Invoice Pugliano/Getty Photos Information

Thesis

I beforehand identified that Stellantis (NYSE:STLA) inventory is buying and selling very low cost and I assigned a ‘Purchase’ advice. Though Stellantis inventory has not moved a lot since my preliminary article, I reiterate my bullish thesis – and argue buyers ought to give it somewhat bit extra persistence.

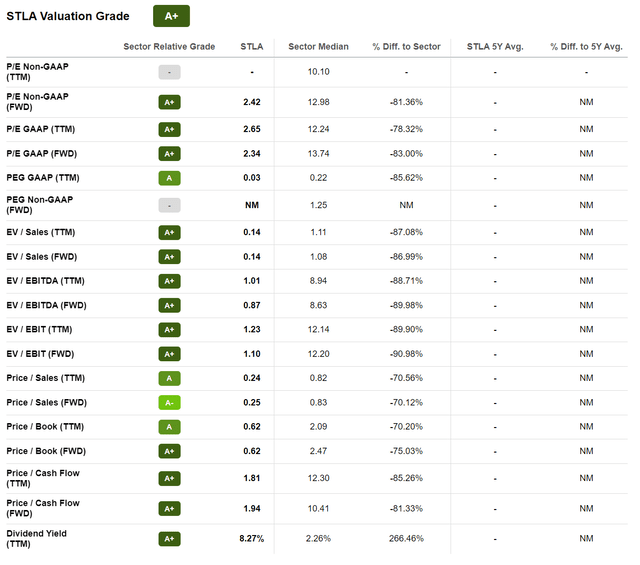

As of late October 2022, the inventory is buying and selling at a one 12 months ahead P/E of about 2.3, a P/S of 0.25 and a P/B 0.62. In my view, Stellantis may very well be the world’s most undervalued and underappreciated carmaker.

For reference, STLA inventory has misplaced about 30.5% YTD, versus a lack of 18.5% for the S&P 500 (SPY).

In search of Alpha

Worth Thesis Stays Sturdy

Stellantis is the world’s fourth largest carmaker with about $177 billion of revenues in 2021. However with an enterprise worth of lower than $25 billion, the OEM auto maker is valued like an experimental start-up equivalent to Lucid Motors (LCID) and Rivian (RIVN).

It would not matter which valuation a number of an analyst considers for STLA – all of them level to a 70% – 90% undervaluation versus the sector median. For reference, Stellantis one 12 months EV/EBITDA is x0.9, which means a 90% premium to the sector median. STLA’s EV/Gross sales is x0.14, which factors to a 87% undervaluation respectively?

What’s going on right here? The market apparently ascribes little worth to Stellantis vehicle empire, with greater than $177 billion of revenues. However buyers ought to take into account that there are not any indications that time to deteriorating fundamentals, and/or a lack of market share within the race for auto electrification.

In search of Alpha

Do not Fear About Fundamentals

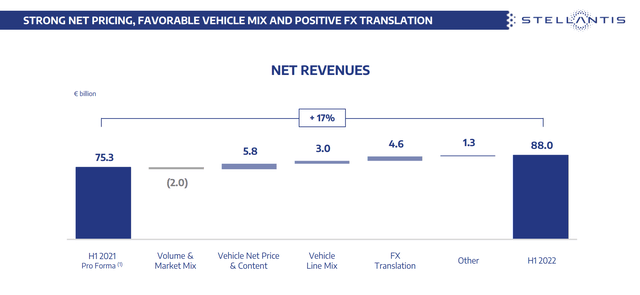

A significant argument why I proceed to have faith in Stellantis’ deep worth thesis is anchored on exceptionally robust fundamentals. For the 1H 2022 interval, Stellantis reported web revenues of $88 billion, which represents a 17% 12 months over 12 months improve versus 1H 2021 – regardless of 1H 2022 being clearly tougher than 1H 2021. The corporate’s adjusted working revenue for the interval reached €12.4 billion and web revenue jumped to €8.0 billion, which represents a 12 months over 12 months improve of 44% and 34% respectively.

Administration highlighted that the robust topline efficiency was pushed by favorable worth will increase, a high-margin automobile combine and optimistic FX translation results. And given a 14.1% working margin, pricing energy greater than offset any headwinds from uncooked materials and wage inflation.

Outcomes – 2022 1H Stellantis

Furthermore, in 1H 2022 Stellantis generated €5.3 billion of business free money movement and ended the interval with €59.7 billion of money and quick time period funding, versus complete debt of about €28.2 billion (greater than €30 billion of web money).

For 2030, Stellantis continues to focus on the next:

Web Revenues to double to €300 billion, whereas sustaining double-digit AOI margin by means of your entire plan interval

Generate greater than €20 billion in Industrial Free Money Flows.

