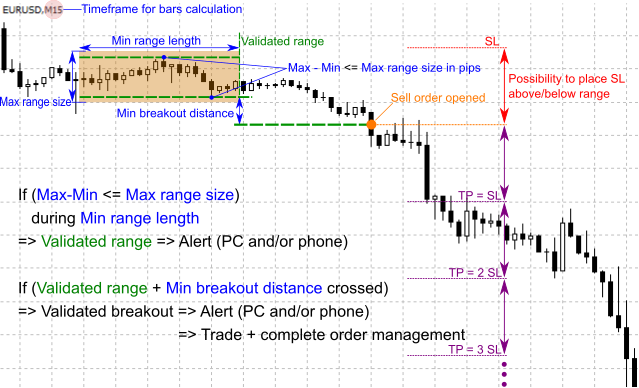

To begin with, this EA alerts (if possibility checked) when an emblem enters into a spread section. Then, it can anticipate breakout of the vary (with further filters if wanted) to ship an alert and/or to open an order. The principle benefit of this EA is that it lets you customise the specs of your vary.

To do that, you outline the three following parameters:

You may as well outline the breakout distance by giving a worth to the ‘Min distance breakout in pips’ parameter: a breakout happens when the value crosses a minimal distance from the vary.

The 4 parameters talked about above seem in blue within the graph under:

Then, the opposite benefits of this EA are:

-====Basic settings====-

Symbols: symbols for alerts & buying and selling (all or image on the chart)

There are a number of potentialities to decide on which symbols needs to be scanned: – ‘Solely image on the chart’ : you must use this selection for backtests or if you wish to apply the bot on the chart image ; – ‘All main foreign exchange pairs’ : the bot will scan all 28 main foreign exchange pairs (EUR/USD/GBP/CHF/AUD/NZD/JPY) ; – ‘Market watch’ : the bot will scan all market watch symbols ; – ‘Solely symbols listed under’ : solely symbols listed within the area under shall be scanned

Symbols to scan or exclude: write right here symbols to scan (‘Solely symbols listed under’ mode) or to exclude (‘All main foreign exchange pairs’ and ‘Market watch’ mode)

Dealer prefix (if crucial): just for brokers who use prefixes. For instance, kind m for mEURUSD

Dealer suffix (if crucial): just for brokers who use prefixes. For instance, kind m for EURUSDm

If a number of symbols should be entered on this area, they should be separated by commas

Use Timer: outline buying and selling days and hours

Monday: alerts & buying and selling on Mondays

Tuesday: alerts & buying and selling on Tuesdays

Wednesday: alerts & buying and selling on Wednesdays

Thursday: alerts & buying and selling on Thursdays

Friday: alerts & buying and selling on Fridays

Saturday (crypto): alerts & buying and selling on Saturday (typically for crypto buying and selling)

Sunday (crypto): alerts & buying and selling on Sunday (typically for crypto buying and selling)

Begin time: begin of the session

Finish time: finish of the session

Indicators alerts: terminal and/or smartphone notifs

Sends an alert when a spread is detected.

Buying and selling alerts: terminal and/or smartphone notifs

Sends an alert when a spread break is detected.

-====Vary settings====-

Timeframe for bars calculation: all MT5 timeframes

Used for ‘Min vary size in bars’: the variety of bars shall be calculated on this timeframe.

Min vary size in bars: min variety of bars to validate the vary

If the value stays throughout the vary dimension (in pips) for x bars or extra, the vary is validated.

Max vary dimension in pips: (Max value – Min value) should be <= Max vary (throughout min vary size)

… or in factors … (relying on the image).

