Sundry Pictures

Funding Thesis

ServiceNow (NYSE:NOW) has drawn the eye of many buyers recently as it’s a firm that manages to develop at a fast tempo in an surroundings the place different corporations wrestle to maintain being profitable. Furthermore, ServiceNow is a worthwhile firm with an incredible money move technology functionality, so it’s not shocking that it managed to succeed in a market capitalization of greater than $140 billion.

Nonetheless, the truth that it’s presently buying and selling at a P/E of 396 is posing the important question: “Is it definitely worth the cash?”

The quick reply is NO. I do not consider that ServiceNow will outperform the market in the long term and I fee it as a promote.

ServiceNow Enterprise Mannequin

ServiceNow Enterprise Mannequin (medium.com)

Through the use of ServiceNow, a cloud-based workflow automation platform, enterprise companies can improve operational efficiencies by streamlining and automating widespread work operations.

About 95% of ServiceNow’s income comes from subscription charges; the precise quantity a shopper should pay depends upon the options they want and the diploma of customization.

The corporate has three (3) sources of income:

1) The Now Platform

The Now Platform is a pre-built resolution with a number of options that can be utilized with each customized apps and cloud companies. Net companies supplied by the Now Platform embrace edge encryption, automated testing frameworks, efficiency analytics, and reporting. Moreover, there are greater tiers of performance accessible for purchasers who need better personalization.

2) The Nonstop Cloud

The cloud structure utilized by ServiceNow is named the “Nonstop Cloud,” and it’s continuously operational. The Nonstop Cloud is secure, dependable, and adaptable to satisfy the wants of particular person shoppers whereas nonetheless complying with worldwide legal guidelines.

3) Cloud companies

The 5 classes that make up cloud companies are enterprise software program, safety, buyer assist, HR, and IT. Every space is additional divided into a lot of sub-functions, together with undertaking portfolio administration, agile improvement, incident response, and buyer and employees satisfaction. The proportion of shoppers whose contracts are renewed when their subscriptions expire is named the renewal fee.

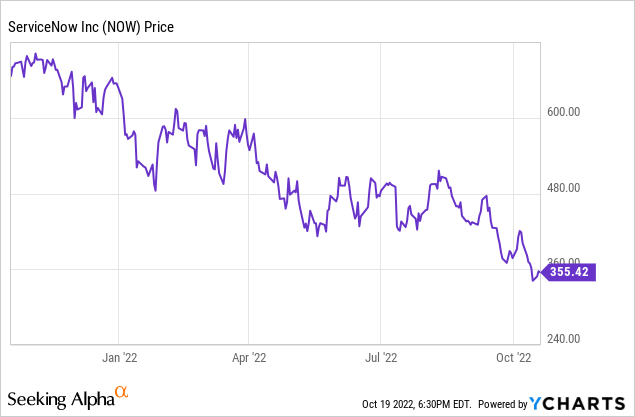

Renewal Charge

Renewal Charge (ServiceNow IP)

The proportion of shoppers whose contracts are renewed when their subscriptions expire is named the renewal fee.

The truth that ServiceNow has a renewal fee of 99% implies that the companies it provides are prime quality and are nicely value its buyer’s cash as they’re keen to pay it many times.

This may assist the corporate restrict its expenditures and thus improve its margins as in comparison with preserving a present buyer, buying new clients is 5 occasions dearer.

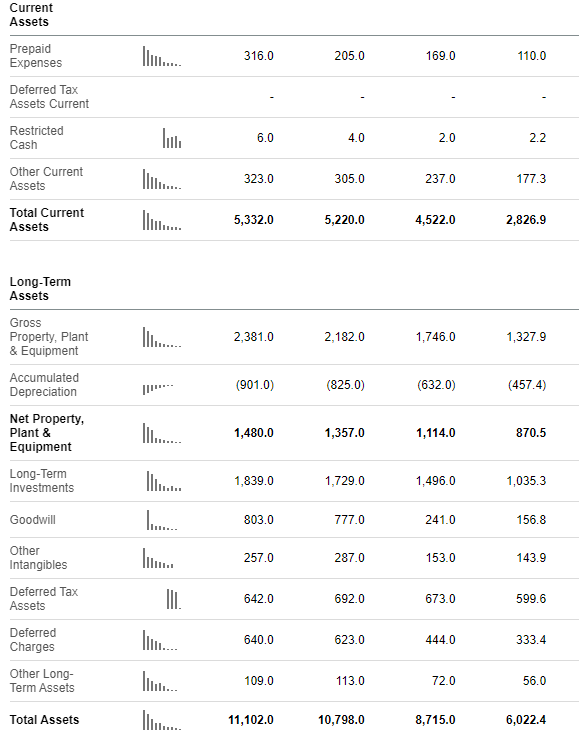

Fundamentals And Inventory Worth

Though ServiceNow is a $70 billion firm it managed to nonetheless develop its top-line income at great charges each and annually because it was listed within the inventory market again in 2012.

Nonetheless, this excessive development and the robust financials that characterize the corporate aren’t depicted within the inventory value because it has plunged about 50% from its all-time excessive of $707.60.

