Kevin Winter/Getty Photos Leisure

Introduction

Technically talking, Apple Inc. (NASDAQ:AAPL) is the one firm in my portfolio that could be a member of the expertise sector. Whereas I are likely to disagree with the definition of expertise, I assumed lengthy and laborious earlier than shopping for expertise in 2021. I wished an organization that brings each development and worth to the desk. An organization that gives a rising dividend and buybacks with out giving up on its potential to outperform – in any case, I am not seeking to go obese in high-yield investments. Apple gives all of this. Whereas Apple is struggling this 12 months, it’s outperforming each different FAANG inventory by a large margin. This occurs regardless of vital shopper weak spot, decrease enterprise investments, and the truth that Apple’s merchandise are within the highest worth vary. On this article, I’ll dive into all of this and clarify why I imagine that Apple is a go-to inventory for traders seeking to purchase high-quality development publicity. This contains my technique going ahead, as we have to incorporate far more than Apple’s potential to invent nice merchandise.

So, let’s get to it!

It is A Scary Enterprise Setting

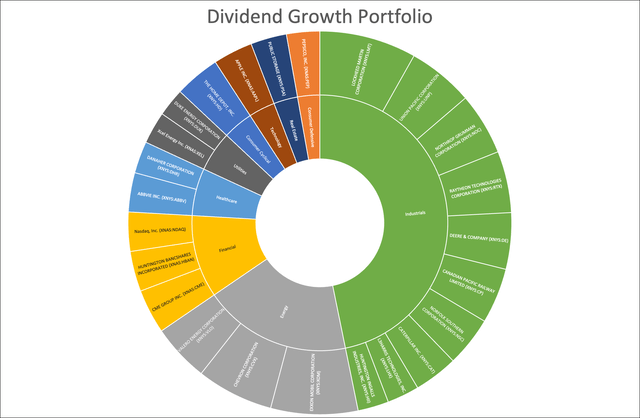

The little brown space within the chart under shows my expertise publicity. Whereas I’d make the case that a number of protection corporations (industrials) in my portfolio are far more high-tech than most shares within the expertise sector, you will need to personal shares that carry out higher in a falling-rate surroundings. In different phrases, shopping for Apple was primarily based mostly on diversification.

Writer

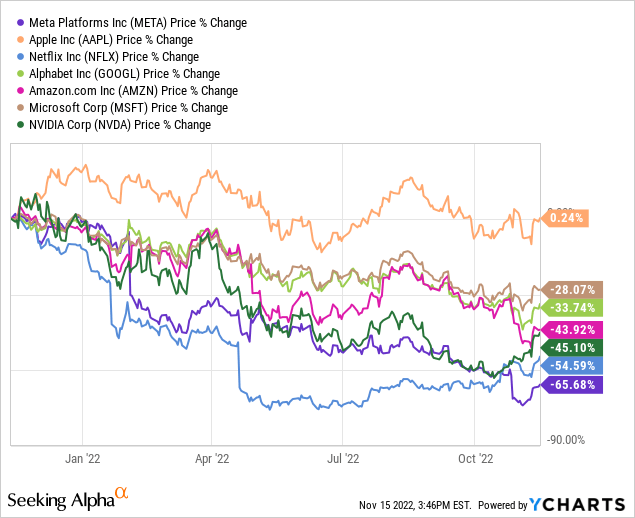

That mentioned, I might have gone with a number of expertise shares, but I went with Apple. Going again twelve months, Apple is at the moment the one inventory in constructive territory. Observe that I included Microsoft (MSFT), NVIDIA Corp. (NVDA), and Amazon (AMZN) as effectively. In any case, FAANG has developed a bit through the years.

