DestinoIkigai/iStock through Getty Pictures

Introduction

At our Conservative Revenue Portfolio service, we’re continuously taking a look at all sectors and asset lessons to seek out relative mispricing alternatives to extend our member’s portfolio yields and/or to cut back danger. Discovering mispricings not solely supplies alternatives to swap one in all your securities for a greater one however can be helpful in figuring out undervalued shares/bonds for outright buy and not using a have to swap.

There are not any objectively low-cost or costly securities. Securities are solely low-cost or costly relative to different securities. Thus, as a way to determine the perfect values out there, you really want to cowl all sectors and all asset lessons (most popular shares, child bonds and conventional bonds). In case you are solely overlaying a sure sector or a sure asset class, or a subset of securities, then it is rather tough to evaluate whether or not a safety is undervalued or not.

For instance, in the event you solely cowl child bonds and never conventional bonds, you might discover that you’re not in the perfect bonds. If you happen to solely take a look at most popular shares and never child bonds, you might also discover that you’re not in the perfect securities. And in the event you solely cowl financial institution most popular shares or REIT most popular shares, additionally, you will possible discover that you’re not in the perfect investments.

We perceive that it is rather time consuming for people, and even different inventory companies, to cowl such a variety of securities which is among the causes that our Conservative Revenue Portfolio exists. On this article we current alternatives for swaps or for merely taking lengthy positions in numerous sectors and asset lessons.

Mortgage REITs

Mortgage REITs, or mREITs, personal mortgages. They will personal company (authorities assured) residential mortgages, non-agency residential mortgages in addition to industrial mortgages. And a few can maintain a mixture of company and non-agency mortgages.

mREITs generate income by borrowing at low rates of interest and utilizing that cash to purchase greater yielding mortgages, hopefully making a revenue on the rate of interest unfold. Whereas company mREITs like Cherry Hill (NYSE:CHMI) and Armour Residential (NYSE:ARR) maintain solely company mortgages, and thus haven’t any credit score danger, different mREITs maintain mortgages that may default in order that they do carry credit score danger. Each sorts of mREITs carry rate of interest danger and pre-payment danger.

Cherry Hill Mortgage

Firm web site

Cherry Hill Mortgage (CHMI) owns residential mortgages which can be backed by the U.S. authorities, in order that they carry no credit score danger. Moreover they personal some mortgage servicing proper (MSRs) by which they earn a charge for servicing these mortgages. MSRs needs to be very secure now as a result of the large danger with MSRs is that the mortgages that they service get refinanced or paid off when the house is bought.

At present, we’re in a superb setting for MSRs that had been bought when rates of interest had been a lot decrease. No one is refinancing their loans now with charges at the moment a lot greater than their present mortgages. Moreover, folks can be very reluctant to maneuver and lose their low curiosity mortgage and must tackle a a lot greater price mortgage as a way to buy a unique dwelling.

So MSRs ought to present a really secure stream of revenue to CHMI, whereas the mortgages owned by mREITs are topic to the dangers of an inverted yield curve, greater long run rates of interest hammering ebook worth, a better price of quick time period borrowing, failed hedging methods and a doable continuation of a widening yield unfold between treasuries and mortgage backed securities (MBS).

Armour Residential Mortgage

Firm Web site

Armour Residential Mortgage (ARR) was as soon as a hybrid mREIT proudly owning each company and non-agency mortgages. Nevertheless, they had been by and huge an company mREIT since over 90% of their mortgages had been company mortgages. Throughout the COVID inventory market meltdown, they took a beating and needed to promote quite a lot of their mortgages at fireplace sale costs. Shortly after the COVID market backside, they determined to promote their non-agency mortgages and develop into a strictly company mREIT.

