koto_feja/iStock by way of Getty Photos

Writer’s Observe: This text is an abridged model of an article initially printed for members of the Built-in BioSci Investing market on October 20, 2022.

PDS

Beware the funding exercise that produces applause; the nice strikes are normally greeted by yawns. – Warren Buffett

In biotech investing, you may see that sure small corporations can lose most of their worth after a unfavourable binary occasion (be it regulatory or medical). Normally, most of these corporations then lose their NASDAQ itemizing and thereby go to the forgotten land of OTC shares. However, sure corporations are decided to overlook their previous and thereby work diligently to make an enormous comeback below a brand new identification.

PDS Biotech (NASDAQ:PDSB) is one such firm that didn’t let obstacles cease it from rising. After a failure within the neuroscience house, PDS is now extremely targeted on the immuno-oncology sector. Prior to now month, this inventory has garnered roughly 40%. Apparently, there’s a huge catalyst that may catapult the shares to a brand new excessive. On this analysis, I will current a elementary evaluation of PDS and share with you my expectation of this attention-grabbing fairness.

StockCharts

Determine 1: PDS Chart

About The Firm

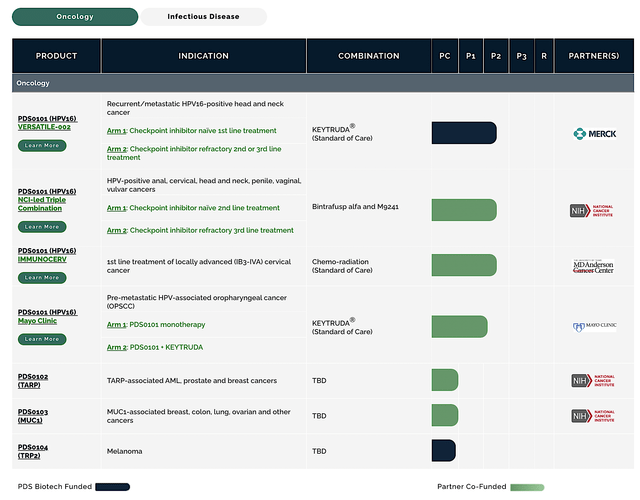

As typical, I will current a quick company overview for brand spanking new traders. In the event you’re acquainted with the agency, I counsel that you simply skip to the following part. Working out of Florham Park, New Jersey, PDS Biotech is a clinical-stage firm specializing in the innovation and commercialization of medication to deal with lethal cancers. Leveraging its two know-how platforms (Versamune and Infectimune), PDS is brewing a deep/broad pipeline of attention-grabbing molecules as proven beneath.

PDS

Determine 2: Therapeutic pipeline

Pessimism to Optimism

Previously referred to as Edge Therapeutics, PDS misplaced most of its worth again in 2018. That’s to say, the corporate was growing a really slim pipeline of solely two medicine (EG1962 and EG1964). Attributable to EG1964’s failed Part 3 information, the pipeline crumbled. Thereafter, the corporate rebranded itself into PDS Biotech. Asides from the model identify, PDS is now targeted on cancers reasonably than neurological bleeds. With its Versamune platform, PDS is now in a position to advance a diversified pipeline as proven within the earlier determine.

Mechanism of Motion (MOA): Versamune Platform

Shifting gears, allow us to stroll by means of the varied elementary developments pertaining to PDS. Provided that the success of PDS is intently tied to Versamune, it is best to assess its underlying science. By mastering its science, you’d higher respect its mechanism of motion (i.e., MOA) which helps you “learn the tea leaves” in future information reviews.

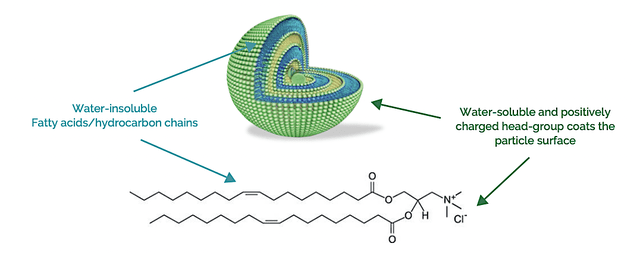

As a platform know-how, Versamune is actually a supply automobile that’s positively charged which helps it maintain tumor antigens inside. As such, Versamune’s construction made the physique thinks it is a man-made virus. As you may think about, the physique’s pure protection (i.e., immune) system would engulf such viral-like particles Versamune.

