Anne Czichos/iStock Editorial by way of Getty Pictures

Earlier than GameStop (NYSE:GME) reported its earlier quarter (FQ2 2023), I wrote an article saying that Microsoft’s (MSFT) gaming revenues had been ominous, and that GameStop was thus set to simply miss income estimates.

Such was the case. When GameStop reported FQ2 2023, it did certainly miss income estimates by a full 10.2%, turning an anticipated progress quarter into 1 / 4 the place revenues really shrank. GameStop inventory, although, had already fallen precipitously into that earnings report, so on the precise earnings report it briefly rebounded.

Now, months later, we’re once more on the similar crossroads. Microsoft has already reported its Q1 FY2023 earnings, and once more we are able to look into what it reported relating to gaming, and maybe once more attain conclusions on how GameStop’s FQ3 2023 quarter is likely to be going.

Moreover, we have now different sources which additionally already reported how gaming did into September 2022, thus leaving simply 1 additional month in GameStop’s quarter which we don’t find out about. Let’s do that train, then.

Microsoft’s Implications

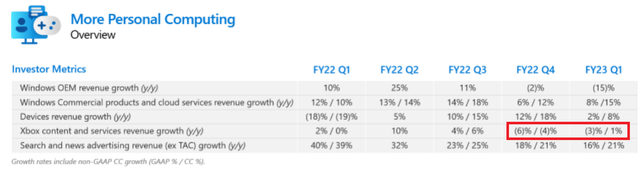

There may be certainly information with regards to Microsoft’s newest earnings report, and the way gaming did. Right here’s what we are able to glean from Microsoft’s earnings presentation (pink highlights are mine):

Microsoft Earnings Presentation

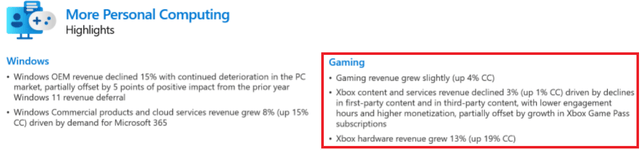

Microsoft Earnings Presentation

Already, there are a number of observations to make:

Xbox content material and companies, which can are inclined to map to GameStop’s software program gross sales, nonetheless confirmed year-on-year contraction. Nevertheless, the contraction slowed. Microsoft’s gaming income on the whole was really up year-on-year (4%, in fixed foreign money). And importantly, Xbox {hardware} income was up strongly (13% on reported foreign money, 19% on fixed foreign money). Later, we’ll see why this is likely to be extra related for GameStop.

One other Supply

This time, we’ll additionally complement the Microsoft observations with observations from one other supply. That will be NPD videogame statistics (for September 2022). Right here’s what we study from it:

Total gaming gross sales continued falling yoy (year-on-year). Nevertheless, the drop has been slowing down, very similar to Microsoft reported. July was -9% yoy. August was -5% yoy. September was -4% yoy. Apparently, though total gaming gross sales continued to point out yoy declines, {hardware} already had a robust September. {Hardware} gross sales had been +19% yoy, which is a robust quantity and, once more, according to Microsoft’s report.

How Is It All Related To What GameStop May Report, Then?

First, let’s check out GameStop’s income expectations for FQ3 2023:

Searching for Alpha

We will see that the market consensus is, once more, for GameStop to put up income progress in FQ3 2023. Nevertheless, the expectation (+4.2% yoy) is now decrease than within the earlier quarter at this level (+6.9% yoy).

We then want to mix this decrease expectation, with the truth that gaming gross sales at Microsoft and on the whole aren’t doing as unhealthy as they had been doing, once more on the similar time within the earlier quarter (once I printed my earlier article). Already we see that issues aren’t so clear now.

It doesn’t cease there, although. You see, gaming gross sales, as per NPD’s reporting, are closely slanted in the direction of software program. As an illustration, within the September report I linked to above, out of $4.073 billion in thought-about gaming gross sales, solely $490 million (12%) referred to {hardware}.

Nevertheless, with regards to GameStop’s personal revenues, issues are slanted a lot, a lot tougher in the direction of {hardware}! In GameStop’s newest quarter, {hardware} represented a full 52.5% of revenues.

We will already see the issue right here. Within the earlier quarter (and thus in my earlier article), each software program and {hardware} gross sales had been doing poorly, but expectations had been for GameStop to put up income progress. That was impossible to occur.

Nevertheless, on this quarter whereas software program and companies are nonetheless weak (however much less weak), {hardware} gross sales really look robust! And what’s extra, for GameStop, with regards to revenues, {hardware} gross sales are way more related than for the general gaming market.

Thus, to sum it up, we have now these info:

GameStop faces decrease anticipated income progress The gaming software program market is unhealthy, however not as unhealthy as earlier than The gaming {hardware} market has turned very robust And GameStop depends (for revenues) to a a lot greater extent on gaming {hardware} gross sales than on software program gross sales

All of those info level to the identical factor: GameStop’s potential income miss is quite a bit much less predictable this time round.

It would even be that GameStop will report such {hardware} income progress that will probably be sufficient to compensate for software program income declines, despite the fact that software program income declines are more likely to proceed at a tempo greater than the market’s. If something, this taking place ({hardware} gross sales progress totally compensating for software program gross sales decline) is extra possible than not.

Conclusion

Briefly, final quarter, considering what Microsoft had reported, it was straightforward to see that GameStop was going to overlook income expectations, and miss them massive.

This quarter, that’s not the case. {Hardware} gross sales improved sufficient (market-wide, not simply at Microsoft), and are a lot extra related for GameStop, that this issue is likely to be sufficient for GameStop to really present income progress through the quarter, presumably even matching or surpassing income expectations.

Now, does this transformation something relating to GameStop’s prospects?

Not likely. GameStop remains to be caught in an obsolescence demise entice. Software program gross sales, the place the margins are, will nonetheless be contracting. And the (low-margin) {hardware} cycle gained’t be favorable for for much longer, both.

In the long run, I count on that GameStop will battle to outlive in its present (bodily store-based) type, if it survives in any respect. And the inventory value will find yourself being a lot decrease than it stands immediately. Struggling bodily retailers don’t carry 1.4x Worth/Gross sales multiples. They will simply commerce for Worth/Gross sales 70-90% decrease than that.

However the principle gist of the article remains to be that this time, a big income miss is way from predictable, in contrast to the final time.

Greetings from KAYIN.CO Indonesia | Introducing all of the TOOLS & Professional Advisors sequence “Ai-Jericho”

Greetings from KAYIN.CO Indonesia | Introducing all of the TOOLS & Professional Advisors sequence “Ai-Jericho”