Guido Mieth

Written by Nick Ackerman, co-produced by Stanford Chemist. This text was initially printed to members of the CEF/ETF Earnings Laboratory on October twenty third, 2022.

Cohen & Steers Tax-Advantaged Most well-liked Securities and Earnings Fund (NYSE:PTA) continues to get hit by rate of interest will increase – in addition to different most popular and stuck revenue funds. Even equities have not been immune from rate of interest will increase. Floating-rate senior loans which are imagined to be suited to larger rates of interest are additionally taking some hits as a consequence of their portfolios’ credit score dangers. There appears to be nowhere secure. Nonetheless, that is usually when alternatives can begin to open up.

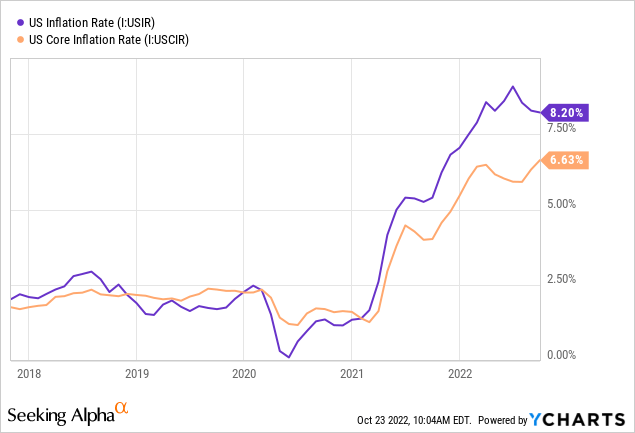

One of many issues with rates of interest is that nobody is aware of the place they’ll find yourself. Each time an inflation report is hotter than anticipated, it provides the Fed extra gasoline to boost charges aggressively. Thus, the expectations for even larger charges develop, and investments get punished once more. That is been a lot of the cycle via 2022.

At the least, in my view, that is what I am seeing. The market tries to cost in what it expects for charges, then a warmer inflation report is available in, and we head decrease. If inflation slows extra quickly, we might see some stabilization out there, since rate of interest expectations would not preserve climbing. With the final CPI report, we noticed CPI come down as soon as once more however stay elevated. Alternatively, core CPI really rose to a brand new 40-year excessive.

Ycharts

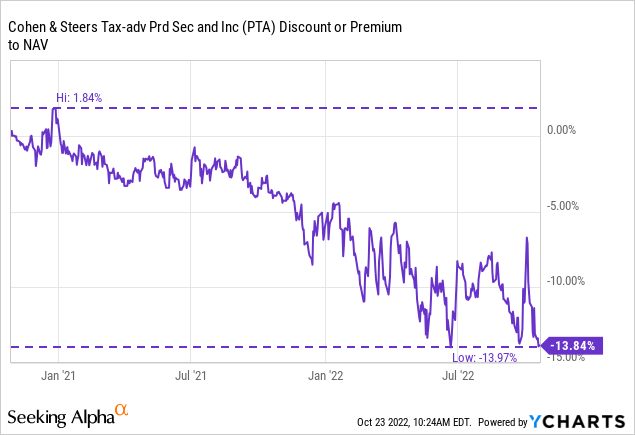

These rate of interest will increase have pushed PTA to close its all-time extensive low cost for the reason that fund launched. Nonetheless, it is not essentially an previous fund but, with its inception in October 2020. That is additionally a time period fund, which implies traders can ultimately understand the low cost. Although we nonetheless have loads of time earlier than that occurs, because it is not anticipated till 2032.

After all, I first thought PTA was a purchase in March, then in July, and now I feel it nonetheless is immediately. However as a result of rate of interest expectations persevering with to climb, I might nonetheless be too early. All we want is one other sizzling inflation report, and it’ll get despatched decrease. Now, my objective is to dollar-cost common into positions over time. Nonetheless, I do know others that may’t contribute new capital – usually, these already in retirement won’t have that sort of flexibility.

PTA Efficiency Graph From Earlier Protection (Looking for Alpha)

Since that earlier replace, the low cost has widened additional. That makes the declines much more extreme than anticipated, that means that the underlying portfolio did not carry out as badly.

