PeopleImages

Whereas I actually like lots of the funds that PIMCO has to supply, there’s one which I’d counsel avoiding proper now. The administration staff at PIMCO is aware of loads about bonds and stuck revenue investments. They’re generally known as a large on this planet of bond investing. The truth is, based on a 2021 article within the Wall Avenue Journal:

Pimco stays certainly one of Wall Avenue’s largest and most-successful bond traders, with a deep pool of managers whose insights transfer markets and maintain central bankers’ consideration.

A number of of the funds that PIMCO manages are funds that I personal, and I recognize the excessive yield revenue that I obtain from these funds together with PIMCO Dynamic Revenue fund (PDI), PIMCO Dynamic Revenue Alternatives fund (PDO), and extra not too long ago PIMCO Entry Revenue fund (PAXS). And a number of other of those funds are nicely positioned to face up to the troublesome financial surroundings that many expect, together with the PIMCO staff. This excerpt is from an perception that discusses the Danger Off – Yield On asset allocation outlook that they counsel for present market positioning.

PIMCO’s enterprise cycle fashions forecast a recession throughout Europe, the U.Okay., and the U.S. within the subsequent yr, and the most important central banks are urgent forward with coverage tightening regardless of growing pressure in monetary markets. The financial system in developed markets can also be below rising stress as financial coverage works with a lag, and we count on this may translate into stress on company income.

We subsequently preserve an underweight in fairness positioning, disfavor cyclical sectors, and like high quality throughout our asset allocation portfolios. The return potential in bond markets seems compelling given greater yields throughout maturities. As we glance towards the subsequent 12 months and the eventual emergence of a post-recession, early cycle surroundings, we’ll assess a spread of market and macro components to tell our considering on when and the way to re-engage with threat belongings.

Nevertheless, not all the PIMCO choices are winners all the time. Lately, I made a decision to overview one of many smaller funds that PIMCO manages known as PIMCO International StocksPLUS & Revenue Fund (NYSE:PGP), and I’d keep away from beginning a place in that fund proper now. The truth is, for some causes that I’ll focus on in additional element, I’d be a vendor of PGP if I had been a holder of any shares proper now.

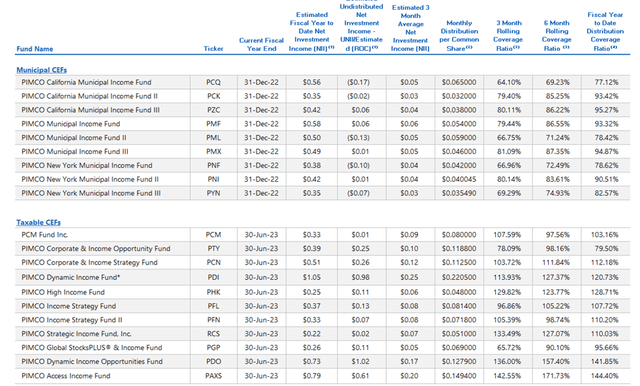

For one factor, the month-to-month UNII report from October 31, 2022, reveals that every of PDI, PDO, and PAXS are all exceeding the protection of their distributions with UNII based mostly on the previous 3-month and 6-month rolling protection ratios in addition to fiscal yr (which ends November 30) protection. Nevertheless, PGP has been seeing a decline within the 6-month and 3-month rolling protection ratios to the purpose of solely about 65% protection over the previous 3 months.

October UNII report (PIMCO)

