zimmytws

Once in a while, I discover it price taking a giant step again and looking out on the “huge image” of the place the perfect funding alternatives are around the globe. A portfolio implementation of this can be a “Make My Dow” strategy, the place as an alternative of 30 home shares, you choose 1-3 “nationwide champions” from every of 10-30 totally different markets around the globe, and in doing so construct your individual portfolio of world-class blue chips whose international development you may observe, dividend by dividend. Since 2022 has been my first 12 months since 2019 that I’ve been in a position to resume my in depth worldwide journey, I assumed my 12 months finish articles ought to embody this “World Tour of Blue Chips”, the place I spotlight only one inventory from every of 10 markets the place I presently see loads of alternative. These 10 shares can function a “starter” worldwide portfolio for buyers who imagine proudly owning a number of good corporations you realize is healthier than proudly owning tons of or 1000’s of corporations you do not know.

Spoiler: my prime choose of those ten is UK-based Unilever PLC (NYSE:UL) partly as a result of I imagine it’s a easy international enterprise that may function a benchmark for the others, but in addition for diversification and foreign money causes I’ll describe beneath.

Why do a “World Tour of Blue Chips”

Anybody who has identified me for any time frame is aware of I want to look around the globe at totally different worldwide markets to seek out the perfect blue chips in every. Over time, I’ve come to see my readiness and willingness to cross borders as a increasingly more important benefit over spending an excessive amount of time in anybody nation. In different phrases, I usually discover extra of a bonus evaluating prime corporations in two totally different nations, somewhat than attempting to choose between prime corporations inside a given nation. It is because I’ve seen many psychological and institutional boundaries that hold many buyers from, say, promoting Apple Inc (AAPL) and shopping for Samsung (OTCPK:SSNLF) even when the latter appears significantly better valued.

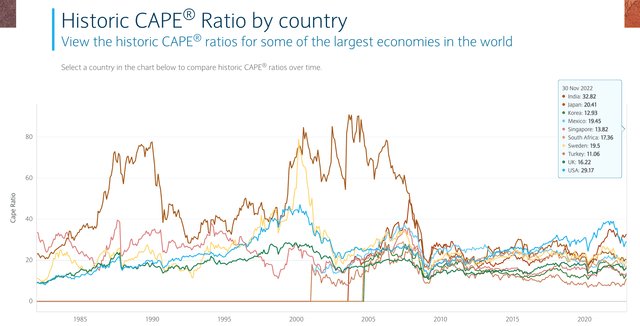

The beneath chart from Barclays reveals the historic and present Cyclically Adjusted Value-to-Earnings, or “CAPE”, ratio measuring the relative valuation of 9 chosen inventory markets relative to 10 years of common inflation-adjusted earnings. By this measure, the US is considerably dearer than eight different markets the place I’ll record blue chip alternatives on this article, with solely India averaging dearer equities than the US. This image tells me, at a excessive stage, that the percentages appear in my favor for choosing a prime identify like Samsung from a less expensive market like Korea, versus choosing AAPL from an costly market just like the US.

Barclays

I’ve intentionally left China out of this world tour as a result of I see the alternatives there as too various and nuanced to incorporate within the scope of a “fast picks” article like this one. For these different 10 markets, I’ve picked one blue chip identify I feel supplies a particular alternative from that market, and conclude with why UL is my largest holding of those 10.

1. Blue chip choose from Japan: Canon

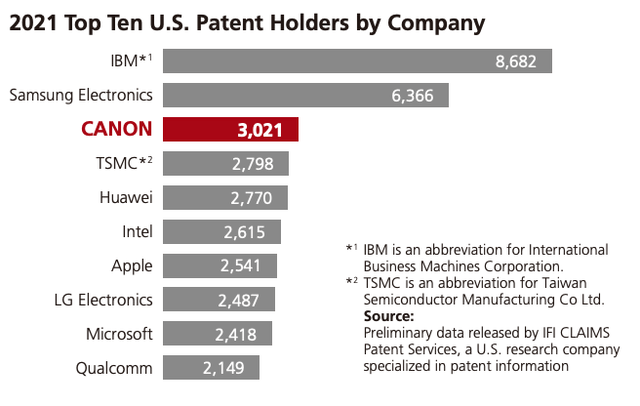

Japan stays by far the most important nation weight within the Vanguard Whole Worldwide Inventory ETF (VXUS) as a result of it stays a really massive and nicely developed market wealthy with alternatives. Because the above CAPE chart reveals, this market went from being considerably dearer than the US from the Nineteen Eighties by the 2000s, to now having a CAPE ratio virtually 30% beneath that of the US market. Whereas lots of Japan’s greatest identified blue chips could not have the worldwide dominance they appeared to have within the Nineteen Eighties and Nineteen Nineties, one identify I do suppose is price persevering with to focus on right here is main digital camera model Canon Inc. (CAJ). The beneath chart from CAJ’s 2021 annual report reveals Canon because the third largest holder of US patents. Many of those patents and 55% of revenues come from printing, which I anticipate to be aggressive and decrease margin, however the remaining comes from wider moat areas like imaging and medical know-how.