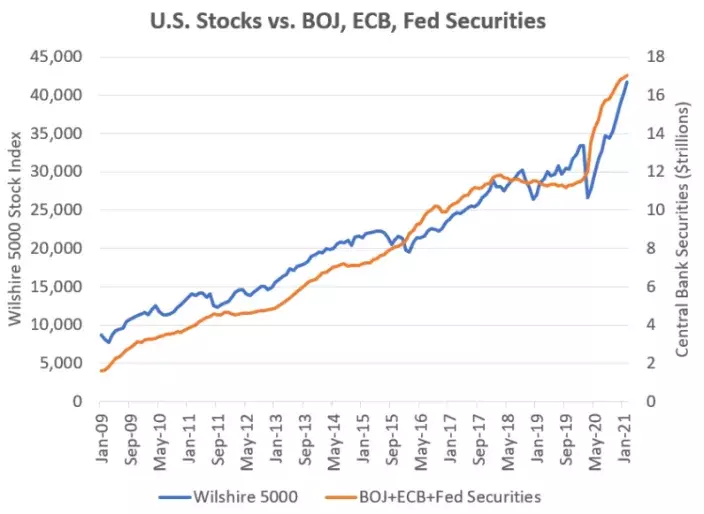

Primarily, I appreciated the idea behind FAANG (or FAANG+, or FAANGMAN, or no matter you wish to use) as a result of it completely captured the bull market between the Nice Monetary Recession and the surge in inflation in 2021.

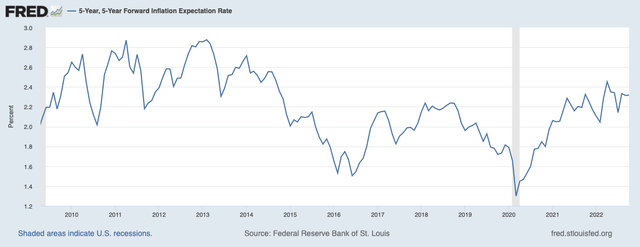

Federal Reserve rates of interest had been low, inflation was low, international QE packages fueled liquidity, and technological developments had been quick. Because the chart (from September 2022) under exhibits, rates of interest had been extremely accommodative between 2009 and 2022. The one exception was the surge in charges after 2016, which allowed worth shares to briefly outperform development shares.

CME Group

Primarily, accommodative charges imply that Fed coverage charges are under long-term inflation expectations. What made the scenario prior to now decade so enticing is that long-term inflation charges had been low – but Fed charges had been even decrease.

Utilizing the 5-year, 5-year ahead inflation chart, which estimates the common inflation charge of the 5 years beginning in 5 years, we see that estimates had been near 2.4% within the years after the Nice Monetary Disaster. After 2013, these charges moved decrease, with constant readings under 2%.

Federal Reserve Financial institution of St. Louis

This makes development shares so enticing as a result of discounting future development is far more enticing when inflation expectations are low. In any case, if you happen to assume that inflation will speed up, you in all probability favor shares that already generate excessive income.

On prime of that, central banks offered liquidity, which was roughly pressured into FAANG shares.

Yahoo Finance

In 2021, I purchased Apple. Not as a result of I anticipated this to proceed, as I already had shifted to the thesis that worth would outperform. I purchased Apple for diversification and since I believed that Apple would outperform different development shares.

My thesis turned out to be right. Inflation accelerated on account of provide chain points, commodity shortages, labor inflation, and financial and financial stimulus of 2020 and 2021. Now, we’re in a scenario the place inflation continues to be excessive, inflicting central banks to reverse all the things they did earlier than the disaster. Rates of interest are surging, financial development is struggling, and inflation continues to be excessive.

