wichayada suwanachun/iStock through Getty Pictures

I like to recommend EverCommerce (NASDAQ:EVCM) as a purchase. As companies globally digitize their operations and providers, the demand for software program options grows by the day. EVCM is an organization that gives software program options to small and medium companies that provide providers to folks. With such a selected area of interest of purchasers and a worldwide digital migration, EVCM has an enormous potential for income progress.

Enterprise

EVCM is an organization that gives software program options to companies providing dwelling providers, healthcare providers, health providers, and wellness providers. Their software program helps companies with operations administration, buyer engagement, cost processing, and advertising and marketing options in order that they’ll run extra effectively and earn more money.

EVCM’s particular options serve the specialised calls for of the companies they serve. The specialised options enhance their market penetration as a result of comfort they provide companies.

Increasingly more SMBs adopting fashionable software program options

I consider it’s inevitable for extra SMBs to undertake fashionable software program options because the world strikes in the direction of digitization for extra efficiencies. That is essential for EVCM, because the U.S. SMB whole addressable market (TAM) may be very engaging, with solely 9% of SMBs totally digitizing their operations. Among the key elements I consider are pushing SMBs towards digitization are:

Shoppers’ preferences: Prospects globally are craving for digital experiences. These digital options additionally assist companies optimize their progress, be extra environment friendly, and enhance buyer engagement. The win-win state of affairs supplies a great motive to undertake digital options. Ease of entry: A lot of companies and providers at the moment are obtainable on-line. Which means that they are often accessed remotely. As a result of increasingly more folks need providers they’ll entry from wherever, digitization is a should for any enterprise to develop and succeed. Market penetration: Digital options enable companies to succeed in their prospects and potential prospects globally in a straightforward and efficient means. Digital advertising and marketing, for instance, permits for specialised concentrating on. This permits companies a broader market attain and offers them a lift in income. Digital adoption development: SMEs internationally have seen extra digital adoption previously three years. Extra companies are transferring towards digitizing their operations as a result of it makes their enterprise run higher and makes funds and monitoring simpler and safer.

Value-effective vertically tailor-made options to deal with core markets

Not like serving giant firms, addressing the SMB market requires very cost-effective options, as there are much more SMBs than giant firms. To this finish, I consider EVCM has carried out an excellent job establishing the required options. They provide quite a few tailor-made options that comply with an analogous course of to supply worth to finish customers, which embody the important thing steps of any enterprise like advertising and marketing, buyer engagement and retention, and billing and cost.

In my view, it’s paramount to supply options on every of those steps because it streamlines purchasers’ operations with no gaps within the worth chain. That is additionally the place, I consider, EVCM differs from friends who supply basic digital options to service companies. EVCM’s options are extremely particular and tailor-made in the direction of the wants of a specific enterprise. This method permits for the continual enchancment of their options or the introduction of a brand new answer based mostly on buyer expertise and suggestions.

To place issues merely, SME companies, in contrast to their giant counterparts, are value delicate. As such, they search reasonably priced and environment friendly options.

S-1

Cell native built-in SaaS-based options

There may be one other aggressive benefit that I consider deserves highlighting. EVCM’s options are full vary in that they cowl all operational features, from inside features to end-user features, which supply a clean consumer expertise and improved operational effectivity.

Why is that this essential? Providers from different gamers providing related options lack connection, which lowers operational effectivity. With a full vary of options, SMBs can scale back the price of advanced on-premise infrastructure by utilizing EVCM’s digital options. This fashion, they’ll higher make the most of their restricted workforce in different operations, thereby simplifying and optimizing their operations, which in the end improves SMB’s notion of the EVCM worth proposition.

As well as, EVCM’s software program options are additionally accessible remotely to customers and enterprise homeowners. On condition that we’re transferring extra towards a distant work setting, I discover this extraordinarily efficient, as technicians and repair professionals can use EVCM’s cellular functions within the subject even when they do not have a mobile or wi-fi community.

Alternatives to broaden into new verticals and improve monetization

Based mostly on my analysis, this can be very essential to have an applicable go-to-market technique when concentrating on the SMB market. In my view, resulting from EVCM’s place within the SMB service ecosystem, sturdy buyer relationships, and in-depth understanding of its clientele, it’s well-positioned to leverage buyer lifecycle insights to find complementary options that enhance their purchasers’ backside strains. By always evaluating alternatives to create or purchase options, EVCM can broaden its market share, enhance buyer loyalty, and gasoline its fast enlargement.

