Coupa headquarters in Silicon Valley Sundry Images

Coupa Software program Integrated (NASDAQ:COUP) is the chief within the Enterprise Spend Administration area (BSM). Whereas it competes with the likes of main ERP (Enterprise Useful resource Planning) software program gamers similar to Oracle (NYSE:ORCL), SAP SE, (NYSE:SAP) and Workday (NASDAQ:WDAY), it’s a pure play specializing in Enterprise Spend Administration.

BSM consists of accounts payable administration, provide chain administration, sourcing and procurement amongst different spending and associated features – a complete, outsourced SaaS (Software program as a Answer) managed on Coupa’s platform.

The BSM area has loads of potential to develop – Lucky Enterprise Insights expects the worldwide market to develop at a CAGR of 11% from $15.7Bn in 2022 to $39Bn by 2029

Strengths

Focus and Management

Coupa is the chief within the cost administration area and in contrast to different enterprise software program suppliers with a number of merchandise, focuses and affords the most effective options on this section. Not like the a lot bigger Oracle and SAP with slower development, it has targeted strictly on the spend administration area the place it has grown revenues at an astounding CAGR of 47% from FY2015 to FY 2022. All extra modules, such because the not too long ago launched journey expense administration and different upsells similar to procurement analytics are additionally targeted on BSM.

Community Impact

Coupa has a big community have an effect on. With its greater than 8 Mn suppliers, it makes the platform extra enticing to suppliers and patrons who profit from a wider vary of buying choices. As extra companies subscribe to their BSM platform, the collective spend underneath administration on the platform grows. The better the overall quantity of spend underneath administration the extra enticing the platform is to suppliers. As extra suppliers be part of their platform, their shoppers profit from a broader vary of buying choices, which in flip encourages better use of the platform by current clients, whereas additionally attracting new clients to their platform. This community impact creates great leverage for the corporate and is a big aggressive benefit.

Price Saver

Coupa is marketed and branded as a cash saver – the primary questions CFO’s and Controllers ask…

How a lot can I scale back in Accounts Payable/Accounting headcount? How can I get the most effective procurement? How can I get the most cost effective offers out of my suppliers? How can I get my division heads to remain inside price range? How can we be sure that no funds have been made with out the right approvals?

Coupa’s power is establishing a course of, which ensures that division heads keep inside their budgets and approve buy requisitions, FPA (Monetary Planning and Evaluation) departments reconcile the requisitions towards budgets and Accounting departments processes transactions with controls in place and at last again finish transactions are seamless built-in with accounting software program and reconciled with minimal manpower.

Switching Prices

Final week, I wrote about switching prices between payroll suppliers, stating how painful, costly and time-consuming it was to modify payroll suppliers and that this was an actual moat. I imagine in Coupa’s case it’s much more of a moat, as a result of this can be a company-wide resolution, throughout each division head that approves bills, to FP&A, which budgets for a similar, to accounting that processes the transactions. Coupa has a retention/renewal price of 94-96%, which bears testimony to the success of its platform. Renewals are key to this enterprise, Coupa routinely loses cash within the cash with new clients within the first few quarters with costly onboarding and coaching/service supply.

Bundling and Upselling

Apart from procurement, provider administration and funds, there have been a number of strategic complementary choices for bundling, upselling and cross promoting.

These embrace Provide Chain Design and Planning, Strategic Sourcing, Provider Threat Administration, Treasury, Contract Administration, Journey Bills and Reimbursements, Coupa Pay through digital playing cards, and Spend Evaluation. All efforts to maintain the client with minimal acquisition prices and supply key advantages at affordable costs.

Weaknesses

Inventory Based mostly Compensation Hurts Margins

Whereas Coupa has proven good working leverage with excessive gross contributions of about 75% of on a non GAAP foundation, on GAAP foundation accounting it has a special story to inform. In FY2021 and FY2022, GAAP based mostly gross contributions dropped to 59 and 57% respectively, as in comparison with a median of 66% within the previous 4 years. The overwhelming majority of the distinction was inventory based mostly compensation. Should you’re paying staff extra for onboarding and repair supply, that are the 2 of the biggest elements of value of gross sales, clearly you are hurting your leverage to cowl fastened bills.

That’s, your contributions will not be sufficient to cowl Promoting, Normal and Administrative bills, which additionally consists of R&D. As a consequence, your street to profitability goes to get for much longer. The success of SaaS based mostly corporations will depend on getting sufficient gross or variable margins to cowl fastened prices, specifically R&D, which is their lifeblood – mainly their platform or software program must be sturdy sufficient to generate sufficient margins with out additional personnel assist. And Coupa has not demonstrated that but.

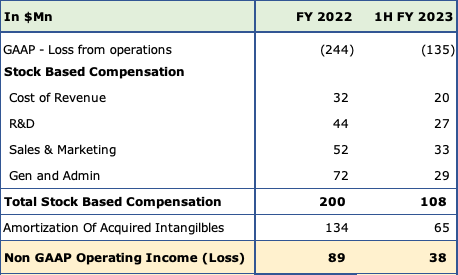

Coupa Inventory Based mostly Compensation (Coupa 10K, 10Q)

Inventory based mostly compensation at $200Mn was 28% of 2022 revenues of $725Mn, and at $135Mn, 27% of $407Mn within the first half of FY2023. The swing from working losses to earnings is sort of massive and whereas that is de rigueur in Silicon Valley amongst tech and different SaaS corporations, the scale is value declaring for these inclined to extra conservative valuations.

