HappyKids/E+ through Getty Pictures

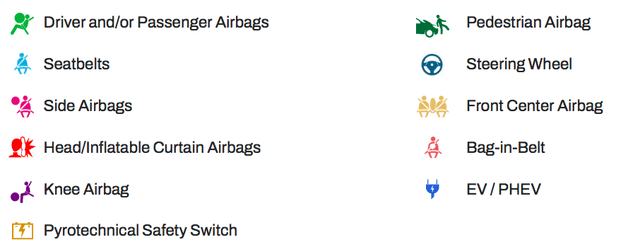

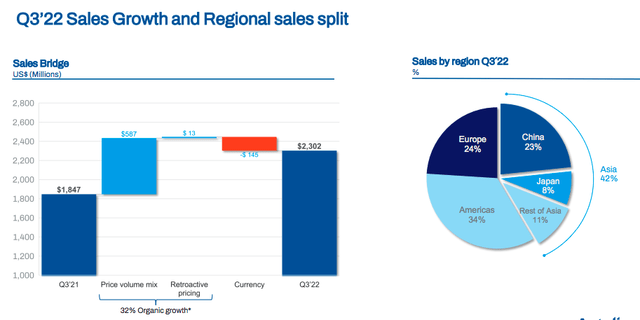

Autoliv, Inc. (NYSE:ALV), by means of its subsidiaries, is the world’s largest provider of automotive security options. The corporate engages its actions in researching, growing, manufacturing, and supplying key merchandise comparable to airbag and pedestrian safety programs, seatbelts, anti-whiplash options, and steering wheels (Fig 1). Autoliv’s predominant purchasers are automobile producers. The corporate is export-oriented with a really diversified GEO publicity (fig 2). It was based in 1953 and is headquartered in Sweden.

Autoliv’s product providing (Autoliv Q3 presentation (Fig 1))

Autoliv’s GEO gross sales (Autoliv Q3 presentation (Fig 2))

Why Are We Constructive?

Regardless of decrease automobile manufacturing, Autoliv is gaining market share. For security merchandise, our main participant stands at virtually 50% of the trade’s security new orders. Given its high quality product, no main recollects within the final 10 years, and its relationship with all the worldwide automobile producers, we estimated that Autoliv’s positioning could be very defensive; Associated to level 1), this was bolstered throughout Autoliv’s Capital Market Day in 2021 when the highest administration highlighted that EVs penetration is increased than the earlier product choices on the ICE degree; Vehicles are evolving however there are not any disruptive modifications in security necessities. Alternatively, EMs requirements are aligning with DMs, due to this fact, regulatory necessities can be a key supportive catalyst for the Swedish firm; Having lately printed its Q3 numbers, Autoliv was in a position to go by means of uncooked materials inflationary strain with increased promoting costs (which completely offset FX and volumes growth); During the last years (contemplating additionally the Veoneer spin-off), the corporate was in a position to generate vital free money movement and deleverage its stability sheet.

On the adverse notes, we report the next:

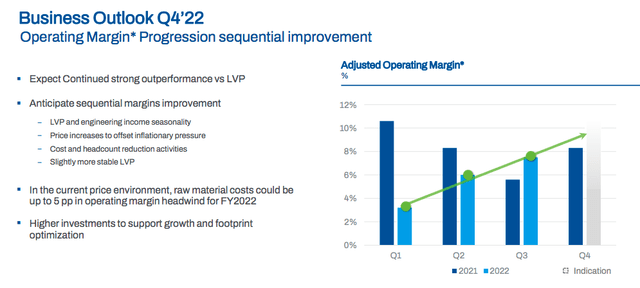

Prime-line gross sales shut automobile manufacturing and the next earnings cyclicality. Provide chain constraints and the semis disaster have positively not performed any favor to the trade. Contemplating the subsequent recession, we’re not forecasting any gross sales rebound; We like Autoliv’s EBIT margin goal; nonetheless, the corporate’s margin has not performed out and continues to be been postponed. With the intention to preserve this premium valuation versus the comps, our inside group believes that Autoliv wants to point out some tangible leads to the next quarters (Fig 3); There are some buyers which might be questioning in regards to the firm’s long-term demand. Product security necessities at this time versus autonomous driving tomorrow. Right here on the Lab, we anticipate no modifications in regulation; Autoliv has important FX publicity with a reporting system in USD however virtually 75% of its turnover shouldn’t be denominated in USD. Essential to notice that the corporate shouldn’t be hedging FX publicity. In line with our calculations, a 1% appreciation in USD vs € led to a lower of 30 foundation factors in turnover and working revenue margin; Other than the FX, 50% of gross sales are linked to uncooked supplies inflationary strain and commodities comparable to plastics and metal; Autoliv has manufacturing factories in 25 nations positioned in areas with decrease workers prices, however, we should always take into account increased logistics prices that may weigh on the corporate’s future profitability; Evaluate to its closest friends, each day buying and selling quantity shouldn’t be excessive; A big % of the corporate’s workers are members of labor unions; Autoliv’s clients have vital pricing energy and have a tendency to decrease costs year-on-year (by a median discount between 1% and three%). This implied CAPEX investments to enhance effectivity.

Autoliv adj. op. margin (Autoliv Q3 presentation (Fig 3))

Conclusion and Valuation

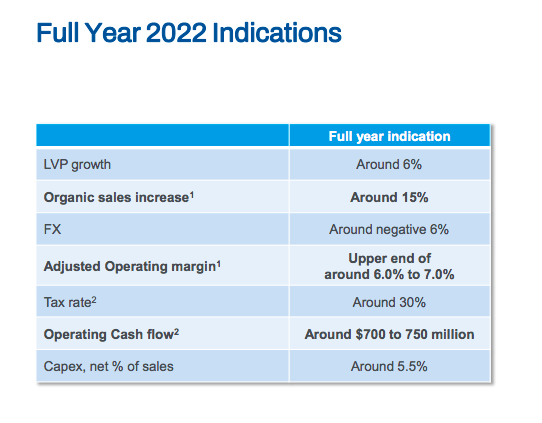

With the most recent firm steering offered through the Q3 outcomes launch, Autoliv’s income development is now anticipated to be within the 15% vary with adverse FX evolution set for five% and adj. EBIT margin near 7%. Making use of an 11.5x P/E ratio (in keeping with the corporate’s ten-year historic common), we derive a goal worth of $81 per share. The corporate continues to be buying and selling at a justified premium in comparison with its closest friends. A constructive catalyst is likely to be OEMs restocking. On the dangers facet, we should always embody international auto manufacturing, increased inflation, and better USD appreciation.

Autoliv YE steering (Autoliv Q3 presentation)