’s take a look at its reinvestment charge. The following desk summarizes my evaluation of how META has been allocating its natural earnings (approximated by its OPC, working money) within the current 3 years. Its largest use of OPC has been share repurchases, on common with 31.8% of the OPC. Additionally notice that its upkeep CAPEX is sort of low, solely 15.1% of its OPC. All informed, my evaluation exhibits that its reinvestment charges have been on common 21.0% lately. A 21% reinvestment charge is pretty excessive amongst mega-caps such because the FAAMG group (whose common reinvestment charge is round 10%). And a big a part of META’s excessive reinvestment charges is pushed by its aggressive bets on varied metaverse initiatives.

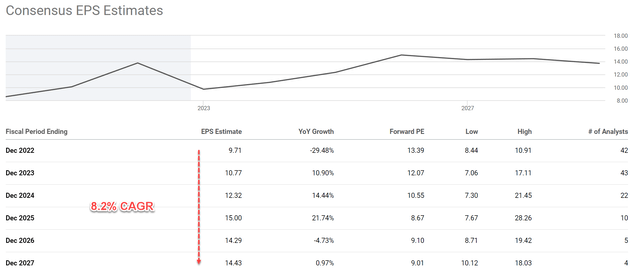

Supply: writer and Looking for Alpha knowledge.

With the mixture of a 68% ROCE and 21.0% reinvestment charge, it could possibly preserve an annual development charge of 14.3% organically (68% ROCE * 21.0% reinvestment charge = 14.3%). In fact, META almost certainly wouldn’t have the ability to preserve 21% reinvestment charges for the long term and can dial again sooner or later. Nonetheless, even with a mean 10% reinvestment charge like different mega-caps, its long-term development charge could be nonetheless 6.8% (68% ROCE * 10% reinvestment charge = 6.8%). The precise development charge must be someplace in between, as mirrored within the following consensus estimates. As you may see from the next chart, the consensus estimates are projection an ESP development from $9.71 in 2022 to $14.43 in 2027, translating right into a CAGR of 8.2%.

Supply: writer and Looking for Alpha knowledge.

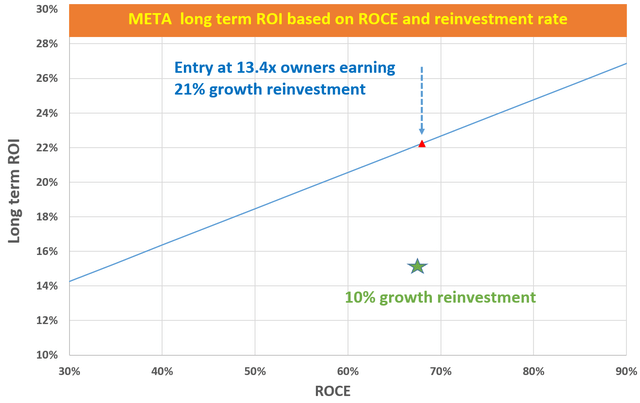

Lengthy-Time period Return

So now let’s see what our return potentials could be if we get to be long-term holders with an entry value close to $122 if the put possibility is exercised upon us. As additionally detailed in my weblog article, our long-term return on funding (“ROI”) is just the sum of two components: the proprietor’s incomes yield after we made the funding (“OEY”), and the long-term development charge (“LTR”) we simply estimated above. That’s:

Longer-Time period ROI = OEY + PGR

For the OEY, I’ll simply use its EPS as a crude and in addition a conservative metric for the proprietor’s earnings. It’s conservative within the sense that the proprietor’s earnings needs to be EPS plus the portion of development CAPEx). Its consensus estimate EPS is $9.71 as aforementioned. At an entry value round $122, the OEY is ~7.96% ($9.71/$122 = 7.96%, or equal to a 12.56x PE). With this, the subsequent chart places each items collectively and exhibits my return projections. The important thing takeaways are:

On the present reinvestment charge stage of 21%, the whole return potential could be over 20% each year (22.2% to be extra actual), consisting of 14.3% of development and seven.9% OEY as aforementioned. Within the case of a normalized reinvestment charge of 10%, the whole return potential would nonetheless be almost 15% each year, consisting of 6.8% of development and seven.9% OEY.

Supply: writer and Looking for Alpha knowledge.

Dangers and ultimate ideas

There are many dangers surrounding META within the near-term starting from macroeconomic components (akin to inflation and geopolitical dangers) and in addition company-specific dangers akin to competitors and regulatory dangers. These dangers have been eloquently mentioned by different SA authors already and I would not repeat them right here anymore.

As an alternative, let me simply say a number of phrases about using choices itself, notably the writing possibility technique talked about on this article. Not less than in principle, there may be at all times a danger that the inventory value goes to zero, however you continue to have to purchase the shares at $122 should you write places. Additionally, the writing technique I discussed right here relies on the belief that you simply write COVERED choices. For those who write uncovered (aka bare) choices, then your danger/return calculus would change relying on the particular phrases of trades (just like the margin charges et al).

To conclude, traders’ nervousness about META’s near-term points and its incoming ER has brought on immense surges in its implied volatility. At the moment, its IV is barely near its 52-week peak however has already diverged considerably from 30-day historic volatility. Particularly, its near-the-money put possibility with Oct 28, 2022 expiry now presents a possibility to purchase the shares at $122 or receives a commission 6.4% in a single week. Such a possibility needs to be engaging each for short-term merchants (to earn 6.4% in a single week) and in addition long-term holders (with potential returns projected within the 15% to twenty%+).