bodnarchuk

Introduction

The Toronto-based Alamos Gold (NYSE:AGI) launched its third quarter of 2022 outcomes on October 26, 2022.

Observe: This text is an replace of my article revealed on July 31, 2022. I’ve adopted AGI on Searching for Alpha since August 2017.

1 – 3Q22 Outcomes Snapshot

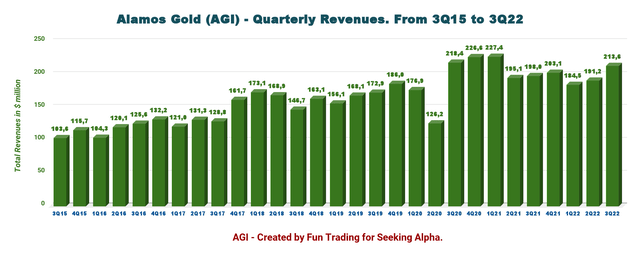

The corporate posted revenues of $213.6 million in 3Q22 and a internet lack of $1.4 million, or $0.00 per share. Revenues have been up 7.9% from 3Q21.

AGI declared a quarterly dividend of $0.025 per share (annualized price of $0.14, or a yield of 1.38%).

With year-to-date manufacturing of 326.2K ounces of gold and an additional improve in manufacturing anticipated within the fourth quarter, the Firm stays on monitor to realize full-year steerage of 440K to 480K ounces.

On a year-to-date foundation, $37.5 million has been returned to shareholders by way of dividends and share buybacks. This consists of the repurchase of 1.1 million shares at the price of $8.2 million ($7.41 per share) underneath the Firm’s Regular Course Issuer Bid.

Luc Guimond has been appointed Chief Working Officer, efficient September 1, 2022.

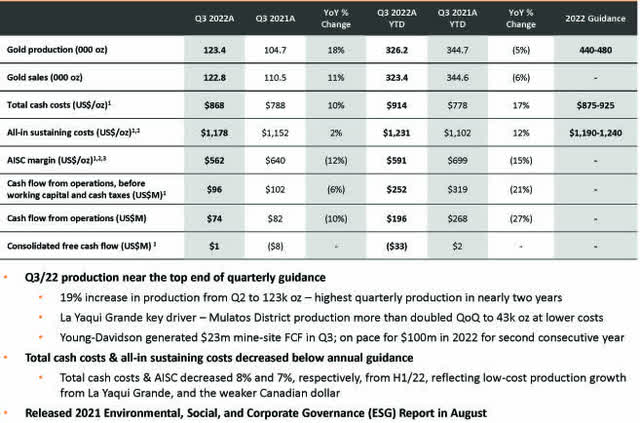

Under is proven the 3Q22 highlights:

AGI 3Q22 highlights (AGI Presentation)

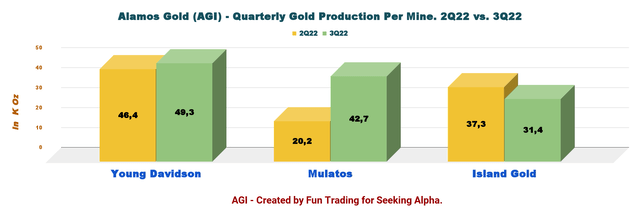

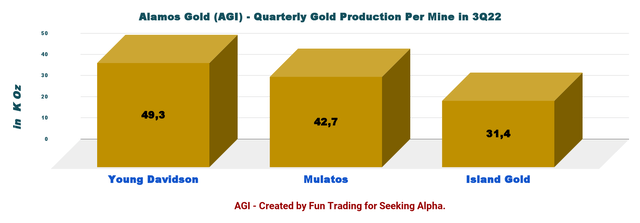

The quarterly gold manufacturing was 123.4K Au ounces, a 17.9% improve from the third quarter of final yr. The rise was defined by a stable efficiency at Mulatos district with 25K Au Oz from La Yaqui and Younger Davidson.

AGI Quarterly Manufacturing 2Q22 versus 3Q22 (Enjoyable Buying and selling)

La Yaqui Grande achieved preliminary gold manufacturing in June 2022, following the completion of development forward of schedule. La Yaqui Grande produced 25k Au Oz in September (Mulatos district).

AGI La Yaqui Grande (AGI Presentation)

Alamos Gold additionally runs two different ongoing tasks in the intervening time. Gold manufacturing is anticipated to extend considerably by 2025.