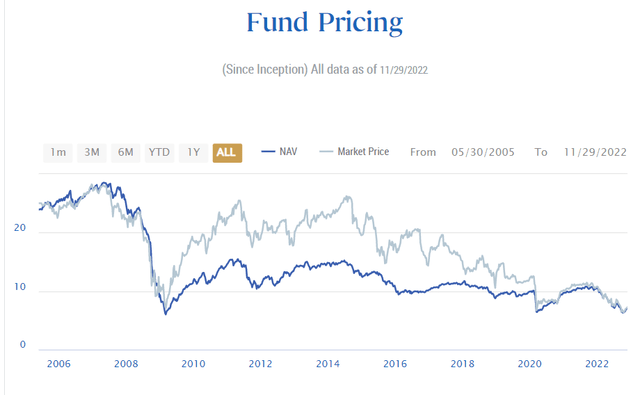

PGP at the moment pays a month-to-month dividend of $0.069 which leads to an annual yield of about 11.5% on the closing market worth of $7.25 as of 11/29/22. The fund’s goal is to hunt complete return comprised of present revenue, present positive factors and long-term capital appreciation. The fund’s inception date was 5/31/2005. The present NAV of the fund is $7.03 which suggests a 2.4% premium.

For a lot of the fund’s life it has traded at a premium. Over the previous 5 years the premium reached as excessive as 50% and it has solely not often traded at a reduction. That every one modified in 2022 because the market worth has dropped by a 3rd YTD and the premium has all however vanished.

PIMCO web site

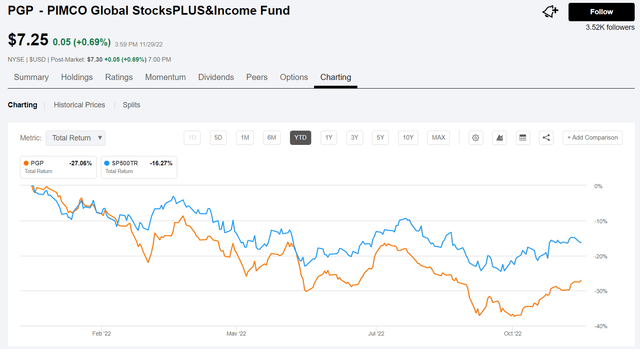

On a complete return foundation, the PGP fund has misplaced -27% YTD in comparison with the S&P 500 TR of -16%.

Looking for Alpha

Bond funds generally have carried out poorly in 2022 with rising charges impacting worth efficiency. However PGP is a hybrid fund with an allocation to world fastened revenue. So how does the fund generate revenue?

The portfolio supervisor builds a world fairness and debt portfolio by investing a minimum of 80% of the fund’s internet belongings (plus any borrowings for funding functions) in a mixture of securities and devices that present publicity to shares and/or produce revenue.

The fund could make substantial use of rate of interest swap and different derivatives transactions (“paired swap transactions”) for the principal objective of producing distributable positive factors that aren’t a part of the fund’s period or yield curve administration methods.

The fund could make use of a method of writing (promoting) fairness index name choices on the U.S. fairness portion search to generate positive factors from choice premiums, which can restrict the fund’s positive factors from will increase within the S&P 500 Index. The fund might also buy put choices on the S&P 500 in an effort to guard in opposition to vital market declines.

The fund employs leverage (40% present efficient leverage) utilizing reverse repurchase agreements and credit score default swaps. With solely $73M in internet belongings, complete managed belongings quantity to $122M. Complete Managed Belongings are outlined within the footnotes:

Complete Managed Belongings embody Web Belongings Relevant to Widespread Shareholders (“Widespread Web Belongings”) + Most well-liked Shares + Reverse Repurchase Agreements + Credit score Default Swaps + Floating Charge Notes Issued in Tender Possibility Bond (“TOB”) transactions, as relevant. In TOB transactions, a fund sells a hard and fast price municipal bond to a dealer who locations that bond in a Particular Objective Belief from which Floating Charge Notes and Inverse Floaters are issued.

By way of portfolio composition, one of many largest holdings is mortgage securities at 24% based mostly on MV (market worth), however over 80% based mostly on DWE% (Length Weighted Equal). Company MBS makes up the most important proportion at 68% DWE with non-agency MBS 9% MV and over 15% DWE. Excessive Yield Credit score makes up 16% by MV and over 18% DWE. Funding Grade Credit score represents solely 3% by MV however over 12% DWE. Rising Market debt, CMBS, non-US developed, Municipal, and Different every make up lower than 5% MV, whereas US Treasuries (together with TIPS, futures, swaps, and Fed assured securities) signify lower than 5% MV however -20% DWE as a consequence of leverage. Web different brief period devices make up 35% of MV and -7% DWE, once more as a consequence of the usage of leverage.