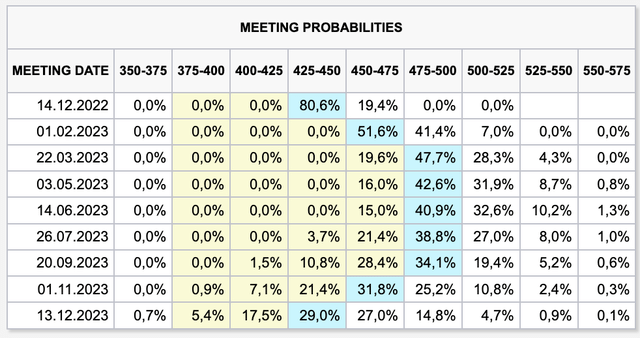

Whereas I am penning this, the market expects the Fed to hike by 50 foundation factors in December, adopted by two 25 foundation factors hikes in early 2023.

CME Group

The danger is that inflation is not coming down as quick because the market could anticipate, inflicting us to get a situation corresponding to the Seventies and Nineteen Eighties, the place supply-side-driven inflation triggered the Fed to provoke a number of aggressive mountain climbing cycles. It triggered financial development to fluctuate.

Till inflation eased within the early Nineteen Eighties, shares went sideways for greater than 20 years. I’m not saying that this can occur once more, nonetheless, I imagine the dangers of a chronic sideways development are very excessive.

TradingView (S&P 500)

Primarily, this is able to imply that we have to pour all of our cash into (excessive) dividend-paying shares. Nevertheless, I am solely altering my technique a bit as I’ll proceed to purchase development.

I will not purchase money-losing development shares. I’ll use the following few years to purchase extra Apple shares at any alternative I get, as I wish to make this a big place in my portfolio.

In any case, Apple combines the perfect of development and worth, inflicting it to stay the final FAANG standing – by a big margin.

Apple – Resilience When It Issues Most

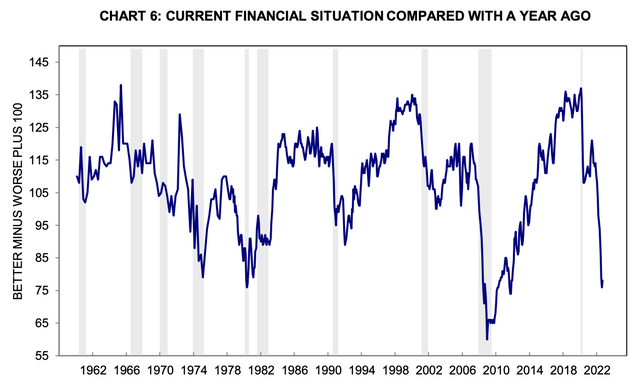

Let’s proceed with some extra dangerous information. Apple is not only a tech inventory, it is usually extremely depending on the well being of the patron. In any case, 52% of its $394 billion internet gross sales in FY2022 got here from its iPhone (different merchandise additionally rely on the patron). Therefore, one of many the explanation why so many traders haven’t invested in Apple is the truth that the patron is in a horrible spot. Utilizing the College of Michigan numbers, the present monetary scenario of shoppers in the USA hasn’t been this low since 2010.

College of Michigan

In Europe, the scenario is even worse as a result of vitality disaster. In China, we’re coping with ongoing lockdowns (Zero COVID) that hold folks from spending as a lot as they might beneath regular circumstances. On a facet word, regardless of lockdowns, Apple grew gross sales by 9% in Larger China in FY2022. That beats European gross sales by 200 foundation factors! I anticipate these gross sales to rebound when China ends its Zero COVID coverage in early 2023 (in keeping with my sources).

