RiverNorthPhotography/iStock Unreleased through Getty Photographs

Verizon Communications (NYSE:VZ) dropped one other 4.5% following their Q3FY22 earnings launch final Friday. This introduced shares to a brand new 52-week low and their YTD losses to over 30%, which is considerably worse than each the S&P 500 and the Dow Jones Industrial Common (“DJIA”), that are every down 21% and 14.5%, respectively over the identical interval.

Headlines proceed to deal with weak internet postpaid cellphone additions. Although the metric is certainly a weak spot, particularly when put next in opposition to their friends, the corporate continues to be rising their common revenues per account (“ARPA”) by way of elevated penetration of their premium plans.

Continued energy of their Enterprise phase and Broadband and Worth markets additionally offers an sufficient counterbalance in opposition to the weak spot within the Shopper unit. A newly introduced price financial savings initiative also needs to enhance their backside line leads to the approaching durations, along with each working and EBITDA margins, that are already exhibiting some sequential enchancment.

For buyers, VZ continues to supply one of many highest danger/reward alternatives out there right now, with a extremely enticing dividend payout that’s backed by an outstanding observe report of steady development and share value upside potential that may reward shareholders with long-term outsized features.

Enhancing Margins On 4% YOY Consolidated Income Development

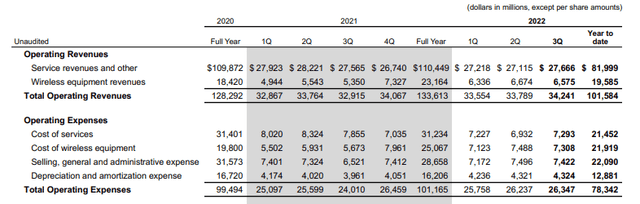

Within the third quarter ended September 30, 2022, VZ reported whole consolidated revenues of +$34.2B. This was up 4% from the identical interval final yr and +$410M higher than anticipated. Service revenues, nevertheless, which characterize roughly 80% of whole revenues by way of the primary 9 months of the yr, have been up simply 40 foundation factors (“bps”) on the quarter and are down 2% YTD. Consolidated income development is as a substitute being pushed by wi-fi gear, which was up 22.9% on the quarter and is now up almost 24% YTD.

Much like Q2, working expense development continues to outpace working revenues, pushed primarily by will increase in the price of wi-fi gear. Within the present quarter, there was additionally a double-digit YOY improve in promoting, common, and administrative (“SG&A”) bills, with the road merchandise representing roughly 21.7% of whole working revenues this yr versus 19.8% final yr. This, nevertheless, is down about 30bps on a sequential foundation.

Q3FY22 Investor Presentation – Historic Abstract Of Working Revenues And Bills

More practical working expense management did enhance consolidated margins through the quarter, nevertheless. At 23.1%, it is nonetheless down from 27.1% from final yr, however it’s up from the 22.4% reported on the finish of the second quarter.

Of the 2 enterprise models, Shopper and Enterprise, Shopper revenues, which account for roughly three-quarters of whole consolidated revenues, have been up 10.8% on the quarter, whereas the Enterprise phase reported development of 1.9%. As well as, each working and EBITDA margins exhibited some sequential enchancment, with every up about 50bps. Margins within the Enterprise phase equally held regular from Q2.

8K Web Telephone Additions, Pushed By The Enterprise Section

Shopper postpaid cellphone gross provides have been up 1.3% YOY, which is up considerably from the 11% decline reported in Q2. And general, the Shopper phase reported 2.6M retail postpaid cellphone gross additions, which is up about 5% YOY. As well as, they skilled continued development in postpaid upgrades, which contributed favorably to the reported 3.8% YOY development in ARPA.

Churn, nevertheless, did tick greater, as a result of firm’s earlier pricing actions, leading to an final internet lack of 189K retail postpaid telephones within the Shopper phase. With sure will increase nonetheless being phased-in all through the third quarter, churn is predicted to hold over into This autumn, although cellphone internet additions are anticipated to show constructive within the ultimate quarter of the yr.

Losses on the Shopper aspect have been absolutely offset by a 197K acquire within the Enterprise aspect throughout their three buyer teams, with Enterprise reporting report internet efficiency and double-digit will increase from each Small Enterprise Options (“SMB”) and the general public sector. Together with the features from Enterprise, internet cellphone additions through the quarter have been 8K.

Energy In The Broadband And Worth Markets Serve As An Ample Counterweight To Weak point In Mobility

Offsetting weak spot within the Mobility market was their Broadband and Worth markets. Broadband internet additions through the quarter have been 377K, 342K of which have been from mounted wi-fi entry (“FWA”). That is up about 35% from Q2. As well as, VZ reported 61K Fios Web internet additions through the quarter, pushed by each robust gross additions and robust retention ranges.

And additional features are anticipated as family protection continues to increase. Already, whole mounted wi-fi family protection surpassed 40M through the quarter, together with over 30M coated by 5G Extremely Wideband. Fios open-for-sale can also be at 16.9M, which represents a YTD improve of 410K or about 75% of their full-year goal.

