400tmax/iStock Unreleased by way of Getty Photos

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is about to launch its Q3 earnings outcomes tomorrow, and there is a chance that the corporate might mitigate many of the macroeconomic dangers if it manages to beat the estimates. After all, Google has already carried out considerably higher than its friends resembling Meta Platforms (META) and Snap (SNAP) did earlier this yr, regardless of the decline in promoting spending. A profitable earnings report might give buyers confidence within the firm’s potential to create shareholder worth even within the present turbulent surroundings. As buyers await the outcomes, this text highlights the most important developments on which buyers must focus and describes the short-term and near-term catalysts that might assist Google’s inventory to rebound within the foreseeable future.

What Ought to Traders Count on Tomorrow?

Earlier this month, I wrote two articles on Google. The primary article highlighted among the newest initiatives of the corporate and offered a valuation evaluation, which confirmed that Google is considerably undervalued to its truthful worth and has the power to understand within the quick to close time period. The second article centered on the long-term threats that the corporate is dealing with.

To today, I proceed to consider that the one main menace for Google comes from antitrust watchdogs and regulators from each side of the Atlantic, who’ve been signaling for some time their want to stage the digital promoting enjoying subject at the price of the Huge Tech. Nonetheless, the excellent news is that it is unlikely that the most important dangers described in that article would materialize within the following years. Consequently, Google has at the least a number of years in my view to proceed to generate aggressive returns and create extra shareholder worth alongside the best way.

That is why there is a case to be made that if tomorrow’s outcomes would beat the estimates, there’s an actual likelihood that the corporate would have the ability to mitigate many of the macroeconomic dangers with relative ease, which might outcome within the appreciation of the enterprise’s shares within the foreseeable future.

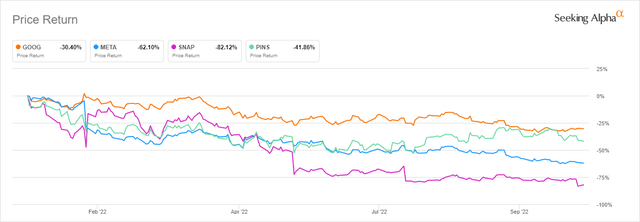

If we return to the Q2 outcomes, we’d see that Google simply barely missed the road estimates, however on the similar time managed to indicate a double-digit income development fee of 12.6% compared to the identical interval a yr in the past. Due to this comparatively impartial report, Google inventory did not depreciate as a lot as its friends resembling Meta Platforms, Snap, and Pinterest (PINS) did in current months, all of whom have been negatively affected by the lower in promoting spending because of the unsure macroeconomic surroundings.

YTD Value Returns of Google and Its Rivals (In search of Alpha)

For Q3, the road expects Google to generate $70.67 billion in revenues, which represents a Y/Y development of 8.53%. This can be a comparatively conservative estimate, which Google has all the probabilities to beat, as in the previous few years the corporate has been delivering a double-digit development fee in every quarter apart from Q2’20 when the promoting enterprise skilled a significant decline because of the begin of the Covid-19 pandemic. As well as, the road additionally expects the corporate’s profitability to enhance on a quarterly foundation, because the EPS through the quarter is predicted to be $1.26, increased than $1.23 and $1.21 in Q1 and Q2, respectively.

On high of that, even after Google’s shut competitor within the digital promoting area Snap has not too long ago dissatisfied its buyers by barely lacking the income estimates, it nonetheless managed to indicate modest income development and development of customers. Whether or not Google would have the ability to beat its personal estimates stays to be seen, however up to now the corporate’s administration was in a position to higher navigate via the present turbulent surroundings than its friends and the corporate itself has greater than sufficient catalysts and aggressive benefits that might assist it to not disappoint its shareholders tomorrow.

The Larger Image

One of many greatest benefits of Google is that it has a number of short-term and near-term catalysts that might assist it mitigate the macroeconomic dangers and navigate via the present turbulent surroundings with relative ease.

Initially, in contrast to Meta, which introduced that the adjustments to Apple’s privateness coverage might value it as much as $10 billion in misplaced revenues, it seems that Google wasn’t so severely affected because it managed to indicate an honest efficiency within the first half of the yr. On the similar time, because of its huge ecosystem of services and products together with a dominant place in search, video, and cellphone companies, Google is ready to proceed to trace the habits of its customers throughout varied entry factors, which in the long run will increase the efficiency of promoting campaigns that the advertisers launch on its platforms.