PDS

Determine 3: Versamune automobile

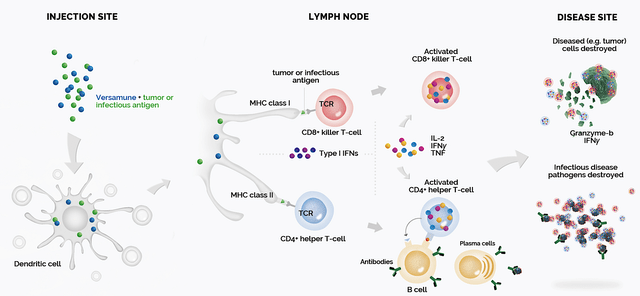

As you may respect, the ingenious facet of Versamune is that it holds the antigen (of assorted cancers) which then triggers key immune cells. They embrace the T-cells — each CD4+ (T-helpers) and CD8+ (killer T-cells) — that perform like “the Generals” of the physique’s pure protection (i.e., immune) system.

Of these cells, killer T-cells are concerned within the direct destruction of cancers. As to T-helper cells, these guys coordinated the “reminiscence formation” which enabled the physique’s immune system to acknowledge cancers. With intelligence/recognition, the physique then amplifies/copies extra T-cells, B-cells (i.e., the Commanding Officers), and different cells to eradicate cancers. Extra importantly, these reminiscences can forestall sure relapses.

PDS

Determine 4: Versamune MOA

Illness Context (i.e., DC): Numerous Cancers

As you may think about, the MOA suits completely with the Illness Context of cancers. You’ve got heard that cancers are so tough to remedy. Furthermore, they have a tendency to at all times come again (i.e., relapses). That is as a result of as cancers develop, they launch chemical substances that suppress the immune setting. Merely put, cancers put the physique’s protection system to sleep.

With Versamune with the ability to get up the immune system and rally the troops, you may see that there’s glorious efficacy. Right here, the MOA and DC match completely like matching puzzle items.

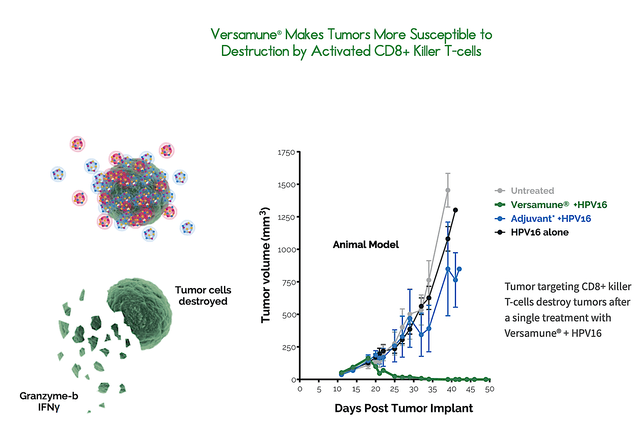

Early Supporting Knowledge

Even when the MOA and DC match completely collectively, there is no such thing as a assure that the info would end up optimistic. As such, you need to inspect the obtainable information to see in case your thesis works out. Viewing the determine beneath, you may see that Versamune remedy results in the most effective tumor reductions in comparison with varied controls.

PDS

Determine 5: Early preclinical outcomes

Extra Supporting Knowledge

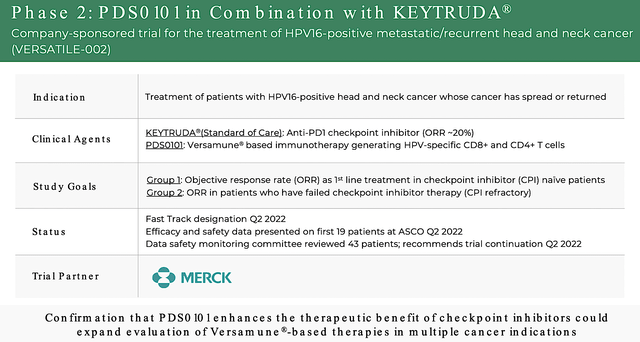

Past early information, PDS not too long ago offered extra superior information on the 2022 American Society of Scientific Oncology (i.e., ASCO). It’s attention-grabbing that PDS0101 remedy resulted in 76.5% of sufferers having medical efficacy. You possibly can view that efficacy because the sum of the 41.2% goal response charge (i.e., 0RR) plus 35.3% secure illness.

PDS

Determine 6: Part 2 (VERSATILE-002) examine

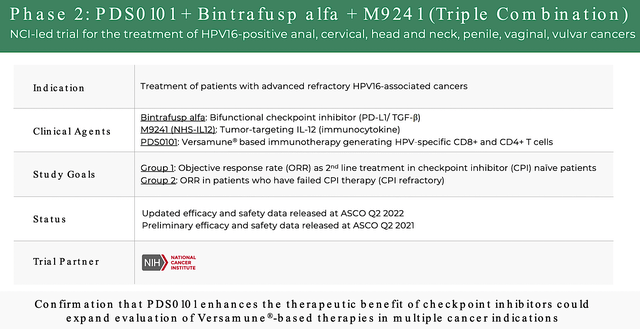

Throughout ASCO, PDS additionally offered the outcomes for the 30 sufferers who enrolled within the Part 2 triple-combo trial that assessed PDS0101 in refractory HPV-positive cancers. Particularly, 88% of the sufferers who had not acquired any checkpoint inhibitor (i.e., CPI-Naive) achieved an total response charge (i.e. ORR) of tumor shrinkage by over 30%. Traditionally, sufferers handled with CPI alone solely expertise an ORR starting from 13% to 24%.

