maybefalse

Brookfield Renewable Companions L.P. (NYSE:BEP) is among the main renewable vitality suppliers in america; its era principally comes from hydro with 33.75% share, 24.6% – wind, 14.1% – photo voltaic, and 27.55% – “Distributed Vitality & Sustainable Options.” The continual interval of rising electrical energy costs is leaving BEP to be one of many beneficiaries. Furthermore, the story does not finish there, because the firm has the potential for additional improvement; it additionally pays secure dividends.

9-month 2022 Monetary Highlights

The final 12 months’ income, ending Sep 30, 2022, elevated by 16.97% to $3.515 million owing to greater vitality costs and enterprise enlargement. Put in capability rose from 20.515 to 23.617 (MW); Common income grew from $84 to $88 MWh.

The weighted common time period of a Energy buy settlement, or PPA, is 14 years. Not solely does the enterprise get pleasure from sectoral stability, since Utilities are probably the most sure-footed sector, nevertheless it additionally has sturdy money flows. Money circulation from operations was up 42.1% YoY. The corporate’s curiosity expense grew by $147 million in comparison with the identical interval attributable to portfolio development, accelerated monetary exercise in South America, and strategic financing of the Canadian hydroelectric energy plant. The online revenue resulted in $78 million. Given the Fed’s fee improve, it’s good that Brookfield will get roughly 90% of its funding at a set fee. Throughout the 12 months, the corporate continues to construct varied tasks with a projected capability of over 19,000 MW.

In September, the corporate agreed to type a strategic partnership with Cameco Company (CCJ) to accumulate Westinghouse Electrical Company; the whole fairness funding might be $4.5 billion, and BEP’s half is $750 million, or roughly 17% stake in a newly shaped entity. This partnership creates a platform for strategic entrance into nuclear energy era.

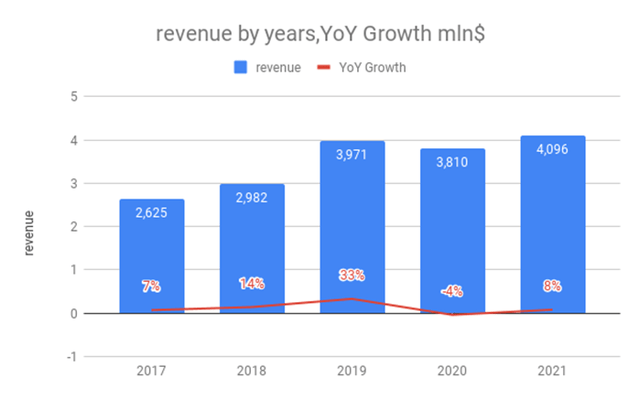

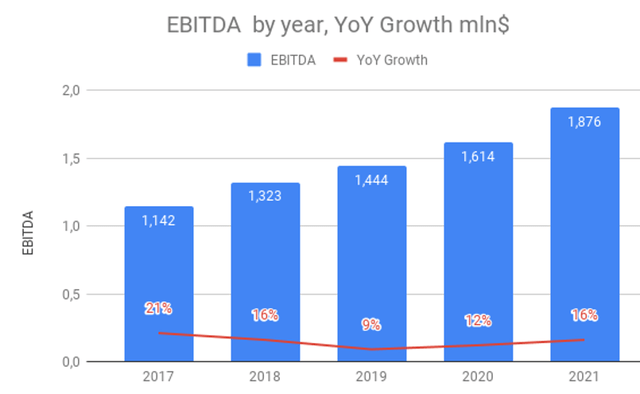

Figures present that Brookfield Renewable is a development firm. The corporate’s principal asset is hydroelectric energy crops; this supply accounted for 50% of all generations in 2021. Probably the most dynamic supply is photo voltaic, which rose from 753 (GWh) in 2017 to 1,777 (GWh) in 2021. The corporate actively invests in new tasks and sells previous capacities.

The Firm’s monetary experiences

The guess on wind and photo voltaic permits the corporate to exhibit assured EBITDA development. In 2017, the share of wind and photo voltaic era was 15% and 1%, respectively; in 2021, the share elevated to 21% and 14+%, respectively. It additionally reduces the danger of the climate issue, which performs a big function within the firm’s efficiency.

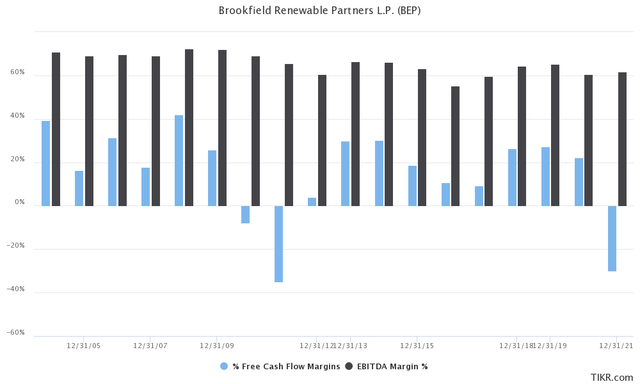

Firm’s experiences

As for the historic information: the corporate maintains extensive margins. EBITDA and FCF margins had been chosen to point out the marginality. The exception was in 2021, when the corporate’s FCF decreased attributable to heavy CapEx. BEP is clearly a secure enterprise, with the FCF margin averaging 15% for the final 10 years.