There may be a variety of room for enlargement because of EVCM’s giant buyer base. As EVCM turns into extra embedded in its prospects’ every day enterprise operations, will probably be in a greater place to reap the benefits of further cross-selling and up-selling alternatives. The rationale EVCM is ready to do it’s because their vertically built-in SaaS options cowl the complete spectrum of buyer engagement. I believe EVCM will have the ability to improve pockets share and enhance retention if it retains growing, buying, and reworking its options.

2022 Q3 earnings

The best way I see it, Q3 earnings have been OK. It was, after all, not the end result I hoped for. EVCM’s Q3 income was 1% decrease than anticipated, and its EBITDA margin was 19%, down from 20%. By way of This autumn steering, administration anticipates $157-$159 million in income and $32-$33 million in EBITDA.

Administration famous growing macroeconomic headwinds, significantly in its advertising and marketing providers options section, in addition to a $0.2 million FX headwind in 3Q and $0.5 million in 4QE, which is regarding however not surprising. The corporate has not offered formal income steering for 2023, however administration has said that if the present macrodynamics proceed, EVCM can anticipate income progress according to what it’s at present experiencing (which isn’t nice as a result of it’s 3% decrease than what the Road anticipated beforehand).

Nevertheless, not all information is unhealthy. One key bullish indicator is that the EVCM funds enterprise, in addition to the underlying software program programs of motion, are thriving, with cost volumes growing by 22%. Moreover, there was no change in churn or NRR, and there was a 30% improve in prospects utilizing a number of options. These are sturdy qualitative elements that point out steady momentum. As well as, I consider the administration staff is clearly conscious of the significance of money stream in that they intend to reallocate spending strategically to its most efficient enterprise areas, whereas additionally instituting value controls.

Lastly, probably the greatest items of stories from the earnings name, for my part, is that EVCM elevated its willingness to spend $100 million on a inventory repurchase program, citing it as a wonderful approach to improve shareholder worth. As well as, the corporate entered right into a $200 million notional rate of interest swap settlement to transform a portion of the time period mortgage from variable to fastened fee.

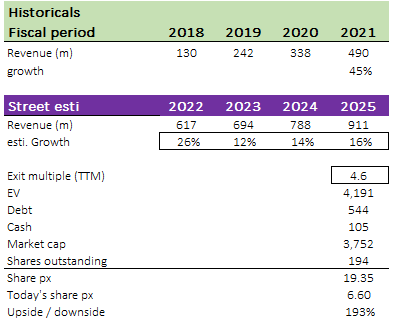

Valuation and mannequin

I consider there’s a variety of upsides over the subsequent three years based mostly on the Road estimates of income. I anticipate EVCM to proceed rising at excessive charges because it continues to seize extra share within the SMB area; nonetheless, progress ought to sluggish ultimately because the Road expects given fewer low-hanging fruits to seize. That mentioned, the TAM is large; therefore, the expansion runway is lengthy.

My key enter is the exit a number of that EVCM ought to commerce at in FY25. EVCM at present trades at 4.6x TTM income, 3x beneath its common. EVCM would possibly commerce again to 7x, however that’s one thing that no person will know. I’ve assumed it could proceed to commerce at 4.6, and that is justified by decrease progress in FY25.

Writer’s personal calculations

Dangers

Increasing into adjoining markets won’t materialize

One in every of my bull thesis factors is that EVCM can proceed to roll out new modules to enter extra markets, which is able to improve its TAM. Nevertheless, EVCM won’t have the monetary muscle or technological sources to design and develop safe software program options for newly specified industries.

Intense competitors

The dynamic nature of the software program options business makes it troublesome to deal with altering buyer wants or the introduction of recent services. Additionally, the low startup prices for firms that need to supply software program options will usher in a variety of rivals, each massive and small. With each new and previous rivals who’ve completely different monetary and technological sources, EVCM may be slower to answer modifications out there or with prospects than its rivals.

Abstract

To conclude, I consider EVCM is undervalued. EVCM has already positioned itself as a market chief in providing SME software program options. These options are self-improving, as suggestions is used to enhance them or provide you with new ones. With a broad buyer base, EVCM has the chance to optimize income progress by cross-selling or upselling. It’s for these causes that I consider that EVCM might be a worthwhile funding.