Within the Worth market, efficiency is highlighted by TracFone, who skilled constructive internet additions for the primary time since Q1FY21. This can be a important milestone within the continued integration of this newly acquired worth unit.

Free Money Flows Are Down However Nonetheless Better Than Dividend Funds

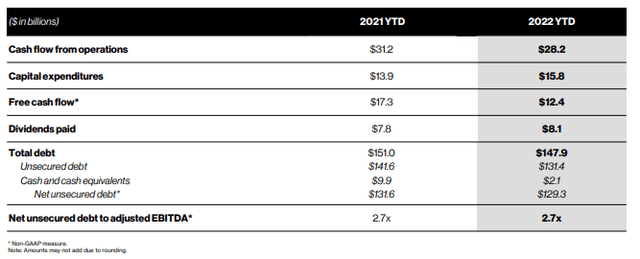

By way of the primary 9 months of the yr, VZ has generated +$28.2B in money from operations. That is down about 10% from final yr because of unfavourable working capital changes pertaining to elevated stock ranges. As well as, capital expenditures (“capex”) are additionally up, pushed by C-band spending, which totals about +$4.5B YTD.

Q3FY22 Investor Presentation – YTD 2022 Money Circulation Abstract

Although free money circulate (“FCF”) is down for the yr, it’s nonetheless ample to completely cowl their dividend payout. As well as, their debt load stays secure at 2.7x, which represents a sequential enchancment of +$1.3B.

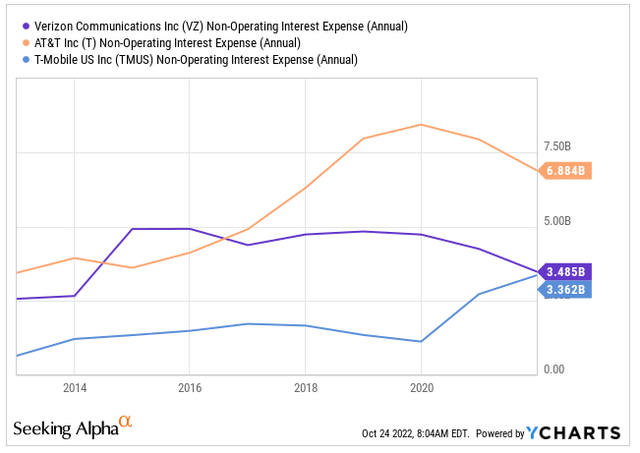

Whereas full-year curiosity expense is predicted to return in +$400M greater than administration anticipated originally of the yr, general curiosity prices have remained pretty flat over time whilst debt has gone up.

YCharts – Chart Of VZ’s Reported Curiosity Expense In contrast To T And TMUS

Submit-Earnings Insights

Although whole consolidated revenues have been up 4% through the interval, general internet earnings was down 24% because of greater overhead prices and curiosity bills. These outcomes, nevertheless, nonetheless topped market expectations.

However, administration nonetheless introduced a brand new cost-cutting program that’s anticipated to avoid wasting between +$2.0B and +$3.0B a yr by way of 2025. Whereas specific particulars weren’t supplied on the convention name, the initiative ought to nonetheless present a lift to each margins and bottom-line figures within the durations forward.

Already, margins have exhibited some sequential enchancment, although they’re nonetheless down considerably from the prior yr. Simpler comparisons starting within the fourth quarter, nevertheless, ought to present a tailwind that may grow to be much more pronounced as further financial savings are realized.

Whereas the 8K internet cellphone additions seem dismal in comparison with the 708K reported by AT&T (T), VZ continues to be reporting respectable YOY development charges in ARPA by way of continued penetration into their premium plans, which continues to be a promising facet of VZ’s development technique of their Mobility market.

Within the present interval, the penetration degree elevated to roughly 42% at quarter finish, which is in step with sequential will increase in prior quarters. As well as, they ended the quarter with 81% of their base on limitless plans, with roughly 60% of their new clients selecting premium limitless instantly from inception.

Web weak spot within the Shopper phase is being offset by strong energy of their Enterprise phase and Broadband markets. The 197K postpaid features in Enterprise, for instance, absolutely offset the losses reported on the Shopper aspect, and it was the fifth consecutive quarter with reported features in extra of 150K. As well as, whole broadband internet additions have been up 40% on a sequential foundation, which is indicative of the worth of VZ’s premium community, regardless of rising charges.

VZ’s quarterly outcomes weren’t robust, however they did not warrant new share value lows following their launch both. In any case, they did are available forward of expectations. Whereas it is true greater pricing is driving some clients away, different clients are opting in to upgraded plans, which is leading to continued energy of their ARPA metrics.

At simply 6.8x ahead earnings, shares are buying and selling at a major low cost to their five-year common of 11.3x. Even when one have been to slash the five-year a number of to the 9.0x degree, which is a goal in-line with my prior estimates, shares would nonetheless have an upside of over 30%. And this does not embrace the 7% yields obtained from the present dividend payout. For buyers searching for so as to add a top quality Dow element to their long-term portfolios, VZ stays a high holding on this difficult market setting.