Black_Kira

C3.ai (NYSE:AI) is a knowledge science platform targeted largely on offering infrastructure that allows firms who lack experience to construct and deploy scalable AI. This can be a giant market, however competitors is fierce and C3.ai’s broader market attraction has but to essentially be established. C3.ai’s inventory is now moderately priced, however given the massive quantity of uncertainty surrounding the corporate’s prospects, should still not characterize good worth.

Market

Whereas the marketplace for machine studying software program is giant, and certain has a vibrant future, investor focus is now pivoting to brief time period prospects, because the specter of a recession threatens IT budgets. In contrast to previous recessions, synthetic intelligence and automation at the moment are seen as core enterprise drivers, relatively than simply value facilities. This may occasionally imply that relatively than chopping budgets, firms flip to synthetic intelligence as a approach to cut back prices and enhance productiveness.

Greater than three-quarters of surveyed tech leaders say that they count on their group to spend extra on expertise this 12 months, with investments targeted on cloud computing, machine studying, synthetic intelligence and automation. Forrester recommends that firms reduce prices by eliminating older applied sciences and underutilized software program (unused seat licenses).

Even when knowledge science budgets are left largely untouched, a discount in IT spending is unlikely to be a optimistic for C3.ai, as the corporate remains to be attempting to ascertain a foothold out there and develop its buyer base. AI vendor DataRobot laid off roughly 7% of its workforce in Could, indicating that AI platforms usually are not immune from financial headwinds.

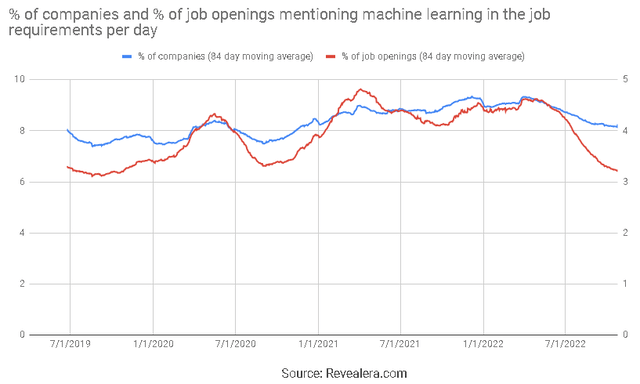

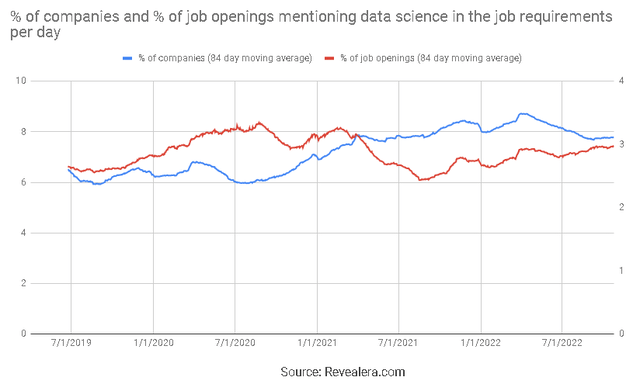

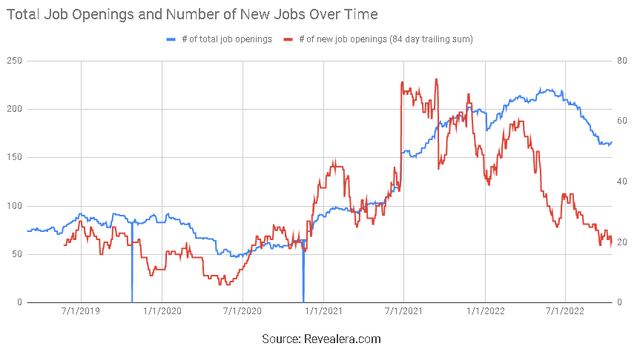

Hiring knowledge factors in direction of a moderation in development of AI spending, if not an outright decline. The variety of job openings mentioning machine studying within the job necessities has declined considerably over the previous 12 months, whereas the variety of job openings mentioning knowledge science has leveled off. There’s possible a problem with the particular language utilized in job postings, however it could seem that development within the variety of related positions has moderated.

