Natali_Mis

The enduring market-wide sell-off has not been type to small-cap healthcare tickers as buyers run to security in blue-chip and defensive shares. On the intense facet, indiscriminate promoting has uncovered varied alternatives for buyers to provoke a place in beforehand “high-flying” tickers. Many of those small-cap healthcare corporations at the moment are deeply discounted and supply irrational threat rewards. Graphite Bio (NASDAQ:GRPH) has not been exempt from blanket promoting and has misplaced roughly 60% of its worth over the previous twelve months and is buying and selling with a destructive enterprise worth, regardless of its potential to be a contender within the gene remedy business. In consequence, I consider GRPH is a first-rate candidate for the Compounding Healthcare “Bio Growth” Portfolio.

I intend to supply a short background on Graphite Bio and can focus on GRPH’s candidacy for the Bio Growth Portfolio. As well as, I spotlight a few of GRPH’s draw back dangers and the way they may affect my technique for dealing with a speculative place. Lastly, I suggest a recreation plan for a starter place in GRPH.

Background on Graphite Bio

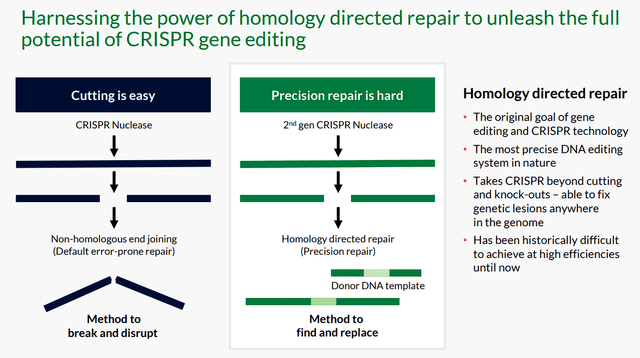

Graphite Bio’s gene-editing platform intends to take CRISPR-based gene modifying to a brand new degree of DNA restore branded as homology-directed restore, or HDR. Graphite’s UltraHDR platform makes use of the cell’s intrinsic DNA restore skills and processes to reestablish regular features to mutated genes which are a supply of a illness.

Graphite Bio CRISPR Highlights (Graphite Bio)

The corporate believes that its method may enable sufferers to get individualized gene therapies that may remedy the sufferers of their genetic illness, and presumably most cancers, autoimmune ailments, and neurodegenerative ailments.

The corporate’s UltraHDR platform is a “discover and exchange” technique to gene modifying, the place they determine the genetic mutation that causes a particular illness, then they reduce the inaccurate DNA sequence utilizing their excessive constancy, RNA-bound, HiFi Cas9, then they exchange the defective DNA sequence with the right DNA sequence, thus restoring operate within the disease-causing gene.

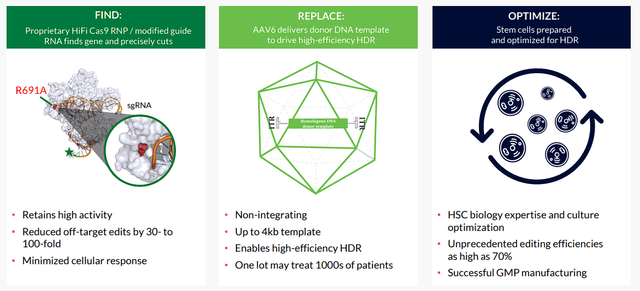

Graphite Bio Discover and Change (Graphite Bio)

The corporate is using hematopoietic stem cells “HSC” with the intention to both appropriate, exchange, or insert genes on a disease-causing gene. The tactic used is set by the illness and what’s wanted to handle the gene’s malfunction.

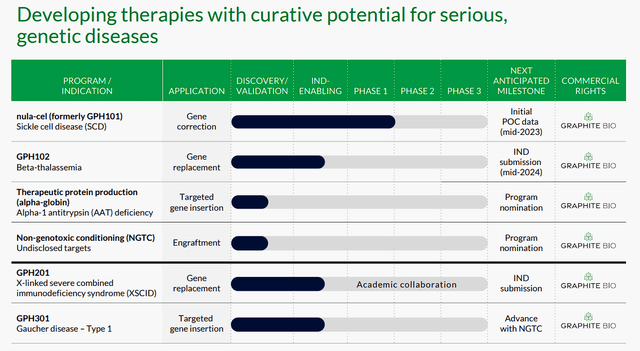

Graphite Bio Pipeline (Graphite Bio)

In the meanwhile, Graphite is creating stem cell-based cures for sickle cell illness “SCD” and beta-thalassemia. The corporate’s preliminary goal is SCD utilizing its Nulabeglogene autogedtemcel “nula-cel” (previously GPH101) candidate, which is predicted to be a one-time hematopoietic stem cell remedy. Nula-cel is trying to appropriate the mutation within the beta-globin gene to cut back HbS manufacturing and reestablish HbA expression, in so doing theoretically curing SCD. If nula-cel is profitable, sufferers can be free from the countless want for blood transfusions and pharmaceuticals. The FDA has granted Nula-cel Quick Monitor and Orphan Drug designations for SCD. Nula-cel is predicted to be “the primary investigational remedy to make use of a extremely differentiated gene correction method,” so it may declare a major proportion of an SCD market that’s estimated to hit $8.28B in 2030.