The Fundamentals

1-Yr Z-score: -1.98 Low cost: 13.84% Distribution Yield: 9.21% Expense Ratio: 1.64% Leverage: 37.76% Managed Property: $1.81 billion Construction: Time period (anticipated liquidation date is October twenty seventh, 2032)

PTA’s funding goal is sort of easy, “excessive present revenue.” In addition they have a secondary goal that’s equally as easy, “capital appreciation.”

To attain this, they’ll make investments “no less than 80% of its managed property in a portfolio of most popular and different revenue securities issued by U.S. and non-U.S. firms, which can be both exchange-traded or accessible over-the-counter.” In addition they will “search to attain favorable after-tax returns for its shareholders by in search of to reduce the U.S. federal revenue tax penalties on revenue generated by the Fund.”

The fund’s expense ratio involves 1.64%; when together with leverage bills, it involves 2.17%. One other drawback with a declining portfolio is the fund’s leverage is now beginning to turn into much more elevated. Typically, most popular CEFs will run larger leverage anyway as a consequence of their comparatively extra conservative investments.

PTA has an enormous portion of its portfolio in investment-grade most popular. Whereas these firms aren’t anticipated to cease paying dividends or go bankrupt, the costs can and nonetheless decline with larger rates of interest. Much more so than below-investment-grade most popular as a result of they often have decrease charges. So it makes them extra delicate to rate of interest modifications being investment-grade. Thus, their leverage can negatively affect the fund for the reason that declines will likely be amplified.

One other trigger for concern with leverage is that almost all CEFs have credit score services tied to floating or variable charges. Typically that is primarily based on LIBOR, however with that being discontinued, it might seem SOFR is gaining popularity.

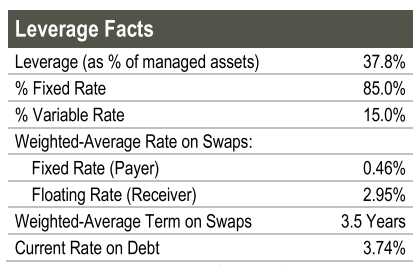

Thankfully, Cohen & Steers did put together for larger rates of interest in that regard. They make the most of each rate of interest swaps and have negotiated fixed-rate borrowings from their lender too.

On the finish of Q3 2022, the fund had round 85% of its borrowings in fastened charges. The typical charge got here to 0.46%, whereas the floating charge debt is now as much as 2.95%. The hedges have a median time period of three.5 years left. The primary-rate swap contracts do not mature till December 2024. By then, relying on how badly the Fed pushes us right into a recession, they may very well be chopping rates of interest.

PTA Leverage Info (Cohen & Steers)

Efficiency – Enticing Low cost

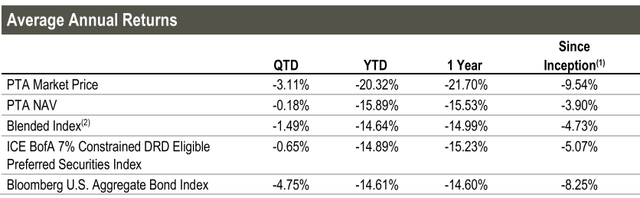

To this point, the fund’s efficiency is disappointing, as I feel is sort of clear. Total, most investor outcomes have not been nice until you run an vitality fund or a heavy vitality portfolio. Alternatively, in comparison with its blended benchmark, on a complete NAV return foundation, it hasn’t been so horrible.

PTA Annualized Efficiency (Cohen & Steers)

Even on a complete NAV return foundation, it has underperformed the blended index on a YTD and 1-year interval. Nonetheless, that is the place the leverage is prone to play a job. Because it has been declining for over a 12 months now, the leverage has had a detrimental affect.

Curiously, the quarter up to now and since inception have proven that PTA’s NAV has outperformed. These are relatively arbitrary benchmarks, however maybe some glimmer of hope that PTA can outperform typically. I imagine Cohen & Steers is likely one of the high fund sponsors; no less than, they’ve proven to do the precise factor with their different funds usually.

