As we famous in our DXY overview at present, at present’s buying and selling day started with the onset of the greenback. It’s rising at present towards all main currencies, together with uncooked supplies, such because the New Zealand, Australian, Canadian {dollars}.

Futures on the DXY greenback index additionally opened at present’s buying and selling day with a small hole up after an unsure development within the earlier 3 buying and selling days. On the time of this text’s publication, DXY futures had been buying and selling at 107.74, up 79 pips from at present’s open and 88 pips from final Friday’s shut.

At this time’s financial calendar just isn’t wealthy within the publication of essential macro statistics for the US, and this complete buying and selling week within the US will likely be shorter than typical: on Thursday, November 24, banks and inventory exchanges on this nation will likely be closed on the event of Thanksgiving Day. This present day marks the beginning of the vacation season. It consists of Christmas and continues till the New 12 months. November 25 is a shortened working day in america as a part of the continuation of Thanksgiving Day celebrations.

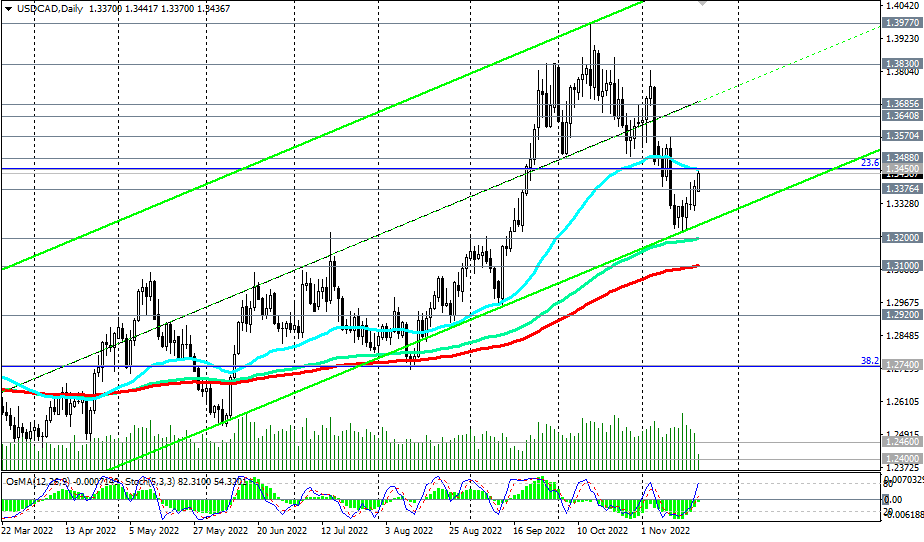

From a technical viewpoint, for calmer purchases, it’s higher to attend for the USD/CAD to rise to the zone above the resistance ranges of 1.3450, 1.3488.

Gross sales will be resumed after the breakdown of the essential short-term assist degree 1.3376 with targets on the assist ranges 1.3200, 1.3100.

*) For upcoming occasions of this week, see Key financial occasions of the week 11/21/2022 – 11/27/2022

Help ranges: 1.3376, 1.3300, 1.3200, 1.3100

Resistance ranges: 1.3450, 1.3488, 1.3500, 1.3570, 1.3600, 1.3640, 1.3685