Laurent Viteur/Getty Photos Leisure

Funding Thesis

Disney’s (NYSE:DIS) fiscal This autumn 2022 outcomes took buyers abruptly. Actually, I am going to spotlight that I used to be bullish on Disney going into the quarter, and believed that the inventory was already too low cost relative to its fundamentals.

With the inventory already down greater than 40% prior to now 12 months, one would have anticipated that a whole lot of negativity would already be within the inventory. However not solely had been Disney’s outcomes very a lot center of the street, however its outlook is the place Disney actually did not dwell as much as expectations.

Earlier than we go additional, be aware that Disney’s fiscal 12 months and calendar 12 months are misaligned. I am going to solely consult with its fiscal 12 months.

That is the punchline. This isn’t the time to throw within the towel on Disney.

What’s Occurring Proper Now?

Disney is in a transition interval. It is intent on capitalizing on its very sturdy manufacturers. The aim for Disney is to broaden its ecosystem and develop a worthwhile streaming enterprise.

That being mentioned, the issue is twofold, subscriber progress charges and working losses in its streaming enterprise.

Within the first occasion, it seems that Disney+’s Home paid subscribers are rising at a extra measured progress of 20% in contrast with its Internationally paid subscribers which had been up 57% y/y.

Moreover, waiting for fiscal Q1 2023, Disney+ Core subscribers are anticipated to decelerate on its tempo of enhance.

On condition that Disney+ is the place the bull case is at, something detrimental on the bull case has an overarching impression on the share worth.

Now, contemplate this, Netflix’s (NFLX) US and Canada subscribers attain 73 million, whereas Disney’s 46 million Home subscribers look like struggling to get the family penetration that Netflix has. And now, Q1 2023 is predicted to see Disney+’s progress reasonable additional.

The second downside that Disney faces is that it is burning a whole lot of money circulation. To place this in context, for Disney+’s income to develop 8% y/y, its losses had been up 134% y/y.

Disney is very cognizant of buyers’ sentiment. Notably because it has shareholder activist, Daniel Loeb constantly makes public his consternation.

The answer was hoped to be promoting. On this be aware, that is what Disney’s CFO Christine McCarthy mentioned on the decision,

The promoting panorama stays fluid. The sports activities market, particularly, is delivering sturdy audiences throughout our platforms with entrepreneurs trying to make the most of dwell occasions and a number of other classes, together with political, pharma, insurance coverage and eating places, have continued to indicate comparatively steady demand whereas others stay cautious in anticipation of potential financial softness.

And therein lies one more downside for Disney. The promoting sector is on its knees. From TikTok (Personal) to Meta (META), to Snap (SNAP), only a few corporations in promoting are doing effectively within the present surroundings.

Because of this promoting is unlikely to be the panacea that Disney seeks.

So, what is the hope as we glance forward?

Income Progress Charges Decelerate

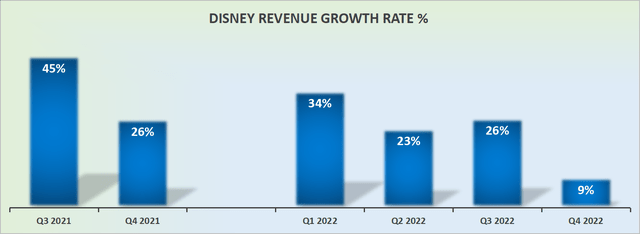

Disney’s income progress charges

Disney’s income progress charges for fiscal This autumn 2022 missed analysts’ expectations. That is one a part of the issue. Here is the opposite half.

This miss in fiscal This autumn 2022, is the most important topline miss in additional than 12 trailing quarters.

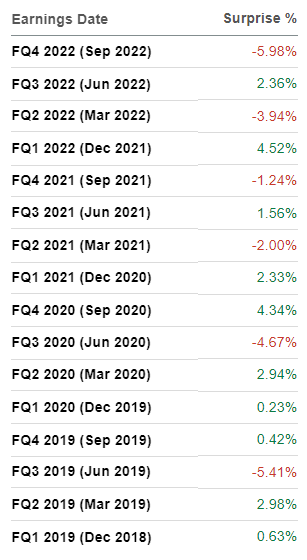

Disney’s income shock

The issue right here is that fiscal This autumn 2022, which lined July, August, and September, was a time when the macro surroundings was nonetheless sturdy. No less than within the first two months of the quarter.

And now as we sit up for fiscal Q1 2023, we’re quickly getting increasingly alerts that the economic system is weakening. Even amongst households that we beforehand would consider to have sturdy client stability sheets.

The Backside Line

That is the one-line takeaway, Disney has a broad portfolio of extremely worthwhile income streams. It’s totally effectively arrange for the go-forward surroundings. That is the bull case.

However between now and the ”go-forward interval”, the present surroundings is a interval of considerable uncertainty.

Traders are trying to grapple with, what is going to Disney’s constant income progress charges normalize at? Can we hope to see 10% CAGR because the ”new regular” income progress charge?

One other key query is what kind of tangible outcomes can we count on from Disney’s promoting alternative? It is one factor to state that manufacturers have expressed curiosity in Disney, it is fairly one other to see that curiosity expressed in revenues.

On this interval of transition, buyers are reflecting their dismay, impatience, insecurity, and frustration, with Disney by dumping their holding.

Individually, I contend that if buyers wished to throw within the towel, the time to have finished this was at any level within the prior twelve months.

Certainly, contemplate this, if an investor throws within the towel and buys one other inventory, and in 2 years, that new inventory is up 30%, they’re going to really feel nice about their inventory choose, proper?

What about if in two years, Disney returns to $120? This was the value Disney was buying and selling at simply 90 days in the past. That is the identical 30% return, from this level. I do not consider that is an not possible feat, notably given how considerably Disney’s valuation has already come down.