Alex Potemkin

Clipper Realty Inc. (NYSE:CLPR) is a pure play on New York Metropolis actual property by means of a portfolio of 66 properties throughout Manhattan and Brooklyn. Traditionally excessive rents have supported firming financials, though the inventory has been beneath strain amid the influence of upper rates of interest and issues of a broader financial slowdown. Certainly, Clipper simply reported its newest quarterly outcome, highlighted by a document working earnings even because the shares are down greater than 20% 12 months thus far.

That being mentioned, we view CLPR as well-positioned to rebound with an outlook for constructive progress as its latest multi-family improvement begins leasing. The attraction of the corporate is its profile as a top quality micro-cap REIT with publicity to some iconic and prime developments that proceed to profit from underlying progress tailwinds. We like CLPR’s 5% dividend yield, which is compelling on this section of primarily-residential actual property

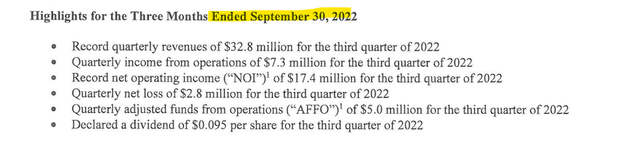

CLPR Q3 Earnings Recap

Clipper generated $32.8 million in Q3 income, up 7.2% 12 months over 12 months, and barely forward of market estimates. Whereas an EPS at -$0.09 represented a internet lack of $2.8 million within the quarter, the determine narrowed from the online lack of $3.4 million within the interval final 12 months.

Extra importantly, the online working earnings of $17.4 million climbed by 9.4% 12 months over 12 months whereas the adjusted funds from operations (AFFO) at $5.0 million, or $0.12 per share, was up in comparison with $4.1 million and $0.10 in Q3 2021.

Firm IR

In the course of the earnings name, administration explains that the corporate continues to see sturdy demand for NYC and Brooklyn rental properties as occupancy ranges, rents, new leases, and renewals are all above pre-pandemic ranges. The highlights right here embrace an 11.7% enhance in residential income, which represents roughly 75% of the enterprise. The motive force right here included greater common rental charges and an uptick in occupancy that reached 99.1% throughout all properties. The gathering fee at 95.5% can be stable.

Reconciling the online loss, the corporate ended the quarter with roughly $1.2 billion in debt, leading to $10.1 million as a quarterly curiosity expense. Whereas the debt degree has climbed over the past a number of years to finance its portfolio enlargement, the development of its latest property at 1010 Pacific Avenue is anticipated to be accomplished by year-end with leasing beginning in Q1 2023.

On this level, we imagine the near-term liquidity is steady contemplating an outlook for stronger money flows going ahead with ample protection of the present dividend. As talked about, CLPR yields 5.0% by means of a quarterly distribution of $0.095 per share, representing a payout of $17 million. That is a minimum of coated by the annualized AFFO run fee now above $20 million.

Firm IR

Energy In NYC Actual State

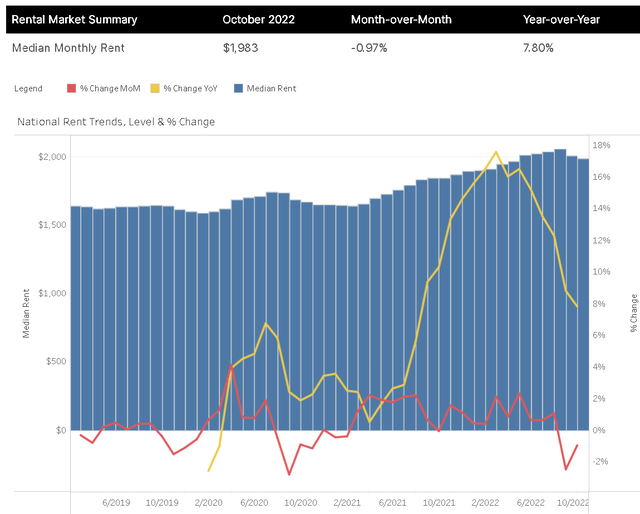

It has been a tough 12 months for actual property and REIT buyers in a shifting market surroundings in comparison with the momentum in 2021. Stubbornly excessive inflation coupled with climbing rates of interest has pressured client spending budgets, translating immediately right into a slowdown in each actual property gross sales exercise and hire will increase.

Focusing simply on the residential and multi-family aspect, a report from “hire.com”, reveals that the year-over-year nationwide common hire within the U.S. was up 7.8% in March, down from a peak nearer to 17.6% again in Q1. The priority is the opportunity of additional declines going ahead.

Because it pertains to Clipper Realty, the sturdy level is that its core market in New York Metropolis has been extra resilient in comparison with different elements of the nation. The identical report notes that the New York Metropolis metro space has been one of many hotter markets, with rents nonetheless up 10% 12 months over 12 months. A part of this considers the sturdy labor market developments and structurally low stock ranges within the metropolis.

hire.com

The understanding is that as leases get renewed and the brand new properties rented, Clipper will seize a runway of progress over time, translating to an upside for its key monetary metrics. This might be along with the topline increase from 1010 Pacific Avenue and the 953 Dean Avenue down the road.

The following a part of the dialogue considers what may very well be some enhancing macro situations going ahead. Favorably, inflation seems to be slowing and up to date messaging from the Fed has opened the door to much less aggressive fee hikes into 2023. By this measure, a “soft-landing” state of affairs for the economic system averting fears of a deeper recession would permit for a rebound in actual property with a return of extra constructive momentum.

CLPR Inventory Value Forecast

Placing all of it collectively, we imagine CLPR’s 5% dividend yield is sustainable and sure has room to slim with an upside within the inventory worth into 2023. Stabilizing rates of interest can assist improved sentiment in direction of REITs with bulls again in management.

It is encouraging to see that CLPR has rallied from its 52-week low of round $6.50, gaining some energy following the Q3 earnings report. The transfer above $7.50 is necessary because it suggests a break-out above the technical degree that had been in play since 2021.

To the upside, we see room for shares to reclaim the $9.00 worth degree which was final reached in late August. This worth goal implies a dividend yield nearer to 4.2% is nearer to a good worth for the inventory. The property portfolio high quality together with “trophy belongings” in New York Metropolis warrants a premium as a part of the bullish case for the inventory.

With a market cap beneath $400 million, CLPR is a novel REIT that seems undervalued in our opinion. On the similar time, its geographical focus and excessive debt place signify dangers that may preserve shares risky. Macro indicators like employment ranges and the route of rates of interest will probably be monitoring factors. Any setback within the timetable to start leasing the Pacific Avenue property would additionally open the door for a leg decrease within the inventory.

Searching for Alpha