rrodrickbeiler

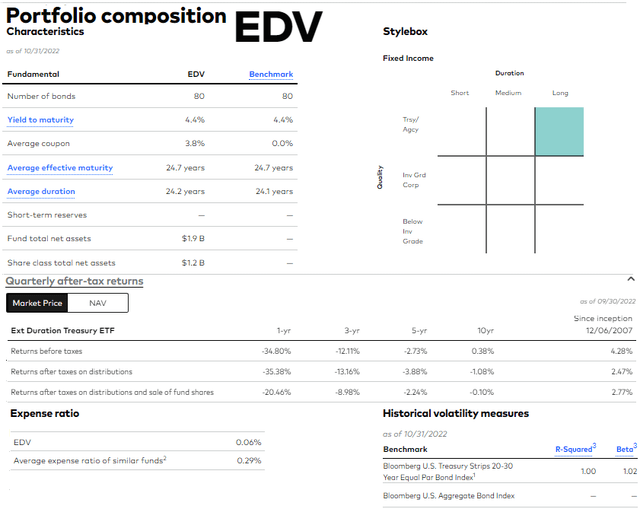

Because the final time I wrote about Vanguard Prolonged Period Treasury ETF (NYSEARCA:EDV) in Could this 12 months, it has misplaced 17.7% of its worth, sharply contradicting my bullish thesis.

I used to be mistaken in my assumption that recession dangers would outweigh increased inflation considerations, and that this could immediate the Federal Reserve to go for a pause within the tempo at which it was climbing rates of interest. Quite the opposite, the Fed Chairman confirmed robust resolve to convey down inflation throughout his August speech. He has aggressively hiked charges since, even at the price of an financial slowdown.

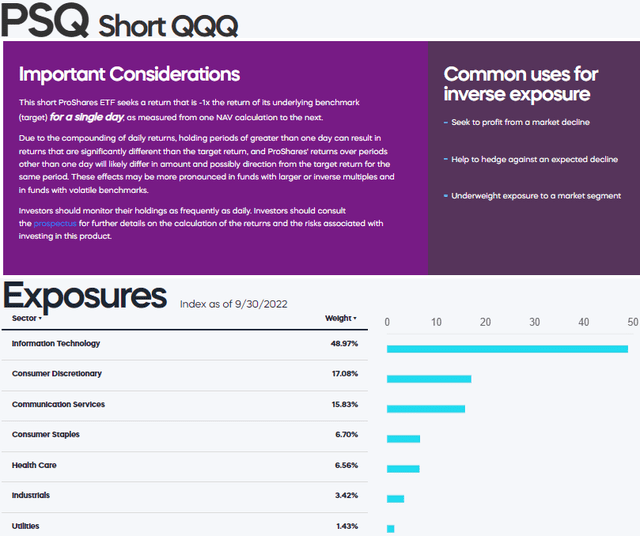

Now, removed from promoting my place in EDV, or averaging down, I added some ProShares Brief QQQ ETF (NYSEARCA:PSQ) shares to my portfolio. It is a hedge in an effort to navigate a extremely unsure financial cycle the place, on the one hand, financial circumstances are getting tighter, whereas, on the opposite, there’s a increased chance of a recession looming forward. On the similar time, one has to keep in mind that even treasuries aren’t proof against a liquidity crunch.

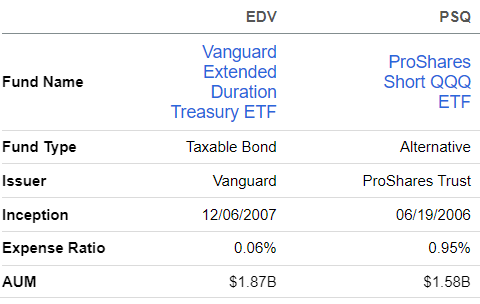

Thus, my goal with this thesis is to supply insights right into a hedging technique making use of a mixture of EDV and PSQ shares. The principle particulars of those two exchange-traded funds (“ETFs”) are pictured under.

EDV and PSQ Key Metrics (www.seekingalpha.com)

I begin by depicting the present financial setting.

An Unprecedented Financial Surroundings

The Fed raised its key charges by 75 foundation factors for the fourth time in a row in November, lifted the benchmark federal funds fee to three.75%-4%, and hinted at the opportunity of smaller hikes. Placing issues into perspective, this was its highest stage since early 2008, which brings again unhealthy reminiscences of the Nice Monetary Disaster.

Nonetheless, this time round, issues are completely different, with the economic system persevering with to be robust, as indicated by job numbers. Thus, in a method, the Fed actually had its palms pressured to hike charges, and in addition, at present, in distinction to 2008, banks are well-capitalized with minimal default threat. Moreover, the JOLTS (Job Openings and Labor Turnover Abstract) for September confirmed persistent and even stunning power within the job market, because of the post-Covid pickup within the companies economic system along with resiliency within the healthcare, transportation, warehousing, and utility sectors.