Goal a 25-30% dividend payout ratio by means of 2025 and the repurchase of as much as 5% of excellent widespread shares

EV Technique Good points Momentum

Reflecting on Stellantis’ valuation, as highlighted above, the corporate would solely want about 2 years of TTM profitability to amortize your entire enterprise worth.

Arguably a significant motive why markets doubt Stellantis future profitability, is anchored on challenges referring to the EV transition, as legacy carmakers equivalent to Stellantis are perceived to free in opposition to new-generation manufacturers equivalent to Lucid – thus, the (irrational) valuation puzzle.

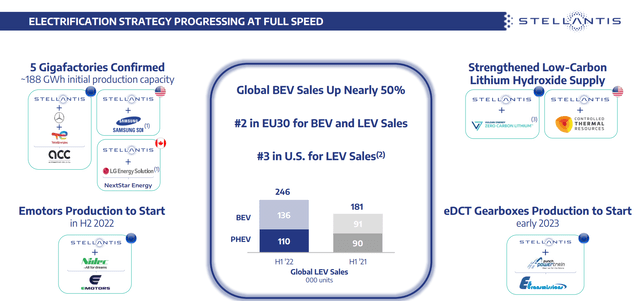

However Stellantis hasn’t but given buyers any motive to verify their doubt. In truth, Stellantis’ electrification technique ‘Dare Ahead 2030’ seems to realize momentum.

Within the 1H 2022, Stellantis reported a 50% 12 months over 12 months development in world BEV gross sales, rising to 136,000 deliveries. If an investor would additionally take into account PHEV automobiles as ‘next-generation inexperienced vehicles’ then Stellantis cumulative 246,000 deliveries would catapult the European OEM carmaker on prime of the worldwide EV rankings – rating second within the EU30 and third within the U.S. market.

Outcomes – 2022 1H Stellantis

Goal Value Replace

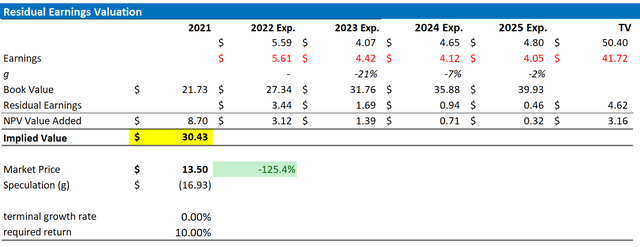

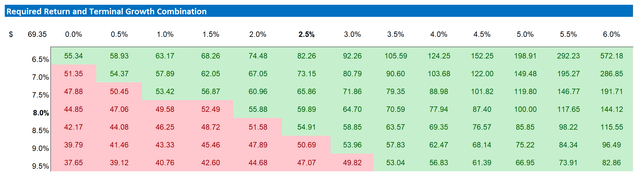

Anchored on Stellantis’ robust 1H 2022, I improve my residual earnings mannequin for STLA to account for consensus EPS upgrades. Nevertheless, I proceed to anchor on an 10% price of fairness and a 0%, terminal development fee (which I believe are very conservative assumptions).

Given the EPS updates as highlighted under, I now calculate a good implied share worth of $30.43, versus $36.06 prior.

analyst consensus; creator’s calculation

Under can be the up to date sensitivity desk.

analyst consensus; creator’s calculation

Dangers

As I see it, there was no main risk-updated since I’ve final lined Stellantis inventory. Thus, I wish to spotlight what I’ve written earlier than

As for Volkswagen, comparable draw back dangers apply to Stellantis: 1) slowing client confidence globally, and particularly Europe, attributable to inflation outpacing wage development; 2) geopolitical dangers together with the Ukraine battle and Stellantis’ publicity to China add to enterprise uncertainty; 3) supply-chain challenges together with semiconductor shortages, which might turn out to be much more difficult because of the Covid-19 lockdowns in China; 4) increased than anticipated CAPEX and R&D investments as a way to understand the strategic repositioning in the direction of an electrical mobility supplier; 5) timid EV adoption attributable to issues concerning the EV know-how and charging infrastructure build-up; 6) macroeconomic uncertainty referring to the financial coverage actions of the ECB and actions of the European/German authorities in opposition to Russia. And at last, following the FCA – PSA merger, integration of the 2 entities into one single conglomerate may show extra well timed, pricey and difficult than at the moment estimated.

Conclusion

Arguably, legacy carmakers equivalent to Volkswagen (OTCPK:VWAGY), Ford (F) and Normal Motors (GM) are all buying and selling low cost. However no OEM auto-company is buying and selling at a equally low valuation as Stellantis – the EV/EBITDA of near x1 (90% low cost to the sector) is solely breath-taking.

Reflecting on Stellantis’ fundamentals and the carmakers’ EV technique, I imagine STLA inventory ought to be pretty valued at about $30.43/share.