Michael Vi

San Diego, CA primarily based Sempra Vitality (NYSE:SRE) serves greater than 40 million prospects – primarily in California, Texas, and Mexico – by its electrical utility, electrical transmission strains (300,000 miles value), and LNG belongings. The firm’s current Q3 earnings report – launched on November third – was a beat and a elevate. Since then, Sempra has made two large bulletins that flush out the event of its proposed Port Arthur LNG challenge, which seems to be very near attaining Section 1 FID (closing funding choice), which I believe will probably come early in Q1 subsequent yr. Meantime, the corporate is seeing important curiosity in Section 2 of the Port Arthur challenge as properly. That being the case, LNG is prone to grow to be the first development thesis for SRE going ahead.

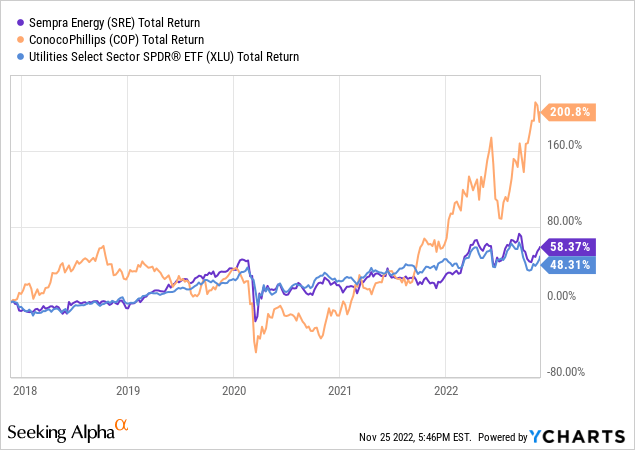

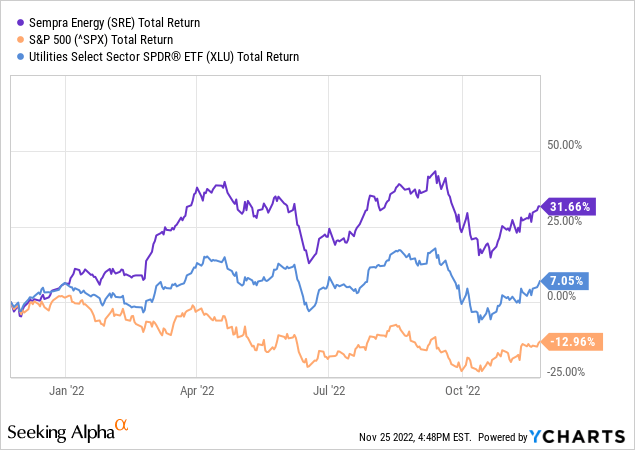

Sempra’s inventory has bucked the bear-market development and is up 30%+ over the previous yr, vastly outperforming each the S&P 500 and the SPDR Utility Sector ETF (XLU):

Funding Thesis

Sempra operates three main development platforms: California, Texas, and Sempra Infrastructure (which incorporates Mexico). Previous to current LNG developments (extra element beneath), Sempra’s regulated utility operations in California and Texas have been the first development catalysts. That’s as a result of Sempra is well-positioned for the clean-energy transition, and will usually be a beneficiary of the Biden administration’s capacity to get each the bi-partisan Infrastructure Act handed and the IRA (or what I discuss with because the “Clear Vitality Act”) handed by Congress. These acts have appropriated tens of billions of {dollars} for funding into EV-charging stations, upgraded utility grid and electrical energy infrastructure, and for clean-tech renewable photo voltaic and wind electrical energy technology capability.

Nevertheless, going ahead, LNG goes to be SRE’s main development catalyst for my part. However earlier than we delve into that, let’s take a short have a look at the corporate’s most up-to-date earnings report.

