Volha Levitskaya

Littelfuse (NASDAQ:LFUS) stays one in every of our favourite corporations, one which isn’t broadly adopted regardless of having generated spectacular shareholder returns.

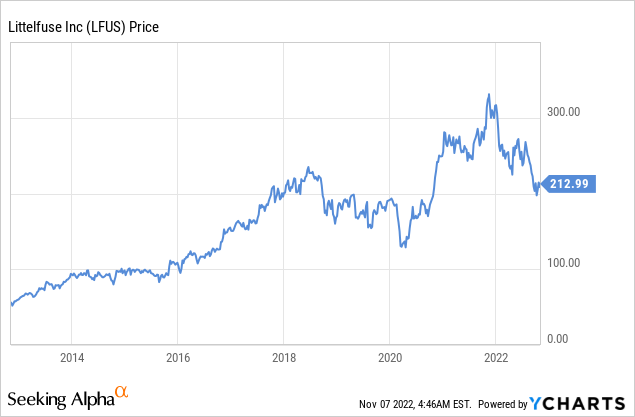

The corporate as soon as extra delivered sturdy outcomes exceeding expectations. For Q3, Littelfuse achieved income progress of twenty-two%, and natural progress of 8%, regardless of overseas change fee headwinds and a weakening economic system. Regardless of its resilience and continued progress, the share worth has come down in sympathy with the market, and is down a couple of third from its peak reached in late 2021.

The corporate reported demand usually stays sturdy, however it’s softer for consumer-oriented end-markets like home equipment. Littelfuse has been in a position to compensate among the demand weak point with new design wins, particularly with functions geared in the direction of sustainability and battery energy. Some examples of design wins in the course of the quarter embrace functions in energy instruments and electrical bicycles.

Q3 2022 Outcomes

Income was $659 million, up 22% over final 12 months and up 8% organically. The Carling and C&Ok Switches acquisitions added 18% and foreign-exchange diminished income by 4%. GAAP working margins had been 18.5%, whereas adjusted working margins had been 21%. Third quarter GAAP diluted earnings per share had been $3.02, and adjusted diluted EPS was $4.28, up 8% over final 12 months.

A High quality Enterprise

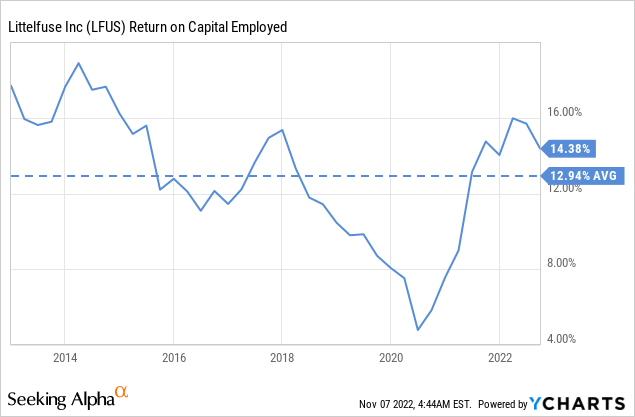

As a reminder of why we like Littelfuse a lot, it is a enterprise that’s not solely rising income and earnings within the double digits, but it surely additionally grows profitably. The ten =0year common return on capital employed is ~13%. That is significantly vital on condition that Littelfuse retains most of its earnings.

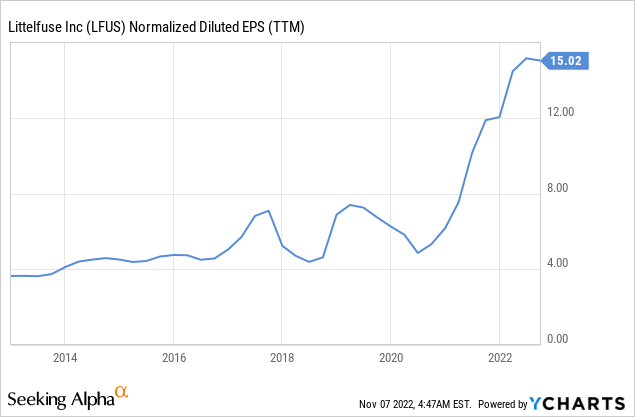

It is a well-run enterprise that has practically quadrupled its earnings per share over the last decade, regardless of working in cyclical industries.

Innovation

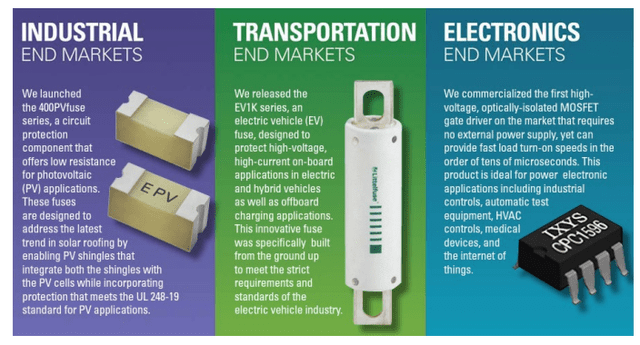

Importantly, Littelfuse continues to innovate and launch new merchandise and applied sciences, lots of which allow sustainability. Some examples are proven under, these embrace a circuit safety element for photovoltaic functions, an electrical automobile fuse, and an optically-isolated MOSFET gate driver.

