Discover ways to begin choices buying and selling in India with Rs 10,000: Choices buying and selling is likely one of the quickest methods to make or lose cash within the inventory market. In case you’ve mastered the best way to do choices buying and selling accurately, you may make lakhs of cash out of your trades. Nevertheless, if traded with out correct information, it might probably result in the erosion of the whole capital of the dealer.

Though a capital of Rs 10,000 just isn’t an enormous quantity to do inventory buying and selling, nonetheless, it may be a very good quantity to be taught the fundamentals and technicalities of buying and selling shares and choices. On this article, we’ll focus on the best way to begin choices buying and selling in India with Rs 10,000. As well as, we’ll additionally cowl a couple of vital ideas to know whereas buying and selling choices. Let’s get began.

What’s Choices Buying and selling?

Earlier than we dig deeper into how precisely to begin choices buying and selling, allow us to provide you with a short introduction to what precisely is choices buying and selling.

Choices are a by-product instrument that offers the correct to ‘Choice Purchaser’ to purchase the underlying asset (Inventory, indexes, and many others) at a pre-decided value from the ‘Choice Vendor’ on or earlier than a hard and fast date (Often known as expiry).

For instance, if a inventory is at present buying and selling at Rs 100, and the ‘Choice purchaser’ thinks that the value can go to Rs 150, by month’s finish, he can enter right into a contract with one other ‘Choice Vendor’ to purchase at this pre-decided value, on or earlier than expiry by paying a small premium. The identical could be accomplished for the circumstances of indexes like Nifty or Financial institution Nifty.

Coming again to the idea, the choice purchaser just isn’t obligated to honor the contract upon expiry. Right here, the Purchaser has the correct to purchase the asset if he chooses to. Nevertheless, if he doesn’t desires to purchase (in case the commerce doesn’t go in his favor), he’ll merely lose the premium paid beforehand. However, the Choice vendor is obligated to honor the contract as he/she has taken a premium in the beginning of the settlement.

You may commerce in Indexes or Shares for choices. Nevertheless, not like inventory buying and selling, choices are traded in heaps. The heaps are pre-decided by the alternate. For indexes, Nifty has so much dimension of fifty and Financial institution Nifty has so much dimension of 25. It implies that you’ve to purchase at the very least 50 portions (and the identical a number of) whereas buying and selling in its choices.

For instance, if the premium value is Rs 40 and also you (as an Choices Purchaser) is buying 1 lot of fifty portions, right here, your preliminary commerce value can be Rs 40*50 i.e. Rs 2,000. This quantity can be paid by the Choice Purchaser to the Choice Vendor. The lot dimension could be elevated based mostly in your commerce dimension and cash administration.

Choices Shopping for vs Choices Promoting

One of many greatest variations between Choices Shopping for and promoting is the Capital required (also called margin).

Whenever you’re an Choices Purchaser, you’re paying for the premium (let’s say Rs 5,000). Right here, the utmost that you may lose is the premium, nonetheless, the potential to earn is limitless. (Inventory can crash to Zero, however can go as much as infinite value theoretically). That’s why you want at the very least the premium quantity to maintain in your buying and selling account to make the commerce.

However, for the Choices Vendor, the margin required is kind of excessive. Sellers mainly imply that they are going to promote the choices first and purchase them later. They’ll attempt to eat up all of the premium by promoting it at a better value and later buying it at a decrease price, generally even near zero in case of the expiry dates. For the choices vendor, the utmost revenue is as much as the premium that he has acquired, however the most loss potential is limitless. (Observe: Patrons revenue is Sellers loss & vice-versa)

For instance, within the earlier case, let’s say the Choice Purchaser is promoting the premium of Rs 5,000 to the vendor. The utmost that the vendor can earn right here is Rs 5,000. Nevertheless, if the commerce doesn’t go in his favor and the premium goes to Rs 50,000 when executed, the vendor will lose this big quantity. That’s why he’s solely allowed to make trades when he has a much bigger margin.

To begin choices buying and selling in India with Rs 10,000, you possibly can solely turn into an Choice Purchaser as lesser capital is required right here.

This implies that you may solely purchase choices and pay for the premium value. If the commerce goes in your favor, the worth of the premium will enhance and also you’ll generate income out of your commerce. However, if the commerce doesn’t go in your favor, you possibly can lose a most of as much as the Premium quantity paid to purchase that contract.

Begin Choices Buying and selling in India with Rs 10,000?

If you wish to Begin Choices Buying and selling in India with Rs 10,000, listed here are the steps:

1. First, you might want to have a buying and selling and demat account. You may open your account with any of the highest brokers in India like Zerodha, Angel One, and many others. We’ll suggest you go together with Zerodha, one of the best dealer to get one of the best expertise of buying and selling.