Earnings

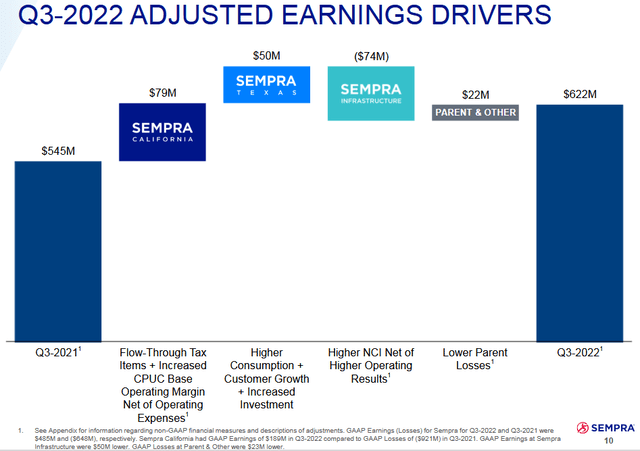

Sempra’s Q3 EPS report was issued the primary week of November, and it was a powerful efficiency. Highlights included:

Non-GAAP earnings of $1.97/share was a $0.19 beat. Q3 income of $3.62 billion (+20.3% yoy) beat by $260 million. Sempra elevated the midpoint of full-year FY22 adjusted earnings steering to $8.85/share from the earlier $8.40/share and above the consensus (at the moment) of $8.66/share.

Because the slide beneath exhibits (taken from the Q3 Presentation), the superb quarter was as a consequence of sturdy yoy efficiency at Sempra California (primarily SDG&E and SoCal Fuel) and Sempra Texas, offset by decrease outcomes from Sempra Infrastructure:

Sempra

LNG

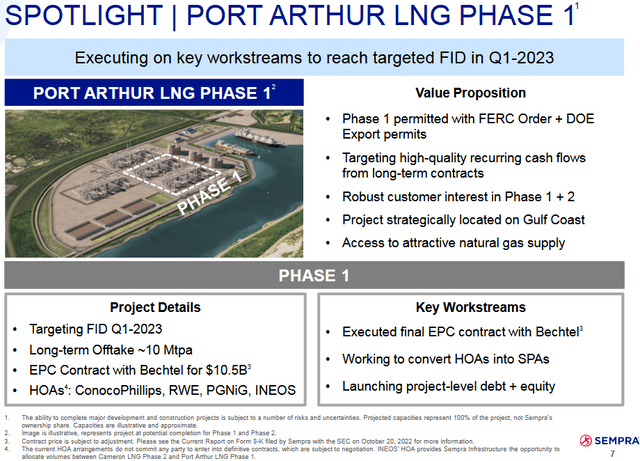

As talked about earlier, because the Q3 report, Sempra has introduced two large offers with respect to advancing its proposed Port Arthur, TX LNG challenge, which is proven beneath:

Sempra

As you may see from the slide, Section 1 of the Port Arthur challenge has already been permitted by FERC and the DOE and is anticipated to export 10 mega-tons of LNG per yr.

On November 15, Sempra Infrastructure (“SI”) introduced a heads of settlement (“HOA”) with Williams (WMB) for the offtake of LNG and growth of related pure fuel pipeline initiatives. Particularly, the HOA goals to finalize two 20-year long-term sale & buy agreements (“SPA”) for ~3 million tonnes every year (Mtpa) of LNG – in mixture – from the Port Arthur LNG challenge and Cameron LNG Section 2 – each of that are at the moment within the developmental stage.

The HOA additionally anticipates forming a strategic joint-venture between the 2 firms to personal, broaden, and function the present 2.35 Bcf/d Cameron Interstate Pipeline that’s anticipated to ship pure fuel to Cameron LNG Section 2 in addition to the proposed Port Arthur Pipeline Louisiana Connector that’s anticipated to ship pure fuel to the Port Arthur LNG facility.

Every week after that announcement, SI introduced an excellent greater offtake settlement with ConocoPhillips (COP) – a 20-year, 5 Mtpa of LNG from Port Arthur Section 1. I say a “greater”, as a result of the 2 firms additionally entered into an fairness deal whereby ConocoPhillips will purchase 30% of the fairness in Port Arthur LNG, Section 1, in addition to a pure fuel provide administration settlement whereby COP will handle the feedgas provide necessities for Section 1. That is pure contemplating COP has built-up one of many largest pure fuel advertising companies in the USA, in addition to the truth that it additionally clearly has important pure fuel manufacturing within the Eagle Ford and Permian Basins, each of which already provide pure fuel to the Texas Gulf Coast. That being the case, Port Arthur LNG is prone to be very aggressive on a cost-basis with any LNG facility on the planet.