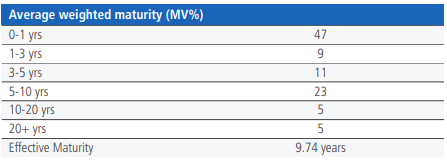

The fund’s common weighted maturity by MV is proven under as of September 30, 2022.

PIMCO

The entire leverage-adjusted efficient weighted period of the portfolio is estimated at 4.56 years. The brief period devices embody securities with period of lower than a yr and are usually funding grade. As described within the fund literature,

Complete Leverage -Adjusted Length represents the Fund’s efficient portfolio period taking into consideration its use of leverage, together with each portfolio leverage (e.g., reverse repos, credit score default swaps, and tender choice bonds), and any structural leverage, resembling auction-rate most popular shares, if any, issued by the Fund. Efficient period is the period for a bond with an embedded choice when the worth is calculated to incorporate the anticipated change in money move attributable to the choice as rates of interest change.

That is the place I imagine the sudden rise in rates of interest in 2022 as a consequence of inflationary pressures has led to issues with the fund’s use of leverage. Whereas PIMCO managers expect the Fed to pause fairly than pivot, continued upside inflation surprises could forestall them from doing so. In one other PIMCO weblog, that they had this to say about expectations for future price will increase:

Whereas the assertion language left the door open to an additional continuation of 75-bp price hikes, we interpret the language adjustments as organising the Fed for a pause within the mountain climbing cycle in early 2023. On the press convention, Fed Chair Jerome Powell emphasised that the Fed could sluggish the tempo of price hikes as quickly because the December assembly, whereas additionally warning that the final word vacation spot for the fed funds price might also be greater than beforehand anticipated as inflation is now greater and seems stickier than the Fed’s forecasts on the September FOMC assembly.

It might be extra wishful considering than actuality in terms of hopes for the Fed to pause and even cease mountain climbing the bottom rate of interest subsequent yr. The bond market has had a tough yr to this point in 2022 (together with progress shares) and a few expect, or maybe hoping that bond costs will start to enhance now that the tip of price hikes seems to be close to the end line.

In accordance with PIMCO, charges may even begin to reverse towards the tip of 2023 if inflation cools and turns into deflationary or stagflation (staying at an elevated price of inflation however not growing). For these causes, and based mostly on the PGP fund’s composition, I really feel that there’s extra ache forward earlier than issues get higher for this fund which might be mid to late 2023.

Wanting on the distribution historical past for this fund, the image doesn’t get any brighter. The dividend has been lowered 3 instances over the previous 5 years and is prone to be lower once more in 2023.

Looking for Alpha

Abstract and Conclusion

Whereas I love PIMCO and benefit from the month-to-month revenue from a number of of the fastened revenue funds they handle, together with PDI, PDO, and PAXS, I’d not be a purchaser of the PGP fund given present market and macroeconomic situations. The fund’s use of leverage has negatively impacted the fund efficiency within the rising rate of interest surroundings and isn’t seemingly to enhance till late subsequent yr when the Fed is ultimately carried out growing charges and inflation has cooled.

Whereas the fund does provide traders a pleasant excessive yield revenue stream of greater than 11% based mostly on the present month-to-month distributions, the UNII protection is severely missing and getting worse, not higher. I’d not be stunned to see the fund managers scale back the distribution in 2023 which is prone to ship the market worth of the fund down even additional.

If you’re contemplating PGP as a long-term funding and don’t thoughts struggling a short-term loss, it might provide some advantages for these prepared to carry it by means of extra risky market situations within the short-term, however I’d counsel ready till subsequent yr earlier than shopping for if you’re contemplating it to your portfolio. If you’re already an current shareholder, I’d take into account promoting the shares and buying and selling them for one of many different funds that I do like resembling PDO or PAXS, which each commerce close to par or at a slight low cost and have stable UNII protection.