What’s extra engaging is the low cost the fund at present has. It was making a pointy transfer larger, solely to return crashing again down. Whereas the common low cost of this fund is not essential at this level (too restricted of historical past), a close to 14% low cost from a fund sponsor that in any other case does nicely is critical.

Ycharts

Distribution – Distribution Trim Potential

I highlighted beforehand that the fund wasn’t incomes its distribution. The truth is, the final time we touched on this fund, PTA’s sister funds had minimize their distribution. PTA has held it in place for now.

That is why the continuation of the identical distribution can be good to see, however I would not essentially have been overly stunned to see a minimize. The sister funds, Cohen & Steers Choose Most well-liked and Earnings Fund (PSF) and Cohen & Steers Restricted Length Most well-liked & Earnings Fund (LDP), they already minimize heading into this 12 months. That was after every had additionally paid a particular on the finish of final 12 months.

The final time we touched on the fund, it confirmed that web funding revenue had elevated of their newest semi-annual report. We can’t get their annual report till across the finish of 2022. Final 12 months, it was filed on December twenty ninth.

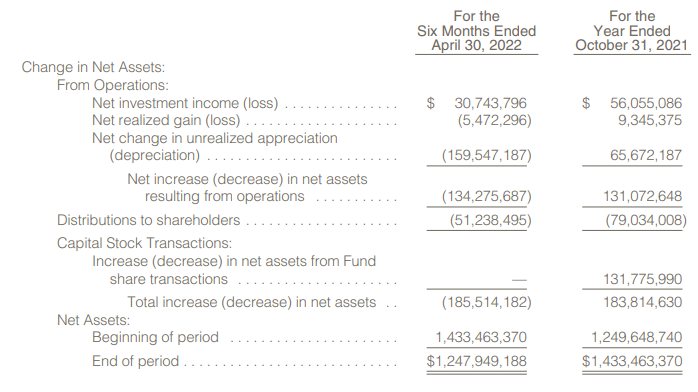

PTA Semi-Annual Report (Cohen & Steers)

We might ideally wish to see NII protection at over 100% for a most popular fund. In that means, it’s just like a fixed-income fund, the place we wish to see revenue cowl the payout to traders. With a reasonably large protection hole, that is the place I’d be involved we see a minimize.

PTA’s Portfolio

As charges rise, the yields on the underlying most popular may also rise. One of many points is that they maintain perpetual most popular, that means an organization might by no means name them. Alternatively, they do carry some floating-rate and fixed-to-float most popular. Right now, it’s only round 4% of the portfolio that’s in floating-rate most popular.

They do not share the portion that’s fixed-to-float of their portfolio. Scanning via their holdings checklist would recommend fairly a reasonably vital variety of them could be. Though, the floating charges kick in over the next years and never all in without delay.

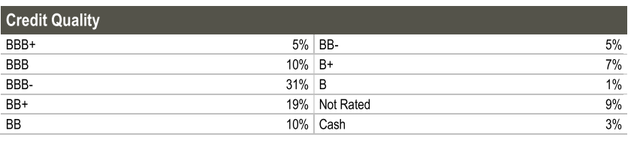

As talked about above, a superb portion of PTA’s portfolio is invested in investment-grade most popular at round 46%. What’s below-investment grade is closely weighted in direction of the higher finish of the below-investment grade. That ought to see its portfolio much less inclined to suspended dividends or bankruptcies.

PTA Credit score High quality (Cohen & Steers)

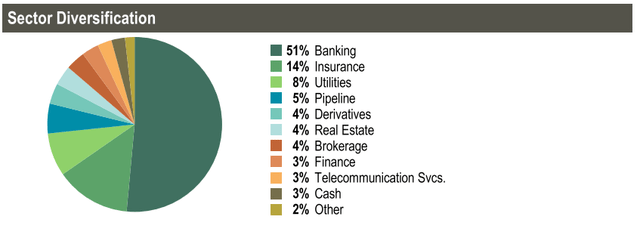

Much like most different most popular funds, the portfolio is primarily invested in banks and insurance coverage firms.