2. Whereas opening your demat account, you might want to make it possible for your derivate section buying and selling is energetic. It permits you to commerce in Futures and Choices. There aren’t any additional costs taken to activate these segments.

3. After your buying and selling account is energetic, add funds to your account. This merely means including an quantity out of your financial savings account to the buying and selling account in an effort to make trades. For instance, when you’re planning so as to add a capital of Rs 10,000 to your buying and selling account, add this fund. Listed below are the precise steps so as to add funds to Zerodha buying and selling Account.

4. As soon as your account is energetic and also you’ve added funds, you’re prepared to begin choices buying and selling.

You are able to do choices buying and selling on Indexes (Observe: Nifty and Financial institution Nifty are essentially the most traded derivatives). However, you may also do choices buying and selling on shares too. For indexes, they’ve weekly expiry together with month-to-month expiry that expires each Thursday. However, for shares, there’s solely month-to-month expiry. On this article, let’s begin with the simplest one to contemplate for instance.

A) Choices Buying and selling with Bullish View

At present, Nifty is buying and selling at 17,692 factors as of Tuesday twenty fifth Oct 2022. The month-to-month expiry can be on twenty seventh Oct 2022 (Final Thursday).

Now, when you’re bullish and assume that Nifty will find yourself at a price far more than 17,700 by the expiry date, you should buy Nifty 17,700 CE for that expiry date. In case you’re extra bullish, you should buy even Nifty 17,800 CE, which implies that consider Nifty will find yourself at even greater ranges than 17,800.

Observe: You can too purchase Nifty 17,400 CE or 17,500 CE, which once more implies that you’re bullish on these figures. Nevertheless, as the present nifty ranges are already greater than 17,400 CE or 17,500 CE, your wager is already true, and the premiums can be greater right here. These are additionally known as ‘Within the Cash’.

If the commerce goes in your favor and the market strikes excessive by the point of expiry, you’ll make income as your premium quantity will go greater. However, in case your hypothesis was mistaken, in that case, you’ll lose the premium as it’ll decay by the expiry date. The premium worth will enhance based mostly on the motion of the index and the way nearer or farther it’s from the expiry dates.

B) Choices Buying and selling with Bearish View

In case you’re having a bearish view and assume that the market will find yourself beneath 17,600 by the expiry date (the present stage is 17,692 factors), you should buy Nifty 17,600 PE choices. In case you are extraordinarily bearish, you possibly can even purchase Nifty 17,500 PE and if the market falls beneath that stage, you’ll have the ability to make income as once more the value of your bought premium will enhance.

Observe: As within the earlier case, you may also purchase 17,800 PE or 17,900 PE, that are ‘Within the Cash’. As the present nifty ranges are already decrease than 17,800 PE or 17,900 CE, your wager is already true, and right here the premiums can be greater.

Briefly, utilizing Name and Put shopping for, you possibly can select your view of the market and in case your view is right, it is possible for you to to generate income. Let’s perceive it additional with the assistance of an instance.

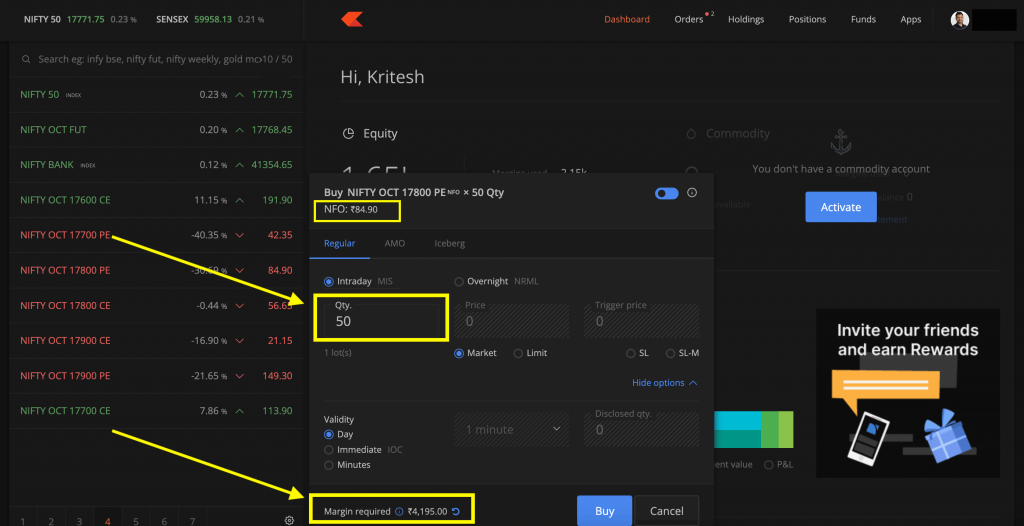

C) Shopping for Nifty 17,800 PE

Let’s suppose, you ended up with a bearish view and plans to purchase Nifty 17,800 PE. Right here, you’ll want to purchase the choices in at the very least 1 lot.