Meantime, with respect to Cameron LNG, word that Justin Chicken, SI CEO, made these feedback on the Q3 convention name:

Let me begin at Cameron LNG, the place operations for Section 1 are going very properly, with manufacturing ranges exceeding expectations. As well as, each the proposed Section 2 enlargement challenge and associated debottlenecking actions of the present 3 trains are transferring alongside as deliberate.

and with respect to Port Arthur, Section 2:

So keep in mind, we have got 3,000 acres of frontage on the waterway there (i.e. Port Arthur), roughly 3 miles of entry to water. Additionally, what’s very enticing to prospects is the potential scale … You may recall that this has the chance to be as much as 8 trains. And if you happen to ever acquired that far, and clearly, that is properly into the long run, it will be the most important export challenge within the Western Hemisphere. So it actually has the flexibility to scale fairly properly. And to your level, Bechtel in all probability has the most effective repute for delivering initiatives on time and on finances … They’ve spent a major period of time on this website, and that is been an actual large linchpin and get us assured in our FID alternative for Section I, which we’ll speak about, hopefully, in Q1, but it surely is also an actual aggressive benefit for Section 2.

On account of the superb progress up to now with each of those new LNG prospects, LNG is prone to be the first development driver for Sempra Vitality going ahead. That stated, buyers ought to take into account that over the previous yr, SI has offered (non-controlling…) stakes of 20% to KKR, and 10% to Abu Dhabi.

Valuation

The chart beneath exhibits some present valuation metrics of Sempra in comparison with that of the broad utility sector as represented by the SPDR Utilities Sector ETF, XLU, the broad S&P 500, and its new associate ConocoPhillips:

P/E Ahead P/E Yield SRE 22.9x 18.6x 2.81% XLU 7.1x N/A 3.04% S&P 500 21.0x N/A 1.62% COP 9.1x 8.9x 3.6%* Click on to enlarge

* yield calculated off of each (base+variable) dividends.

As you may see, SRE is at the moment buying and selling with a P/E considerably above that of the XLU ETF and even above that of the S&P 500. That being the case, it seems to me that a lot of the excellent news relating to Sempra’s pivot to LNG has already been priced into the inventory this yr. At right this moment’s shut (Friday, Nov. twenty fifth) of $163 and alter, the inventory appears to be like absolutely valued to me.

Abstract & Conclusion

Sempra has pivoted towards a prioritization of LNG. The current large-scale agreements with Williams and ConocoPhillips improve the knowledge that SI will attain a closing funding choice for the proposed Port Arthur Section 1 in Q2 FY23, probably early within the quarter for my part. Whereas all that is excellent news for Sempra shareholders, it seems to already be well-priced into the inventory.

Alternatively, a inventory like ConocoPhillips seems to be one of the simplest ways to play Sempra’s rising LNG plans (and LNG usually). Whereas I notice that COP does not have the comparatively secure cash-flow profile of a utility firm like Sempra, it’s buying and selling at lower than half the earnings a number of and is delivering considerably extra earnings for its buyers. As well as, with COP’s advertising arm being accountable for a lot pure fuel feedstock for Sempra’s LNG vegetation, it is in all probability protected for buyers to suppose that COP will, usually and going ahead, very probably obtain greater realized pricing for its pure fuel manufacturing within the Eagle Ford and Permian that it in any other case would have. I’d additionally guess that the Port Arthur LNG challenge will very probably license COP’s proprietary LNG know-how (the Optimized Cascade Course of) – that I beforehand wrote about on this Looking for Alpha article – and which is being utilized in a lot of the LNG services at the moment in operation on the planet.

Meantime, word that COP already has a major international LNG footprint. See my Looking for Alpha article ConocoPhillips Shift Focus To LNG, which was written in July – months earlier than the Sempra agreements have been introduced.

I will finish with a 5-year whole returns chart of SRE, COP, and the XLU. And sure, earlier than you permit a remark, I do know that COP will not be a utility firm. The comparability is just in reference to my earlier touch upon maybe a greater solution to play SRE’s LNG prospects going ahead.