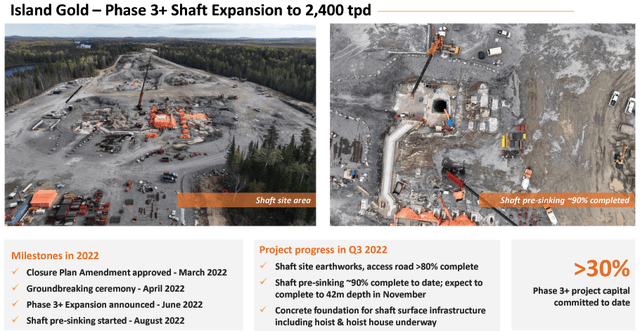

The Island Gold growth Part 3+ Ontario, Canada. (With 2,400 TPD by 2026). Development actions on the Part 3+ Enlargement ramped up, together with the beginning of the pre-sink of the shaft in August. The Lynn Lake mission with development resolution is anticipated in H2 2022 (EIS approval and development resolution). The common annual manufacturing anticipated is 143K Au ounces over a 10-year mine life at a median mine-site AISC of $745 per ounce.

2 – Inventory Efficiency

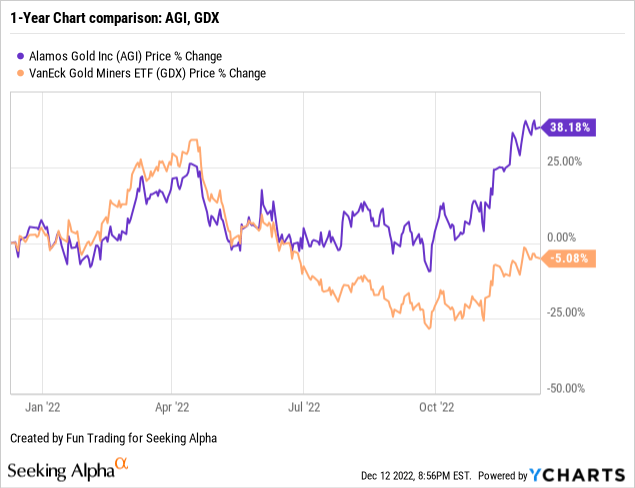

AGI is outperforming the VanEck Gold Miners ETF (GDX) and is now up 38.2% on a one-year foundation.

John A. McCluskey, President and Chief Govt Officer, mentioned within the convention name:

we had a robust third quarter led by one other stable efficiency from Younger-Davidson and a standout consequence from La Yaqui Grande in its first full quarter of operation.

3 – Funding Thesis

The funding thesis continues to be the identical as indicated in my previous articles. Alamos Gold is a superb firm with glorious financials, no debt, and stable money.

The La Yaqui Grande is now producing and double manufacturing on the Mulatos district in 3Q22. The lately reported outcomes of the Part 3+ Enlargement Research performed on the Island Gold mine exhibit a major progress potential for the following few years, reinforcing the rationale for a long-term funding primarily based on stable multi-year gold manufacturing from the Americas.

AGI Island Gold growth replace (AGI Presentation)