PTA Sector Allocation (Cohen & Steers)

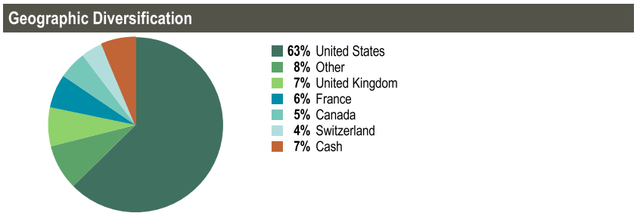

Moreover, the portfolio is not totally comprised of U.S. holdings. There’s larger diversification because the fund invests in a number of European nations, and we even see some publicity to Canada.

PTA Geographic Weighting (Cohen & Steers)

For probably the most half, there weren’t any significant shifts in both sector diversification or geographic diversification since our earlier replace.

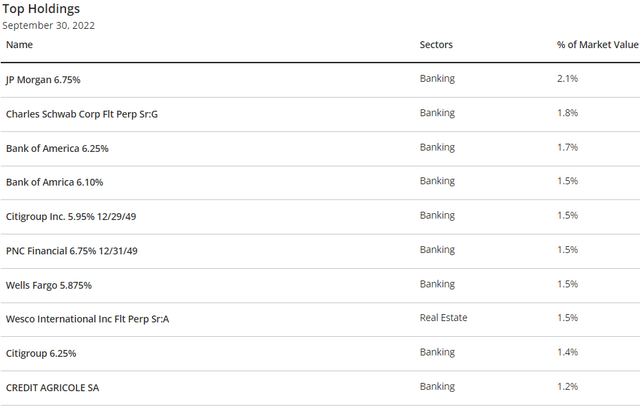

Wanting on the high ten holdings, it won’t be any shock that we see the large monetary establishments make up nearly all of the checklist.

PTA Prime Ten Holdings (Cohen & Steers)

We’ve got JPMorgan (JPM), Financial institution of America (BAC), Citigroup (C) and Wells Fargo (WFC). After all, these aren’t the widespread equities they’re holding, however numerous most popular choices these firms have issued. One of many causes for that is that noncumulative perpetual most popular is a element of Tier 1 capital. Thus, it helps with their regulatory capital necessities.

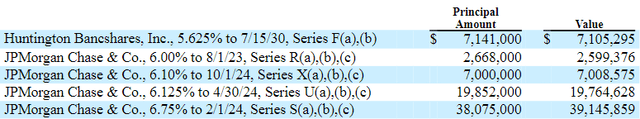

Here is a take a look at a number of the holdings that PTA is holding. These are the JPM positions.

PTA JPM Holdings (Cohen & Steers)

The (a) means it’s a perpetual safety, and the (b) means it’s a safety that converts to a floating charge. On this case, the JPM Sequence R will likely be transformed to floating on 8/1/2023 from the 6% fastened. Alternatively, the safety may very well be redeemed by JPM too, which might occur when the safety begins to drift.

The Company, on the possibility of the Board of Administrators or any duly licensed committee of the Board of Administrators, might redeem out of property legally accessible therefor the Sequence R Most well-liked Inventory on any Dividend Cost Date on or after August 1, 2023 in entire, or occasionally partly, at a redemption value equal to $10,000 per share, plus any declared and unpaid dividends on the shares of the Sequence R Most well-liked Inventory known as for redemption as much as the redemption date.

We additionally see a (c) designation meaning all or a portion of the safety is collateral for PTA’s credit score facility.

Conclusion

PTA is at a deep low cost. Whereas that is fairly engaging, the restricted historical past of the fund suggests we do not actually know the place a ground is. Alternatively, Cohen & Steers is a higher-quality fund sponsor, so a close to 14% low cost total would seem engaging. Moreover, with how crushed down preferreds are as a consequence of larger rates of interest, it may very well be presenting a pretty alternative to revenue traders.

The primary dangers listed below are additional low cost widening and inflation remaining larger, which might end in even larger rates of interest. The leverage will amplify any draw back strikes and can be turning into fairly elevated.