Nisian Hughes/DigitalVision by way of Getty Photos

Intel (INTC) in mid February 2022 introduced it was signing a definitive settlement to accumulate Israel-based Tower Semiconductor (NASDAQ:TSEM) for $5.4 billion or $53 per share in an all-cash deal. Intel has set its sights on sub-7nm chips, and famous that the acquisition is according to the corporate’s IDM 2.0 technique to broaden its manufacturing capability, world footprint, and know-how portfolio.

Within the 9 months for the reason that acquisition announcement, regulatory approval has not been finalized. Vital to Tower traders, the acquisition settlement gave the businesses a full yr during which to finish the deal – February 2023. Much more necessary, due to Tower’s world attain, it requires approval from regulators within the US, China, Germany, Israel, Japan, the UK, and Italy.

All Eyes on China and the Regulatory Company

Even underneath regular instances, China has been the sticking level on most mergers. In February 2022, China accepted the merger between Superior Micro Units (AMD) and Xilinx, however turned down the acquisition of ARM Ltd by Nvidia (NVDA).

However these choices happened previous to an Oct. 7, 2022, escalation of sanctions imposed on China by the U.S. authorities. I’ve written extensively on In search of Alpha about China sanctions, and the most recent was on Nov. 5, 2022, with an article entitled “U.S. Chip Tools Suppliers Greatest Losers From China Sanctions However KLA Fares Finest.”

These U.S. sanctions have an effect on China as a rustic. Whereas Chinese language President Xi Jinping is seemingly involved about local weather change and has agreed to renew local weather change talks with Biden throughout their assembly in Bali, others within the China authorities are targeted on U.S. sanctions. On Oct. 8, 2022, following the most recent spherical of sanctions, China’s overseas ministry spokesperson Mao Ning stated “The US will solely harm and isolate itself when its actions backfire.”

However the U.S. sanctions have instantly influence China’s Semiconductor Manufacturing Worldwide Company (SMIC), {a partially} state-owned publicly-listed Chinese language pure-play semiconductor foundry firm. It is the most important contract chip maker in mainland China.

SMIC’s expects fourth quarter income will fall 13% to fifteen%, and expects the gross revenue margin to shrink to 30% to 32% QoQ on weak demand within the cell phone and client market. However SMIC has been struggling due to U.S. sanctions. Capability utilization was 92.1%, down 5 share factors from the earlier quarter.

China’s Hua Hong can be a competitor of Tower Semiconductor. Most of its income is from China (65% of 2020 income), adopted by North America (13%). Its main merchandise embrace energy discrete merchandise, micro-controller models (MCUs) and smartcards.

These three corporations – Tower, SMIC, and Hua Hong – will likely be analyzed on this article because it pertains to (1) Tower’s prowess as a competing semiconductor foundry with and with out being acquired by Intel and (2) Whether or not the Chinese language regulatory will approve the acquisition based mostly on its competitors in opposition to SMIC and Hua Hong.

Tower Semiconductor Competitors With Chinese language Foundries

Importantly, SMIC competes with Tower Semiconductor, notably within the manufacturing of semiconductors on 200mm wafers, and this direct competitors, will influence the choice of Chinese language regulators.

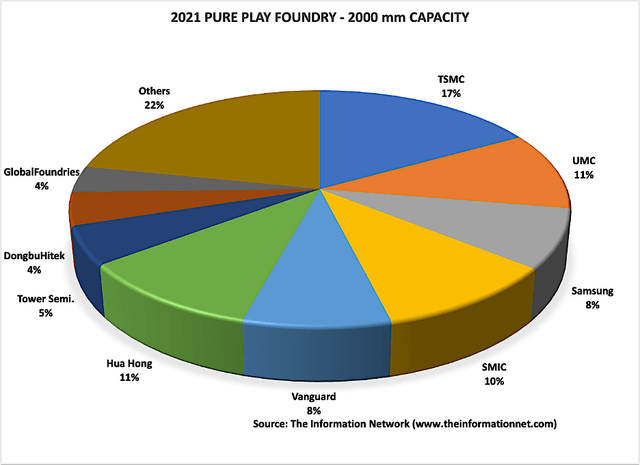

Chart 1 exhibits 200mm wafer capability by pure-play foundries (semiconductor corporations that make chips for others with no inside chip utilization). In 2021, SMIC had an 11% share of the general 200mm capability of three.1 million wafers monthly. China’s Hua Hong held a 11% share of 200mm capability, whereas Tower Semiconductor held a 5% share.