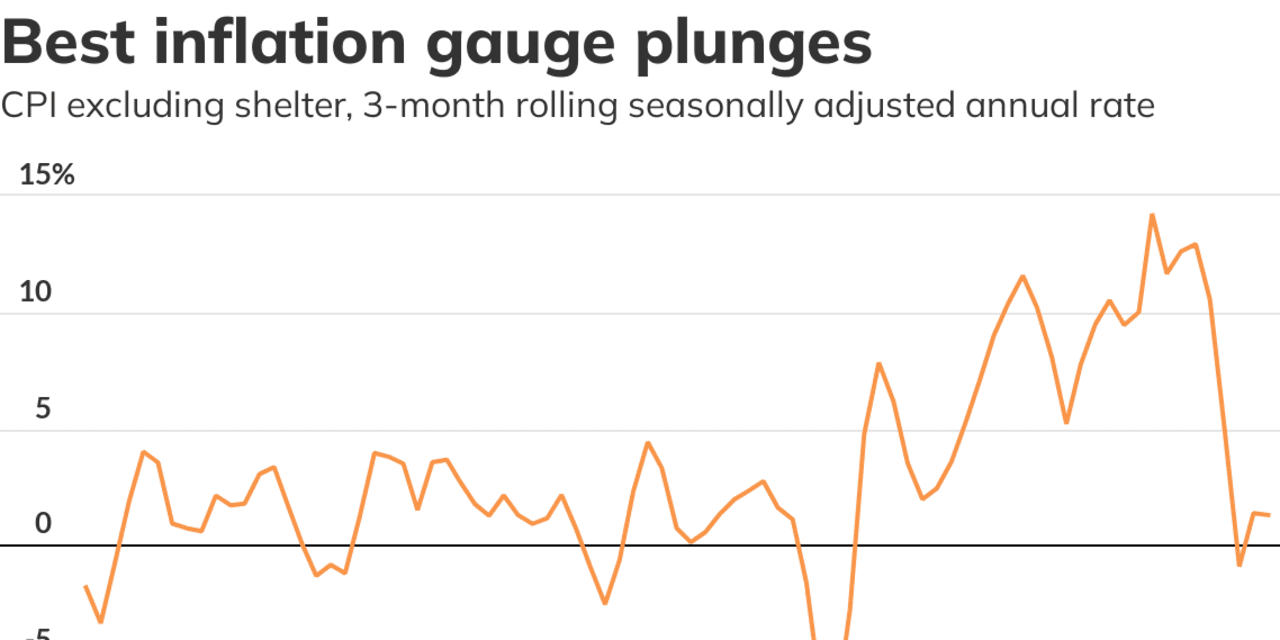

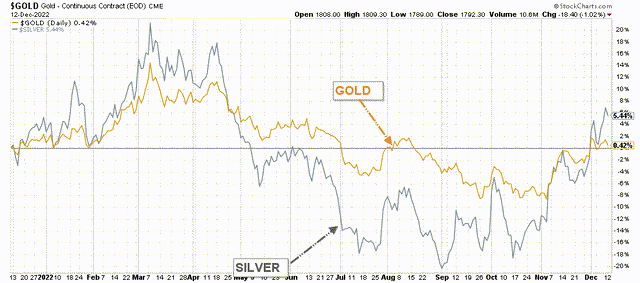

Gold trended up from a latest selloff in September, forming a bullish Cup and Handles formation. Nevertheless, the Fed might shortly trash this optimistic outlook if the CPI for November disappoints. This outlook makes an funding in gold miners much more interesting.

Inflation is a regarding problem for the worldwide economic system, and it’s more and more evident that we might slide right into a recession in 2023.

AGI Gold and silver comparability 1-year foundation (Enjoyable Buying and selling StockCharts)

Alamos Gold – Monetary Snapshot 3Q22 – The Uncooked Numbers

Alamos Gold 3Q21 4Q21 1Q22 2Q22 3Q22

Whole Revenues $ million

198.0 203.1 184.5 191.2 213.6 Quarterly Earnings in $ million 25.10 29.5 -8.5 6.4 -1.4 EBITDA $ million 100.0 88.0 70.9 69.7 84.8 EPS (diluted) $ per share 0.06 0.07 -0.02 0.02 0.00 Money from Working Actions $ million 82.4 88.1 46.5 75.7 74.0 CapEx in $ 89.2 119.0 87.3 69.0 72.6 Free Money Circulation -6.8 -30.9 -40.8 6.7 1.4 Whole Money $ million 234.3 196.4 145.2 144.0 132.0 Whole LT Debt in $ million 0 0 0 0 0 Dividend $/share (semi-annual) 0.025 0.025 0.025 0.025 0.025 Shares Excellent 395.9 392.3 391.9 394.5 391.8 Click on to enlarge

Supply: Firm press launch

* Estimated by Enjoyable Buying and selling

Alamos Gold Monetary Evaluation

1 – Revenues have been $213.6 million within the third quarter of 2022

AGI Quarterly Income historical past (Enjoyable Buying and selling)

The corporate indicated a internet lack of 1.4 million, or $0.00 per share, down from an revenue of $25.10 million, or $0.06 per share in 3Q21.

Generated money circulate from working actions of $74.0 million ($96.1 million, or $0.25 per share, earlier than adjustments in working capital).

The price of gross sales was $168.1 million within the third quarter, 30% larger than the prior-year interval.