Min distance breakout in pips: the breakout is validated when the value goes out of the vary and reaches a minimal distance

-====Filters settings====-

-=Transferring common settings=-

Use a MA: checks if value is above (purchase sign) or under (promote sign) this MA

Ma timeframe: all MT5 timeframes

Ma interval: interval of the MA

Ma methodology: SMA / EMA / SMMA / LWMA

Ma utilized value: CLOSE / OPEN / HIGH / LOW / MEDIAN / TYPICAL / WEIGHTED

Ma shift: shift of the MA

-=Pivot factors settings=-

Each day PP: checks if value is above (purchase sign) or under (promote sign) every day PP

Weekly PP: checks if value is above (purchase sign) or under (promote sign) weekly PP

Month-to-month PP: checks if value is above (purchase sign) or under (promote sign) month-to-month PP

Notice: the extra filters applied, the less orders shall be opened. In case you discover that there aren’t sufficient open orders, strive disabling some filters.

-====Buying and selling settings====-

Permit buying and selling: if false, solely alerts are operational

Magic quantity: should be distinctive if different EA are operating

‘Max open orders’, ‘Max % misplaced / day’ and ‘Max % win/day’ are calculated from the magic quantity. For instance, when you have 3 EAs with the identical magic quantity, the full variety of orders opened would be the sum of the orders opened in these 3 EAs.

Max open orders: max variety of orders opened concurrently (if 0, no max)

Max % misplaced/day: if max worth is reached, the EA open orders are closed and no different order is opened till the subsequent day (if 0, no max)

The calculation relies on account steadiness + open orders advantages. With the intention to velocity up the backtests, the calculation is finished each hour throughout backtests, as an alternative of each minute for an actual buying and selling session.

Max % win/day: if max worth is reached, the EA open orders are closed and no different order is opened till the subsequent day (if 0, no max)

Similar comment than for ‘Max % misplaced/day’.

Shut earlier than weekend: shut all EA orders on Friday

Shut time earlier than weekend: if ‘Shut earlier than weekend’ is ‘true’

Use cash administration: if ‘true’, lot dimension in % steadiness

Lot dimension in %: % steadiness per order (if ‘Use cash administration’ is ‘true’)

Fastened tons dimension: lot dimension per order (if ‘Use cash administration’ is ‘false’)

Max unfold: max allowed unfold to open an order (if 0, no max unfold)

Warning: if the worth of the unfold is just too low, no order shall be opened! To keep away from any downside, it is suggested to set the worth ‘0’ for the backtests.

Max slippage: max allowed slippage to open an order

Similar comment as ‘Max unfold’.

Place SL above/under vary: If ‘purchase order’, SL is positioned under vary; if ‘promote order’, SL is positioned above vary

A number of of SL for take revenue: cease loss distance is multiplicated by x for take revenue distance (if ‘Place SL above/under vary’ is ‘true’)

SL: cease loss in pips (if ‘Place SL above/under vary’ is ‘false’)

TP: take revenue in pips (if ‘Place SL above/under vary’ is ‘false’)

Break even: if ‘true’, break even is activated

Break even revenue: triggers the break even from a sure revenue in pips

Trailing cease: if ‘true’, trailing cease is activated

Path revenue: triggers the trailing cease from a sure revenue in pips

Path distance: distance in pips between trailing cease and value

Path step: step in pips for the trailing cease

Open further orders: a further order is opened every time the revenue reaches a step

Max further orders (by image) : ‘Open further orders’ should be ‘true’

Lot dimension of further orders: it’s higher to have smaller tons than for primary orders

Revenue step in pips to open a further order: every time the revenue reaches this step, a brand new order is opened

SL of further orders: SL in pips of the extra orders

TP of further orders: TP in pips of the extra orders

Main foreign exchange pairs :

EURUSD / GBPUSD / USDCHF / AUDUSD / USDCAD / USDJPY / NZDUSD

EURGBP / EURCHF / EURAUD / EURCAD / EURJPY / EURNZD

GBPCHF / GBPAUD / GBPCAD / GBPJPY / GBPNZD

AUDCHF / CADCHF / CHFJPY / NZDCHF

AUDCAD / AUDJPY / AUDNZD

CADJPY / NZDCAD

NZDJPY