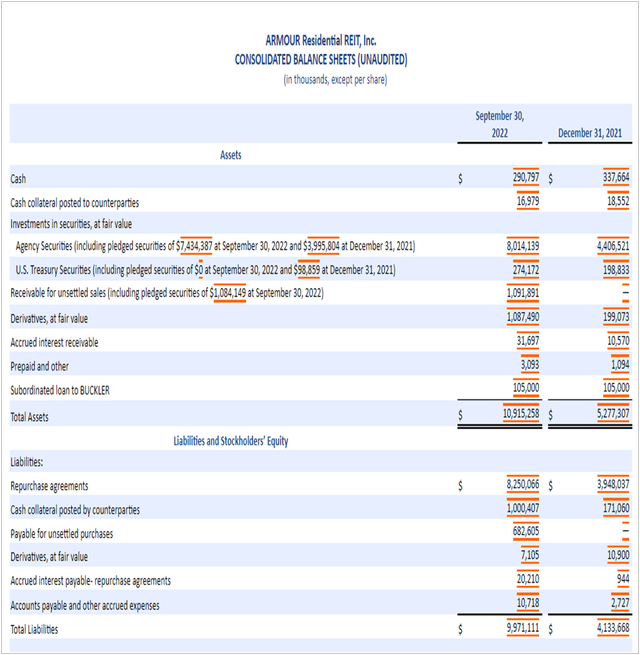

Whereas ARR operated at pretty low leverage for a while, ARR has quickly been rising their leverage this 12 months. It looks like traders haven’t seen this and are nonetheless keen to buy ARR Most well-liked “C” (NYSE:ARR.PC) at a a lot decrease yield than Cherry Hill Most well-liked “A” even supposing ARR’s leverage is now greater than CHMI’s. Right here is the latest ARR stability sheet which additionally reveals a comparability of the present quarter’s leverage to the leverage in the beginning of this 12 months.

SEC

As you may see, in the beginning of the 12 months, ARR’s complete liabilities had been solely 78.5% of complete property. Nevertheless, as of September thirtieth, complete liabilities at the moment are 91.3% of complete property.

Purchase Cherry Hill Most well-liked “A”, Promote Armour Residential Most well-liked “C”

What makes these 2 most popular shares simple to check is that they each function in the identical enterprise, and these are the one 2 company mREIT most popular shares which have a set dividend. Most mREIT preferreds which have IPO’d in latest instances have been fixed-to-floating price preferreds. So in the event you like proudly owning an company mREIT most popular inventory the place you may lock in a excessive fixed-income, CHMI Most well-liked “A” is the one to personal. Right here is why:

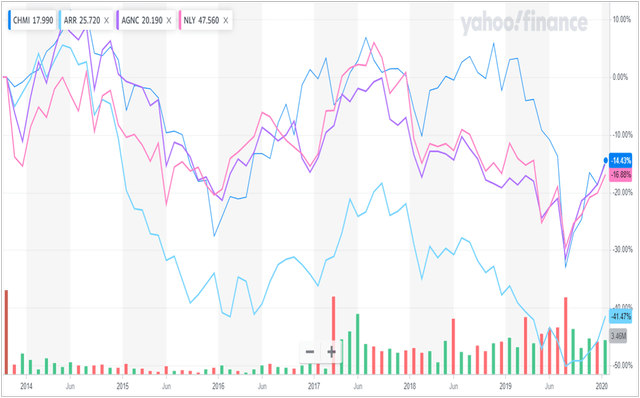

The primary and most evident purpose to purchase Cherry Hilll Most well-liked “A” (CHMI.PA) and promote Armour Residential Most well-liked “C” (ARR.PC) is the very giant distinction in yield. Whereas ARR.PC yields solely 8.67%, CHMI.PA yield’s 9.8%. CHMI operates at decrease leverage. Whereas CHMI’s complete liabilities, together with most popular inventory, are 8.8 instances its frequent stockholder’s fairness, ARR’s complete liabilities plus most popular inventory are 12.1 instances its frequent stockholder’s fairness. That’s fairly excessive leverage for ARR. Cherry Hill’s frequent inventory has nicely outperformed ARR’s frequent inventory because the charts under present.

Yahoo Finance

Here’s a worth chart evaluating CHMI to ARR earlier than the COVID meltdown when ARR was principally an company mREIT however not fully. The interval is from the inception of CHMI in 2013 to the start of 2020 earlier than the COVID market meltdown. As you may see, CHMI carried out considerably higher than ARR as ARR was down 41% throughout this era. I threw within the charts of the large company mREITs, NLY and AGNC, to point out that CHMI carried out equally nicely to their extra well-known friends.

For the reason that March 18th, 2020 COVID backside out there, CHMI has additionally outperformed ARR.

I consider company mREIT preferreds are very secure. They haven’t any credit score danger and since they challenge frequent inventory to lift money when leverage begins to rise, this mitigates stability sheet danger. Thus, I consider that CHMI.PA is an excellent worth with a 9.8% fastened yield. Whereas many personal the fixed-to-floaters of company mREITs AGNC and NLY, these at the moment contain a wager on LIBOR (or its alternative) remaining excessive. This isn’t a wager that I’d personally make. I consider that locking in a 9.8% yield will look actually good when the Fed slows the financial system and charges begin coming down. And given its giant low cost from par, there’s quite a lot of room for CHMI.PA to maneuver greater in worth.

And I consider that ARR.PC needs to be bought. It’s merely overpriced relative to its closest peer, and you’ve got a superb different in CHMI.PA.

Different Swapportunities

Promote OPINL and Purchase the OPI 2025 Bond

OPINL is a bond from Workplace Properties, an workplace REIT. It doesn’t mature till 2050 and carries a 9.3% yield to maturity (YTM). But you should purchase their a lot shorter time period conventional bond, a bond that matures on February 1st, 2025, at a present YTM of 12.28%. The CUSIP of this bond is 81618TAC4.

