Basic Evaluation of BPCL: Do you know that yellow is among the quickest colors that may be detected by the human eye? Many companies use yellow lights or identify boards to seize the eye of shoppers.

One such firm that makes use of the color is Bharat Petroleum Company Ltd. When operating low on gas, we breathe a sigh of aid once we spot a yellow and blue colored petrol station close by.

Effectively, we’re not going to speak concerning the human eye or gas points. As an alternative, we will do a elementary evaluation of BPCL, an organization that competes with the likes of Reliance Industries. Not less than by way of the character of enterprise. We’ll undergo its enterprise, the trade that it features in and extra! Let’s dive in, we could?

Basic Evaluation of BPCL

On this elementary evaluation of BPCL, we are going to know concerning the firm, enterprise verticals, financials and way more.

In regards to the firm

Bharat Petroleum Company Ltd (BPCL) is an oil advertising firm. It refines crude oil and markets petroleum merchandise. It’s a Maharatna Public Sector Enterprise that ranks 295th on the Fortune 500- 2022 world listing.

Upstream Presence

The corporate has an upstream presence in six international locations, particularly Russia, Brazil, Mozambique, UAE, Indonesia, and India. As well as, it has 18 blocks with an fairness stake in two Russian entities. Furthermore, it has greater than 15 world companions together with Complete, ENI, ONGC, Rosneft, Mitsui, OIL, BP, ADNOC and Petrobras.

Midstream and downstream Presence

BPCL has a balanced portfolio with strategically situated refineries and advertising infrastructure. It has three refineries in India with a refining capability of 35.30 MMT. They’re situated in Mumbai, Kochi and Bina.

Furthermore, it has 82 retail depots, 53 LPG Bottling Vegetation, 57 Aviation service stations, 4 lube mixing vegetation in 50 geographical areas together with joint ventures. It has a pipeline community of 2597 km with a capability of 21.35 MMTPA. Additional, it has a robust distribution community with 20,217 shops and 6,227 LPG distributors.

Business Overview

BPCL operates within the Indian oil trade. The oil and gasoline trade is among the eight core companies of India. Modifications on this trade have a major impression on all different main financial sectors.

In line with World Vitality Outlook 2022, revealed by the Worldwide Vitality Company (IEA) on October 27, 2022, India’s coal technology and oil imports are going to peak in 2030, whereas gasoline imports will double across the similar time.

The demand for oil in India is projected to register a 2x development to succeed in 11 million barrels per day by 2045. Additional, the demand for diesel is anticipated to double to 163 MT by 2029-30, with diesel and gasoline overlaying 58% of India’s oil demand by 2045.

India goals to commercialise 50% of its SPR (strategic petroleum reserves) to boost funds and construct extra storage tanks to offset excessive oil costs.

The federal government has allowed 100% International Direct Funding (FDI) in upstream and personal sector refining tasks. As well as, it decreased the customs responsibility on sure crucial chemical substances akin to methanol, acetic acid and heavy feedstocks for petroleum refining.

BPCL– Enterprise Verticals

Fuels and Companies

Bharat Petroleum gives quite a lot of product choices like Petrol, Diesel, Automotive LPG and CNG. Additional, it gives premium petrol merchandise like Velocity and Velocity 97. It has specialised Gas Station codecs like Ghar, Freeway Star, Pure for Certain, and different such providers that assure a clean enterprise expertise.

Bharatgas

Bharatgas gives end-to-end options and providers to satisfy necessities for vitality and helps create merchandise which are superior in high quality and dependable. It has unfold its motto ‘Prepare dinner Meals Serve Love’ throughout hundreds of thousands of households and has reached over 8 crore households.

MAK Lubricants

BPCL’s product MAK Lubricants is a trusted model in lubricants and greases in Indian and worldwide markets. It serves a spectrum of all the spectrum of vehicle segments – bikes, scooters, automobiles, gentle and heavy industrial autos, and tractors.

Aviation Companies

The corporate has a presence in all the worth chain of the Aviation gas enterprise proper from the manufacturing of jet gas at refineries, its transportation, storage, and Intoplane providers as per worldwide high quality requirements and different value-added providers within the aviation enterprise.

Different merchandise & Companies

BPCL has a presence within the enterprise of pure gasoline, liquefied pure gasoline and compressed pure gasoline. As well as, it has began organizing Proficiency Take a look at (PT) packages for the primary time within the petroleum trade to be able to cater to the wants of petroleum sector laboratories within the nation and adjoining areas.

Opponents

A few of the main opponents of BPCL are Reliance Industries, Indian Oil Company, Hindustan Petroleum Company, Mangalore Refinery And Petrochemicals and Chennai Petroleum Company.

