Maria Vonotna/iStock by way of Getty Pictures

Funding thesis: The present decade is proving to be one in all some dramatic international adjustments, of historic proportions. The more and more interconnected world is beginning to unravel and we’re breaking into two separate camps. One camp facilities across the US and one other round China. There’s additionally an unaligned group within the center, with most impartial international locations arguably seeing their very own pursuits extra aligned with the BRICS-centered group. Our aggressive techniques of pushing extraterritorial sanctions on their bilateral dealings with the opposite camp appear to more and more annoy the impartial nations. Moreover, the nice financial decoupling appears to be inflicting quite a lot of financial ache on some US allies, with their economies shrinking precipitously this yr in USD phrases, even because the likes of Russia & Iran are seeing the dimensions of their economies in nominal USD phrases gaining floor. In gentle of this profound change within the international financial and geopolitical order, buyers ought to take into account pricing an ideal deal extra danger into each funding determination. This decade would possibly flip right into a problem to keep up actual wealth for many portfolio methods, slightly than being a chance to realize.

The nice international financial struggle arguably began with the proxy struggle in Ukraine.

Now we have been sliding in the direction of this second for some years now, however it all arguably got here to a head with Russia’s determination to invade Ukraine this yr. A lot of the Western World, along with a handful of different allies mobilized itself for a proxy army confrontation on the bottom in Ukraine, in addition to an financial struggle on Russia, which is being waged globally, affecting most different nations on the planet. Russia seemingly has few open allies, however there appears to be fairly a little bit of tacit assist coming from a lot of the remainder of the world, with most international locations outdoors of the Western alliance fully uninterested and even aggravated with the present financial struggle being waged by the West towards Russia.

Individually, a tech containment struggle began towards China some years in the past. The takedown of Huawei was arguably the start line of that battle, which stored escalating over the previous years, and it has intensified over the previous few months, with the most recent semiconductor-related sanctions on China being arguably paralyzing on a sectoral foundation. It stays to be seen to what extent China can re-adapt its tech sector to be able to assist it cope.

The unilateral withdrawal of the Trump administration from the Iran nuclear deal led to what’s at this time one other main international financial system being closely sanctioned. These three international locations are confronted with rising isolation from the Western Block, due to this fact it’s inevitable for them to merge into an opposing financial and geopolitical grouping, with many different nations, comparable to those in Central Asia inevitably changing into allies on account of geographical realities.

Ever because the emergence of the Western-dominated post-WW2 World order, there have been many countries that confronted related sanctions. It ought to be famous nevertheless that these three international locations at present make up over 20% of the world’s whole GDP, based mostly on the IMF’s newest numbers. Nor can this be in contrast with the Soviet-NATO face-off, principally as a result of the Soviets had been working a deeply flawed socio-economic experiment that was all the time pre-destined to implode. Moreover, China is the world’s manufacturing unit, that means that it can’t be totally and even partially contained on the worldwide stage, provided that the entire world depends upon manufactured merchandise and middleman items that it offers. Russia can also be indispensable on the worldwide stage, given that it’s the world’s largest web exporter of commodities. Inside the context of what appears to be a decade of tight supply-demand balances in lots of commodities around the globe for the foreseeable future, it offers Russia with outsized leverage over the worldwide financial system.

12 months one of many nice financial struggle may be summed up as one the place it appears to pay extra to be a US adversary than an ally.

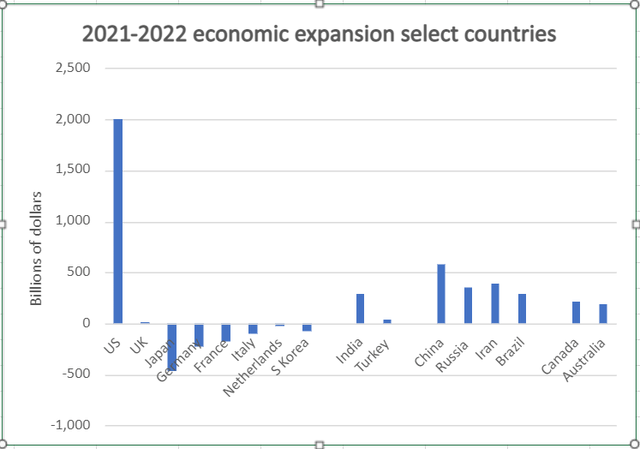

Knowledge supply: IMF

As we will see, the US is doing comparatively effectively in relation to a lot of the remainder of the world. It even managed to outgrow its principal international rival China by a large margin, making it much less possible that China will turn out to be the world’s largest financial system in nominal phrases any time quickly. Its principal geopolitical and financial allies around the globe, nevertheless, have been seeing a less-than-stellar efficiency this yr. The group of nations I highlighted within the chart collectively as being along with the US, misplaced about $1 trillion {dollars} by way of the dimensions of their collective economies this yr in contrast with final yr. Once we add the remainder of the EU in addition to quite a lot of different allies around the globe, it rises to about $1.2 trillion