The Data Community

Chart 1

Tower Semiconductor Fabs

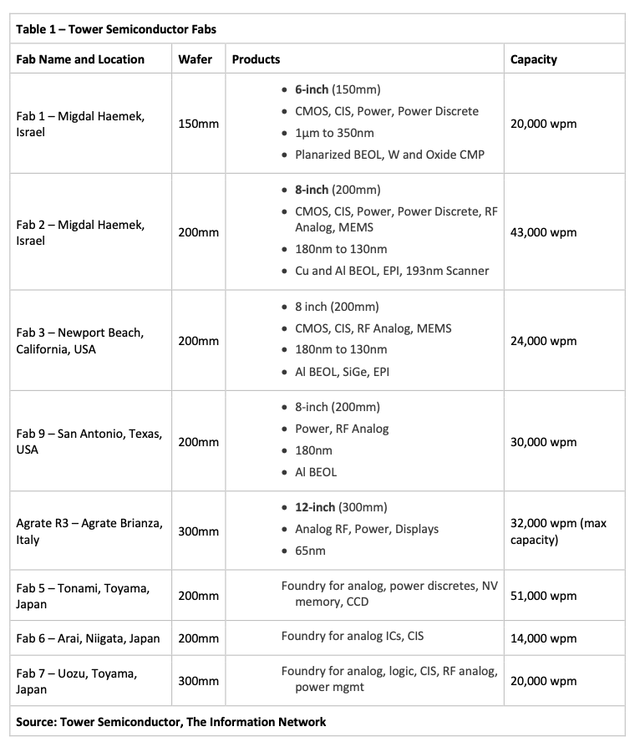

The TSEM acquisition offers Intel two 300mm wafer fabs with a mixed capability of 52,000 wafers monthly, 5 200mm wafer fabs with a mixed capability of 162,000 wafers monthly, one 150mm fab with a capability of 20,000 wafers monthly, and 1/3 of the capability on the ST JV fab, as proven in Desk 1.

Tower Semiconductor

Fabs 5, 6, and seven are TPSCo fabs (owned 51% by Tower, 49% by Nuvoton). The fabs assist geometrics ranging right down to 45nm. The Agrate R3 fab is a three way partnership with ST Microelectronics (STM). I mentioned the robust potential for Intel in my June 1, 2022, In search of Alpha article entitled “Tower Semiconductor Acquisition: A SiC Supply For Intel For Future U.S. EV Manufacturing.”

The SiC inverter marketplace for EVs for 2021 and 2030. The market will develop from $3.4 billion in 2021 to $186.6 billion. This represents a CAGR (compound annual progress fee) of 56% between 2021 and 2030. in accordance to our report entitled “Energy Semiconductors: Markets, Supplies and Applied sciences.”

SMIC Fabs

SMIC has three 200mm fabs and 5 300mm fabs. SMIC added 19% capability in 2021 and expects 2022 capability additions to be sooner than 2021.

Hua Hong

Hua Hong Semiconductor (Hua Hong) is the second-largest foundry (by capability) in China devoted to IC manufacturing at each 8-inch and 12-inch wafer fabs. Its first 12-inch fab started mass manufacturing in Q419. Hua Hong operates three 200mm and one 300mm fab.

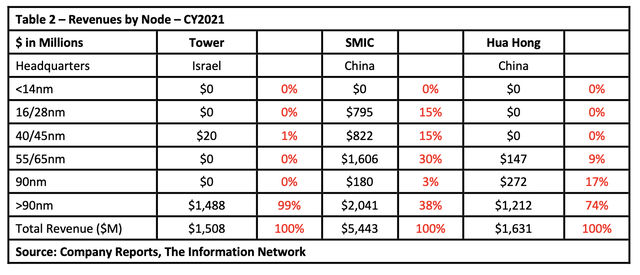

Income by Node

In Desk 2, I present revenues for the three foundries for 2021. Knowledge for TSEM are nebulous due to the best way the corporate offers monetary metrics. Introduced income for 2021 was $1,058 million, as in comparison with $1,266 million in 2020, reflecting 19% income progress. But it surely companions with Nuvoton, which had revenues of $40.8 million in 2021, and which I estimate its chips had been manufactured on the 45 nm. Revenues to TSEM had been $20 million.