I’ve personally launched quite a few campaigns for my eCommerce facet enterprise because the starting of the yr and did not expertise a decline in adverts effectivity regardless of adjustments to Apple’s privateness coverage. On the similar time, because of Google’s determination to launch the power to launch efficiency max campaigns that assist advertisers promote their merchandise throughout varied mediums resembling search, video, and show without delay improved my total return on advert spend (ROAS).

Secondly, as I discussed earlier this month, Google has all the possibility to begin attracting content material creators from TikTok by launching the YouTube Shorts monetization program originally of subsequent yr, underneath which it would share revenues from quick video format adverts at a a lot larger fee. This might assist Google to realize a large portion of the short-form video phase of the digital promoting market and on the similar time enhance its total advert providing for advertisers. As well as, if the U.S. nonetheless decides to lastly ban TikTok in its jurisdiction, YouTube Shorts might develop into one of many greatest if not the most important, and most tasty platforms for short-form video content material attracting content material creators and promoting {dollars} at a larger fee because of the lack of formidable competitors.

On high of all of this, regardless of the present decline in promoting spending, the digital promoting trade nonetheless is predicted to develop at a comparatively respectable fee within the following years, and Google as one of many main digital advertisers in the marketplace would additionally have the ability to profit from this. That is why I proceed to consider that Google is at the moment oversold and may very well be thought of a cut price on the present ranges, as my discounted money movement (“DCF”) mannequin not too long ago confirmed that the corporate’s truthful worth is $142.44 per share, which represents an upside of ~40% from the present ranges.

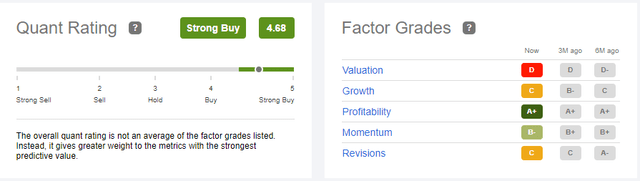

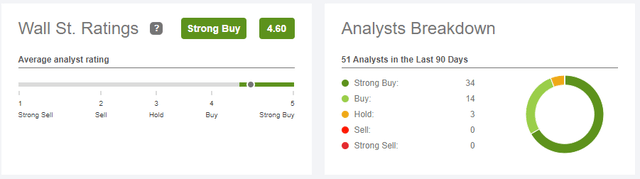

It additionally seems that there is a consensus amongst market members that Google is certainly undervalued, as each In search of Alpha’s Quant ranking together with the most important advisory corporations consider that the corporate is a powerful purchase at as we speak’s value.

Google’s Quant Ranking (In search of Alpha) Google’s Wall St. Scores (In search of Alpha)

Contemplating all of this, it seems that the one main danger is the regulatory danger to which I devoted the entire article final week, and by which I said that it is probably that none of these dangers would materialize within the following years. The antitrust circumstances towards Google would take years earlier than the decision is delivered, whereas the potential appeals might improve the time till a ultimate verdict is reached.

Due to this fact, plainly Google would not have any main dangers proper now, and in case of a profitable report tomorrow, there is a chance that its inventory would lastly begin to rebound and go away the oversold territory. Nonetheless, if the administration fails to ship tomorrow, then buyers would probably want to attend longer earlier than the promoting market improves and Google’s shares lastly rebound and respect because of the lack of main headwinds.

The Backside Line

It is protected to say that Google has numerous benefits towards its friends on account of its potential to higher observe the habits of its customers throughout varied platforms and units, which is without doubt one of the most important the reason why it wasn’t affected as a lot by Apple’s privateness coverage change compared to others. Though the regulators might strip Google of its benefits by the top of the last decade, it is unlikely that that is going to occur within the following years. Due to this fact, because the enterprise is predicted to proceed to ship a double-digit top-line development fee within the foreseeable future, there is a chance that in case of profitable efficiency in Q3, the corporate would have the ability to mitigate many of the macroeconomic dangers and create extra shareholder worth alongside the best way.