JHVEPhoto

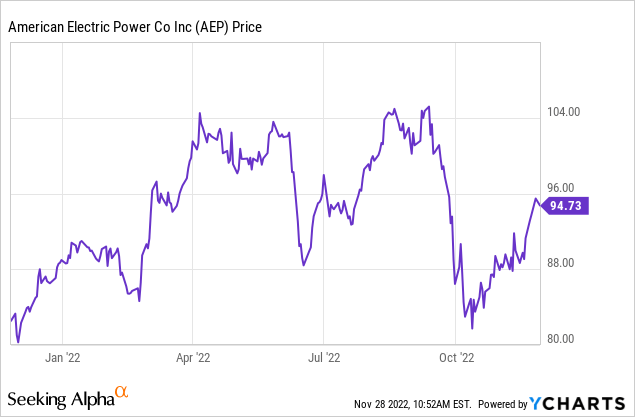

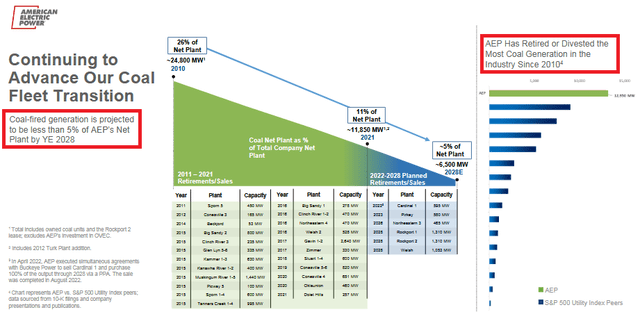

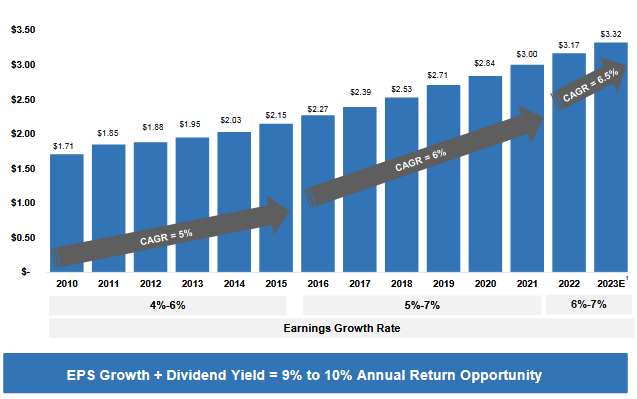

In 2010, 26% (24.8 GW) of American Electrical Energy’s (NASDAQ:AEP) internet plant energy era got here from coal. On account of plant retirements and gross sales, at year-end 2021 AEP’s coal-based energy era was all the way down to solely 11% (11.85 GW). Certainly, no different U.S. utility firm has diminished its coal era as drastically as AEP has and, by 2028, coal is predicted to account for lower than 5% of AEP’s combine (see beneath). Going ahead, the corporate is in an ideal place to profit from the Biden administration’s infrastructure and clean-tech laws and speed up the pivot towards renewables. Meantime, AEP continues to ship sturdy monetary outcomes that has enabled it to reward buyers with a latest 6.4% enhance within the quarterly dividend to $0.83/share. The equates to an annual dividend obligation of $3.32 and a yield of three.5%.

AEP

Funding Thesis

As you possibly can see from the graphic above, AEP has achieved a improbable job of closing down high-cost and dirty-coal crops over the previous decade. Certainly, even throughout the earlier administration’s reasonably idiotic “make coal nice once more” failed “technique,” AEP shut-down many coal crops throughout the 2016-2020 timeframe. Going ahead, that development will proceed with one other 5.3 GW of coal plant capability deliberate to be shut down over the following six years.

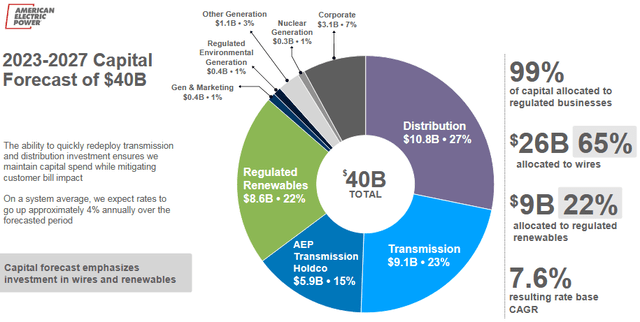

Meantime, AEP has pivoted to renewable power, with ~20% of its deliberate capital price range going towards clean-energy throughout the 2023-2027 timeframe. That equates to virtually the entire firm’s funding in increment energy era capability (slide taken from AEP’s latest 57th EEI Monetary Convention Presentation):

AEP

Given the Biden administration’s skill to move a bipartisan Infrastructure Plan, in addition to the IRA Act (which I desire to name the “Clear-Tech Act”), that is a wise technique. Going ahead, AEP’s capital allocation to Transmission Strains enlargement also needs to profit from these authorities tailwinds.