Moreover, U.S customers proceed to spend, now out of financial savings made throughout the Covid lockdowns. Additionally, commodity costs proceed to stay excessive, as Russian fuel provides are absent from the European vitality equation. Alternatively, container transport prices have dropped by 73% since their January peak, resulting in the worth of sure imported items falling, whereas there have been some extremely publicized job cuts by firms like Meta Platforms (META), Twitter, and even Amazon (AMZN). These are two components that may probably trigger a dovish response from the Fed.

Nonetheless, to be sensible, tech encapsulates solely a minor proportion of total jobs, most of that are to be discovered within the companies sector, particularly in leisure and hospitality. It’s this sector that created the majority of the 247K jobs in October whereas wages grew by 11.2%.

Due to this fact, the indications are blended, however they primarily point out that inflation will proceed to rise, more likely to be punctuated by episodic declines and, almost definitely ensuing within the pursuit of a hawkish tone by the Federal Reserve. On this respect, the November 2 assembly implies that rates of interest are more likely to see an uptrend, albeit at a slower tempo. Moreover, with the Fed squeezing liquidity out of a financial system that has been used to low cost liquidity circumstances for the final decade, financial slowdown dangers at the moment are actual and there can also be unexpected occasions now we have by no means come throughout.

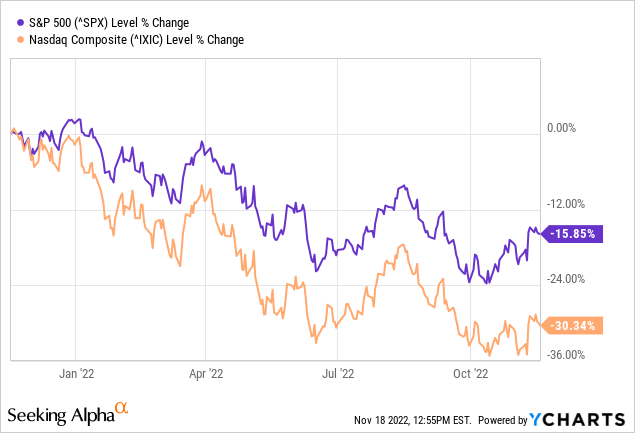

Alongside the identical strains, rising rates of interest are already adversely impacting high-growth shares, a lot of which are typically tech names. That is illustrated under with the tech-heavy Nasdaq composite extra adversely impacted than the broader market S&P 500 which additionally contains extra “worth” names. Conversely, tech’s increased valuations are additionally ensuing within the rotation from progress to worth which has been gaining steam since April.

Evaluating the performances of the NASDAQ and S&P 500 (www.ycharts.com)

That is exactly why I selected PSQ, which gives features that correspond to the inverse (-1x) of the each day efficiency of the Nasdaq-100 Index.

Cause For Selecting PSQ And Illustrating The Hedging

Historically folks used gold for hedging functions however the robust greenback has been detrimental to valuable metals, an asset class which opposite to what many had been anticipating has not carried out effectively in present market circumstances. Transferring to bonds, many who historically adhered to a 60:40 fairness to fastened earnings portfolio safety technique have been disillusioned because the starting of 2021. The reason being once more increased rates of interest make company debt much less engaging as an asset class, however, after the Ukrainian battle and recession fears, U.S. treasuries are seen as the last word hedge since they’re assured by the U.S authorities.

Nonetheless, additionally they haven’t been sparred by volatility, particularly in March 2020 when many sectors of the economic system together with bond markets suffered from challenges pertaining to liquidity. Now, that scary episode when the Covid virus prevailed and all people was operating for money appears so far-off, however, should you take a while to consider it, isn’t the Fed not doing the identical factor, by permitting U.S. treasuries and mortgage securities collected on its steadiness sheet to mature with out changing them? This course of known as Quantitative Tightening and is strictly the other of Quantitative Easing which was in power since 2008.

In these circumstances, until you could have sought the refuge of money, it is very important assume out of the field, with a technique that lets you proceed benefiting from EDV’s low charges of simply 0.06%, dividend yield of three.24% (as measured by the trailing 12 months) whereas getting some safety in opposition to volatility.

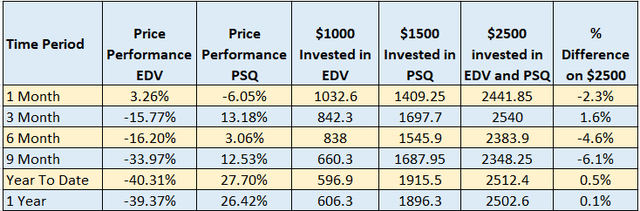

For this goal, PSQ has labored at mitigating the volatility endured by EDV, not less than on a historic foundation as proven within the desk under. For illustration functions, this portfolio consists of a $2,500 funding break up between EDV at $1,000 and PSQ at $1,500, for durations from one month to 1 12 months.

