House costs are nonetheless greater than they have been a yr in the past, however features are shrinking on the quickest tempo on report, in line with one key metric, because the housing market struggles beneath sharply greater rates of interest.

Costs in August have been 13% greater nationally in contrast with August 2021, in line with the S&P CoreLogic Case-Shiller House Value Index. That’s down from a 15.6% annual acquire within the earlier month. The two.6% distinction in these month-to-month comparisons is the most important within the historical past of the index, which was launched in 1987, that means worth features are decelerating at a report tempo.

The ten-city composite, which tracks the most important housing markets in the USA, rose 12.1% yr over yr in August, versus a 14.9% acquire in July. The 20-city composite, which features a broader array of metropolitan areas, was up 13.1%, in contrast with a 16% enhance the prior month.

Home for Sale by Proprietor, Forest Hills, Queens, New York.

Lindsey Nicholson | UCG | Common Pictures Group | Getty Pictures

“The forceful deceleration in U.S. housing costs that we famous a month in the past continued in our report for August 2022,” wrote Craig Lazzara, managing director at S&P DJI, in a launch. “Value features decelerated in each certainly one of our 20 cities. These information present clearly that the expansion fee of housing costs peaked within the spring of 2022 and has been declining ever since.”

Main the worth features in August have been Miami, Tampa, Florida, and Charlotte, North Carolina, with year-over-year will increase of 28.6%, 28% and 21.3%, respectively. All 20 cities reported cheaper price rises within the yr led to August versus the yr led to July.

The West Coast, which incorporates a few of the costliest housing markets, noticed the most important month-to-month declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) falling probably the most.

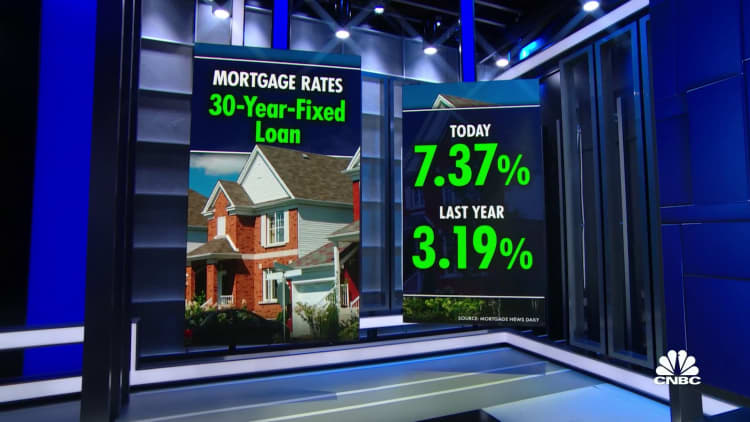

A fast soar in mortgage charges from report lows this yr has turned the as soon as red-hot housing market on its heels. The common fee on the favored 30-year mounted residence mortgage began this yr proper round 3%. By June it stretched over 6% and is now simply greater than 7%, in line with Mortgage Information Every day.

“With month-to-month mortgage funds 75% greater than final yr, many first-time consumers are locked-out of housing markets, unable to seek out houses with budgets which have misplaced $100,000 in buying energy this yr,” mentioned George Ratiu, senior economist at Realtor.com.

He additionally famous that greater residence costs mixed with greater rates of interest are conserving would-be sellers from itemizing their homes. They look like locked in to their decrease charges.