Jeremy Hunt’s Autumn Assertion had two audiences: collectors and voters. It wanted to persuade the previous that the UK authorities could be trusted with their cash and it wanted to persuade the latter that the Conservative authorities is doing its greatest to restrict the injury to them and their households from a worldwide financial storm.

To date the chancellor appears to be doing somewhat properly on the primary goal. Nonetheless, the prices of debt service have risen considerably. The federal government has taken sizeable actions to ship on the second, too. However the blow to family actual disposable incomes will nonetheless be monumental. In the meantime, he has adopted yet one more set of fiscal targets and pushed the austerity designed to attain them into the years after the subsequent election. These guarantees of future fiscal chastity can’t be taken significantly. They could or might not be delivered. However no parliament can bind its successor.

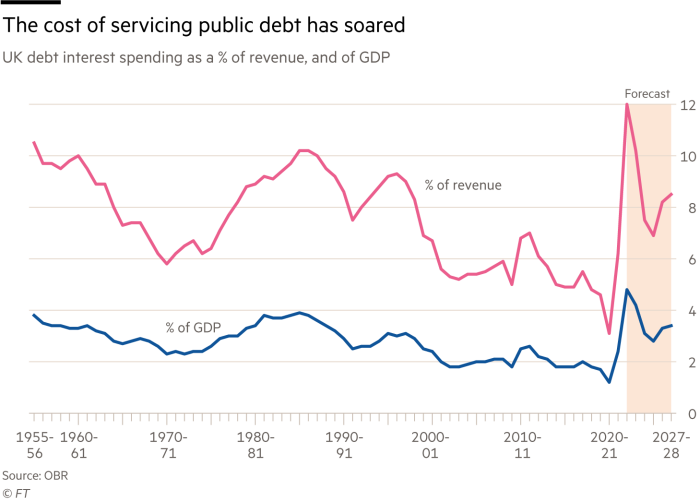

What is for certain is the affect of the Russian aggression in opposition to Ukraine. That is the principle rationalization for the large revisions within the Workplace for Price range Duty’s forecasts since final March. The choice of Liz Truss and Kwasi Kwarteng to launch massive unfunded tax cuts and spending will increase at such a juncture, whereas repudiating enter from the OBR and the Financial institution of England, was insane. Hunt went out of his option to laud these establishments: sanity, he emphasised, is again. To date, fortunately, collectors agree. The so-called “moron premium” on UK bond yields has melted away. Nonetheless, the leap in debt service prices shall be big: in accordance with the OBR, authorities spending on curiosity will leap from 1.2 per cent of gross home product in 2020-21 to 4.8 per cent in 2022-23.

The rise in rates of interest is a response to inflationary pressures. These are simply one of many financial issues brought about or exacerbated by the worldwide leap in vitality costs, which itself got here on high of the post-Covid rise within the costs of products. The vitality shock is not only inflationary. It’s also contractionary for GDP and much more so for actual incomes, because it has elevated the price of imports vastly relative to these for exports. The consequence is a large fall in forecast financial development and an much more dramatic squeeze on family incomes.

The weather on this total image are startling. The OBR expects inflation to peak at a 40-year excessive of 11.1 per cent within the fourth quarter of 2022, revised up from a forecast of 8.7 per cent in March. It additionally expects the economic system to enter a recession lasting simply over a 12 months from the third quarter of 2022 (particularly, now). By the primary quarter of 2027, it says, “cumulative development in actual GDP because the fourth quarter of 2019 is 3.4 share factors decrease than in our March forecast”; 2.4 share factors of this is because of decrease cumulative development over the forecast interval. Furthermore, the majority of that is because of decrease potential development and so is prone to be everlasting.

Worst of all is what’s going to occur to family actual disposable incomes. “On a fiscal 12 months foundation,” says the OBR, these fall “by 4.3 per cent in 2022-23, which might be the most important since ONS data started in 1956-57. That’s adopted by the second largest fall in 2023-24 at 2.8 per cent.”

These big reductions in residing requirements happen regardless of huge spending on help: the fiscal measures since March are forecast to lift actual family disposable incomes per individual by 4.5 per cent in 2022-23 and a pair of.5 per cent in 2023-24. The affect on the general public funds comes not solely from the recession, but additionally from spending focused at decreasing the burden on households. Extra spending introduced since March quantities to £103bn from 2022-23 to 2024-25. The offsetting will increase in taxes and cuts in spending solely start from 2024-25 (for taxes) and 2025-26 (for spending). The federal government shall be gifting away cash vastly over the 2 years working as much as the election. Fiscal targets will, not surprisingly, be missed as soon as once more. Certainly, public sector web debt is now forecast to hit a 63-year excessive of 97.6 per cent of GDP in 2026-27, in opposition to a forecast of 78.9 per cent solely final March. That is certainly an enormous storm.

Is there some excellent news? Sure, the OBR thinks inflation might go destructive in 2024. In that case, rates of interest would possibly plummet. The Ukraine struggle would possibly finish before is now anticipated, although the possibilities that this can reverse the squeeze on fuel provides look small. In all, that is about weathering a storm that shall be very painful for a big portion of the general public. May the federal government have achieved extra to cushion the blow? Solely by being keen to lift taxes much more.

The longer run questions are nearly inevitably left to at least one facet. There’s definitely nothing to counsel radical new considering on development. Worse, the disaster is imposing a giant hit to already weak enterprise funding, whereas the federal government plans to chop capital spending, too. These cuts are positive to point out up in longer-term weak point in potential output.

But there are issues that may be achieved cheaply. An important achievement of Hunt and Rishi Sunak is to reintroduce a level of coherence and predictability into policymaking. That should absolutely now be prolonged to our relationship with our most vital financial associate, the EU. The period of Brexit fantasy wants finally to be put behind us. On the very least, and particularly at a time of such radical uncertainty, the doubts over future buying and selling relationships should be ended. So, allow us to agree on Northern Eire, abandon totemic discord, attain as shut and credibly steady an financial relationship with the EU as is feasible, after which transfer on. It’s excessive time for us to take action.

Comply with Martin Wolf with myFT and on Twitter

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)