JamesBrey

As talked about on this article’s bullets, the TTM distribution yield of the Constancy Excessive Dividend ETF (NYSEARCA:FDVV) – at 3.96% – shouldn’t be precisely what I contemplate to be “excessive yield”. That mentioned, I do imagine the FDVV ETF delivers a comparatively excessive yield – greater than 2x that of the S&P 500 (1.74%) – whereas additionally having a comparatively decrease danger profile as in comparison with many increased yield alternate options. That being the case, buyers searching for first rate yield and the prospect of long-term capital appreciation ought to contemplate the FDVV ETF.

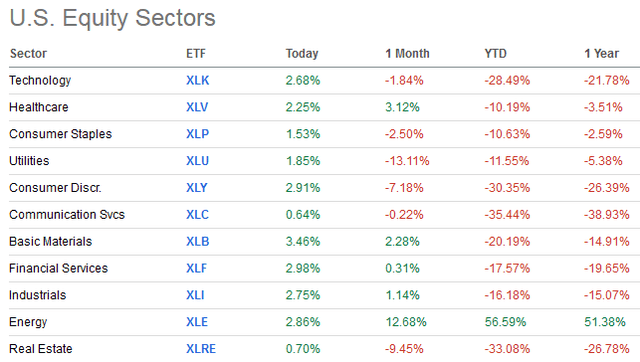

As most of , the 2022 bear market has been significantly arduous on these firms with high-valuation ranges that pay little or no dividends on to buyers. In the meantime, power shares that do pay sturdy dividends (the yield of the Vitality Choose Sector SPDR ETF (XLE) is 3.35%) have additionally led the market this yr in capital appreciation:

Searching for Alpha Homepage

Certainly, because the graphic above clearly exhibits, the Vitality Sector is the one sector within the inexperienced YTD and over the previous yr. The mix of yield and capital appreciation is an effective motive for any dividend income-oriented ETF that is likely to be chubby the Vitality Sector – and the FDVV is definitely that. Let’s take a more in-depth take a look at the FDVV portfolio.

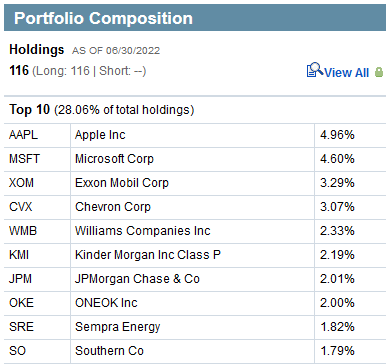

Prime-10 Holdings

The highest-10 holdings of the Constancy Excessive Dividend ETF are proven beneath and equate to what I contemplate to be a well-diversified 28% of your complete 116 firm portfolio:

Constancy Investments

Supply: Constancy’s FDVV ETF Homepage

As talked about earlier, Apple (AAPL) and Microsoft (MSFT) are the top-two holdings within the ETF and – in combination – account for 9.6% of your complete portfolio. Neither of which throw off thrilling and even first rate yields (0.62% and 1.12%), so that you should be questioning what they’re doing within the portfolio to start with, not to mention the top-2 holdings.

The possible motive is that each Apple and Microsoft pay important dividends by way of inventory buybacks. Over the primary 6 months of this yr, Apple spent $43.1 billion on share buybacks (virtually 6x the quantity spent on dividends on to shareholders) and – consequently – diminished its common totally diluted excellent share depend by 3.3% yoy.

Equally, Microsoft spent $15.1 billion on share buybacks over the primary 6 months of this yr (about 60% greater than dividends on to shareholders), which has solely diminished the typical fully-diluted excellent share depend by ~0.9%. Clearly, Apple’s share buyback is way stronger as in comparison with Microsoft, whereas MSFT does give buyers a little bit of a fairer shake by way of dividends on to them.

Getting again to the theme of power, be aware that 5 of the highest 10 holdings are power firms. These embrace the #2 and #3 holdings, Exxon (XOM) and Chevron (CVX), each of which yield 3.3% regardless of having risen 68.9% and 55.0% YTD, respectively.

Apart from #7 holding monetary agency JPMorgan Chase (JPM), #9 holding Sempra Vitality (SRE), and the #10 holding utility firm Southern Firm (SO), which yield 3.3%, 3.2%, and 4.2%, respectively, the rest of the FDVV portfolio’s top-10 holdings are midstream power firms: Williams Firms (WMB), Kinder Morgan (KMI), and ONEOK (OKE). These three midstream firms throw off very sturdy dividend revenue and yield 5.4%, 6.3%, and 6.6%, respectively.