Apparently, the 2 most sanctioned nations, amongst all main international economies, particularly Russia & Iran have seen some spectacular beneficial properties by way of the dimensions of their economies in nominal USD phrases. China continues to be affected by its COVID-Zero insurance policies, in addition to from an intensification of sanctions on its financial system, particularly within the tech sector. India & Turkey, arguably impartial nations are seeing respectable financial development charges, with Turkey, specifically, affected by a case of foreign money devaluation, which is stifling its financial enlargement. It’s, nevertheless, methodically and systematically creating new international financial connections, principally with the BRICS group, which might bear fruit in coming years, particularly if its foreign money devaluation state of affairs will likely be introduced below management.

There are two principal elements that formed the nominal development sample of sure nations this yr. Arguably a very powerful issue has been the risky foreign money alternate charges, with the US greenback doing notably effectively. The ruble is outperforming the greenback this yr, which explains its spectacular beneficial properties in nominal USD phrases. The euro and different currencies have been having a tough time, which is mirrored in some economies shrinking an ideal deal this yr in USD phrases. The opposite issue has been the worldwide commodities market, which to a point affected the worldwide FX market in favor of main web exporters of commodities. Within the explicit case of China, the Zero-COVID coverage is probably the principle issue that’s curbing its development, which is a separate concern from the 2 above-mentioned points.

One could be tempted to argue that since foreign money alternate charges are the principle offender behind the shift within the international financial weight, there’s not a lot to it by way of permanence. It is a flawed assumption. The EU as an illustration is confronted with a rising commerce deficit hole, even because the euro retains weakening, which isn’t what one would possibly anticipate in response to economics 101.

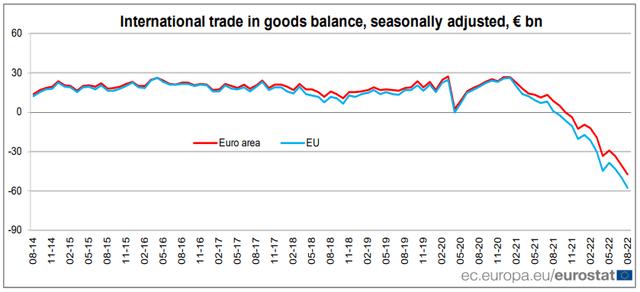

Eurostat

One of many principal elements that contributed to the top of Europe’s regular run of commerce surplusses has been the spike in vitality costs. These pressures will most likely persist and even worsen if the euro retains shedding floor on the worldwide FX market. There can even be secondary results, with increasingly industrial actions ceasing, which can result in fewer exports, regardless of the weaker euro, which ought to ordinarily make EU exports cheaper and extra enticing. A shrinking industrial base can even hit Europe’s total financial actions. As issues stand proper now, Europe’s fertilizer manufacturing is cratering. Aluminum manufacturing can also be down considerably. The crucial EU auto business is forecast to shrink as a lot as 40% if the disaster continues.

Taking a look at Europe’s basic financial developments, there appears to be no foundation to anticipate a firming of the euro foreign money going ahead. The ECB is caught between surging inflation and a cratering financial system. Even because the EU financial system shrinks in USD phrases, so does its actual financial output. It’s a little bit of a distortion that also has it rising in euro phrases, at the same time as increasingly industrial institutions are shutting down. Because of this, there isn’t any prospect for a foreign money rebound, due to this fact the shrinkage in its financial system is actual, tangible and it’s long-lasting. Worst of all, so long as the financial confrontation will final, so will the pattern of additional financial shrinkage.

America’s principal allies are uncovered and weak on account of an acute lack of essential pure sources.

The primary differentiating consider the best way the US financial system fared via the opening salvoes of the worldwide financial struggle versus its principal allies is the diploma of self-sufficiency by way of pure sources. I disregarded two of America’s principal allies to the proper facet of the financial enlargement chart, on their very own, principally as a result of I needed to focus on the distinction that permit them increase extra akin to what we’ve got seen this yr with the US, or Russia & Iran. That every one-important issue is after all the extent of commodities self-sufficiency that international locations like Canada & Australia get pleasure from, versus the relative poverty on this regard {that a} nation like Japan has to deal with. Each international locations loved a proportionally related enhance within the dimension of their economies this yr in contrast with final yr because the US did.

