Spencer Platt

The Chart of the Day belongs to the tobacco firm Philip Morris (PM). I discovered the inventory by sorting the S&P 100 Index shares first by essentially the most frequent variety of new highs in the final month and having a Development Spotter purchase sign, then used the Flipchart characteristic to overview the charts for constant worth appreciation. For the reason that Development Seeker first signaled a purchase on 11/8, the inventory gained 9.87%.

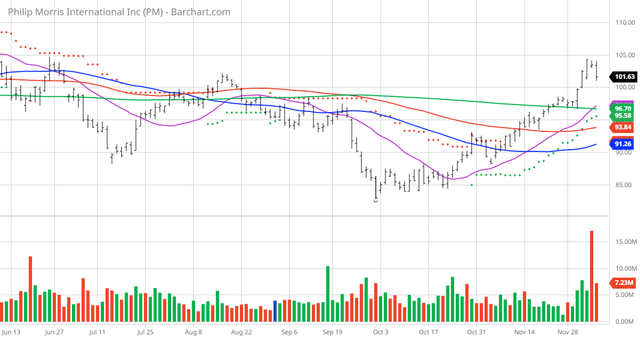

PM Value vs 20,50,100 DMA ( )

Philip Morris Worldwide Inc. operates as a tobacco firm working to ship a smoke-free future and evolving portfolio for the long run to incorporate merchandise exterior of the tobacco and nicotine sector. The corporate’s product portfolio primarily consists of cigarettes and smoke-free merchandise, together with heat-not-burn, vapor, and oral nicotine merchandise which can be bought in markets exterior america. The corporate provides its smoke-free merchandise underneath the HEETS, HEETS Creations, HEETS Dimensions, HEETS Marlboro, HEETS FROM MARLBORO, Marlboro Dimensions, Marlboro HeatSticks, Parliament HeatSticks, and TEREA manufacturers, in addition to the KT&G-licensed manufacturers, Fiit, and Miix. It additionally sells its merchandise underneath the Marlboro, Parliament, Bond Avenue, Chesterfield, L&M, Lark, and Philip Morris manufacturers. As well as, the corporate owns varied cigarette manufacturers, resembling Dji Sam Soe, Sampoerna A, and Sampoerna U in Indonesia; and Fortune and Jackpot within the Philippines. The corporate sells its smoke-free merchandise in 71 markets. Philip Morris Worldwide Inc. was included in 1987 and is headquartered in New York, New York. (Yahoo Finance)

Barchart’s Opinion Buying and selling programs are listed under. Please word that the Barchart Opinion indicators are up to date stay through the session each 20 minutes and may due to this fact change through the day because the market fluctuates. The indicator numbers proven under due to this fact might not match what you see stay on the Barchart.com web site if you learn this report.

Barchart Technical Indicators:

40% technical purchase indicators 12.18+Weighted Alpha 11.20% acquire within the final 12 months Development Seeker purchase sign Above its 20-, 50- and 100-day transferring averages 14 new highs and up 12.95% within the final month Relative Energy Index 67.30% Not too long ago traded at $101.63 with 50-day transferring common of $91.26

Basic Elements:

Market Cap $160 billion P/E 17.62 Dividend yield 4.91% Income anticipated to lower by 2.20% this 12 months however be up one other 2.00% subsequent 12 months Earnings estimated to extend 4.50% this 12 months. a further 2.82% subsequent 12 months and proceed to compound once more at an annual price 4.97% for the subsequent 5 years

Analysts and Investor Sentiment — I do not purchase shares as a result of everybody else is shopping for however I do notice that if main corporations and traders are dumping a inventory it is exhausting to earn a living swimming in opposition to the tide:

Wall Avenue analysts have 7 sturdy purchase, 3 purchase, and eight maintain opinions in place on this inventory Analysts have worth targets from $86.00 to $127.00 with a median of $102.64 The person traders following the inventory on Motley Idiot voted 2,775 to 83 for the inventory to beat the market with extra skilled traders voting 546 to 12 for a similar end result 122,500 traders are monitoring this inventory on Searching for Alpha

Scores Abstract

Click on to enlarge

Issue Grades

Click on to enlarge

Quant Rating

Sector – Client Staples

Business – Tobacco

Ranked General – 1425 out of 4754

Ranked in Sector – 69 out of 193

Ranked in Business – 5 out of 9

Quant Scores Beat The Market »

Dividend Grades

Click on to enlarge

Dividend Grades Beat The Market »