In the meanwhile, Graphite Bio has nula-cel within the CEDAR trial, which is a part I/II proof-of-concept research for sufferers with extreme SCD. Thus far, the corporate has dosed its first affected person with nula-cel, and enrollment in CEDAR is ongoing. The corporate believes it’s “on monitor to share preliminary proof-of-concept information in mid-2023.”

The corporate is wanting ahead to presenting on the sixty fourth American Society Of Hematology “ASH” Annual Assembly & Exposition being held December Tenth-Thirteenth. The corporate will current “particulars in regards to the growth of a single-cell RNA sequencing “scRNAseq” technique to evaluate the gene correction outcomes in sufferers handled with nula-cel.”

GPH102 is the corporate’s beta-thalassemia program, which is trying to remedy the genetic blood dysfunction by changing the mutated beta-globin gene with a practical gene. GPH102 is in IND-enabling actions.

GPH201 is predicted to be a healing remedy for X-Linked Extreme Mixed immunodeficiency “X-SCID”, also referred to as “bubble boy” illness. Sadly, bone marrow transplantation is basically the most suitable choice in the meanwhile, however promising gene therapies are in ongoing medical trials. Graphite goes the gene substitute route to exchange the defective IL2RG gene. GPH201 is in IND-enabling actions.

GPH301 is being developed to doubtlessly remedy Gaucher Illness Sort I, which is a uncommon genetic dysfunction the place sufferers are lacking a particular enzyme that’s liable for breaking down lipids. Utilizing the focused gene insertion technique, Graphite is trying to insert a functioning GBA gene. GPH301 is in IND-enabling research.

Wanting on the financials, the corporate reported $18.3M in R&D bills and $7.9M in S&A, which led to a $24.7M internet loss for the third quarter. By way of money, Graphite Bio completed Q3 with $305.1M, which the corporate expects shall be adequate to “fund its deliberate operations into the fourth quarter of 2024.”

One other Bio Growth Candidate

The Bio Growth Portfolio holds healthcare corporations which are usually not worthwhile and are very speculative, but they suggest appreciable upside resulting from a potent impending catalyst, anticipated income development, or a potential turnaround. Normally, these are small to mid-cap corporations with risky tickers that can supply repetitive buying and selling alternatives that may generate appreciable revenue whereas rising a “home cash” place over time. These tickers are traded offered they’re nonetheless in play or till the corporate advances to the “Bioreactor” development portfolio.

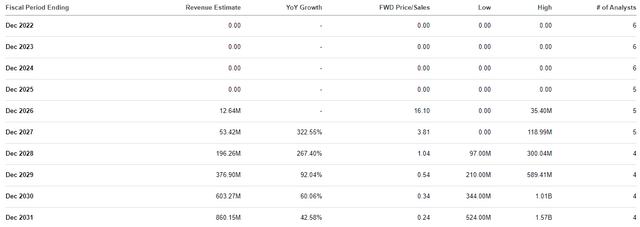

I consider GRPH does have a number of Bio Growth traits that point out outstanding upside potential from these present costs. Before everything, I consider GRPH is buying and selling at a reduction for its future projected revenues. The corporate’s gene modifying packages are projected to supply vital income within the second half of this decade as these packages doubtlessly hit the market. Certainly, the Avenue expects Graphite to report sturdy double-digit and triple-digit development in 2027 and will hit roughly $377M in income in 2029.

Graphite Bio’s Annual Income Estimates (In search of Alpha)

Graphite’s market cap is about $199M, so that might be a roughly 0.54x ahead price-to-sales. Seeing that the business’s common price-to-sales is 4x-5x, we will say GRPH is buying and selling at a reduction for its ahead income estimates. If the inventory was to be matched with its friends, we may see GRPH buying and selling round $17 per share close to the tip of the last decade. Certainly, Graphite will nearly actually must carry out some technique of dilution, and we will’t depend on these estimates. Nonetheless, these estimates do present GRPH’s upside potential, which is a elementary attribute of a Bio Growth ticker.