Basic Evaluation of BPCL – Financials

Income and Profitability

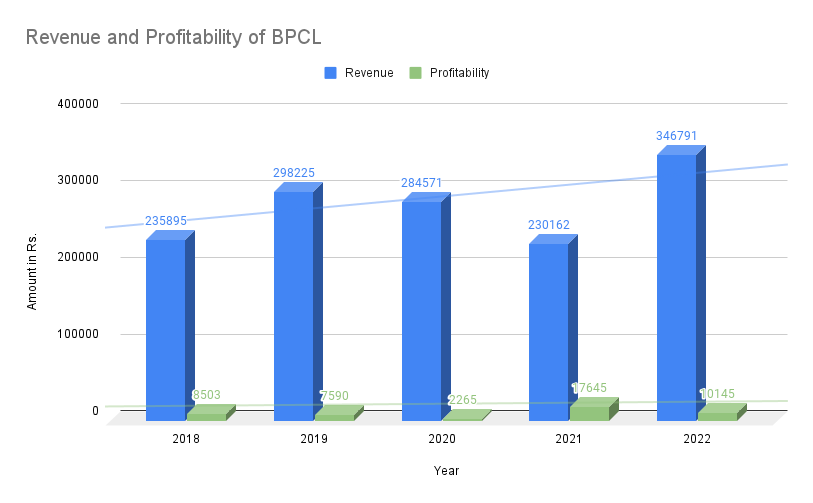

Year20182019202020212022

Revenue235895298225284571230162346791

Profitability8503759022651764510145

BPCL’s income and revenue present an growing pattern over a interval of 5 years. The corporate in its investor presentation for the June quarter (Q1FY23) talked about that its income grew at a CAGR of 10.6% from 2006 to 2022. On the similar time, its revenue after tax grew at a CAGR of 19.5%.

So far as the September quarter (Q2FY23) is worried, oil advertising firms (OMCs) like BPCL have incurred losses for promoting petrol and diesel decrease than the fee. Petrol and diesel costs have remained stagnant in India, although the worldwide costs of crude oil have been extremely risky and elevated in the course of the interval.

The Ministry for petroleum and pure gasoline, due to this fact mentioned that it’s going to help these firms. The Union Cupboard authorised a one-time cost of ₹ 22,000 crores to OMCs to compensate them for his or her losses. These firms have bought cooking oil beneath value. BPCL is included within the listing of firms that may obtain a portion of this grant.

Revenue Margins

YearGross Revenue Margin (%)Working Margin (%)

20187.185.96

20195.754.60

20203.612.17

202110.238.34

20226.174.60

The above desk reveals the gross revenue margin and the working margin of BPLC for the final 5 years. These margins have been falling until 2020, nevertheless, a pointy improve was seen in 2021 and a decline thereafter.

Return Ratios & Debt

YearReturn on Networth / Fairness (%)ROCE (%)Return On Belongings (%)

Mar 201824.618.877.48

Mar 201920.1216.385.69

Mar 20208.366.832.02

Mar 202130.1818.4610.04

Mar 202222.5015.286.22

BPCL has an excellent return on fairness at 22.50% and a perfect Return on belongings at 6.22%. Nevertheless, it has a average return on capital employed at 15.28%.

Over a interval of 5 years, it has had a perfect return on fairness ratio, besides in 2020. Additional, this ratio was glorious in 2021. Its return on capital is beneath the best stage for all 5 years, however it was poor in 2020. A return on belongings above 5% is taken into account to be excellent. This ratio has been excellent for the previous 5 years besides in 2020.

Additional, its debt-to-equity ratio was 1.08 as per its newest annual report, which is barely above the best stage however manageable. This ratio was 0.87 within the earlier 12 months.

Shareholding sample & pledged shares

The President of India is the corporate’s promoter and holds a 52.98% stake in it. One other main shareholder is the Life Insurance coverage Company of India with a 9.08% stake. Different DIIs maintain a 12.76% stake, FIIs maintain a 12.96% stake and the remaining is held by the general public. Additional, there isn’t any pledge towards the promoter’s shares.

Basic Evaluation of BPCL – Key Metrics

ParticularsValuesParticularsValues

Face Worth (₹)10ROE (%)22.50

Market Cap (Cr)65,869Net Revenue Margin2.92

EPS (₹)12.27Current Ratio0.75

Inventory P/E (TTM)24.75Debt to Equity1.08

Dividend Yield (%)5.27Promoter’s Holdings (%)52.98

The corporate’s shares are at present buying and selling at a price-to-equity ratio (PE) of 24.37, which is barely larger than the trade PE of twenty-two.60. Due to this fact, the inventory could be overvalued as buyers could be hoping that its value would possibly improve sooner or later.

Future Plans of BPCL

These are a number of strategic aspirations that the corporate has for 2022-27:

It plans to extend its petrochemical capability technology, which is able to contain an funding of ₹ 38,000 crores. Furthermore, it plans to triple its footprint in gasoline and improve its EBIT contribution. It goals at rising its bio-fuels portfolio, particularly 1G ethanol. Additional, it plans to open 7000 vitality stations.

In Closing

On this article, we did a elementary evaluation of BPCL. We took a have a look at BPCL’s enterprise verticals, the trade by which it features, its opponents, financials and extra. That’s all for this text of us! Blissful investing, till subsequent time.

Now you can get the most recent updates within the inventory market on Commerce Brains Information and you’ll even use our Commerce Brains Portal for elementary evaluation of your favorite shares

Begin Your Monetary Studying Journey

Wish to study Inventory Market and different Monetary Merchandise? Be certain to take a look at, FinGrad, the training initiative by Commerce Brains. Click on right here to Register in the present day to Begin your 3-Day FREE Path. And don’t miss out on the Introductory Supply!!