AleksandarNakic/E+ by way of Getty Pictures

Abstract

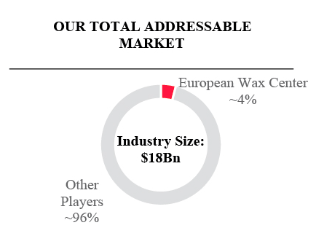

I like to recommend a HOLD score on European Wax Heart (NASDAQ:EWCZ). EWCZ is the franchisor and operator of out-of-home [OOH] waxing companies, proudly owning 4% of the entire addressable market within the business. Regardless that its present valuation will not be engaging sufficient for brand spanking new traders, the corporate’s discretionary market with recurring demand, main market attain, distinctive franchise mannequin, and optimistic model recognition is an efficient motive for present shareholders to maintain their place.

Firm overview

EWCZ has easy enterprise operations. In the USA, the agency is a franchisor and operator of OOH waxing companies. The European Wax Heart model is dependable, efficient, and accessible. In all of its handy areas, the corporate’s licensed and EWC-trained estheticians present shoppers with waxing companies of the very best potential high quality and stage of hygiene. The technology-enabled visitor interface supplied by EWCZ helps to simplify and streamline the visitor expertise by automating appointment scheduling and offering the power to examine in remotely. The EWCZ pre-paid Wax Cross program makes cost easy and hassle-free, which in flip encourages buyer loyalty and repeat visits.

Discretionary market with recurring demand

Within the U.S., nearly all of ladies and lots of males embrace hair elimination as an everyday and obligatory a part of their private care and wonder routines. Given the recurring nature of hair progress, there’s a constant demand for services and products that may take away undesirable hair. For his or her hair elimination wants, customers flip to a wide range of OOH companies in addition to at-home remedies. However individuals typically discover out that at-home options are much less efficient, messier, and extra painful, and that they take much more time than OOH companies given by extremely skilled professionals.

Based mostly on the outcomes of buyer surveys, EWCZ thinks that about 40% of individuals searching for hair elimination companies would not take into account laser hair elimination and that fifty% of people that have tried laser hair elimination have given up on it due to the price. In response to the filings made by EWCZ, it’s estimated that the corporate’s whole addressable home market is value $18 billion and consists of about 69 million people in the USA. They’re both waxing this present day or contemplating starting the follow. The at-home waxing market, through which EWCZ competes, is the hair elimination various that’s rising on the quickest charge.

Based mostly on latest estimates referenced from EWCZ S-1, the at-home waxing market has elevated at a compound annual progress charge of 8% between 2015 and 2019, whereas the general hair elimination market grew at a 3% CAGR throughout the identical time interval. As we are able to see, OOH waxing companies have gotten an more and more non-discretionary and routine a part of private care and wonder regimens, which is fueling progress within the business. Different secular traits which might be contributing to the expansion of OOH waxing embrace:

Rising client curiosity in private care and self-expression:

Buyer consciousness of the effectivity and efficacy of OOH waxing compared to at-home options Affordability of OOH waxing is in distinction to different OOH options. Increasing geographical attain throughout the board Curiosity from a wide range of age teams and genders

EWCZ is a number one participant within the business

I consider that EWCZ’s unmatched scale and unique focus on waxing companies make it potential for the enterprise to benefit from its potential and huge market alternative. Regardless that EWCZ solely has 4% of the addressable market in the meanwhile, the corporate thinks that it’s about 10x bigger than its closest waxing-focused competitor within the OOH waxing business when it comes to system-wide gross sales and about 6x bigger when it comes to middle rely.

Moreover, the market business for EWCZ’s services and products remains to be extremely fragmented, with greater than 10,000 particular person waxing-focused operators who lack scale and roughly 100,000 magnificence salons that solely present waxing as a minor portion of their extra complete service providing (figures referenced from EWCZ S-1). Waxing will not be a core competency for a lot of magnificence salons and different related operators. Because of this, waxing companies are incessantly supplied in “backrooms” with out vital funding in enhancing the client expertise as an entire. As a consequence of this fragmentation, the business has develop into outlined by variable high quality, an absence of technological accessibility and scheduling, and one-time transactional companies which might be unable to ascertain belief in prospects or encourage their engagement.

S-1

I’ve so as to add that the monitor report the EWCZ franchisees have of efficiently constructing new facilities and frequently producing engaging unit-level economics confirms its technique to develop its footprint and develop its capability to accommodate extra company. EWCZ believes it has a major alternative for a whitespace of roughly 3,000 areas for its normal middle format throughout the USA. It’s because not one of the firm’s present markets have been fully penetrated. As well as, roughly 75% of its whitespace alternative is positioned in markets the place EWCZ already has a presence at present. This provides the corporate loads of confidence that new areas will probably be effectively obtained and do effectively, which is sweet for the corporate’s enterprise.

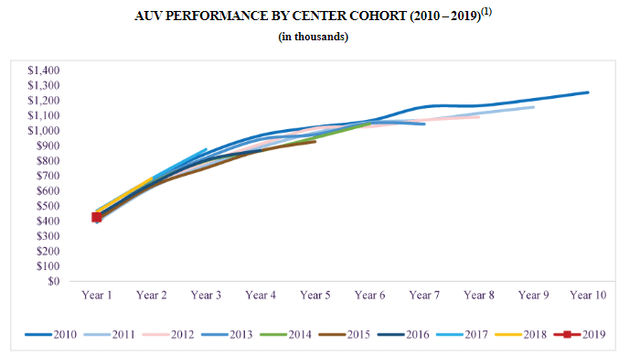

Past EWCZ’s fast whitespace, it has a chance to develop middle enlargement and product distribution into non-traditional locales, abroad markets, and various middle codecs. By combining information from its visitor database with inside evaluation and exterior analysis, EWCZ can determine the optimum markets and locations for enlargement. EWCZ’s new facilities want a modest preliminary funding and comply with a extremely predictable maturation curve throughout cohorts and geographies. This may make it straightforward for EWCZ and its franchisees to see how a lot cash every new middle has the potential to make.