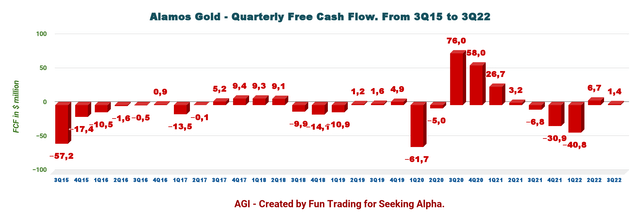

2 – Free money circulate was estimated at $1.4 million in 3Q22

AGI Quarterly Free money circulate historical past (Enjoyable Buying and selling)

Trailing 12-month free money circulate was a lack of $63.6 million, and the corporate posted an FCF of $1.4 million in 3Q22. Free money circulate will probably improve with the completion of La Yaqui.

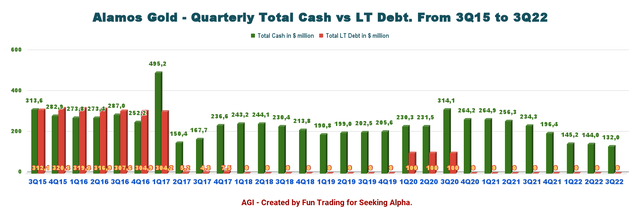

3 – The corporate is debt-free (internet money) and had whole money of $132 million in 3Q22. Liquidity was $616.7 million

AGI Quarterly Money versus Debt historical past (Enjoyable Buying and selling)

Alamos Gold ended the third quarter with money and money equivalents of $116.7 million, fairness securities of $15.3 million, and no debt. Within the press launch:

As at September 30, 2022, the Firm had money and money equivalents of $116.7 million and $15.3 million in fairness securities, in comparison with $172.5 million and $23.9 million, respectively, at December 31, 2021.

As well as, the Firm has entry to $500.0 million of liquidity accessible underneath its credit score facility. Within the opinion of administration, the Firm’s liquidity place of $616.7 million at September 30, 2022 comprised of money and money equivalents and availability underneath the credit score facility, along with money flows from operations, is adequate to help the Firm’s regular working necessities and capital commitments on an ongoing foundation.

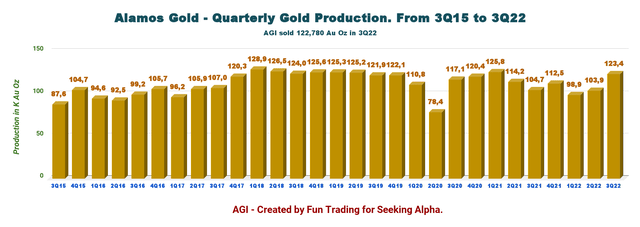

4 – Whole quarterly manufacturing in 3Q22 was 123.4K Au ounces and bought 122.78K Au ounces

AGI Quarterly Gold Manufacturing historical past (Enjoyable Buying and selling)

Alamos Gold mentioned it bought 122,780 ounces of gold within the third quarter at a median realized worth of $1,740 per ounce for revenues of $213.6 million.

Alamos Gold posted third-quarter manufacturing of 123.4K ounces,

Under is the 3Q22 manufacturing per mine:

AGI Quarterly Gold manufacturing per mine in 3Q22 (Enjoyable Buying and selling)

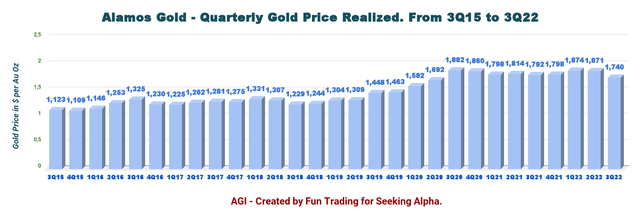

The worth of gold realized for the third quarter was $1,740 per ounce, down 7% sequentially.

AGI Quarterly Gold worth historical past (Enjoyable Buying and selling)

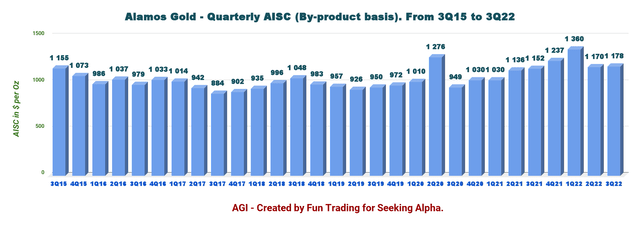

All-in sustaining prices, AISC, have been decrease this quarter at $1,178 per ounce. Regardless of inflationary pressures, the corporate considerably maintained its AISC under $1,200 this quarter.