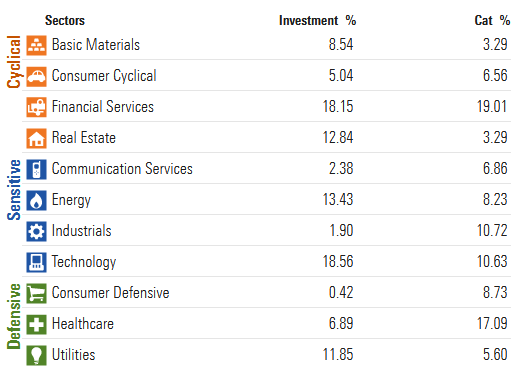

In combination, petroleum firms in FDVV’s top-10 holdings equate to 12.9% of your complete portfolio, of which Morningstar (which provides FDVV a 4-star score) reviews a complete power publicity of 13.43%. Be aware that utility firms have an 11.85% weight. The complete sector breakdown is proven beneath, with Monetary Companies firms – at present benefiting from sturdy net-interest margin – having an 18.15% weight:

Morningstar

Supply: Morningstar’s FDDV ETF Webpage

Efficiency

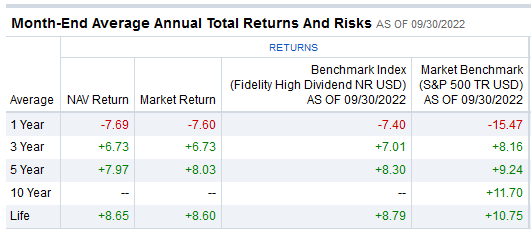

The FDVV’s common annual whole returns observe file is proven beneath:

Constancy

Regardless of the 2022 bear market, FDVV’s common annual 5-year whole return of 8% nonetheless lags that of the Vanguard S&P 500 ETF (VOO) – which has averaged a 9.2% annual return, by over 1%. A part of that outperformance may be attributed to the truth that VOO has an expense payment of solely 0.03% as in comparison with FDVV’s moderately stiff expense payment of 0.29%.

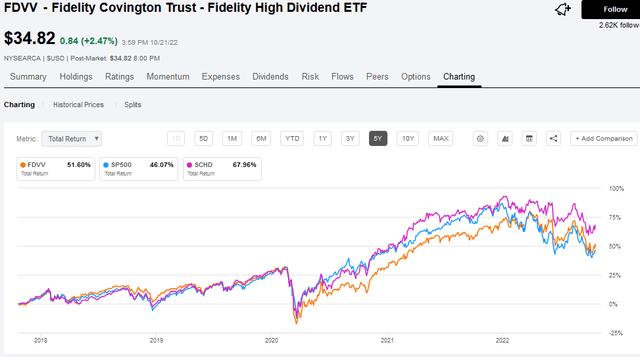

Evaluating FDVV with one other dividend-centric fund, just like the Schwab U.S. Dividend Fairness ETF (SCHD), exhibits that FDVV trails its Schwab competitor – by way of whole returns – by about 16% over the previous 5 years:

Searching for Alpha

Be aware that each FDVV and SCHD have delivered higher whole returns as in comparison with the S&P 500 over the previous 5 years. Additionally, be aware that the SCHD ETF additionally has a considerably decrease expense ratio (0.06%) as in comparison with FDVV (certainly, 23 foundation factors decrease).

Dangers

The chance of investing within the FDVV ETF at this level within the cycle is the final market dangers that you just all are already acquainted with: excessive power and meals inflation because of Putin’s horrific war-of-choice on Ukraine – that successfully broke the worldwide power & meals provide chains – are forcing governments to reply with increased rates of interest. These increased charges are, little doubt, a part of the rationale behind the 2022 bear market and will result in a big slowdown within the international economic system, a world recession, or doubtlessly – given Putin has arguably misplaced his grip on actuality – even worse.

Meantime, the FDVV ETF is over-weight power with a 13.43% publicity (be aware the XLE Vitality ETF is barely ~5.35% of the S&P 500). That being the case, a big recession that might result in important oil and fuel demand destruction, would possible hit this fund greater than, say, the SCHD ETF, which has solely 4.7% allotted to the Vitality Sector, which has extra of its portfolio allotted to sectors like Client Staples, HealthCare, and Financials. That mentioned, I do imagine FDVV’s comparatively excessive publicity to Apple and Microsoft makes it a bit extra of a defensive and lower-risk oriented revenue fund given these firms’ very sturdy free-cash-flow profiles.

Abstract & Conclusions

The FDVV ETF is an “OK” fund, however the expense ratio is just too excessive. That mentioned, I typically just like the positioning of the portfolio and can price it a HOLD. Meantime, in the identical funding class, I favor the Schwab SCHD ETF. If you’re already chubby the power sector, SCHD can be a a lot better ETF as in comparison with FDVV in case you are searching for portfolio revenue diversification.