As a result of OPI is managed by RMR, many traders are turned off to the frequent inventory and to the corporate basically. Whereas I don’t have good emotions about OPI itself, and I wouldn’t wish to wager on a bond of theirs that doesn’t mature till 2050, once I see an enormous yield on a bond that matures in a bit of greater than 2 years, I develop into .

Whereas I solely personal a small place on this OPI bond, I believe it is rather unlikely that this firm goes bankrupt in such a brief time frame. RMR definitely needs this firm to outlive in order that they’ll proceed amassing administration charges, and I’d be shocked in the event that they didn’t challenge inventory to lift money if it turns into crucial. And workplace property leases are usually a few years in size which provides to the safety of those bonds.

Purchase PEB.PG and Promote Hersha Hospitality (HT) Most well-liked Shares

Each Hersha Hospitality (HT) and Pebblebrook (PEB) are lodge REITs. In my view, PEB.PG (PEB.PG) at the moment represents essentially the most undervalued lodge REIT most popular inventory relative to all others. However it appears to be like notably undervalued relative to the HT most popular shares as a result of PEB’s a lot better stability sheet. A swap from HT most popular shares to PEB not solely will get you a greater yield, however a greater stability sheet and a much bigger low cost from par offering extra long run worth upside.

HT has 3 most popular shares, HT.PC, HT.PD and HT.PE. The present stripped yield on these is round 8.4% they usually promote at a mean worth of $20.00. PEB.PG sells at $17.72 with a 9.12% present stripped yield. It’s the solely lodge REIT most popular inventory amongst many with a greater than 9% yield.

But when that isn’t sufficient to make you wish to swap into PEB.PG, the distinction in stability sheet leverage ought to persuade you. Whereas HT’s complete liabilities plus most popular inventory is 3.1 instances its frequent stockholder’s fairness, PEB’s is only one.55 instances. Moreover, in the course of the large 2020 market selloff, HT suspended its most popular inventory dividends whereas PEB has by no means accomplished so.

Promote RILYL Most well-liked Inventory and Purchase a RILY Child Bond (RILYM or RILYT)

This one is fairly easy. The B Riley (RILY) most popular inventory with the ticket RILYL appears to be like very overvalued and needs to be bought. RILY has a lot better securities to swap into then RILYL. Even their different most popular inventory is a a lot better worth, however the RILY child bonds current extraordinarily higher values than RILYL.

RILYL present sells for $24.22 for a 7.65% present yield. Even their different most popular inventory, RILYP, is a lot better with an 8.32% present yield and far more worth upside at a worth of $19.90.

However the perfect values are within the RILY child bonds which give extra safety, being greater within the capital stack, but in addition maturity dates which makes them a lot much less vulnerable to rate of interest adjustments and the safety that you’re going to get $25 again in the event you maintain to maturity. Except there’s a chapter, all RILY bonds will find yourself greater in worth sooner or later.

My 2 favorites now are:

RILYM has a superb YTM of 9.77% and a comparatively quick maturity date of two/28/2025. RILYO at the moment has a YTM of 8.07% YTM and matures 9 months earlier. Getting a complete 1.7% higher yield for merely going out 9 months additional in period appears to be like to be a relative discount. RILYM, with a ten.11% YTM which lets you lock on this excessive yield for an extended time frame if you want. It matures on 1/31/2028 and at the moment presents a better YTM than RILYZ which matures later in 2028 than RILYT.

Abstract

As I wrote within the introduction, at Conservative Revenue Portfolio we’re continuously looking out for undervalued most popular inventory, child bond and conventional bond alternatives in all sectors as a way to enhance member’s portfolio yields and to cut back danger. On the earth of investing, there are not any objectively low-cost or costly securities. There are solely comparatively low-cost or costly securities. On this article we introduced the next mispricing alternatives or “swapportunities” as I name them which minimize throughout all sectors and asset lessons:

Shopping for CHMI.PA and promoting ARR.PC, enhancing your yield from 8.67% to 9.8%, and lowering danger with a decrease leveraged firm with a greater monitor file. Shopping for a a lot shorter yielding bond from OPI with a 12.28% YTM, and promoting a really long run bond from OPI whose YTM is just 9.3%. Shopping for the Pebblebrook most popular inventory image PEB.PG, with a 9.12% present yield and a 1.55 instances leverage, and promoting Hersha Hospitality most popular shares, HT.PC, HT.PD, and HT.PE, with their decrease yields of round 8.4% and far more leverage of three.1 instances. Shopping for both RILYM or RILYT with YTMs of 9.77% and 10.12% respectively, and promoting RILY’s most popular inventory, RILYL, with solely a 7.65% present yield and little or no worth upside potential.