Determine 1: Job Openings Mentioning Machine Studying within the Job Necessities (supply: Revealera.com)

Determine 2: Job Openings Mentioning Information Science within the Job Necessities (supply: Revealera.com)

C3.ai

C3.ai claims to be an AI firm, however is extra of a platform-as-a-service for normal machine studying capabilities. A lot of their platform’s performance is aimed toward obviating the necessity for experience when growing and deploying AI at scale.

Since going public in December of 2020, C3.ai has spent roughly 250 million USD on R&D, amounting to 59% of income. The majority of this substantial funding was targeted on the event of Model 8 of the C3.ai Platform, which is anticipated to offer prospects 10x to 1,000x scalability and efficiency enhancements. As well as, there are new knowledge integrations, new no-code, low-code growth instruments and improved knowledge science instruments.

C3.ai continues to take a position aggressively in R&D, with these efforts usually concentrating on the event of use case particular purposes. C3.ai has launched 5 new purposes since their IPO:

C3.ai ERP C3.ai ESG C3.ai Property Appraisal C3.ai Legislation Enforcement C3.ai Ex Machina

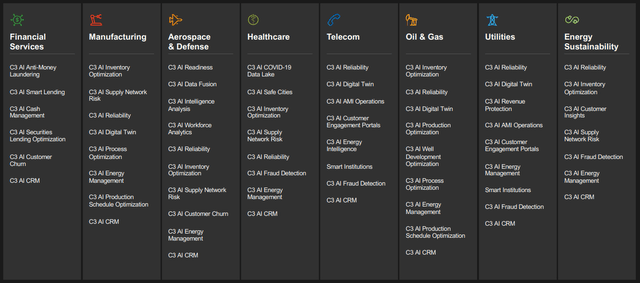

The corporate expects to have round 100 turnkey purposes inside the subsequent two years, for industries together with banking, manufacturing, oil and fuel, automotive and transportation. This concentrate on purposes is on the coronary heart of C3.ai’s enterprise, because the overwhelming majority of their income comes from turnkey purposes relatively than offering prospects with instruments to develop their very own purposes.

Determine 4: C3.ai Functions (supply: C3.ai)

Along with constructing out their portfolio of purposes, C3.ai can also be attempting enhance the productiveness of their gross sales operate and enhancing their strategic partnering mannequin. The corporate hopes these efforts will speed up gross sales cycles and result in a rise in market share.

Thomas Siebel characterised the previous profile of C3.ai’s gross sales group as much like SAP (SAP) and Oracle (ORCL). The corporate desires to shift this in direction of a extra extremely educated and skilled group with area particular experience. The typical age of C3.ai’s salesforce is 35, all of whom have no less than one superior diploma and 67% of whom have MBAs. They’ve 12 years of labor expertise on common and plenty of have academic backgrounds at organizations like West Level, the Naval Academy, MIT, Princeton, Illinois, Michigan, Berkley, Stanford, MIT, Georgia Tech and Carnegie Mellon. I’m undecided of the efficacy of this technique, however it can possible end in a gross sales group with a comparatively excessive prices foundation. If nothing else, it appears to suit with C3.ai’s concentrate on credentials and look.

C3.ai has expanded their partnership with Google Cloud, with Google Cloud growing its dedication to co-sell and co-fund over 100 new C3.ai Tier 1 pilot deployments. Thus far, C3.ai has closed over 265 million USD in contracts with Microsoft (MSFT), and Microsoft is funding C3.ai trials to speed up buyer acquisition. AWS is C3.ai’s largest put in base, with roughly 56% of C3.ai’s prospects operating on the AWS cloud.

Baker Hughes (BKR) can also be an vital associate for C3.ai. C3.ai is collaborating with Baker Hughes, Microsoft and Accenture to develop and market a complete industrial asset administration answer for purchasers within the power and industrial sectors.

