Zhanna Danilova/iStock by way of Getty Pictures

Written by Nick Ackerman, co-produced by Stanford Chemist. This text was initially printed to members of the CET/ETF Revenue Laboratory on Oct. 10, 2022.

2022 hasn’t been sort to too many investments. Even PIMCO Dynamic Revenue Alternatives Fund (NYSE:PDO) and XAI Octagon Floating Price & Various Revenue Time period Belief (NYSE:XFLT) are getting slammed this yr. Regardless of this, I discover each of those investments worthwhile, and I feel there’s a possibility so as to add these names to 1’s portfolio. Although, these aren’t with out dangers that must be weighed.

The primary two dangers towards each of those names are the rate of interest dangers and the credit score dangers. Rates of interest are being elevated aggressively by the Fed. Meaning PDO’s underlying portfolio of bonds is taking some huge hits on their costs.

In line with CEFConnect, the common bond worth in PDO’s portfolio is right down to $84.66. That being mentioned, they are not completely inclined to increased rates of interest. They’ve taken some actions to hedge towards them with varied derivatives. With XFLT, that is much less of an affect because of the floating price nature of the portfolio.

Nevertheless, each are nonetheless impacted meaningfully by credit score dangers. Both of the funds put money into portfolios which can be closely invested in beneath investment-grade choices. These are the types of corporations that falter first and usually tend to falter when the economic system begins to go poorly. So there is definitely danger right here.

On high of those, each of those closed-end funds run elevated ranges of leverage. That signifies that any draw back is additional exacerbated by the leverage utilized to extend their funding publicity.

If we enter right into a deep recession, the principle dangers outlined listed below are solely set to worsen issues for the funds. That being mentioned, traditionally, the default charges have been low for bonds and loans. Naturally, the default charges ramped up throughout instances of financial stress, such because the GFC, the 2016 debt disaster and 2020 COVID.

People who do default or go bankrupt do not imply a whole loss as a portion is recovered. Mortgage defaults and restoration charges have been extra favorable as they’re increased within the capital stack.

The concept is also now that a few of this ought to be priced in and mirrored. Each of those funds are buying and selling at engaging reductions and provide attractive distribution yields for traders. Each pay month-to-month distributions too.

PIMCO Dynamic Revenue Alternatives Fund

1-12 months Z-score: -0.84 Low cost: 7.63% Distribution Yield: 11.42% Expense Ratio: 2.12% Leverage: 47.82% Managed Belongings: $3.286 billion Construction: Time period (anticipated time period date Jan. 27, 2033)

PDO is designed to supply “present revenue as a main goal and capital appreciation as a secondary goal.” That is fairly normal for the PIMCO funds and most CEFs. They go on to say how they may try to attain this;

The fund will usually make investments at the least 25% of its complete property in mortgage-related property issued by authorities companies or different governmental entities or by personal originators or issuers. The fund might make investments as much as 30% of its complete property in securities and devices which can be economically tied to “rising market” nations; nonetheless, the fund might make investments with out limitation in short-term funding grade sovereign debt issued by rising market issuers. The fund might usually make investments as much as 40% of its complete property in financial institution loans (together with, amongst others, senior loans, delayed funding loans, covenant-lite obligations, revolving credit score amenities and mortgage participations and assignments). It’s anticipated that the fund usually can have a brief to intermediate common portfolio length (i.e., inside a zero to eight yr vary), though it might be shorter or longer at any time relying on market circumstances and different components.

Together with the leverage bills, the fund’s complete expense ratio involves a reasonably lofty 2.79%. That being mentioned, that is about the place the entire PIMCO suite is available in, with increased bills. They’ve historically outperformed regardless of this, too, traditionally.

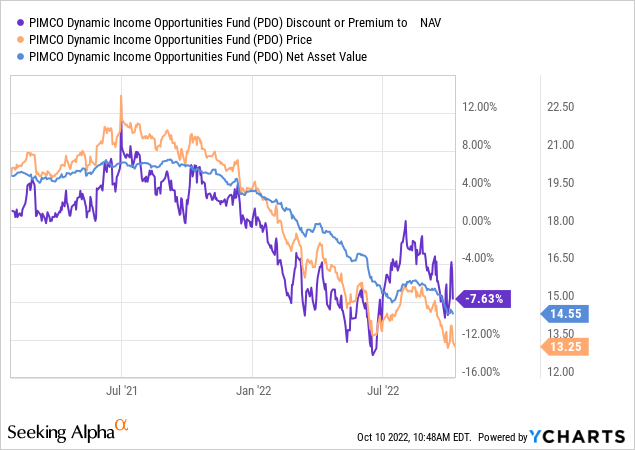

One space that is normally the case for PIMCO is excessive premiums on their funds. These have now come down throughout the board. Much more so for PDO, as they seem to be a newer fund. It appears to be getting a more moderen fund low cost relative to its sister funds.

At one level earlier in July this yr, the fund touched a premium as soon as once more. Even when the fund first launched for the primary a number of months, it loved a premium. The low cost is a operate of the share worth dropping sooner and additional than the NAV itself.