The China-centered block that’s rising, formed by the diploma to which sure international locations are dealing with sanctions, tends to be wealthy in essential pure sources that the world is deeply depending on. Russia as an illustration is the world’s largest web exporter of commodities. Oil, fuel, meals in addition to sure metals, nuclear gasoline, and fertilizers are all uncooked supplies or processed uncooked supplies that the world can’t simply change, particularly not on brief discover. A few of these supplies, particularly oil & fuel, the world can’t change, even when we’re given the time.

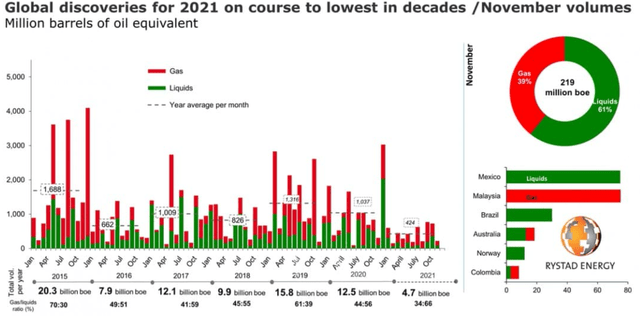

Rystad

Final yr the world found nearly 5 billion barrels of oil equal in oil & fuel mixed, at the same time as we produced and consumed about 45 billion barrels of oil equal. Different international locations like Iran or Brazil are additionally well-endowed on this regard, and Saudi Arabia has been cited as a future potential BRICS member. Time is clearly not on our facet by way of changing Russian oil & fuel provides. The one factor that may assistance is demand destruction, and as we’re curbing a few of these Russian merchandise from making it to market, we see increasingly that the EU and Japan are the principle candidates for the mandatory demand destruction that should happen to be able to rebalance the worldwide provide/demand state of affairs.

The US has a really arduous determination to make. It sees the financial confrontation with Russia, Iran, and more and more with China to be of significant financial and safety curiosity. Its financial system is effectively sufficient insulated from overdependence on major financial inputs that it could comfortably take the battle to its adversaries. On the similar time, its principal allies around the globe aren’t able to face up to the blow of shedding entry to sure sources in addition to some items.

With the intention to proceed this confrontation, particularly with Russia, it must share sources. In different phrases, settle for a sure degree of demand destruction in its personal home financial system to be able to assist Europe and different allies out.

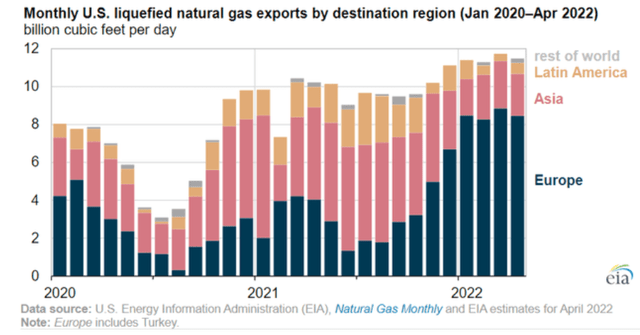

EIA

On the difficulty of pure fuel shortages in Europe, the US is already doing an ideal deal. It diverted huge volumes of LNG to the European markets and elevated total export volumes. The measure is ready to have a major affect on US utility prices this winter. Extra should be carried out subsequent yr, on pure fuel, diesel, and different fronts, if the coverage of financial confrontation is to proceed going ahead. There are solely two alternate options. One is to proceed with the financial confrontation and danger the outright implosion of the EU, the UK, and Japan’s economies. The opposite selection is to de-escalate and have some type of rapprochement.

Potential fallout:

There are at present no indicators that the trail to de-escalation is in any respect a viable end result, due to this fact we’ve got to imagine that the worldwide financial battle will proceed. What this implies is that the US, UK, EU, and Japan will all have to simply accept additional declines in vitality utilization. The EU ban on Russian oil & diesel will come into power in December and February, respectively. Consequently, US diesel exports will most likely have to extend considerably within the coming months, which can trigger an additional spike in total inflation, provided that diesel is essential within the transport of most shopper and industrial items. Larger inflationary pressures will in flip result in extra aggressive financial coverage tightening, which can final far past the anticipated ranges of financial ache that will likely be inflicted consequently. In different phrases, the extent of demand destruction should be deeper than most would possibly anticipate earlier than there will likely be a much-expected Fed pivot. Consequently, the latest inventory market bullishness shouldn’t be seen as an indication of bottoming. There are nonetheless some months to go, at the least. For my part, the earliest that we will anticipate that pivot will likely be late spring, subsequent yr.