Monetary Evaluation

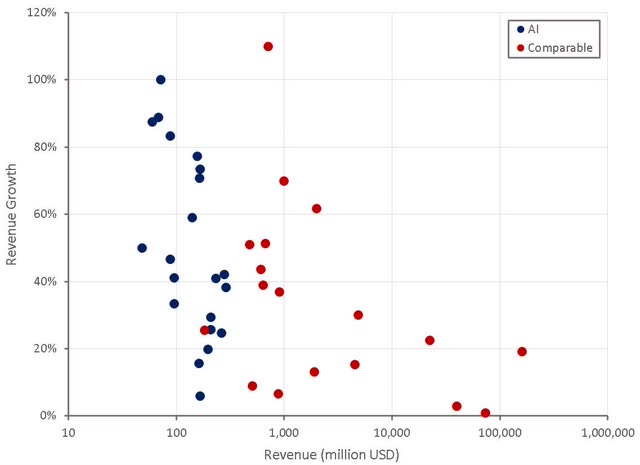

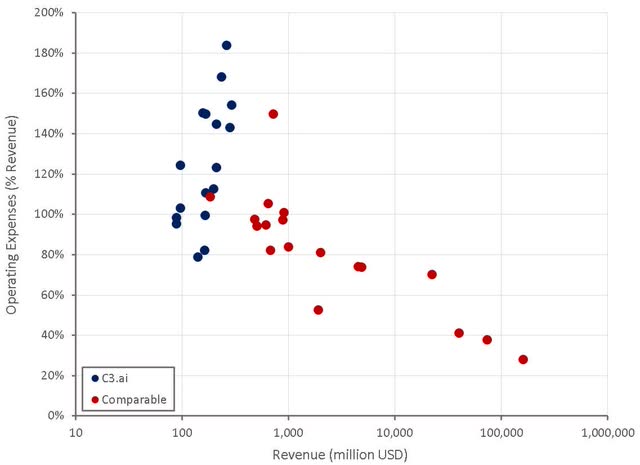

C3.ai’s income development is comparatively low given the corporate’s dimension, and has been declining quickly. This isn’t shocking given C3.ai’s reliance on giant prospects. It has at all times been questionable whether or not the corporate may efficiently penetrate the broader market and there may be nonetheless restricted proof of a capability to do that.

C3.ai’s reliance on use case particular purposes may restrict enlargement charges relative to software program firms that present infrastructure that prospects construct on. This might enhance the burden of gross sales and restrict C3.ai’s development price.

Along with uncertainty concerning the basics of C3.ai’s enterprise, there may be mounting macroeconomic uncertainty which is prone to weigh on the corporate’s efficiency going ahead. Administration has pointed in direction of price range cuts and lengthening gross sales cycles on earnings calls. Whereas some friends are going through comparable points, it must be famous that this stands in sharp distinction to the commentary offered by Alteryx (AYX).

C3.ai’s buyer rely grew 27% YoY to 228 in the newest quarter. This development is being pushed by smaller prospects, with the variety of sub million USD offers rising 44% YoY. In consequence, C3.ai’s common whole contract worth is compressing quickly. Whereas that is obligatory for C3.ai to extend income, it doubtlessly additionally requires a distinct gross sales technique and competencies.

C3.ai is at the moment within the strategy of transitioning to a consumption-based pricing mannequin, which they hope will speed up adoption of their platform. Previously, C3.ai’s gross sales cycles concerned prolonged negotiations of 36-month contracts that included developer license charges, utility license charges, knowledge science license charges, skilled providers and run time charges totaling commitments within the 1-35 million USD vary. With a consumption-based pricing mannequin, the price of adoption is low and the protracted acquisition deliberation course of is prevented. C3.ai expects to see extra new prospects who begin smaller however develop over time. In consequence, they hope to see a considerable enhance in income and income development charges after three to 4 quarters. The near-term affect on income and RPO might be damaging although.

Determine 5: C3.ai Income Development (supply: Created by creator utilizing knowledge from firm reviews)

C3.ai is concentrating on a discount in advertising bills from 29% of income to 11% of income. Additionally they plan on decreasing R&D bills from 44% of income to 29% of income and common and administrative bills from 15% of income to 12%. Gross sales bills are anticipated to extend from 23% of income to 26% of income although.