Ycharts

The low cost for PDO may be extra uncommon as a result of it is a time period fund. Solely the brand new funds launched from PIMCO after round 2018 are structured this manner. Time period funds are actually the usual. PIMCO Entry Revenue Fund (PAXS), which launched extra just lately, is also an instance of a PIMCO time period fund, which is one other fascinating title right now, applicable for its personal article.

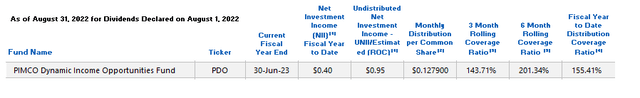

The final time we touched on PDO, we famous that the robust distribution protection led to a distribution increase. With continued energy of their protection, we might see additional boosts or a year-end particular. Over the past rolling six months, PDO had the best protection ratio of all PIMCO funds.

PDO August UNII Report (PIMCO)

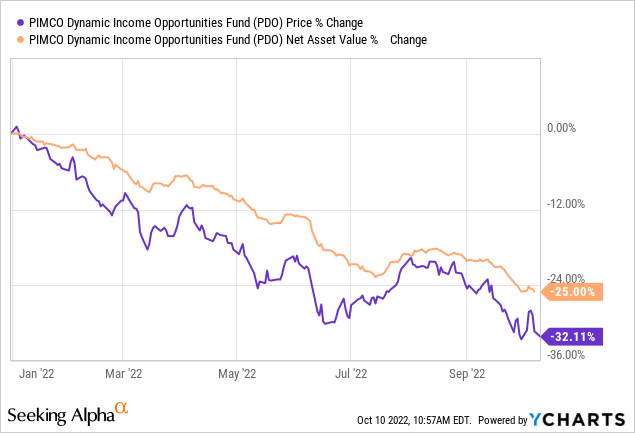

The overall leveraged-adjusted efficient length involves 2.88 years. That will point out that any 1% improve in rates of interest would end in a decline of two.88% for PDO. As we are able to see, the fund has skilled sharper losses than that YTD. That is the place the credit score danger and the value of the underlying bonds come into play. That will see an extra decline within the NAV.

Ycharts

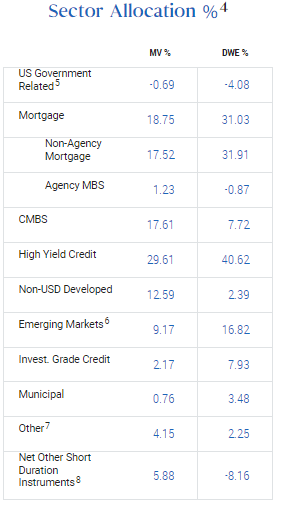

Regardless of the portfolio leaning to extra speculative junk-rated debt, PIMCO has proven traditionally they have been capable of navigate efficiently on this space of the market. Due to this fact, the bonds, whereas being discounted right now, nonetheless have a great likelihood of receiving par again at maturity.

Their diversification throughout the board as a multi-sector bond fund might assist see them navigate by means of troublesome intervals too.

PDO Allocations (PIMCO)

XAI Octagon Floating Price and Various Revenue Time period Belief

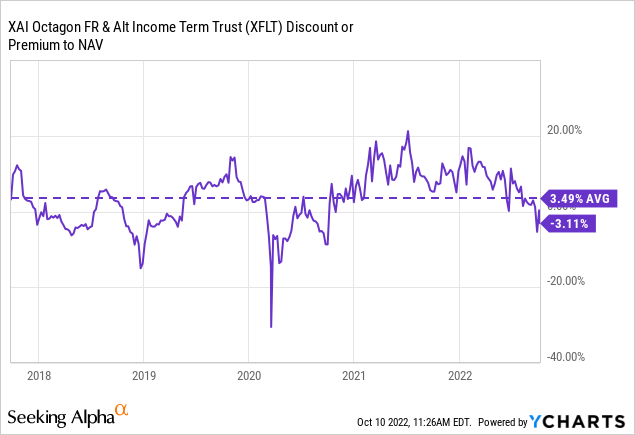

1-12 months Z-score: -2.35 Low cost: -3.11% Distribution Yield: 14.04% Expense Ratio: 3.72% Leverage: 41.63% Managed Belongings: $391.63 million Construction: Time period (anticipated liquidation date Dec. 31, 2029)

XFLT’s goal is to “search engaging complete return with an emphasis on revenue era throughout a number of phases of the credit score cycle.”

They’ll do that by means of “a dynamically managed portfolio of floating-rate credit score devices and different structured credit score investments inside the personal markets. Below regular market circumstances, the Belief will make investments at the least 80% of managed property in senior secured loans, CLO debt and fairness.”

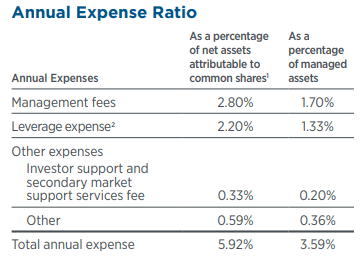

The expense ratio right here may look extremely excessive, which might be a good criticism. It is even increased than PDO’s expense ratio. Nevertheless, in comparison with the opposite CLO-related funds, that is decrease. One of many causes is that they do not have incentive charges, which might assist present higher efficiency over the long term for traders.