Canon 2021 annual report, web page 21

Canon’s dividend was 115 yen per share over the previous 12 months, and the present value of round 3,100 yen per share presents a wholesome 3.7% yield with some room to develop, particularly with the good thing about the weak yen.

2. Blue chip choose from Korea: Samsung Electronics

Transferring over to Korea, we are able to choose the highest identify there which can also be #2 on the above record of US patent holders simply above Canon: Samsung Electronics. That is the electronics arm of the bigger Samsung Chaebol, however alone is the one largest holding within the iShares MSCI South Korea ETF (EWY) at 22%. Whereas 16x ahead earnings makes this dearer than the common Korean inventory, the nicely above common international presence of the Samsung identify and its applied sciences make it a transparent prime blue chip choose from this peninsula.

3. Blue chip choose from Singapore: OCBC

Singapore is a market I used to frequent, and I used to be very completely happy to have the possibility to return and go to two weeks in the past for the primary time since early 2020. The market itself is comparatively small and concentrated in financials, actual property, and logistics, although for anybody new to this market, I like to recommend beginning with the three huge blue chip banks, all of which have diversified publicity throughout Southeast Asia. The Abroad-Chinese language Banking Company (OTCPK:OVCHY) is my present prime choose of the highest three, primarily due to the dividend hike over the previous 12 months. I used to joke that OCBC stands for “over-charging enterprise clients”, as a result of their excessive charges bought me to modify my very own account there to a competitor, however I’ve seen what number of of their clients pay these charges and do not trouble switching.

4. Blue chip choose from Indonesia: Indofood

A brief ferry trip from Singapore takes us to Indonesia, the place my present prime choose is PT Indofood Sukses Makmur Tbk (OTCPK:PIFMY). Indofood is a blue chip meals model throughout Southeast Asia, and after three years of holding its dividend at 278 rupiah per share, I see robust meals costs versus a weak rupiah feeding probably future dividend will increase.

5. Blue chip choose from India: Infosys

Throughout the Bay of Bengal to what has turn out to be the world’s quickest rising massive financial system, I choose a prime blue chip doing one of many many issues India might be greatest identified for: IT outsourcing. That firm is Infosys Restricted (INFY), which like the general Indian market, is likely to be thought-about costly at 27x ahead earnings, however I see that is the identify to personal in know-how manpower on the proper value.

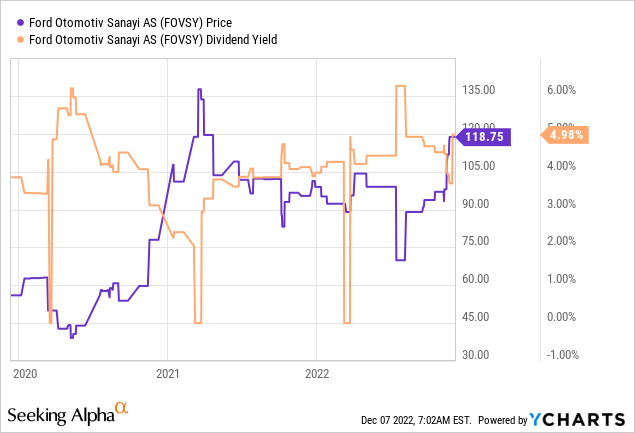

6. Blue chip choose from Turkey: Ford Otomotiv

In what appears to be like like the most cost effective of those markets on a CAPE foundation, Turkey, my choose is the Ford subsidiary Ford Otomotiv Sanayi A.S. (OTCPK:FOVSY). This can be a blue chip principally due to the Ford identify, and combines the benefits of its dad or mum with its place in a dynamic if dangerous market nicely positioned between Europe, the center east and Africa. I began shopping for earlier this 12 months beneath 100, and remorse not shopping for extra, however nonetheless see it as nicely valued with its yield round 5%, a premium with probably extra development forward than its dad or mum.