Now that the worth has reached $355, many buyers might consider that this can be a good time to purchase the dip, however is that this actually the case?

ServiceNow P/S is 9.39 in comparison with its sector’s median of two.50. The corporate is also buying and selling at a fairly excessive P/E GAAP (TTM) of 396. Buyers usually solely pay for this sort of valuation through the early phases of an organization’s development to people who are increasing the quickest. An organization will broaden extra slowly because it matures, and the P/E ratio will usually drop. Thus, to ensure that ServiceNow’s P/E to be justified, the enterprise ought to possess a really promising future along with a powerful moat.

In keeping with analysts, ServiceNow checks not less than the primary field because the income forecast for the corporate is 20%-25% for the subsequent 4 years. However is that sufficient?

On the finish of the day, with out revenue, gross sales improve is pointless and at this level NOW barely makes ends meet, having a web earnings margin of two.79% though it has been profitable since 2019.

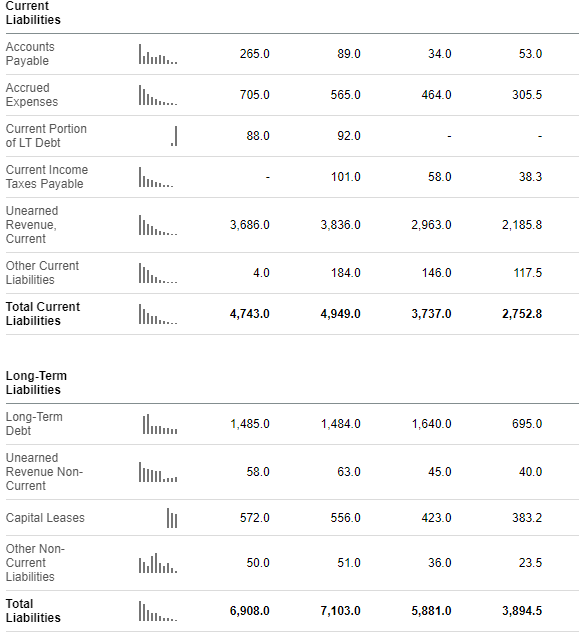

ServiceNow – Steadiness Sheet

In search of Alpha In search of Alpha In search of Alpha

I might say that ServiceNow’s stability sheet is neither good nor dangerous. The corporate’s long-term debt is greater than what I normally wish to see, particularly in a high-rate surroundings, however it’s manageable. The value of its complete belongings outnumbers the overall liabilities that the enterprise has, which is reassuring for the corporate’s buyers as they not less than know that the corporate will likely not go bankrupt not less than within the close to future. Nonetheless, I want to see its present liabilities being greater than its complete liabilities sooner or later simply to have an even bigger margin of security.

Valuation, Is It Price The Threat?

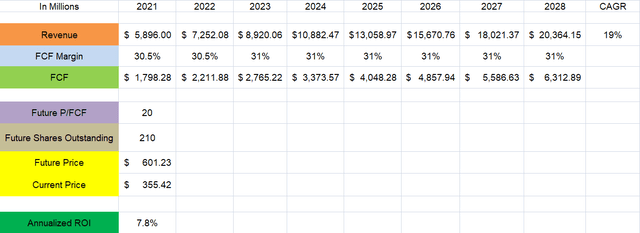

Writer’s Calculations

This time I went a bit extra aggressive on the income development fee, simply to show my level, projecting a CAGR of 19% for the subsequent 6 years. I stored the FCF margin at 31%, about the identical as it’s now. I consider 31% is fairly rational as it’s excessive sufficient for a SaaS enterprise however low sufficient to cowl the case of the rising competitors that can trigger margin stress. Add to {that a} P/FCF of 20 (which can be a bit aggressive if we consider the truth that traditionally, the S&P 500’s common P/E ratio has fluctuated between 13 and 15) and also you get a future value of $601.26 in 2028.

By shopping for the inventory at $355.42, even within the bull case situation that the numbers above do come true, you’ll have an annualized ROI of lower than 8%. By investing your cash in an ETF that tracks the S&P 500, you’ll have a median ROI of just about 10% as historical past has proven by taking a lot much less threat as you’re placing your cash within the 500 massive corporations listed on inventory exchanges in the US as a substitute of only one.

So is ServiceNow actually value it?

Dangers

Competitors

The one conspicuous threat that I see in the intervening time is aggressive stress. There are quite a few different gamers who would possibly create gadgets to rival the corporate’s providing, which might put the corporate underneath additional aggressive stress. Moreover, if these gamers adopted a extra aggressive enlargement plan, the quite a few companies which might be lively within the ITSM business would lead to rising aggressive pressures. Moreover, there are specialised opponents in every business that ServiceNow enters past its extra established, which could compete with it and make working circumstances harder for a brand new entry.

Conclusion

Total, ServiceNow is a good enterprise with robust fundamentals and a good stability sheet; simply not the fitting value. Personally, I might think about shopping for the corporate’s inventory for underneath $200. At $355, it’s simply not definitely worth the threat for me and I might reasonably put my cash in one other inventory that I think about to be a discount.