XFLT Bills (XA Investments)

For example, Oxford Lane Capital (OXLC) final reported an expense ratio of 10.76% to complete off fiscal 2022. That was a decline from fiscal 2021, the place the expense ratio topped 12.14%. Fiscal 2016 confirmed an much more eye-popping 16.60% expense ratio.

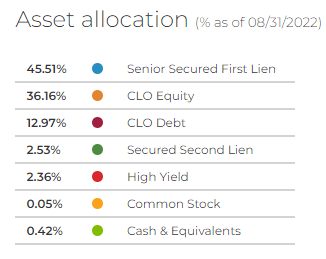

So once more, XFLT bills may appear excessive, nevertheless it’s the character of their underlying investments. These are the collateralized mortgage obligations or CLO. They’re cut up up in investing in each debt and fairness sleeves of the CLO tranches. Nevertheless, the biggest publicity is to senior secured first-lien loans or floating-rate loans.

XFLT Allocation (XA Investments)

They do that by means of 455 holdings that may present them with diversification throughout varied industries. The typical bond worth as a share of par for XFLT involves 85.96%. That is noteworthy as a result of, regardless of the floating price nature of XFLT’s holdings, they are not getting credit score for the pure safety they supply throughout rising charges.

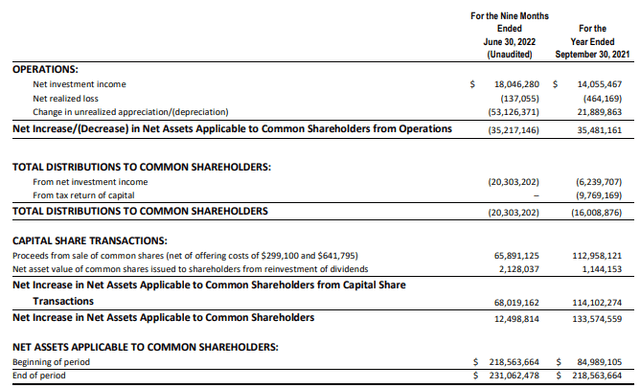

The advantages of rising charges have been mirrored within the internet funding revenue, although. That resulted in a rise after they final supplied a quarterly replace. The ~$18 million they generated within the 9 months ended June 30, 2022, compares favorably from the prior fiscal yr.

XFLT 9-Month Report (XA Investments)

On this case, elevated revenue can come from the extra capital they’ve invested by means of the proceeds of the sale of widespread shares and the DRIP. Extra excellent shares imply extra revenue era but additionally extra distributions to pay. NII protection within the newest interval was 88.8% from 87.8%.

Not a large improve, however rate of interest will increase weren’t absolutely mirrored by June 2022 both. Senior loans have a ground to breach first, which was possible solely hit after the primary couple of raises in most of those investments. With subsequent will increase, the revenue era ought to begin rolling in.

One other manner to take a look at this to mirror the dilution of added shares could be taking a look at NII per share within the monetary highlights. In that case, we see an NII of $0.58 for the 9 months in comparison with the prior fiscal yr 2021 of $0.76. If we annualized out that newest determine, we might come out to $0.7733. Once more, reflecting that the revenue era wasn’t overly accretive at this level, nevertheless it ought to begin ramping up in subsequent studies.

I imagine that is why the present low cost within the fund presents an fascinating alternative. They’re shy on NII distribution protection, however there is a path to get it coated, in my view. Because the fund launched, a premium has been extra of the standard for the fund. Going to a reduction when the remainder of the market tanked, a lot as we are actually.

Ycharts

Serving to to maintain their leverage prices in line is the XAI Octagon Floating Price & Various Revenue Time period Belief 6.50% Most well-liked (XFLT.PA). XFLT.PA is a reasonably engaging funding by itself. Nevertheless, it is at the moment buying and selling above par and has achieved so for many of its life. It turns into callable on or after Sept. 30, 2026.

With a fixed-rate most well-liked making up $39.9 million of their leverage, they’ve a significant portion not uncovered to floating charges. The credit score facility confirmed that they had $110.65 million in borrowings on the finish of June. That was a decreased quantity from the $124.15 million mirrored on the finish of March 31, 2022. The credit score facility is topic to prices of one-month LIBOR plus 1.25%.

Conclusion

Regardless of what the share worth and NAV may be exhibiting on PDO and XFLT, these two funds proceed to supply important payouts to traders. These payouts are considerably coated within the case of PDO or have a path to being coated within the case of XFLT.

In addition to the reductions that these funds are sporting, the underlying holdings are also discounted, which may very well be realized sooner or later after they mature. The primary danger is that they default throughout a recession. Thus, why they’re discounted within the first place as they mirror these dangers. Nonetheless, a few of this appears to be priced in at this level. Admittedly, I do not know when the underside is or the place peak rates of interest are, however I feel PDO and XFLT current fascinating decisions right now.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.