Littelfuse Investor Presentation

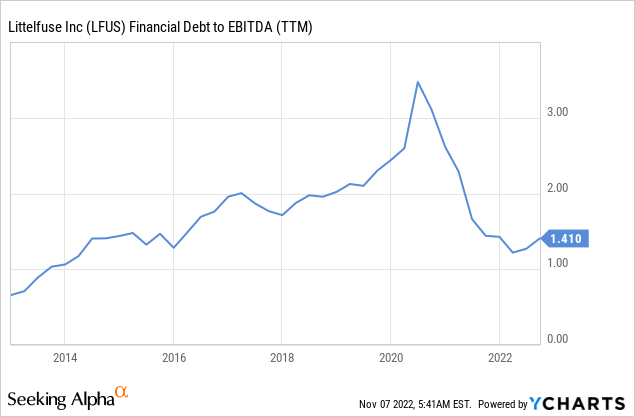

Stability Sheet

Littelfuse ended the quarter with $474 million of money and short-term investments. The online debt to EBITDA leverage stays on the low finish of their goal vary, which ought to permit the corporate to make new acquisitions ought to the weakening economic system deliver enticing M&A alternatives.

Outlook

For the fourth quarter the corporate expects gross sales within the vary of $603 million to $623 million, up 11% versus final 12 months and up 4% natural. This assumes about 15% progress from acquisitions and a 4% headwind from overseas change. Littelfuse is projecting fourth quarter adjusted EPS to be within the vary of $3.14 to $3.34.

Fourth quarter steering implies full-year gross sales of ~$2.5 billion and adjusted earnings per share of ~$16.77, each information for the corporate. This may signify 21% gross sales progress over the earlier 12 months, and 27% adjusted earnings progress.

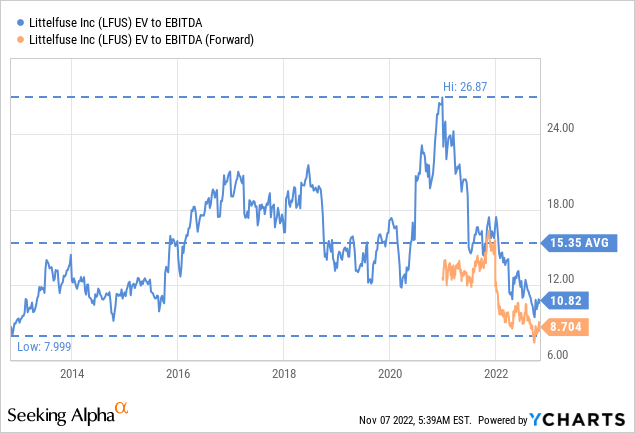

Valuation

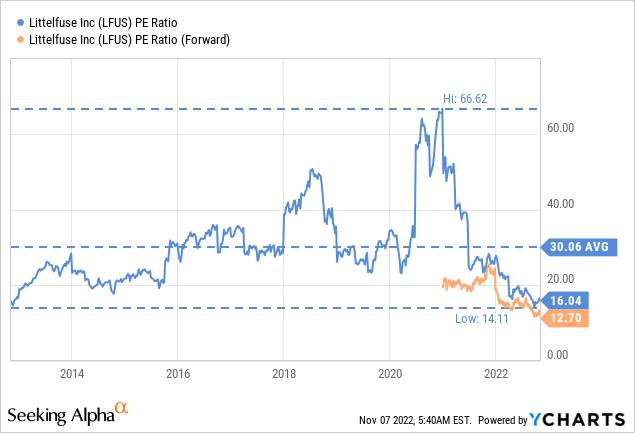

The market is at present giving little or no credit score to Littelfuse’s excellent outcomes. Shares are buying and selling close to the underside of its EV/EBITDA vary for the final ten years. We imagine ~10x for such a top quality firm is a lovely worth, and subsequently contemplate shares to be considerably undervalued.

The trailing twelve months price-earnings ratio is nearly half of the ten-year common, and the ahead P/E is even decrease at ~12.7x.

Dangers

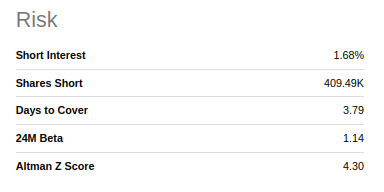

We imagine the largest danger with Littelfuse is that it operates in very cyclical industries, and buyers seem very nervous that earnings and revenues are about to crater. That is doubtless the rationale for the valuation to have come down as a lot because it has, regardless of the corporate delivering glorious outcomes up to now. Whereas it’s totally doable that we’re about to enter a extreme recession, there may be additionally the opportunity of a comfortable touchdown or a really gentle recession. In any case, we imagine the corporate is powerful sufficient and has the steadiness sheet to outlive a deep recession. This power is mirrored within the very excessive Altman Z-score of 4.3x, which is comfortably above the three.0 threshold for sturdy corporations.

In search of Alpha

Conclusion

Littelfuse shares have misplaced a couple of third of their worth since they peaked in late 2021, regardless of the corporate persevering with to ship strong progress and optimistic outcomes, which now embrace the latest Q3 quarter. We proceed to view the corporate as a really prime quality enterprise, regardless of the cyclicality of the industries through which it operates. Consequently, we contemplate present costs a chance to buy shares at a low valuation. There are dangers to think about, together with the opportunity of a recession across the nook, however we’re reassured by the power of the enterprise, new design wins, and its strong steadiness sheet.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)