Jose Luis Pelaez Inc

Threat-off sentiment continues to dominate international markets. Though there have been hints that the worst of the promoting has handed, there’s nonetheless loads of room for skepticism, primarily based on tendencies for key markets through a set of ETF pairs for costs via Thursday’s shut (Nov. 17).

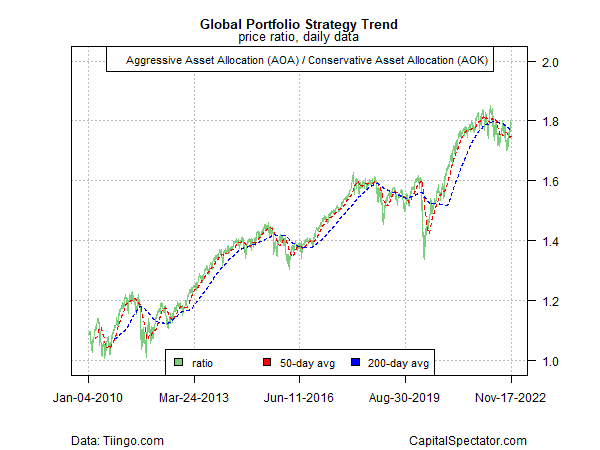

Let’s begin with the ratio of an aggressive asset allocation technique (AOA) to conservative (AOK). Though the pattern for this proxy has popped these days, the draw back bias stays intact, primarily based on 50- and 200-day transferring averages, and so it is untimely to imagine that the bear market has been exhausted.

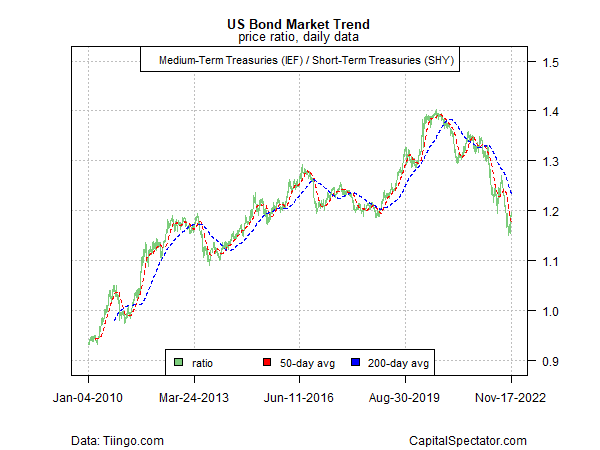

The draw back bias for medium-term Treasuries (IEF) relative to short-term Treasuries (SHY) actually hasn’t modified, which means that the urge for food for security stays robust.

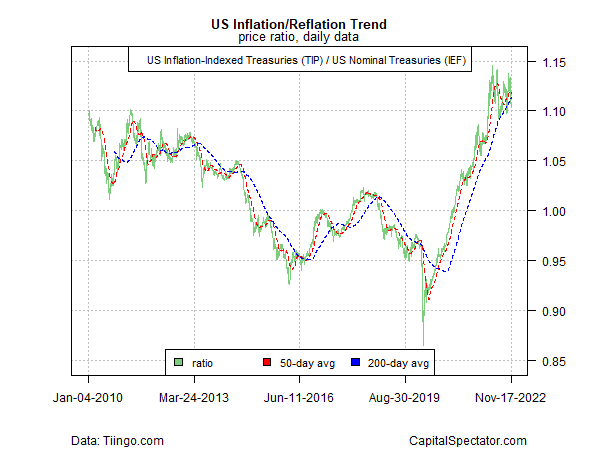

Threat-on for the inflation/reflation commerce continues to carry its floor, primarily based on the ratio for inflation-indexed Treasuries (TIP) vs. their normal counterparts (IEF), however the pattern is trying drained and is susceptible if the financial system continues to weaken.