Although the US is prone to attempt to assist its energy-poor allies in surviving the intensifying international financial confrontation, it will not be sufficient. This can be the case particularly since plainly ME and different web vitality exporters that might assist appear to be at most disinterested. OPEC in addition to Qatar have been warning all through this yr that there isn’t any substitute for the large volumes of vitality that Russia is exporting. Even when there have been to be extra that they may do, plainly they aren’t in any respect interested by yielding the Asian market to Russia and pivoting to assistance from the EU market, which is more and more seen as a long-term loser from the angle of commodities exporters.

Subsequent yr, the EU and UK vitality state of affairs might turn out to be untenable, even with enhanced US exports to the area. Provided that the political management invested itself into the justification for the battle, will probably be very arduous to pivot away, due to this fact we could also be taking a look at an financial meltdown occasion for the EU, which is the three’rd largest international financial system, and the UK which is the world’s 5’th largest. In different phrases, it could be politically powerful for them to pivot, even when at this level they see the financial hazard. It’s arduous to formulate a constructive funding story for subsequent yr inside that potential context.

We must also take into account that whereas we hold ratcheting up strain on China’s tech business, attempting to deprive them of applied sciences wanted to advance, China is but to noticeably retaliate. We do not know whether or not they ever will, or when they are going to do it, nor in what kind they are going to do it. Or maybe they’re already retaliating, and we simply do not understand it but. My private view is that the extra weak we turn out to be, as the present financial struggle is carrying us and our allies down, the extra possible will probably be that China will retaliate, particularly since we’re regularly eradicating all incentives for China to attempt to protect relations. My view on that is that China might act subsequent yr, particularly if the financial state of affairs within the EU and to a lesser extent within the US turns into direr. There isn’t any telling how intense any potential Chinese language financial or geostrategic measures could be, however for now, we’ve got to bear in mind that the chance is there and it’s most likely intensifying by way of odds, in addition to by way of the potential magnitude of affect.

Funding implications:

Threat is one thing that must be re-priced for many portfolio positions, given the general international financial outlook, inside the context of what now appears to be an inevitable slide right into a interval of deglobalization. On the minimal, we have to more and more assume that multinational corporations can have a more durable time penetrating sure main international markets, whereas additionally doubtlessly dealing with rising competitors in non-aligned markets, comparable to India as an illustration. In a worst-case state of affairs, we will likely be confronted with a state of affairs the place opposing financial & geopolitical blocks will proceed to hunt to destroy one another economically, with escalating measures, resulting in extra escalation and a endless vicious cycle of ensuing wealth destruction. On this hypothetical worst-case state of affairs, the worldwide enterprise surroundings in addition to native markets are set to see a marked deterioration. Dwelling requirements are prone to plunge, and with that so will the worldwide funding surroundings.

My private response to the state of affairs has been to shift to a extra various portfolio, with my total goal being to keep away from constructing a place that exceeds 3% of my total portfolio in any explicit inventory or ETF. I nonetheless have some legacy positions that far exceed that, comparable to Suncor (SU), which I’m in no rush to cut back, given my expectations for a unbroken commodities bull market, at the same time as we’re more and more seeing demand destruction take maintain. Just a few new positions additionally exceed that mark of roughly 3%, however not by a lot.

When investing in new positions, I’m searching for deeply discounted property that I deem to be an in any other case strong long-term funding alternative. As an example, I not too long ago purchased Intel (INTC) and AMD (AMD) shares in small increments. If such oversold alternatives don’t current themselves, I choose to remain in money, which now makes up effectively over 30% of my total portfolio. Gold additionally must be a distinguished a part of a portfolio now greater than ever in case your entire fiat monetary system goes for a dive, which is now not a situation that we will deem as far-fetched. My bodily gold & silver place, in addition to my place in GLD (GLD) in addition to Barrick Gold (GOLD), in addition to Wheaton (WPM) inventory, quantities to a few fifth of my present whole portfolio.

I see gold as an insurance coverage coverage within the occasion that issues go South, though it shouldn’t be assumed that it’s assured to work. No place, be it in shares, bonds, currencies, or gold ought to be seen as secure at this level. It could be the case nevertheless that some property will show to stay priceless all through this decade of turbulence. And in some unspecified time in the future, when issues will quiet down, maybe with a brand new international grand discount rising that can enable the completely different warring factions to coexist and even cooperate within the curiosity of mutual advantages, one needs to be able to make the most of new alternatives, which after all requires capital. For now, nevertheless, that is much less a time of alternatives however slightly one in all having to battle for actual wealth preservation. It’s bleak to even ponder it from an investor’s perspective, however it is usually essential to actively search for methods to protect as a lot as doable, and wait it out, whereas we cross into what is going to hopefully be a extra steady and affluent future.