Sean Gallup

This story was initially written on October 28, 2022, for subscribers of Studying The Markets, an SA market service.

Shopify (NYSE:SHOP) reported better-than-feared outcomes final week, and now the inventory could also be poised to run a lot larger. The firm reported a lack of $0.02 per share within the third quarter, higher than estimates for a lack of $0.07 per share. In the meantime, income got here in at $1.36 billion, which was higher than estimates of $1.34 billion.

The corporate additionally had robust phase beats, with merchandise options topping estimates by 3.7% and subscription options coming in 1.2% higher than estimated. On the flip facet, gross merchandise quantity missed estimates by 1.3%, and month-to-month recurring income missed estimates by 4.1%.

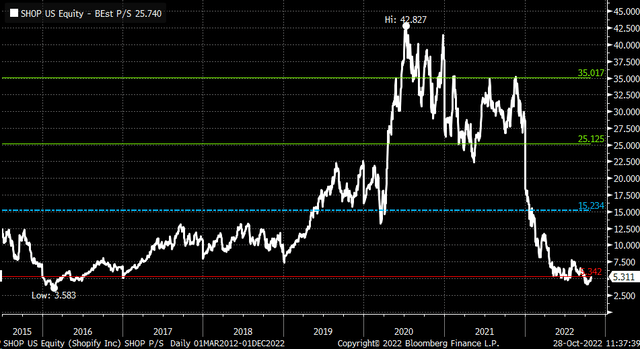

On a price-to-sales metric, Shopify is about as low cost as it can get at 5.3. In fact, it may get cheaper, however on a historic foundation, the inventory is buying and selling very near its lowest valuation going again to 2015.

Bloomberg

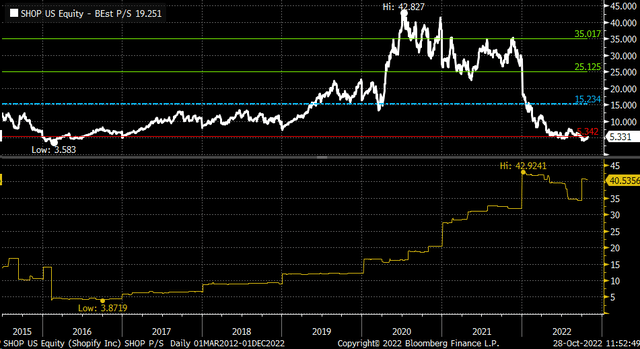

The inventory’s valuation has plunged as a result of income progress is predicted to fall to 19.1% in 2022 from 57.4% in 2021. However progress will possible reaccelerate in 2023 and 2024 to round 22% annually. A reacceleration in income progress may drive the price-to-sales a number of larger over time. Even a bump within the a number of to six may push the inventory to round $40.

Bloomberg

Huge Guess Shares Rise

The bettering basic outlook might have pushed somebody to guess on the shares surging over the subsequent few weeks. The open curiosity for the SHOP January 20, 2023, $25 calls rose by round 40,000 contracts on October 28. The info reveals that 25,000 contracts had been purchased for $10.63, 10,000 contracts had been purchased for $10.60, and 5,000 contracts had been purchased for $10.95. In whole, it seems they purchased 40,000 contracts and paid a premium of $42.6 million, which is an enormous quantity. It will indicate that the dealer sees the inventory rising above $35.90 per share by the center of January.

It is usually price noting that the dealer possible rolled a number of the proceeds from a previous choices commerce as a result of it seems they bought to shut 25,000 contracts of SHOP November $25 requires $9.18 per contract. The open curiosity for these contracts dropped by round 25,000 contracts on October 28, as nicely. It appears they’d initially bought these calls on July 27 for $11.30.

Bullish Traits

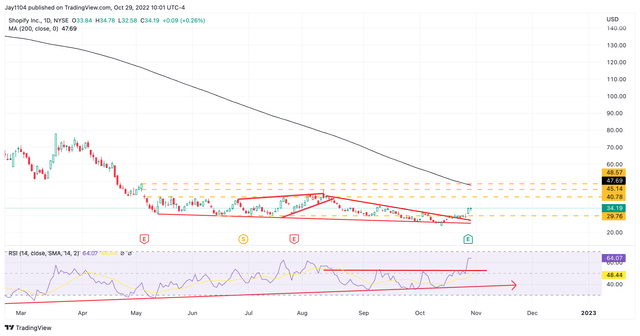

Moreover, SHOP has some bullish tendencies on the technical chart. The inventory seems to have damaged out, rising out of a technical bullish reversal sample often known as a falling wedge. Moreover, the relative power index appears to have damaged out from a latest vary and has been trending larger, suggesting a change in momentum from bearish to bullish.

Ought to the inventory rise above resistance at $36, it may run larger to round $41. Nevertheless, if resistance holds, the shares may fall again to $27.

TradingView

Total, if it seems that the worst could also be behind Shopify and fundamentals can begin to enhance, then a bullish narrative may develop and ship the shares larger from right here.