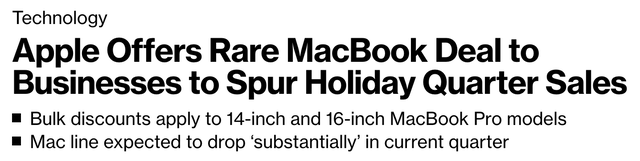

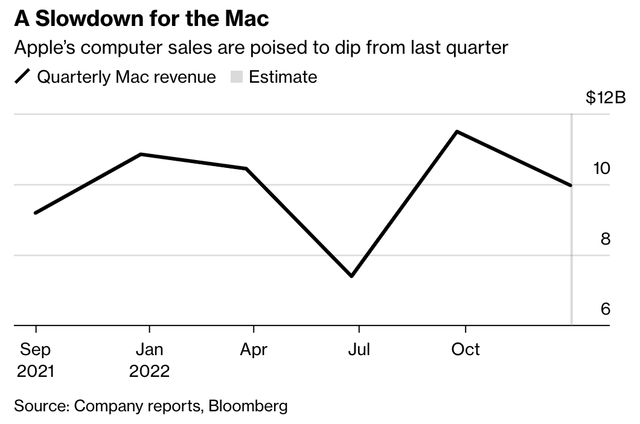

Therefore, now dangerous headlines are rising. For instance, Apple is now providing uncommon MacBook offers to speed up its gross sales.

Bloomberg

As reported by Bloomberg, the corporate is providing reductions of as a lot as 10%. But, it solely impacts its M1-chip MacBooks.

Bloomberg

It is a measure aimed to spice up gross sales and eliminate extra stock forward of MacBook upgrades within the first few months of 2023.

That is not all the things. Weak spot can be hitting the iPhone (as most already anticipated, given macroeconomic circumstances). J.P. Morgan simply got here out, making the case that gross sales within the December quarter will decline year-on-year.

As reported by In search of Alpha:

Analyst Samik Chatterjee lowered his iPhone 14 estimates by 5M and different iPhone estimates by 3M and now forecasts iPhone and complete revenues to say no year-over-year through the interval.

“In relation to affect to [fiscal year 2023] estimates total, the discount to estimates are extra modest as we anticipate a part of the cargo shortfall within the December quarter to be made up within the March quarter, which generally being a decrease manufacturing quarter will give Apple ample alternatives to get well the shortfall, and on the demand facet based mostly on historic precedent we anticipate restricted to modest affect to shopper demand from delays and prolonged supply occasions,” Chatterjee wrote.

I’ve to say that this information sounds worse than it’s. For instance, the iPhone has been robust till the December quarter. In its fourth quarter, the corporate grew iPhone gross sales by 10%. Whereas this contains pricing, it is on prime of 39% income development within the prior-year quarter. That is higher information than most give Apple credit score for.

Nevertheless, Apple was very reluctant on the subject of predicting what demand could appear like – particularly with regard to pricing points and lower-cost opponents.

Tim Cook dinner talked about provide chain points that saved the corporate from promoting as many iPhones as it might have appreciated. Furthermore, iPhone 14 demand is difficult to estimate as Apple has launched a variety of new fashions (Max, Professional, you title it).

Nevertheless, one of many the explanation why I am not anxious about competitors is the truth that high quality variations are an enormous problem when searching for higher costs. I’ve spent the previous 4 weeks determining what my new cellphone goes to be. I can go for an inexpensive possibility from a competitor. Nevertheless, opinions are simply horrible. When searching for a top quality cellphone, there actually is not an affordable various to the iPhone anymore. Therefore, folks keep within the Apple ecosystem. Or, even higher, folks be part of the ecosystem. I’ve had extra pals and colleagues change to Apple prior to now 12 months than folks leaving Apple – together with a number of penny pinchers.

Therefore, I wasn’t shocked that Tim Cook dinner talked about nice outcomes for the iPhone in all key areas:

We had been actually happy with the broadness of the iPhone power final quarter. We had three of the highest 4 smartphones within the U.S. and the UK, the highest three in City China, the highest six in Australia, 4 out of the highest 5 in Germany and the highest two in Japan. And buyer satisfaction for the iPhone stays very, very robust at 98%.