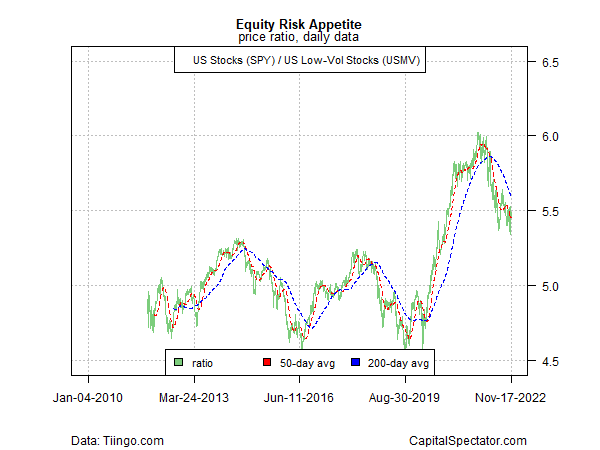

Estimating the danger urge for food for US equities (SPY) relative to a portfolio of low-volatility shares (USMV) continues to sign risk-off.

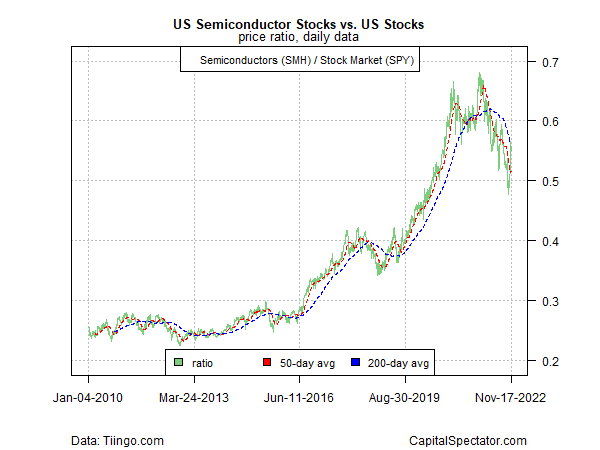

A proxy for financial exercise – semiconductor shares (SMH) vs. equities total (SPY) – has loved a reduction rally these days, however it’s too early to say that the bearish pattern for this proxy has ended.

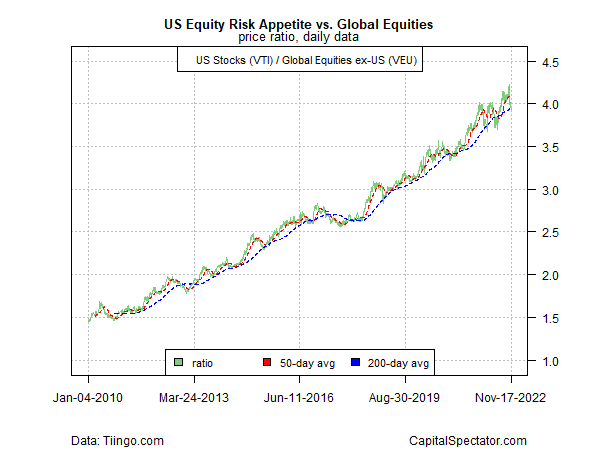

Regardless of the bearish bias for shares usually, the urge for food for US equities (VTI) over overseas shares (VEU) persists.

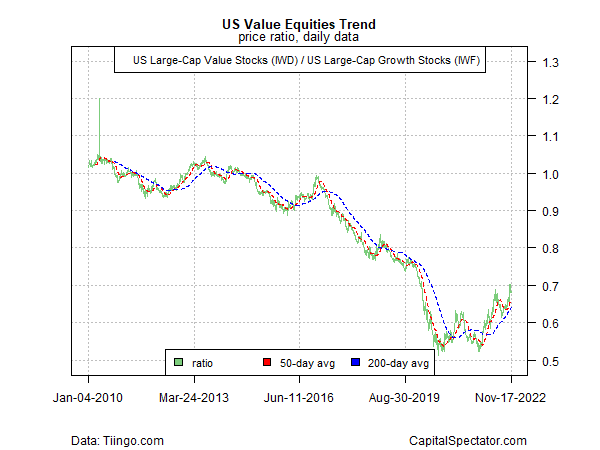

Lastly, relative power for worth shares (IWD) vs. development shares (IWF) continues to run. The logic is the extensively held view that worth shares are likely to outperform when rates of interest are rising. On that foundation, expectations that the Federal Reserve will proceed to hike charges within the close to time period suggest that worth will proceed to outperform.

Authentic Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.