AGI Quarterly AISC historical past (Enjoyable Buying and selling)

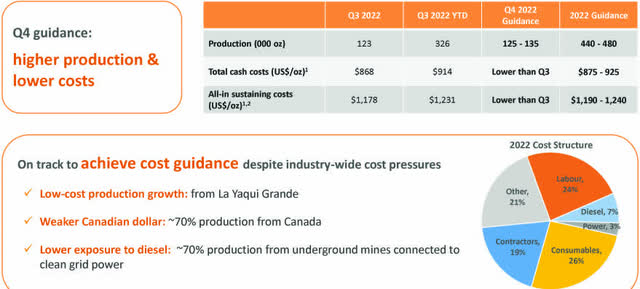

5 – 2022 Steering

As indicated in my earlier article, Alamos expects secure manufacturing in 2022, with a 4% progress anticipated in 2023.

Manufacturing is anticipated to be between 440K oz and 480K oz in 2022 and a rise of 4% (mid-point of steerage) to between 460K and 500K oz in 2023 and 2024.

AGI 2022 Steering (AGI Presentation)

The corporate’s all-in sustaining prices steerage is anticipated to be $1,190 to $1,240 per ounce in 2022, bettering to $950 to $1,050 per ounce in 2024.

AISC is anticipated to lower roughly 18% from 2022 to 2024 (primarily based on the mid-point of steerage), reflecting decrease prices at Mulatos and Island Gold.

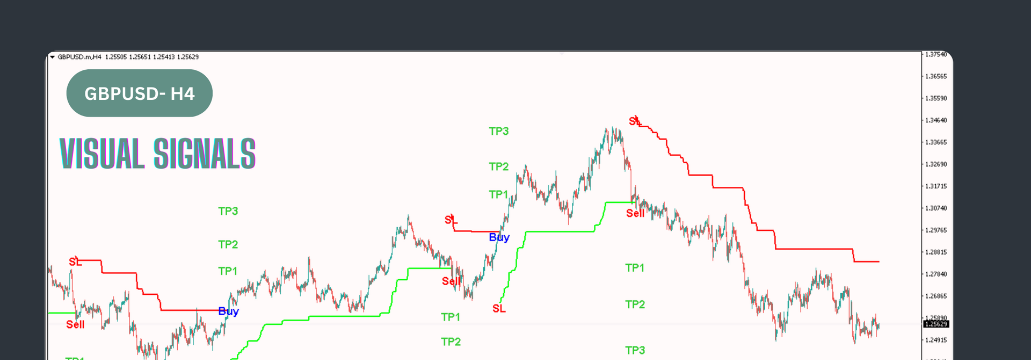

Technical Evaluation (Brief Time period) And Commentary

AGI TA Chart short-term (Enjoyable Buying and selling StockCharts)

Observe: The chart has been adjusted for the dividend.

AGI chart reveals an ascending wedge sample with resistance at $10.2 and help at $9.8. The ascending wedge sample is a bearish chart sample that alerts an imminent breakout to the draw back. One other indicator is that the RSI is 63, which is near overbought.

The overall technique I normally promote in my market for AGI is to maintain a core long-term place and use about 30%-40% to commerce LIFO whereas ready for the next closing worth goal in your core place between $11 and $12.

I recommend promoting about 30%-40% of your place between $10.35 and $10.15.

I recommend shopping for AGI between $9.8 and $8.5. Nevertheless, relying on the Fed’s choices tomorrow, AGI might retest $7.85 if the market sells off, which is a superb worth for long-term traders.

Conversely, if the market turns bullish after December 14 with 50 factors rise and a reasonable future outlook, AGI might escape and retest $11-$12.

Watch the gold worth like a hawk.

Warning: The TA chart should be up to date often to be related. It’s what I’m doing in my inventory tracker. The chart above has a attainable validity of a couple of week. Bear in mind, the TA chart is a device solely that can assist you undertake the suitable technique. It isn’t a option to foresee the longer term. Nobody and nothing can.

Creator’s be aware: If you happen to discover worth on this article and want to encourage such continued efforts, please click on the “Like” button under as a vote of help. Thanks.