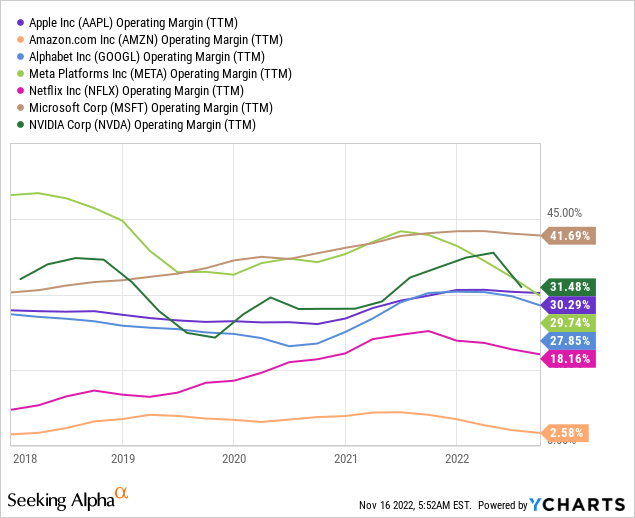

Furthermore, in gentle of excessive inflation, Apple has maintained robust margins. Apple’s working margin has been persistently above 30.0% within the 2022 calendar 12 months. Microsoft is powerful as effectively. Corporations like Netflix (NFLX), Meta (META), and Amazon have a a lot more durable time coping with inflation. Furthermore, usually, demand weak spot makes this even more durable.

The important thing right here is Apple’s provide chain resilience. Like all corporations, Apple did really feel headwinds from the extreme provide shortages (i.e., semiconductors) that began after the 2020 lockdowns. Nevertheless, Apple is superior on the subject of provide chains.

Even means earlier than the pandemic, Apple was recognized for its seamless provide chain operations. In 2019, I did my grasp’s diploma centered on provide chains. Tim Cook dinner was a frequent subject of dialogue.

As reported by Provide Chain Digital, it’s no shock that Steve Jobs made Tim Cook dinner his successor. He is a provide chain man, chargeable for a giant a part of Apple’s success.

[…] it was Cook dinner who had ensured Apple’s phenomenal development by by no means permitting the provision of its merchandise to be outstripped by demand, even when demand was stratospheric.

[…] But lower than a 12 months after Cook dinner joined, Apple was reporting income. Because the visionary Jobs got here up with one era-defining product after one other, Cook dinner made certain they had been at all times accessible, and in large numbers.

An early Cook dinner ploy was to purchase US$100mn of vacation season air freight, months prematurely. This lower out opponents, and left them scrambling to ship merchandise through the vacation season.

However he realised very early in his Apple profession that the corporate’s provide chain was unwieldy, over-complex and unresponsive, and so he moved Apple to a just-in-time (JIT) manufacturing mannequin – a course of he had overseen in his time at IBM.

It is good to know there’s an knowledgeable in cost (clearly) as Apple is now reconfiguring its provide chain. Apple will scale back its reliance on Asian markets as geopolitical and financial dangers have triggered an acceleration in provide modifications after the pandemic.

Apple is now seeking to supply chips in the USA and Europe. As reported by Bloomberg:

“We’ve already decided to be shopping for out of a plant in Arizona, and this plant in Arizona begins up in ’24, so we’ve bought about two years forward of us on that one, perhaps rather less,” Cook dinner informed the workers. “And in Europe, I’m certain that we’ll additionally supply from Europe as these plans develop into extra obvious,” he mentioned on the assembly, which included Apple providers chief Eddy Cue and Deirdre O’Brien, its head of retail and human assets.

In Arizona, Apple may have entry to produce from the Taiwan Semiconductor Manufacturing Firm (TSM), beginning in 2024. Furthermore, Intel (INTC) is constructing crops in Arizona, with an identical timeline. But, Apple will not probably develop into a buyer because it has produced its personal chips – as everyone seems to be conscious of by now.