The Data Community

Desk 2 exhibits that there is little overlap among the many foundries on the present time, with most of Tower’s revenues from nodes higher than 90nm. However one profit from being acquired by Intel is that when the corporate converts to smaller nodes, totally depreciated tools might be transferred to Tower amenities relatively than offered on the used tools market. With Intel’s emphasis on transferring its foundry enterprise to <7nm, and with Tower’s revenues of simply $1.5 billion, transitions to extra worthwhile nodes are possible.

From a historic foundation, this is likely one of the routes that China used to broaden into the semiconductor enterprise. Japanese semiconductor producers expanded their 200mm fabs to 300mm in Japan within the 1980, and constructed 200mm fabs in China, outfitting them with their used tools.

Investor Takeaway

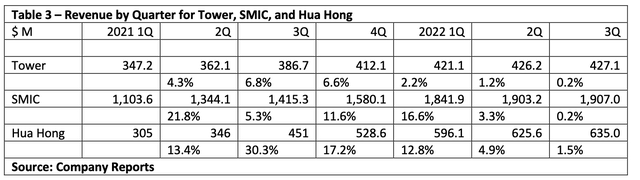

Desk 3 exhibits revenues for the three corporations in addition to QoQ change. It illustrates that Tower’s income progress has dropped considerably to virtually no progress in 3Q. Since we’ve got no steerage from the corporate, I’m assuming income has been impacted by gradual gross sales of client digital merchandise following a 40-year excessive in inflation, excessive gasoline and meals costs, and lowered discretionary cash from customers.

The dramatic slowdown in SMIC and Hua Hong are attributed to Covid lockdowns in China and to U.S. sanctions along with weak gross sales of client merchandise.

The Data Community

The transition for China to turn out to be self-sufficient in Chip manufacturing, a part of its Made in China 2025 program, coupled with the torpedoing of its chip business by the U.S. is a powerful rationale for the acquisition to be rejected.

China has no allegiance to Intel, which offered its NAND enterprise and Dalian China fab to SK hynix in late 2021. Expertise corporations that obtain authorities funding will likely be banned from constructing “superior know-how amenities” in China for a decade. The necessities come underneath the US authorities’s near-$53bn Chips Act supposed to scale up manufacturing of semiconductor chips.

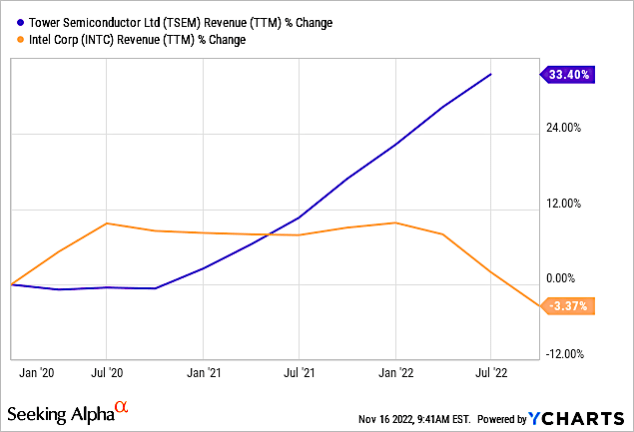

TSEM has had robust monetary metrics for the previous yr, and by itself is price contemplating as an funding. However the acquisition is much more necessary for Intel. Proven in Chart 2 are Income % change for Tower in contrast with Intel.

YCharts

Chart 2

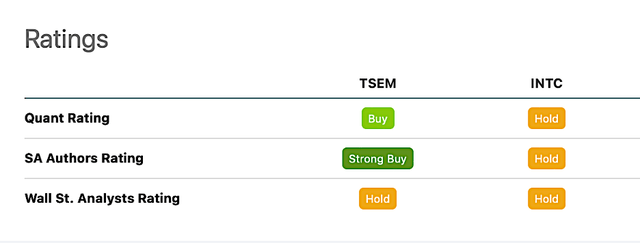

Chart 3 exhibits In search of Alpha Quant Issue Grades for TSEM and INTC. The acquisition of TSEM would profit Intel, however TSEM has robust progress potential by itself.

In search of Alpha

Chart 3

Intel wants TSEM greater than TSEM wants Intel. In my view, it is Tower’s partnership with STM in SiC that’s the major catalyst of the acquisition. With out Intel, assuming the deal is rejected by China regulators, TSEM is nonetheless a Purchase.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)