Earnings

In the meantime, regardless of the “pro-coal” naysayers, AEP has continued to ship sturdy monetary outcomes for income-oriented buyers. The Q3 earnings report was very sturdy. Highlights together with:

Non-GAAP EPS of $1.62 was a $0.06 beat. Income of $5.5 billion (+19.6% yoy) beat by $750 million. The midpoint of FY22 working revenue steerage was raised to $5.02/share vs consensus of $5.01, and its long-term development price is predicted to be within the 6-7% vary.

As talked about earlier, AEP’s sturdy monetary efficiency enabled it to boost the quarterly dividend 6.4% to $0.83/share, or $3.32 on an annual foundation (3.5% yield). The purpose right here is that CEO Nick Akins has proved the “pro-coal” naysayers incorrect: I say that as a result of AEP has really been capable of speed up dividend development whereas shutting down the costly coal energy era that had been holding the corporate again for thus lengthy:

AEP

AEP has a really shareholder pleasant administration staff and expects dividend development to stay “in-line with earnings development” and the corporate’s focused payout ratio of 60%-70%. And it is necessary to notice that buyers have a comparatively clear line-of-sight into AEP’s anticipated 6%-7% earnings development price given the corporate’s excessive publicity to regulated utility belongings.

Going Ahead

Going ahead, AEP goes to proceed on this observe: Shutting down costly coal-powered era, investing closely in renewable clean-energy initiatives, and investing closely in transmission line initiatives to get that clear power to market and put together for the period of upper electrical energy demand as a result of EV transition.

Exhibit No. 1 is, as reported final week by UtilityDive.com, AEP’s Oklahoma subsidiary introduced an software to speculate $2.5 billion to accumulate three deliberate wind and three photo voltaic crops totaling 995.5 MW from Invenergy. Importantly, the AEP subsidiary mentioned the deliberate initiatives in Kansas and Texas are anticipated to provide $1 billion in federal tax credit and are anticipated to go in-service by January 2026. Certainly, in September, Morgan Stanley included AEP in its listing of utility firms anticipated to profit from the transition to renewables. With AEP’s massive transmission line enterprise (40,000 miles – the biggest transmission system within the nation), it is in an excellent place to leverage its power in energy transmission infrastructure.

Valuation

The next desk compares the relative valuation metrics of AEP versus the SPDR Utility ETF (XLU), competitor NextEra Power (NEE), and the S&P500:

TTM P/E Ahead P/E Yield AEP 19.7x 19.0x 3.48% NEE 43.6x 29.6x 1.99% XLU ETF 7.0x 19.8x 3.04% S&P500 20.8x 19.5x 1.64% Click on to enlarge

For my part, AEP appears comparatively pretty valued by way of its relationship with the S&P 500 and the XLU ETF. NextEra is clearly buying and selling at a major premium, however many would argue NEE is in an excellent higher place than AEP to profit from the clean-energy transition contemplating it was a really early adopter and has a lot larger portfolio of renewable wind, photo voltaic, and battery backup initiatives already in operation and within the pipeline going ahead.

Dangers for AEP embrace slowing client and industrial demand for electrical energy as a result of high-inflation, higher-interest price atmosphere that would gradual home financial development. And, as with all U.S. utility firms, hostile regulatory outcomes can have an effect on earnings and distributions.

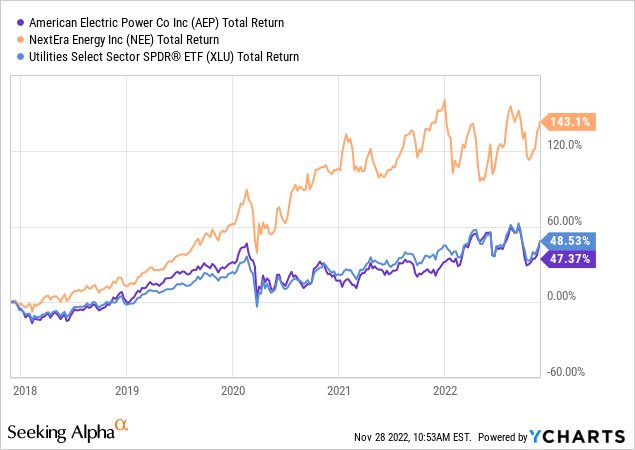

The graphic beneath exhibits the five-year whole returns efficiency of APE versus the XLU and NEE. Clearly, NEE has left each consuming its mud:

Abstract and Conclusion

AEP is a really strong utility that continues to ship for income-oriented utility sector buyers. Regardless of the “pro-coal” narrative that “making coal nice once more” was “the ticket,” AEP has been capable of speed up dividend development whereas closing down a large number of coal-based capability and pivoting towards renewable power. The end result has been extra dividend revenue for its shareholders. I at the moment price AEP a HOLD, but when market volatility drove the inventory again down into the low $80s (final seen in October, see beneath), I might be a purchaser.