For Nifty, 1 lot = 50 Portions & the present premium is Rs 84.90

On this case, the premium required can be Rs 84.90*50 = Rs 4,245

If the market declines considerably, in that case, let’s suppose the value of this premium goes to Rs 105. Right here, your gross revenue per lot can be (Rs 105- 84.90) * 50 = Rs 20.1*50 = Rs 1,005.

If the commerce doesn’t go in your favor and let’s say that the Nifty goes bullish (greater), then the premium worth of Rs 84.90 may even decay to Rs 0 by the expiry date and also you’ll lose your premium quantity.

One Essential Level to know whereas Choices Buying and selling

Don’t overtrade or take a variety of trades as a result of right here a variety of the quantity will go to brokerages and taxes solely.

In case you are shopping for and promoting, it makes as soon as full commerce, and right here Rs 20 + Rs 20 = Rs 40 is already gone in brokerage. (Please be aware that many of the brokers cost Rs 20 Per commerce for Choices Buying and selling). In case you’re making 10 such trades in a day for five consecutive days in per week, it means a complete of fifty trades. This can consequence within the brokerage of Rs 20*50 =Rs 1,000, together with an additional quantity say Rs 500–600 in authorities taxes & alternate costs. A complete of Rs 1500–1600 is gone.

In case you overtrade with a capital of simply Rs 10,000, most of your capital will erode solely in brokerages and taxes. (Study extra about Choices Buying and selling Prices right here.)

Few Different Factors to Know Whereas Buying and selling Choices

As an Choice Purchaser, if the market strikes in your course in fast time, you’ll have the ability to make some huge cash.Not like long-term buyers, whether or not the market goes up or happening, choices merchants can generate income by buying the correct Name or Put choices.Time is in opposition to the choice purchaser and in favor of the choice vendor. If the market doesn’t transfer (i.e. goes sideways), then your premium will decay and also you’ll lose whole cash.In case you use cease loss and restrict your losses to 10–20% per commerce, your loss can be decrease and also you’ll not find yourself shedding the whole premium. If commerce just isn’t in your favor, higher to give up and save your capital than go for the ‘hope’ buying and selling.

Margin Required for Choices Promoting

To date, we solely confirmed you the way a lot capital is required when you’re shopping for an possibility. However for each purchaser, there’s a vendor. Let’s additionally look into the Margin Required for Choices Promoting.

In case you want to promote the 1 lot (50 Portions) of Nifty 17,700 PE, the margin required can be over Rs 1 lakh (Rs 1,03,804.90 to be precise). If you wish to commerce in a number of heaps, the margin can be even greater.

That’s why we talked about that it’s tough to turn into an choices vendor with small capital.

Conclusion

On this article, we defined the best way to begin choices buying and selling in India with Rs 10,000 capital. From the above dialogue, you will have discovered that you may turn into an Choices Purchaser and begin buying and selling in choices with Rs 10,000.

For buying and selling in indexes, if the premium is Rs 100 and also you’re shopping for 1 lot of fifty portions, you should buy it with Rs 100*50 = Rs 5,000. The premiums could be even decrease at totally different strike costs and days nearer to expiry. Choice consumers should purchase Name (CE) or Put (PE) for exhibiting their bullish or bearish view respectively. If the commerce goes in favor, the value of the premium will enhance. In any other case, the premium value will lower and finally fall to Zero by the point of Expiry for those with mistaken views.

That can be all for this text on the best way to Begin Choices Buying and selling in India with Rs 10,000. We hope this text was helpful to you. In case you probably have any queries relating to choices buying and selling, be at liberty to ask them within the remark part beneath. Have an excellent day and Joyful buying and selling.

Kritesh (Tweet right here) is the Founder & CEO of Commerce Brains & FinGrad. He’s an NSE Licensed Fairness Basic Analyst with +7 Years of Expertise in Share Market Investing. Kritesh incessantly writes about Share Market Investing and IPOs and publishes his private insights in the marketplace.

Begin Your Monetary Studying Journey

Need to be taught Inventory Market and different Monetary Merchandise? Make sure that to take a look at, FinGrad, the training initiative by Commerce Brains. Click on right here to Register immediately to Begin your 3-Day FREE Path. And don’t miss out on the Introductory Provide!!