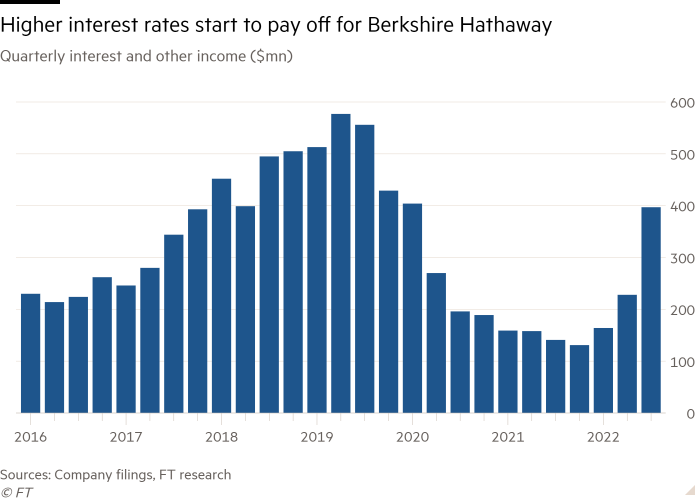

Warren Buffett’s Berkshire Hathaway is shortly turning into one of many principal beneficiaries from the sharp enhance in rates of interest within the US, as its fortress-like stability sheet begins to generate a whole lot of thousands and thousands of {dollars} in revenue for the sprawling conglomerate.

The curiosity the corporate earns on its $109bn money pile almost tripled from a yr earlier than to $397mn within the third quarter, it disclosed on Saturday, noting the acquire was “primarily because of will increase in short-term rates of interest”.

Berkshire holds the overwhelming majority of its money in short-term Treasury payments, deposits at banks and in cash market accounts, the place rates of interest have been quickly rising because the Federal Reserve has tightened financial coverage. Final week the US central financial institution lifted charges to between 3.75 and 4 per cent, up from close to zero on the yr’s begin, and merchants anticipate that price to high 5 per cent subsequent yr.

Whereas tighter coverage has despatched shockwaves by way of monetary markets — even bludgeoning the worth Berkshire’s mammoth inventory portfolio — it’s lastly starting to pay dividends for corporations and shoppers holding money.

Information from the Funding Firm Institute confirmed that money parked in cash market funds that cater to on a regular basis retail traders has swelled to a file excessive.

Buffett and Berkshire vice chair Charlie Munger have over the previous decade presided over a big enlargement in Berkshire’s money holdings, which they imagine is vital given the potential catastrophic payouts the corporate’s insurance coverage companies might in the future have to make.

It was a degree underlined by third-quarter outcomes that confirmed Berkshire was hit by a $3.4bn pre-tax loss from Hurricane Ian, which killed greater than 100 folks because it tore by way of components of Florida. US president Joe Biden has mentioned it can take years, not months, for the area to get well.

Berkshire’s insurance coverage unit suffered an working lack of $962mn in the course of the quarter, with Geico warning that increased used auto components costs and a rise in accidents have been weighing on its outcomes.

Buffett and Munger have lengthy been capable of abdomen massive losses in its insurance coverage division due to the sizeable “float” — insurance coverage premiums it collects earlier than it should finally pay claims on obligations. That float has helped gas its investments in shares and fund the corporate’s acquisitions of companies.

The sell-off in monetary markets hampered Berkshire’s fairness portfolio, which incorporates massive stakes in Apple, American Categorical, Chevron and Financial institution of America. The corporate mentioned its portfolio slid in worth to $306.2bn from $327.7bn on the finish of June.

These declines pushed it to a web lack of $2.7bn within the interval, or $1,832 per class A share, from a revenue of $10.3bn a yr earlier than, value $6,882 a share. Buffett has lengthy characterised the swings in its funding portfolio — which it should recognise in its revenue and loss statements because of accounting guidelines — as “meaningless”.

The handfuls of companies it owns, that are widely-watched for indicators of the well being of the American industrial and enterprise advanced, laid naked the resilience of the US economic system whereas additionally signalling the potential slowdown engineered by the Fed. Berkshire’s outcomes additionally confirmed the results of inflation and the fights over higher wages as actual residing requirements come underneath stress from increased costs.

Revenues at its BNSF railroad surged 17 per cent to $6.5bn, however income slid because the volumes of freight it shipped declined and it paid increased wages to its staff. The railroad turned a flashpoint earlier this yr as greater than 30,000 unionised staff at BNSF threatened to strike, pushing again in opposition to situations and demanding a lift to pay.

A tentative settlement in September delivered concessions to staff and BNSF mentioned pay prices rose 27 per cent within the third quarter from a yr earlier.

The vitality companies inside Berkshire’s utility division reported a 17 per cent bounce in revenues, boosted by increased energy prices.

However the firm’s actual property brokerage unit noticed gross sales tumble by almost a fifth, and working income on the unit plummeted 72 per cent from the yr earlier than because the housing market cooled and it offered fewer properties.

Berkshire mentioned increased mortgage charges have been additionally anticipated to stress its handful of companies within the housing sector. Through the quarter, nevertheless, these companies — together with the brick maker Acme and flooring group Shaw — have been capable of increase costs and registered sturdy demand.

General, working earnings rose to $7.8bn from $6.5bn a yr earlier. The outcomes have been helped by bigger income in its manufacturing and companies enterprise strains.

Berkshire, which this yr purchased a 21 per cent stake in vitality firm Occidental’s frequent inventory, disclosed that within the fourth quarter it could start reporting earnings from the oil and fuel large as a part of its outcomes.

The corporate additionally mentioned it had spent simply over $1bn within the quarter shopping for again its personal inventory.

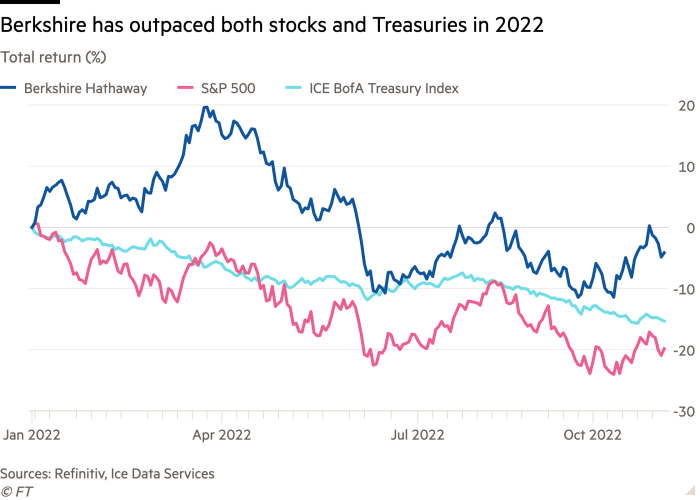

Berkshire’s class A shares, that are down 4.1 per cent this yr, have far outperformed the broader market. The benchmark S&P 500 has declined 20.9 per cent whereas an investor in US Treasuries has misplaced 15.3 per cent, in keeping with Ice Information Providers.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)