7. Blue chip choose from South Africa: SPAR Group

South Africa is one other market that has popped up on my dashboard in current months as having many well-valued and worthwhile alternatives. For now, my prime choose right here is the native subsidiary of Dutch grocery retailer SPAR Group (OTCPK:SGPPY). Once more, I think about this a blue chip principally due to the model of its dad or mum, which I see throughout Europe, and in contrast to many different names in South Africa, is not as uncovered to the volatility of mining and mineral costs.

8. Blue chip choose from Sweden: Securitas

One other identify I’ve seen throughout Europe this 12 months is that of Sweden-based international safety supplier Securitas (OTCPK:SCTBY). The share value is down considerably this 12 months, regardless of persistently sustaining its annual dividend at over 4 krona per share over every of the previous 5 years, and the 2 causes this is not my prime choose over Unilever are:

The inventory continues to be a “falling knife”, and I want to maintain it on my watchlist and anticipate the knife to cease falling earlier than shopping for extra, and; The ADR trades OTC within the US, so is not the simplest identify to commerce for buyers with out entry to straight buying and selling the shares listed in Stockholm.

9. Blue chip choose from the UK: Unilever

The one blue chip identify I’ve talked extra about over the previous 12 months than another is shopper merchandise big Unilever Plc, with a model portfolio I am positive many readers right here use day-after-day. UL has very worthwhile subsidiaries in Indonesia, Bangladesh, India, Pakistan, Nigeria, Cote d’Ivoire, and Ghana simply to call a number of, however I concentrate on the dad or mum as a result of it’s well-priced and diversified, in addition to being probably the most liquid. I additionally imagine the profit Unilever enjoys from having lots of its gross sales in stronger currencies like {dollars}, however its accounts in weaker currencies like kilos and euros, is barely beginning to get priced in with the bounce in its inventory value over the summer season. I see the EUR 0.4268 quarterly dividend as very nicely coated by its earnings and prone to resume mountain climbing over the subsequent 12 months or two, after administration assesses any impression of upper charges.

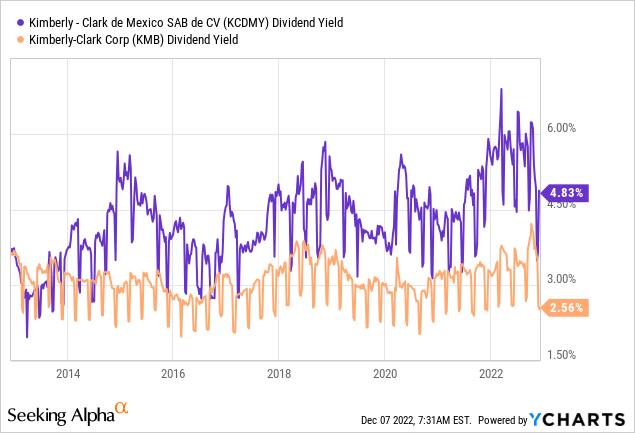

10. Blue chip choose from Mexico: Kimberly Clark

Lastly, I end on the US’s doorstep with an American blue chip identify, however by way of its cheaper subsidiary south of the border: Kimberly Clark de Mexico (OTCPK:KCDMY). My view right here is easy: the US’s working age inhabitants is beginning to stage off, whereas Mexico’s is constant to develop at a wholesome charge, and that working age inhabitants development is essential to Kimberly Clark’s income development on either side of the border. So long as quicker development potential KCDMY trades at a big yield premium to Kimberly-Clark Corp (KMB), I am going to proceed accumulating extra of the previous.

Backside line, my prime choose: Unilever

2022 has introduced buyers with many world-class blue chip names at decreased costs from final 12 months, and this has been very true for buyers with robust {dollars} able to spend money on cheaper international shares with bills in weaker currencies. The above record is simply 10 of those names from 10 totally different markets I’m trying in the intervening time, however my prime blue chip choose of those that I like to recommend any reader begin with, if you have not already, is Unilever. One issue I’ve named as making most of those 10 names enticing is a robust greenback, and UL does this with probably the most international diversification (masking all 10 markets listed above and lots of extra). On prime of that 3% yield, the dividend is presently anticipated to develop from $1.60 to $1.81 over the subsequent two years, a development charge of 6% per 12 months, which on prime of the three% yield signifies a 9% anticipated charge of return. That continues to be a very good blue chip yield in any foreign money.