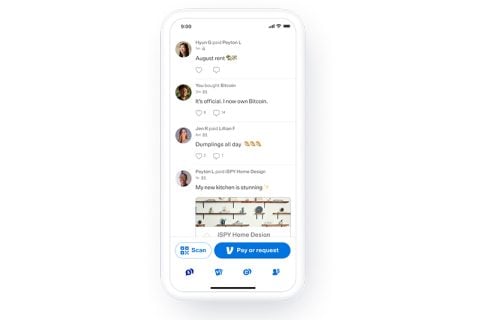

Peer-to-peer cash switch app Venmo permits you to purchase, promote and maintain cryptocurrencies in its app. The function launched in April 2021, following an identical transfer by its mum or dad firm PayPal.

Whereas it’s a handy manner to purchase and promote crypto, particularly in small quantities, it lacks the performance different main crypto exchanges supply. For instance, customers can’t switch crypto from the app into their very own crypto wallets. You can also’t commerce cash with different customers or use your crypto belongings to make funds on the app. This makes it a so-so selection in comparison with extra feature-rich exchanges.

Like PayPal, Venmo permits purchases of 4 totally different currencies: Bitcoin, Ethereum, Litecoin and Bitcoin Money. Its pricing construction is analogous, too: Charges quantity to $2.49 on a $200 buy, plus an estimated 0.5% buying and selling price based mostly on the coin’s trade price, a reasonably costly price in comparison with different platforms.

Right here’s what to find out about shopping for and promoting cryptocurrency with the Venmo app.

You’ll want to make use of a verified Venmo profile to purchase and promote crypto via the app. There are two main exceptions: Venmo doesn’t help crypto transactions in Hawaii, and enterprise accounts can’t take part.

In case you’re utilizing a private account within the 49 different U.S. states, listed here are the steps:

Go to the “Crypto” tab, which will be discovered on the backside of the app’s house display with this icon:

(Picture courtesy of PayPal Newsroom)

3. Be certain your id is verified. In case you need assistance, this help web page outlines the steps. You might want to simply accept Venmo’s cryptocurrency phrases and situations earlier than you proceed, and also you’ll probably must submit just a few identification paperwork to substantiate your own home tackle, title, date of start and Social Safety quantity.

4. Enter the greenback quantity of your buy and choose “Assessment.” You’ll get the prospect to double-check how a lot crypto you’re buying, plus any charges that shall be added.

The utmost restrict for crypto purchases is $20,000 per week and $50,000 in a 12-month interval. You should purchase as little as $1.

5. Select your fee technique. You should use a debit card, linked checking account or funds in your Venmo steadiness.

6. Choose “Purchase” to substantiate. Venmo updates the market worth of all 4 currencies each few seconds, so the worth you see proper once you faucet “Purchase” is the quantity you’ll obtain.

The charges Venmo expenses for cryptocurrency purchases are calculated based mostly on the margin between the market worth and the trade price between the foreign money and the U.S. greenback. This distinction, known as the “unfold,” is round 0.5% and is determined by market situations.

On prime of the unfold, Venmo expenses the next transaction charges based mostly on the acquisition quantity:

There are not any charges for holding crypto on Venmo. You’ll be able to view the quantity of crypto you maintain, and its present market worth, in the identical tab you used to buy.

You’ll additionally have the ability to see your earlier transactions by foreign money, plus your “Whole Return,” which is the distinction between your buy worth and the present worth for your entire mixed crypto belongings on Venmo.

In case you’re seeking to maintain a big quantity of crypto, a pockets is a safer possibility.

After getting crypto belongings on the app, you’ll have the ability to view the present worth and promote via the identical tab. The charges for promoting are the identical because the charges to buy: a per-transaction charge, plus the 0.5% market unfold.

Proceeds from the sale will go to your Venmo account, the place you should use the funds to make funds or switch them to your checking account.

Presently, Venmo doesn’t help funds or purchases with crypto, peer-to-peer trades or transferring crypto to different accounts on or off the app, together with your personal pockets.

If in case you have Venmo’s cobranded bank card, you may make purchases on it to earn crypto rewards. You are able to do this on the finish of the cardboard’s reward cycle by redeeming the cash-back you’ve earned into one of many cryptocurrency choices supplied.

The app waives Venmo transaction charges for these automated purchases, although you’ll nonetheless pay the 0.5% market unfold.

The app can ship push notifications that alert customers to crypto worth adjustments. You’ll be able to customise these alerts with a particular foreign money and the specified share worth enhance or drop. Crypto alerts will be discovered within the app’s settings beneath “Push Notifications.”

What protections does Venmo supply?

Like with different exchanges, your crypto funds on Venmo aren’t eligible for Federal Deposit Insurance coverage Corp. protection, which might shield as much as the primary $250,000 in deposits. However Venmo says that crypto purchases shall be protected against unauthorized exercise. In case you suspect fraudulent exercise in your account, Venmo says it’s best to contact customer support.