2Ban

It’s been some time since my final replace on the main bank card corporations, Visa (V) and Mastercard (MA). Whereas the remainder of market has had a tough 2022, each shares are roughly flat YTD. Each corporations are excessive margin money cows, however the valuations nonetheless look wealthy to me. I’m not searching for a 15x earnings a number of to begin shopping for (which might be a slam dunk in my thoughts), however they aren’t low-cost sufficient for a margin of security. Each shares stay on my watchlist attributable to their spectacular enterprise fashions, and shares have had a powerful run within the final couple months of greater than 20%.

Funding Thesis

Visa and Mastercard are two prime quality companies which have earned their premium valuations for a number of causes. Each corporations have strong steadiness sheets with loads of money and spectacular earnings statements that showcase the excessive margin nature of their companies. Each can borrow at low rates of interest and have persistently grown their dividends at double digit charges. They’ve additionally been persistently shopping for again inventory for a number of years.

The principle purpose I don’t personal both inventory at present is the wealthy valuations. Visa at present trades at 28.5x earnings which is barely above their common a number of. Mastercard is much more costly at 34.6x earnings. It’s not shocking as each have persistently grown the underside line at double digit charges, however I don’t see a margin of security in both inventory at present. The yield isn’t a lot both as each yield lower than 1%. I can be searching for shopping for alternatives in Visa and Mastercard, and I wouldn’t advocate promoting, however I’m not a purchaser at present both.

Visa’s 10-Ok

Visa just lately reported its annual outcomes displaying that the enterprise continues to hum alongside. I skimmed the 10-Ok and there’s a lot to love in regards to the financials. The highest line confirmed spectacular development, from $24.1B in 2021 to $29.3B in 2022. In addition they maintained their internet margins over 50%, a powerful feat. Visa has averaged double digit prime and bottom-line development for years, and that’s projected to proceed over the subsequent couple years.

A fast peek on the steadiness sheet exhibits $20B in debt, which could seem to be so much, the debt breakout exhibits so much to love. The maturities are effectively laddered, and many of the notes carry rates of interest within the 2-3% vary. Some are as little as 0.75% or as excessive as 4.3%, however the firm’s AA- S&P credit standing means Visa ought to have the ability to proceed to borrow at low rates of interest. I don’t suppose the debt degree is just too excessive both, with $15.7B in money and equivalents and $4.3B in restricted money and investments to steadiness issues out.

Mastercard’s 10-Q

Mastercard adopted swimsuit with one other spectacular quarter of its personal. The highest and backside traces confirmed double digit development for the primary 9 months of the 12 months. Income grew from $13.7B within the first 9 months of 2021 to $16.4B in 2022, with internet earnings rising from $6.3B to $7.4B. Mastercard doesn’t fairly have the margins that Visa does, however it’s no slacker both, with 45% internet margins for the primary 9 months of the 12 months.

Mastercard additionally has loads of money, with $7.6B in money and equivalents and one other billion in restricted money and investments. Mastercard had $14.5B in debt excellent at the newest report, most of which can be within the 2-3% rate of interest vary. In addition they have a powerful credit standing at A+, so they may seemingly have the ability to proceed to get engaging phrases on future notes. On account of their spectacular enterprise fashions and outcomes, each Visa and Mastercard carry a well-deserved premium valuation.

Valuation

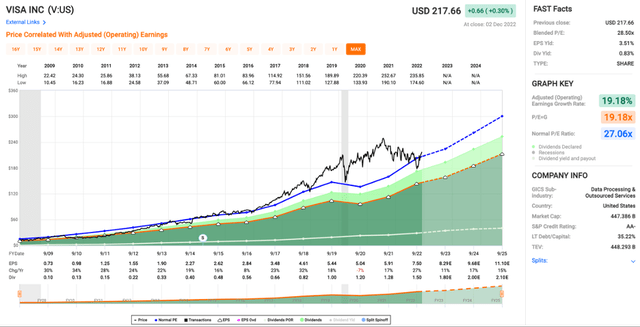

Visa is at present buying and selling at 28.5x earnings, which is a bit wealthy for my tastes. It’s barely above the typical a number of of 27.1x. As you’ll be able to see beneath, shares have spent most of their time above the typical a number of lately, and any time shares contact the blue line lately has turned out to be a good shopping for alternative. Estimates for Visa predict continued double-digit development within the backside line, one thing that has been constant for the corporate exterior of the slight decline in 2020 that have been seemingly brought on by COVID lockdowns.