Tikr.com

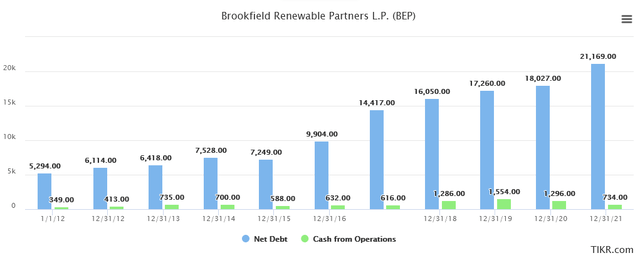

The online debt place of Brookfield Renewable Companions has been rising over the previous 5 years; it doubled. In the meantime, a corresponding development of FFO means that the enterprise has been efficient.

Tikr.com

Vitality Market

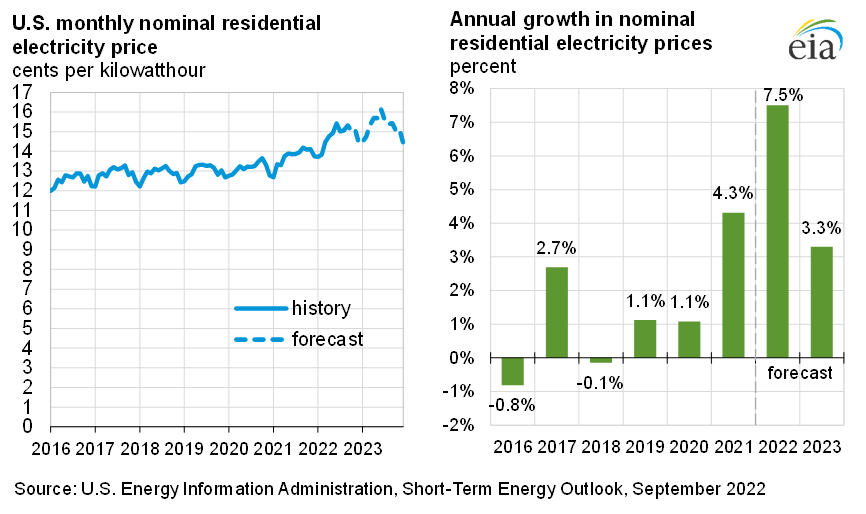

Renewable vitality is rising; it’s anticipated to develop at an 8.5% fee, rising from $860 billion in 2021 to $1.68 trillion by 2029. That may drag Brookfield Renewable alongside at a stable tempo. Rising vitality prices have pushed the surge in inflation. Consequently, BEP will repair at greater charges when present contracts expire. So, in accordance with IEA’s forecasts, in 2022, the typical worth of electrical energy for the U.S. inhabitants might be 14.8 cents per KWh, which is a 7.5% carry YoY.

Vitality info administration

The corporate groups up with others and invests in tech, together with inexperienced hydrogen, carbon seize, and storage – CCS. The inexperienced hydrogen market is predicted to develop at a CAGR of 39.5% towards $60.56 billion by 2030. BEP has labored with Enbridge (ENB) to develop inexperienced hydrogen assets in Quebec. Additionally it is partnering with hydrogen firm Plug Energy (PLUG) to supply renewable vitality to its first plant to supply sustainable hydrogen. The carbon seize and storage market is predicted to develop at a 13.7% CAGR in the direction of $7 billion by 2030. Brookfield just lately shaped a three way partnership with oil producer California Assets (CRC).

The corporate’s development drivers embrace scale financial savings and additional capability development. Accordingly, Brookfield Renewable has long-term potential for income development and FFO.