Extra Causes Why Apple Is not Promoting Off

Thus far, we’ve got a number of causes. Regardless of imploding shopper sentiment, provide chain points, and ongoing geopolitical points (together with Zero-COVID), Apple is standing robust. Its margins in FY2022 reached one of many highest ranges ever, its iPhone continues to resist fierce competitors, and Apple additional improved gross sales on prime of robust comparisons in FY2021. All of this was offered by stellar provide chains.

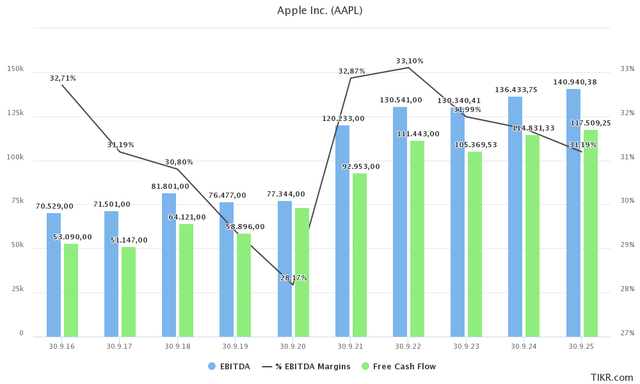

When trying on the greater image, we see that margins are anticipated to return down a bit. Nevertheless, each EBITDA and free money move are anticipated to stay in an uptrend.

TIKR.com

Within the present fiscal 12 months (2023), the corporate is predicted to generate $105 billion in free money move. This suggests a 4.4% free money move yield, utilizing its $2,400 billion market cap.

That is excellent news for traders as Apple is on a mission to eliminate its money load.

Within the September quarter, the corporate returned $29 billion to shareholders. $3.7 billion was distributed by means of dividends (sustaining its 0.6% yield). The remaining $25.2 billion was (not directly) distributed by means of open market purchases of 160 million AAPL shares. Whole distributions had been roughly 1.2% of its market cap. On an annualized foundation, that is 4.8%, permitting the corporate to distribute all of its incoming free money move and parts of its current money holdings.

The corporate ended the quarter with $169 billion in money and marketable securities. The corporate repaid $2.8 billion in money, decreased industrial paper by $1 billion, and issued $5.5 billion in new debt. Gross debt was $120 billion, indicating $49 billion in internet money (damaging internet debt).

Apple is seeking to develop into internet money impartial over time, that means the corporate will speed up distributions not simply according to FCF development, however a bit quicker to distribute $49 billion in present internet money.

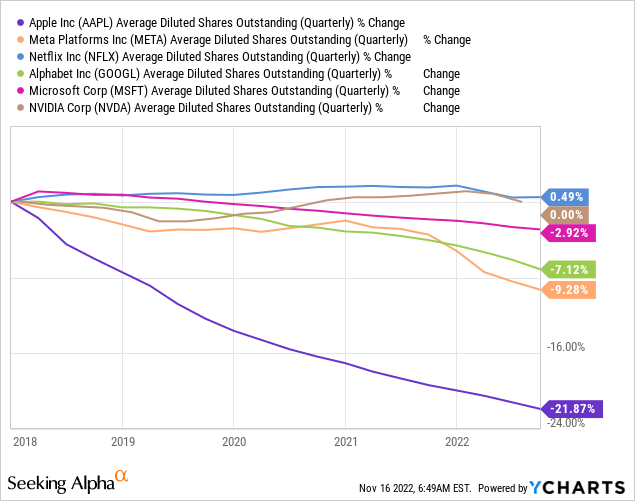

Consequently, Apple is the one FAANG+ with substantial internet share buybacks. Not one of the others purchased again greater than 10% of their shares excellent.

That could be a large deal because it artificially boosts earnings per share.

So, what concerning the valuation?