Enticing franchise mannequin

EWCZ believes its worth provide has constructed a franchisee base dedicated to model progress. The engaging return on franchisees’ invested capital outcomes from EWCZ’s easy but troublesome to duplicate operational technique. EWCZ facilities require a modest preliminary capital funding, then rapidly attain profitability and generate superior unit-level economics. A typical European Wax Heart location usually reaches maturity in its fifth 12 months of operation, at which level it earns a mean yearly income of $1,000,000 and cash-on-cash returns of over 60%. The corporate obtains revenue from its franchisees by way of the sale of branded merchandise and the cost of recurring charges, resembling royalties and advertising and marketing fund contributions, that are based mostly on the service gross sales of every middle. EWCZ facilities bear a extremely predictable maturation curve that’s fixed throughout cohorts and geographies, offering franchisees with a excessive stage of assurance that they are going to generate vital returns. The next graph paints a really optimistic image of how EWCZ franchisees have been performing over the previous decade. (Be aware: AUV = common unit quantity).

S-1

Model issues

EWCZ believes that displaying stunning pores and skin is step one to revealing one’s finest self, and its model stands for offering company with unabashed confidence. Waxing is a private expertise, and EWCZ shoppers anticipate a trusted, secure, and clear surroundings with a reliable wax specialist. I consider the corporate’s unmatched measurement permits it to have a nationwide presence and serve its devoted buyer base wherever it might be. EWCZ’s advertising and marketing actions have been creating nationwide model consciousness and a spotlight, which helps reaffirm the corporate’s unique dedication to offering the very best service in its business. As a result of the corporate is so sure in its capability to satisfy its prospects’ expectations, it has by no means charged any of its shoppers for the primary wax that they obtain. The NPS rating of 85 demonstrates EWCZ company’ devotion to its model (NPS rating as per S-1 submitting).

EWCZ signifies that influential client traits will proceed to develop the OOH waxing enterprise and that the OOH market will proceed to achieve market share from various hair elimination choices. That is why, even when its model is well-known on a nationwide scale, there are nonetheless ample alternatives for EWCZ to spice up model consciousness to draw new guests and improve the engagement of present company by rising their go to frequency and the enterprise’s services and products buy. As well as, EWCZ believes there’s a distinct probability to boost model consciousness amongst males, who make up 5% of the corporate’s whole company in comparison with 20% of all the addressable market. Having stated all of this, for the previous 5 years, male curiosity in OOH waxing has elevated considerably over the previous 5 years. By means of focused male-oriented advertising and marketing literature and repair choices, EWCZ seeks to reinforce its share of male guests by way of male-oriented advertising and marketing supplies and services and products designed for the male buyer base.

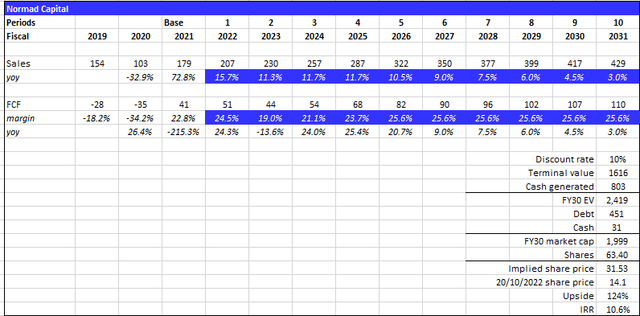

Valuation

On the present inventory worth of $14.1 and 63.4 million shares, the market cap is ~$900 million. I consider the present valuation will not be engaging sufficient, though it could actually present traders with market-like returns over the approaching decade. I anticipate EWCZ to make $430 million in gross sales in FY31, giving it a market cap of $2 billion and a inventory worth of $31.53 in FY31 assuming a terminal progress charge of three% and a reduction charge of 10%.

Assumptions:

Gross sales: to comply with consensus’s estimates till FY26 and slowdown after to inflation ranges over the following 5 years. Development ought to ultimately taper down as EWCZ has cleared all of the low-hanging fruits because it reaches maturity ranges. FCF margin: Much like income, I used consensus’s estimates for first few years till 2025, and assumed that EWCZ has reached maturity in margins.

Normad Capital

Danger

High quality assurance at franchisee stage

The operational and monetary success of EWCZ’s franchisees has a direct bearing on the corporate’s enterprise, together with such components because the franchisees’ skill to implement strategic plans and their capability to get obligatory funding. If unhealthy financial circumstances damage EWCZ franchisees they usually cannot assure safe funding sources, their monetary well being could go down. This might imply that EWCZ’s gross sales go down, which might pressure the corporate to increase cost phrases or make different modifications.

Low boundaries to entry

EWCZ competes with over 10,000 impartial waxing operators and about 100,000 magnificence salons that supply waxing as a sub-service of their total service choices. The corporate could also be unable to compete successfully in sure markets through which it operates. Opponents could attempt to replicate the corporate’s enterprise mannequin or components of it, which, I consider, may scale back EWCZ’s market share and model recognition, in addition to decelerate the enterprise’ progress tempo and profitability.

Conclusion

The present valuation will not be the very best, but it surely might nonetheless yield traders first rate market-like returns over the approaching decade. EWCZ has been thriving to develop its enterprise operations to a bigger business scale and improve its profitability with modest funding prices. If present shareholders maintain their place and the franchise enterprise continues to develop, EWCZ could attain a market cap of $2 billion and a inventory worth of $31.53 in 2031.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)