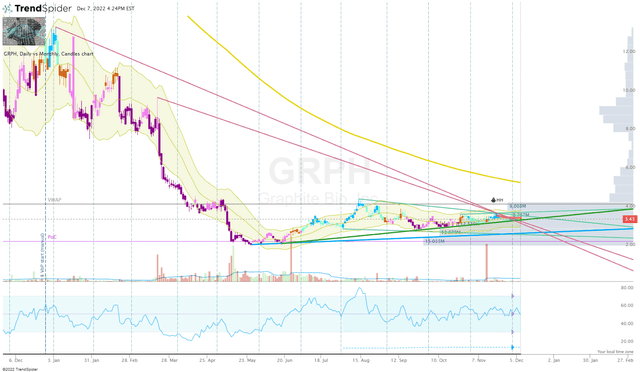

One other attribute to think about is the ticker’s oversold state because of the market-wide sell-off. Like many small-cap healthcare shares, GRPH has misplaced greater than 60% of its worth over the previous twelve months and has been “basing” since April of this 12 months. If the small-cap shares catch a robust bid within the coming months, GRPH ought to profit from the opportunity of the inventory shifting by gentle quantity as much as $7 per share.

GRPH Every day Chart (TrendSpider)

A imply reversion within the share worth may ship a chance to e-book substantial revenue and transition GRPH to a “home cash” standing.

One other “Bio Growth” attribute is GRPH’s long-term funding prospects. Graphite seems to have the platform and pipeline to be a tricky competitor in gene modifying. The corporate’s sturdy money place needs to be sufficient to get a few its pipeline packages by proof-of-concept, which may reveal if the corporate’s expertise is able to delivering. At that time, we should always have a greater concept if Graphite has the potential to make it by the FDA, thus bettering the corporate’s long-term outlook and presumably changing into labeled as an acquisition goal.

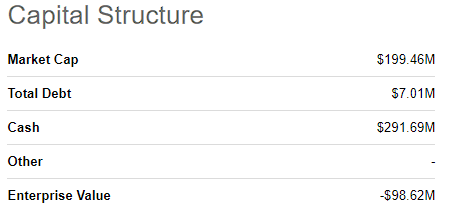

Lastly, I want to level out GRPH’s present valuation… particularly the very fact the ticker is buying and selling with a destructive enterprise worth.

GRPH Capital Construction (In search of Alpha)

Certainly, we’ve got to count on the corporate to burn by its money within the coming years because it continues to develop and develop its pipeline. Nonetheless, the very fact the ticker is buying and selling properly under money worth may assist gas a resurgence as soon as the small-caps begin to catch a bid.

Primarily, GRPH has the workings to carry out a robust reversion transfer for a swift revenue however, on the similar time, nonetheless has the weather wanted to change into a attainable multi-bagger down the highway.

Draw back Dangers

GRPH has plenty of draw back dangers that buyers want to think about when managing a place. First, there are the dangers related to gene remedy and the corporate’s unproven HSC gene modifying expertise. At this level, the corporate solely has preclinical information, however the lack of proof of idea in people makes GRPH extremely speculative. It’s attainable that Graphite’s expertise is just not successful, and might’t produce accepted therapies. One other concern is competitors, a few of whom are properly funded and have spectacular expertise that would enable them to provide superior therapies, or outcompete Graphite in the marketplace. Regardless of the corporate’s present money runway, funds are one other concern to control within the coming years. Graphite’s pipeline may be very younger and a great distance from approval, so we’ve got to count on that the corporate will in all probability must carry out some type of dilutive funding within the coming years.

Clearly, these points may change into important setbacks for the corporate and the share worth. In consequence, I’m giving GRPH a conviction degree of two out of 5 at this time limit.

Starter Recreation Plan

GRPH is not going to be a major piece of the Bio Growth Portfolio; nevertheless, I’m keen to begin a place after its ASH shows. I believe that we’ll see some extra promoting stress after the corporate’s presentation that can carry the share all the way down to the blue uptrend line from the all-time low, which is at present round $2.75 per share. This could be an excellent alternative to determine a starter place at an excellent low cost. As soon as I’ve established a place, I’ll look to make minuscule additions sporadically all through 2023 once I see strong reversal setups under my Purchase Threshold of $3.50.

My goal is to e-book earnings on a attainable imply reversion transfer that may ship a gap to take away my preliminary funding to transition my GRPH place right into a “home cash” state for a long-term funding. This fashion, I’ll nonetheless have some GRPH on the desk for upside potential, however it’ll solely revenue in danger.

No matter GRPH’s upside potential, buyers want to just accept that the ticker is speculative with appreciable draw back dangers right now. It’s conceivable an investor may lose the majority or all of their funding.