Valuation

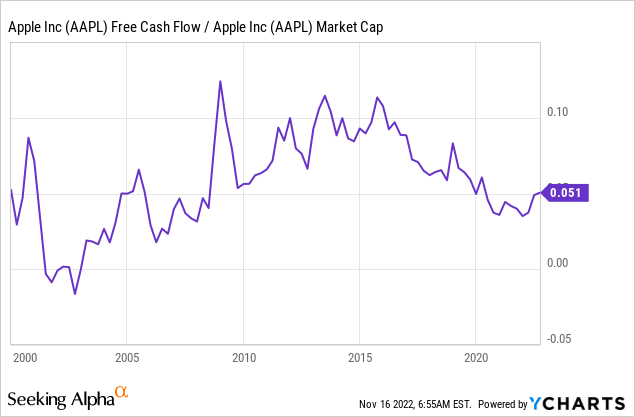

Let’s begin with the worst information. The implied free money move yield is not very excessive. Utilizing LTM FCF, it is roughly at 5%. Whereas it is off the lows, it’s far under something the market witnessed previous to international central banks turning accommodative in 2015. As I confirmed you in the beginning of this text, inflation expectations got here down laborious round 2015. It triggered traders to use a unique valuation to Apple. All of the sudden, a ten% FCF yield was means too excessive. Now, a 5% FCF yield could also be too low, if we assume that inflation is right here to remain…

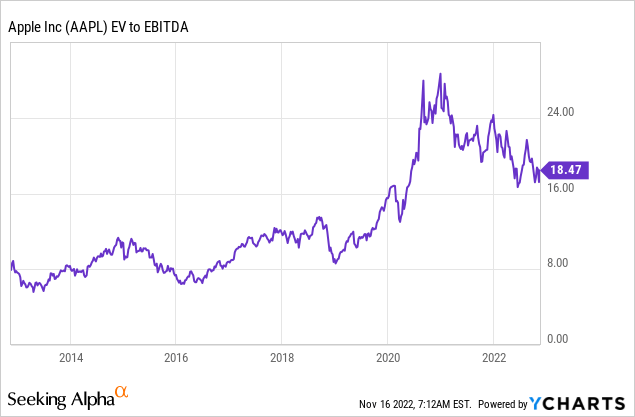

Furthermore, Apple is buying and selling at 18.0x NTM EBITDA. That is based mostly on its $2.4 trillion market cap and FY2023E internet money of $61 billion.

This valuation is effectively under its peak, but not at extraordinarily enticing ranges. I imagine {that a} valuation of 15-16x EBITDA is an effective place to begin shopping for extra shares – or to provoke a place.

So, let’s summarize this text.

Takeaway

I went with a considerably confrontational title. Nevertheless, I feel it is true. Whereas Apple is down 16% year-to-date, the corporate has protected its traders towards weak spot that occurred in different tech shares. Not solely that, however by doing so, traders are nonetheless sitting on large beneficial properties over the previous few years as AAPL didn’t underperform over the past bull market.

I additionally went with this title as a result of I imagine that Apple is the perfect FAANG+ inventory going ahead. I don’t anticipate the market surroundings to all of a sudden flip accommodative of development shares. Whereas provide chain points are easing, above-average inflation is prone to persist. Central banks will proceed to be pressured to unravel this, which might result in a number of mountain climbing cycles down the street.

My technique is to proceed shopping for Apple on any main weak spot. Whereas the corporate could chorus from rallying because it did previous to 2022, we’re coping with – what I imagine – is the perfect FAANG inventory in the marketplace. The corporate has distinctive provide chain administration, merchandise capable of face up to robust competitors, and permitting the corporate to make use of pricing to offset inflationary headwinds.

On prime of that, it has an AA+ stability sheet, permitting administration to aggressively purchase again shares, boosting EPS at a time when it issues most.

In abstract, AAPL is a tech inventory that lets me sleep effectively at night time, realizing I personal the perfect combine between development and worth.

So, if you happen to’re searching for tech publicity, I imagine that AAPL is the way in which to go. Particularly in gentle of ongoing and anticipated macroeconomic developments.

(Dis)agree? Let me know within the feedback!

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)