Worth/Earnings (fastgraphs.com)

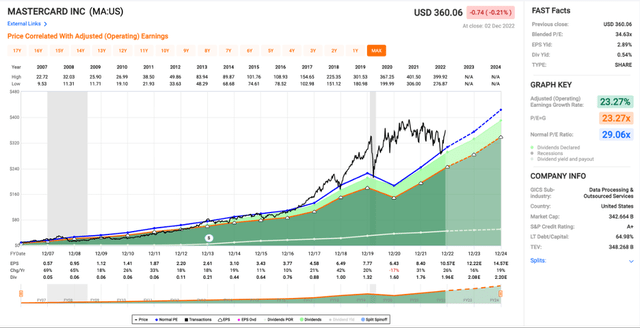

Whereas Visa inexpensive than Mastercard, I don’t suppose the present valuation for both firm leaves a lot in the best way of a margin of security. Mastercard at present has an earnings a number of of 34.6x, which can be above the typical a number of of 29.1x. Primarily based on estimates, it seems to be like Mastercard could have barely higher earnings development over the subsequent couple years than Visa. Like Visa, it has additionally spent more often than not lately effectively above the typical valuation a number of.

Worth/Earnings (fastgraphs.com)

Whereas the premium valuations make it exhausting for me to drag the set off on both firm, I can perceive why each shares are seldom low-cost. They’re confirmed long run compounders with spectacular financials and large margins. In addition they provide spectacular dividend development, even when the beginning yields are small.

Dividend Progress

Neither of those corporations will appeal to many traders searching for present earnings, however the dividend development has been constant and spectacular. Visa at present yields 0.8% whereas Mastercard’s yield is 0.5%. They make up for that small yield with dividend development. Visa just lately introduced a major hike with its most up-to-date quarterly dividend, from $0.38 to $0.45. Mastercard is due for a dividend hike within the subsequent quarter if the sample continues, and I’m anticipating a rise within the ballpark of 10%. Each corporations have low payout ratios that give them loads of cushion for future will increase. In addition they have been returning capital to traders within the type of buybacks.

Buybacks

Visa repurchased 56M shares in 2022 for a complete of $11.6B. This was at a median value of $206.47. The present program had $5.2B remaining at 12 months finish, they usually reloaded the buyback authorization in October with an extra $12B. Mastercard has additionally been shopping for again a big chunk of shares, with 18.3M shares repurchased within the first 9 months of the 12 months. They spent $6.3B for a median value simply over $345. They’ve $5.6B remaining on the present authorization and I wouldn’t be shocked in the event that they comply with swimsuit and authorize extra buybacks within the subsequent 12 months.

Conclusion

Visa and Mastercard are two companies that positively fall within the high-quality bucket. It’s so apparent to traders that they routinely carry earnings multiples above 30x, which is uncommon for corporations of their dimension (roughly $450B and $350B market caps, respectively). Each corporations have spectacular steadiness sheets and really excessive margins. The issue is that neither inventory provides a lot of a margin of security, regardless of spectacular development monitor information and ahead estimates.

Whereas I just like the dividends and buybacks, I’d relatively see bigger dividend hikes and fewer buybacks as a result of valuations of each shares. That is definitely nitpicking, however I’d be leaning in the direction of bigger dividend hikes over buybacks when each shares are buying and selling at 30x earnings (give or take). With yields of 0.8% and 0.5% and payout ratios beneath 20%, each have loads of room for future dividend hikes, even when each corporations proceed to emphasise buybacks.

They may keep on my watchlist for now, however I can be searching for shopping for alternatives if we see broader market weak point in 2023. I may need missed the newest probability as shares are up over 20% within the final couple months, but when they get cheaper within the subsequent 12 months, I can be trying to begin a place. If I had to decide on one to purchase at present, I’d most likely go together with Visa, as a result of decrease valuation, higher margins, and its barely bigger dividend.