Longer Gross sales Cycles

Coupa has a median gross sales cycle of 6-9 months, which is widespread for enterprise software program corporations, however given the slowdown within the tech sector that is more likely to get even longer. Coupa’s objective is get bigger clients who spend $100,000 a yr, and an outlay of this dimension does require lengthy gross sales cycles.

Convertible Debt

Coupa carries $1.6Bn of convertible notes maturing in 2023, 2025 and 2026, which is about 50% of their complete stability sheet of $3.2Bn. With sturdy money flows (greater than 20% of revenues) there isn’t any rapid menace and the enterprise is doing very effectively. Nonetheless, given the recessionary tendencies and slowdown in development there are both potentialities of dilution on conversion or the necessity to increase money ought to the notes not convert.

Dilution

Coupa had 60.4Mn diluted shares excellent as of FY-2019, which ballooned to 75Mn by FY-2022, a dilution of 25% in three years. That is more likely to go up by one other 7-8% this yr to about 80Mn shares.

There was a current Downgrade from Piper Sandler citing among the similar points, that I’ve talked about right here.

Alternatives

Provide chain disruption and or migration out of Asia, may very well be an enormous alternative – I can see Coupa having an edge for 3 causes.

a) They’ve a big database of 8Mn suppliers all around the world, which they will springboard on.

b) They’ve loads of area experience on this space, which is an enormous deal in enterprise software program

c) Spending on ERP shouldn’t be small, you possibly can see that from the 6-9 months gross sales cycles. Getting a buyer to cough up $100,000 every year shouldn’t be straightforward. To make sure, in the event you’re a buyer spending 100K a non spending specialist might not lower it, it might make sense to stick with the specialist or go to the specialist.

Coupa charges a really spectacular 4.6 within the BSM area in keeping with Gartner. SAP is rated 4.3 and Oracle 4.1 in the identical report, with two others getting larger scores at 4.8 and 4.7.

With a recession looming, Coupa’s capacity to avoid wasting shoppers cash must also be a powerful device they will exploit.

Threats

The most important menace to Coupa is an financial slowdown and in any B2B enterprise that is often fairly pronounced. We’re already seeing this with comparatively slower development of 18% as in comparison with 47% within the final seven years. Spending budgets get hit and any non-productive expense is often lower first!

I had talked about switching prices as a moat for Coupa, nevertheless, conversely this is usually a millstone as effectively – if you’re attempting to get a brand new shopper to modify enterprise and accounting techniques. Whereas integration with accounting is often seamless for mid dimension and smaller corporations, bigger corporations with entrenched legacy techniques discover it a lot troublesome to modify. For instance, in the event you’re utilizing SAP to run all or most of what you are promoting processes, you’d positively think about SAP’s ARIBA first for spend administration, which is a really sturdy competitor to Coupa in that area.

I imagine obsolescence is a particular menace. Piper Sandler talked about Zip as a reputable competitor. Even a relative younger Coupa (15 years previous) cannot race to make their interface or techniques the best or most user-friendly. If the choice makers at your potential clients are youthful and used to finger swipes to make choices, you should have bother promoting a system that must be put in or onboarded, even with a brief studying curve.

Valuation and Funding Case

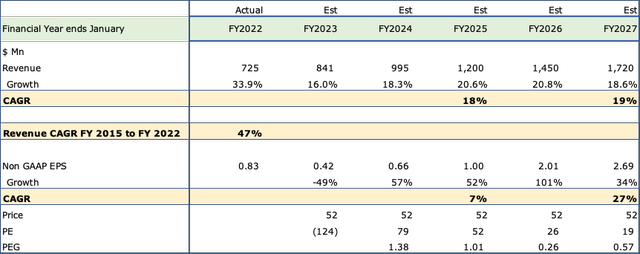

Coupa Funding Case (10K, In search of Alpha Estimates, Fountainhead)

I count on Coupa’s revenues to develop at a a lot a decrease 18-19% price over the following 3 to five years in comparison with the heady 47% development of the final seven. Non GAAP Earnings ought to develop at 27% over the following 5. P/E multiples stay elevated until FY 2026, although, and maybe will possible hold the inventory sideways until different catalysts emerge or we get respite from rate of interest hikes.

Coupa’s inventory has fallen to twenty% of its 52 week excessive of $250 and to 14% of its all time excessive of $357! A lot of the weaknesses of slower development, longer gross sales cycles and financial recession are already within the worth. There’s a risk that the inventory will go sideways given the present bear market, however I am keen to just accept a 10-20% draw back for a a lot bigger potential upside within the subsequent 3 – 5 years.

Coupa’s market cap of $3.9Bn or 4.15X Gross sales of $841Mn is decrease than valuations of different tech and SaaS corporations, because the CNBC article on Starboard’s stake in Salesforce suggests.

I am score Coupa as a purchase for one fundamental motive, it’s much more invaluable to an acquirer than a stand-alone firm. Constructing a Billion Greenback, B2B profitable enterprise with one main focus space (BSM) within the enterprise software program area, with entrenched shoppers and a switching prices moat, is an especially troublesome, prolonged and costly endeavor.