Competitors

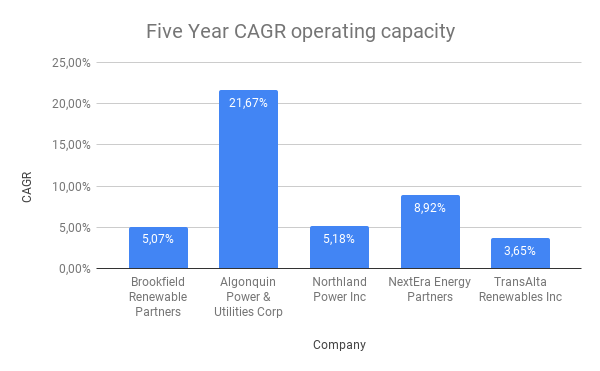

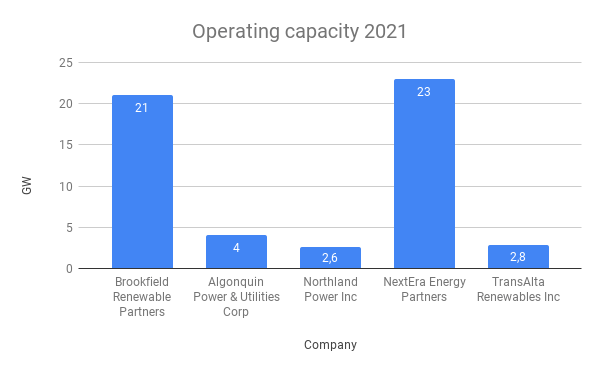

Let’s choose friends: Algonquin Energy & Utilities Corp. (AQN), Northland Energy Inc. (OTCPK:NPIFF), NextEra Vitality Companions (NEE), and TransAlta Renewables Inc. (RNW:CA). NextEra is main the pack by general put in capability, and Brookfield Renewable is barely decrease with 21 GW. The put in capability development fee is weak amongst friends; solely Algonquin Energy & Utilities Corp is actively rising.

Corporations’ reporting

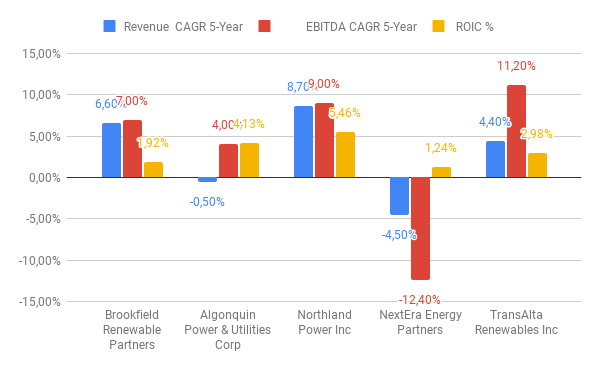

Corporations’ reporting

In monetary phrases, most corporations have a low ROIC. It signifies that if rates of interest rise additional, the borrowing prices can be greater; Corporations would discover it difficult to pursue M&A offers and develop the enterprise. Nevertheless, Brookfield famous that with the $15 billion closure of the Brookfield International Transition Fund, the corporate has entry to capital to take a position.

Corporations’ reporting

As for BEP’s multiples, information level to a reduction in comparison with the closest counterparts and business.

Firm Title

PE (TTM)

P/B (TTM)

EV/EBITDA (TTM)

P/S (TTM)

Brookfield Renewable Companions

-51,13

1,80

11,56

1,84

Algonquin Energy & Utilities Corp.

109,57

1,01

21,63

2,03

Northland Energy Inc.

13,05

2,44

7,20

3,59

NextEra Vitality Companions

15,57

2,02

15,52

5,72

TransAlta Renewables Inc.

46,20

2,16

14,55

8,10

Common

25,20

2,30

14,10

7,02

Potential Development/Fall

–

27,78%

21,97%

281,52%

Median Utilities – Impartial Energy Producers business

17,55

1,58

12,70

3,40

Potential Development/Fall

–

-12,22%

9,86%

84,78%

Click on to enlarge

(Supply: Gurufocus.com.)

Dividends

Beneath the present dividend coverage, the corporate pays $0.32 per quarter. The dividend development fee over 5 years was 4.06%, whereas the payout ratio rose from 53% to 84%. Regardless of the elevated payout ratio, the corporate has no liquidity issues. The corporate reported about $4 billion in out there liquidity, which nonetheless lags the headroom for enterprise development. The common dividend yield was 4.46%, barely beneath the potential present 3.30%.

Yr

Funds From Operations per Unit$

Distribution per LP Unit$

Payout Ratio

Dividend Yield Yr Finish Yield

2017

1,90

1,00

53%

5,36%

2018

2,16

1,05

49%

7,57%

2019

1,30

1,10

85%

3,31%

2020

1,32

1,16

88%

2,68%

2021

1,45

1,22

84%

3,39%

Click on to enlarge

(Supply: Corporations’ reporting)

Main Danger

The main focus of the vitality coverage might shift away from renewable vitality because of the vitality disaster. Due to this, the U.S. authorities allowed the rise of oil manufacturing, which might delay the vitality transition. That would end in a discount of curiosity in shares like BEP.

Conclusion

Brookfield Renewable Companions L.P. is predicted to ship in coming years due to the commissioning of latest capacities and rising electrical energy costs. Brookfield Renewable is among the leaders in renewable vitality and at the moment is buying and selling with a reduction; it additionally has a constant dividend historical past. Multiples present a reduction of 15-20+ %, and Brookfield Renewable Companions inventory appears enticing for buy.