PDS

Determine 7: Part 2 NCI-Led Triple Combo examine

For sufferers who’re already proof against CPI remedy, the bulk (i.e., 77%) are nonetheless alive at 12 months. On October 11, PSD additionally reported extra information for this trial. Particularly, 66% of those sufferers remained alive on the 16-month follow-up which is extraordinarily robust. You possibly can respect that that is extremely vital as a result of historic CPI remedy solely averages 3-4 months of survival. Commenting on the event, the President and CEO (Dr. Frank Bedu-Addo) enthused,

We made large progress this quarter with our lead candidate, PDS0101, throughout all 4 ongoing Part 2 medical trials, and likewise with our advancing oncology pipeline candidates PDS0102 and PDS0103. Our medical information at this yr’s ASCO assembly not solely solidified our confidence in our Versamune platform, but in addition within the potential of PDS0101 to make a significant distinction within the remedy of superior HPV16-positive most cancers sufferers with vital unmet wants. With these information, we’re hopeful that our upcoming conferences with the FDA will make clear our regulatory path ahead for PDS0101.

Monetary Evaluation

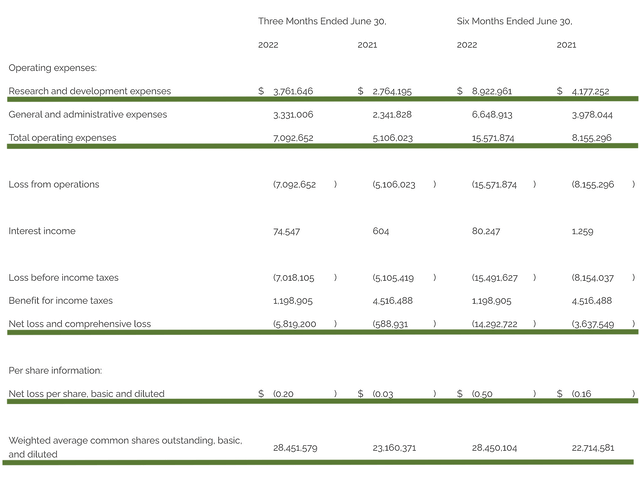

Simply as you’d get an annual bodily on your well-being, it is necessary to examine the monetary well being of your inventory. As an example, your well being is affected by “blood circulate” as your inventory’s viability relies on the “money circulate.” With that in thoughts, it is best to assess the 2Q2022 earnings report for the interval that ended on June 30.

Like most developmental-stage biotech corporations, PDS doesn’t have any income. As such, it is best to inspect different extra significant metrics. Accordingly, the analysis & growth (i.e., R&D) registered at $3.7M in comparison with $2.7M for a similar interval a yr prior. I considered the 37.0% R&D improve positively as a result of the cash invested as we speak can flip into blockbuster income tomorrow. In any case, you need to plant a tree to take pleasure in its fruits.

Moreover, there have been $5.8M ($0.20 per share) web losses in comparison with $588K ($0.03 per share) declines for a similar comparability. As you may see, the upper R&D spending minimize into the underside line.

PDS

Determine 8: Key monetary metrics

Concerning the steadiness sheet, there have been $53.0M in money. On high of the $35.0M in latest financing, the money place is elevated to $88.0M. Towards the $7.0M quarterly OpEx, there must be satisfactory capital to fund operations into 2Q2025. Merely put, the money place is powerful relative to the low burn charge.

Potential Dangers

Since funding analysis is an imperfect science, there are at all times dangers related together with your inventory no matter its elementary strengths. Extra importantly, the dangers are “growth-cycle dependent.” At this level in its life cycle, the principle concern for PDS is whether or not the Versamune drug (i.e., PDS0101) would proceed to generate optimistic medical information. The opposite danger is that Merck did not need to fund the VERSATILE-002 trial. As such, it does not give a lot validation to Versamune know-how. At the least, not at this level.

Conclusion

After it rebranded from Edge Therapeutics, PDS Biotech is now in a totally completely different biotech area of interest. As a premier remedy automobile for lethal cancers, there are large guarantees from the Versamune platform. Each early information and Part 2 outcomes are extraordinarily sturdy. If extra optimistic information are reported in November, PDS shares are more likely to rally. Furthermore, different developments like a greater partnership would ensue.