C3.ai expects to be worthwhile on a non-GAAP foundation and be producing optimistic money flows from regular operations by the tip of fiscal 12 months 2024. These look like fairly aggressive targets that may possible require vital income development, along with value controls, to attain.

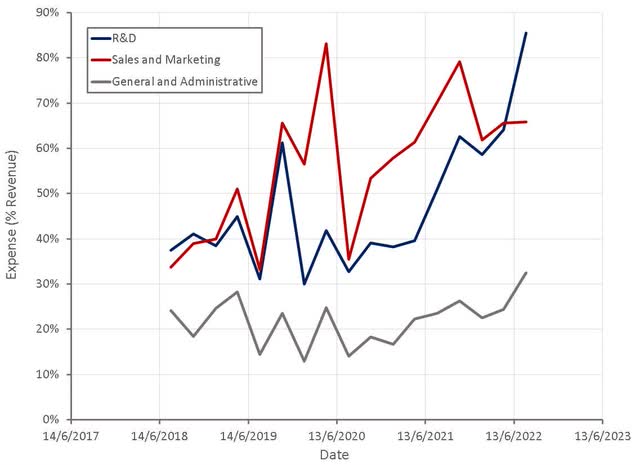

Determine 6: C3.ai Working Bills (supply: Created by creator utilizing knowledge from C3.ai)

Determine 7: C3.ai Working Bills (supply: Created by creator utilizing knowledge from firm reviews)

C3.ai has slowed hiring considerably over the previous 12 months, as anticipated given the corporate’s concentrate on decreasing working prices. Hiring remains to be above pre-pandemic ranges although, so the corporate doesn’t look like overly involved with its present monetary state of affairs. C3.ai’s giant money steadiness affords them a buffer to have the ability to work by short-term macro points. C3.ai has acknowledged that they proceed to rent, particularly in gross sales and engineering, with engineering development concentrated in Guadalajara because of the value advantages.

Determine 8: C3.ai Hiring Pattern (supply: Revealera.com)

Valuation

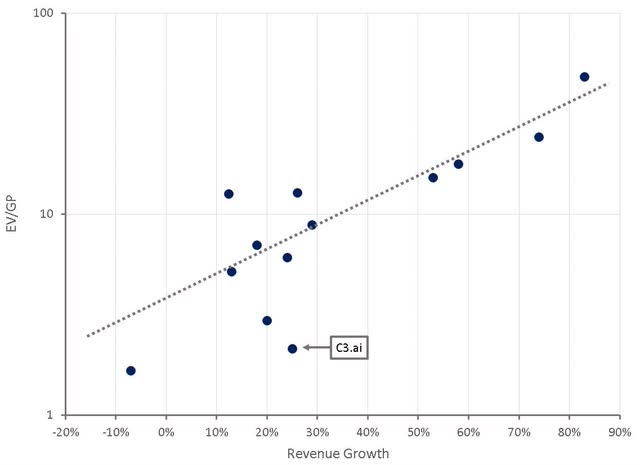

C3.ai’s EV/S a number of seems fairly low, though that is considerably deceptive, as the corporate has almost one billion USD in money, which it can possible burn by in coming years. C3.ai actually may show to be undervalued if they’ll speed up adoption of their platform and enhance the productiveness of their gross sales group, however given the corporate’s present lack luster efficiency and macro uncertainty it seems pretty valued.

Determine 9: C3.ai Relative Valuation (supply: Created by creator utilizing knowledge from Searching for Alpha)

Conclusion

C3.ai’s inventory has been punished severely by the market because it went public to a lot fanfare in 2021. A few of this has been based mostly on valuation, however numerous it’s associated to the corporate’s comparatively poor monetary efficiency and unsure place in a fragmented and aggressive market. The shift to a consumption based mostly enterprise mannequin and the restructuring of the gross sales group point out that C3.ai has issues that transcend easy macro headwinds. It’s not clear that these efforts will do a lot to enhance C3.ai’s excessive prices and low development although. If the corporate can discover a approach to management prices and reaccelerate development, the inventory may show to be fairly low cost at present ranges.