Desk Constructed by the writer utilizing knowledge from (www.seekingalpha.com)

These outcomes present {that a} mixed funding of $2.5K in EDV and PSQ has resulted in features various from features of 1.6% to losses of 4.6% over the completely different time durations. Nonetheless, should you add the quarterly dividends of above 3% paid by EDV to those numbers, the losses are lowered. Furthermore, traders can select completely different proportions of the EDV/PSQ combine to suit their very own particular person wants, however as seen by the worth efficiency columns above, these two ETFs are inversely correlated as I additional clarify under utilizing charts.

One other essential commentary is that the losses (-2.3%) have both decreased or there have been features (+1.6%) within the final one-month and three-month time durations, in comparison with increased losses of -4.6% for the final six months. That is no coincidence as tech has been struggling probably the most, as an increasing number of traders have been rotating from progress to the worth technique.

Some Precautions When Utilizing PSQ

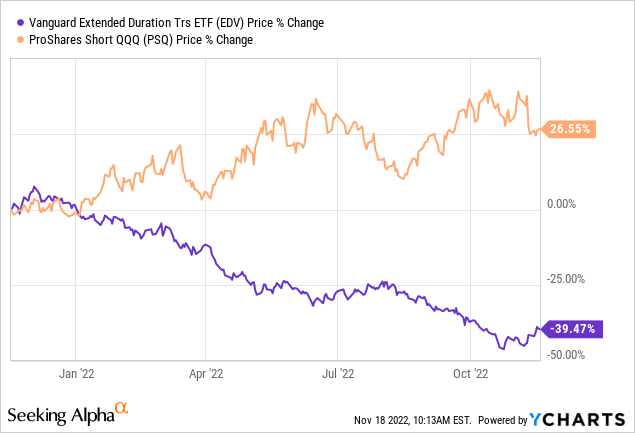

Trying ahead, with the Fed more likely to proceed rising charges even at a extra moderated tempo, PSQ is more likely to ship extra features as illustrated by its historic efficiency within the orange chart under. Right here, this ETF’s inverse correlation with EDV is telling and kinds the premise for hedging the place when one asset class goes down, the opposite goes up.

Divergence paths of EDV and PSQ (www.ycharts.com)

Nonetheless, do word that with leveraged shorting ETFs like PSQ comes dangers associated to the compounding impact whereby whereas it thrives with downsides within the Nasdaq, it’s itself adversely impacted by volatility, like when there’s a excessive diploma of market fluctuations for the time interval it’s traded.

I intentionally used the phrase “traded” right here as you don’t make investments on this energetic Invesco ETF which prices 0.95% as charges in the identical method as a passive fund like EDV. The reason being compounding, which successfully trims down your features and that is the explanation why it shouldn’t be traded over lengthy durations.

PSQ Particulars (www.proshares.com)

Therefore, my time horizon is the top of 2022, or, in different phrases, I’ll maintain on to PSQ until the top of this 12 months earlier than exiting. It additionally pays dividend yields of 1%, however, the cost historical past reveals that distributions haven’t been constant.

EDV Makes Sense, However Hedged

Coming again to the target, this thesis has been to elaborate on a hedging mechanism for long-term authorities bonds in mild of the Federal Reserve tightening liquidity and may proceed doing so in 2023 as inflationary pressures persist. The choice chosen by the U.S central financial institution to boost rates of interest signifies extra ache for longer-duration treasuries, which carry extra dangers than shorter-duration ones due to the time issue. For this matter, EDV held 80 bonds as of October 30 with the typical efficient maturity being 24.7 years as proven under.

EDV Particulars (investor.vanguard.com)

By comparability, the typical efficient maturity is 1.9 years for the Vanguard Brief-Time period Treasury ETF (VGSH), nevertheless it yields just one.16% or a few third of EDV. Thus, for the extra dangers premium of proudly owning EDV, the bond investor obtains a better dividend yield, which is why I’m serious about persevering with to personal long-duration bonds.

On the similar time, benefiting from the truth that tech has misplaced its shine, each due to its increased valuations and in addition as a result of it’s not proof against financial cyclicality dangers, I shield search safety via PSQ.

Conclusion

Final however not least, earlier than embarking on such a hedging technique, I backed the noticed inverse correlation between EDV and PSQ with a value efficiency desk utilizing historic knowledge. This stated, nobody is aware of precisely what the longer term might appear to be, particularly within the present financial cycle however, as traders, it’s our responsibility to attempt to determine the utmost variety of dangers in an effort to shield our hard-earned money in opposition to volatility.