Introduction & Thesis

Jean-Luc Ichard

Whereas reviewing numerous analysis stories, I got here throughout a current report from Goldman Sachs that was despatched to financial institution shoppers on December 5, 2022. In it, the analysts take a look at the tactical positioning of mutual funds (x-axis) and hedge funds (y-axis) and conclude that FAAMG corporations are at the moment underweight:

Goldman Sachs, 2023 US Fairness Outlook [December 5th, 2022], creator’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-1671005118274807.png)

That’s, demand for these shares from institutional buyers has fallen for one cause or one other. Just lately, I’ve already printed particular person articles on a few of these corporations, particularly:

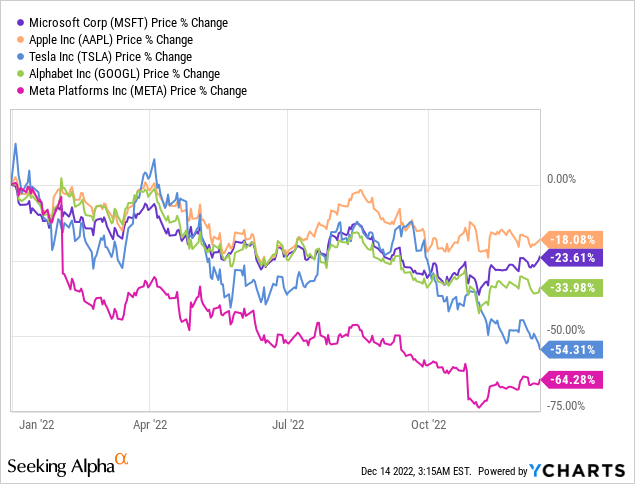

Nevertheless, I’ve by no means touched Microsoft Company (NASDAQ:MSFT) earlier than right here on Looking for Alpha, though MSFT is likely one of the most steady mega-cap shares along with Apple (AAPL):

I think about Microsoft one of the vital steady in its area of interest, however on the similar time nonetheless fairly costly to purchase now, even after a 23% YTD drawdown. In my view, we are going to nonetheless have an excellent alternative to purchase MSFT close to the underside – my evaluation suggests such a possibility in 2023. Subsequently, I strongly advocate that you simply get your dry powder prepared till then.

Why do I feel so?

I recommend dwelling on the above Goldman Sachs report for some time and analyzing it in additional element. As I perceive it, the chart you noticed above is predicated on the inflows and outflows of two teams of institutional buyers – a constructive distinction within the complete flows signifies a tactical chubby, and a unfavorable signifies an underweight.

The “dangerous information” applies to all FAAMG corporations directly – why are you studying particularly about MSFT now?

The purpose is that MSFT is crucial firm for many institutional buyers (hedge funds). As the identical GS report exhibits, offered that this place is among the many 10 largest holdings, it reaches 8% of the whole portfolio on common:

Goldman Sachs, 2023 US Fairness Outlook [December 5th, 2022], creator’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710069121667004.png)

On the similar time, the corporate is among the many candidates for extra modest EPS development and a decrease web margin in contrast to what’s at the moment priced in:

Goldman Sachs, 2023 US Fairness Outlook [December 5th, 2022], creator’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710074610608304.png)

From this, I conclude that within the situation the place Microsoft fails to satisfy buyers’ expectations of upcoming earnings (within the subsequent quarter or perhaps a few quarters later), the inventory may very well be affected by an enormous exit of hedge funds from their positions.

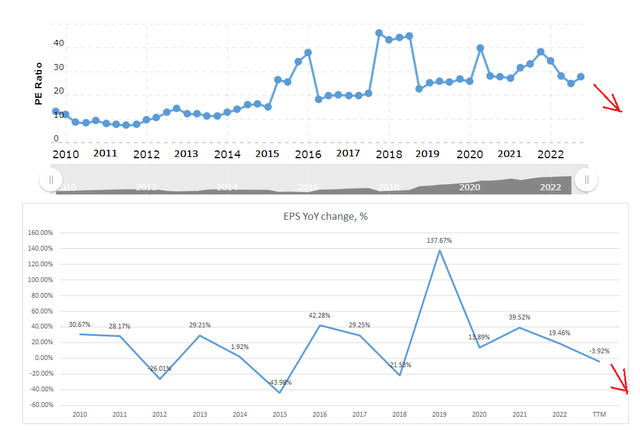

Decrease earnings will demand extra modest multiples from the corporate for a much less rosy future – in any case, I feel there may be room to maneuver down in MSFT valuation multiples at the moment:

Creator’s calculations, based mostly on macrotrends.web and roic.ai

2018 was notable for MSFT regardless of falling EPS (it fell over 22% YoY). That 12 months, the corporate skilled frenetic development in its cloud phase, launched Home windows 10, and purchased GitHub – all of which mixed to permit the inventory to develop >35% whereas sustaining an unnaturally excessive P/E of 40-45x.

In 2015, though layoffs and the cellphone enterprise weighed closely on Microsoft’s monetary outcomes (EPS declined 44% YoY), it was the corporate’s success within the cloud that helped its share worth rise 20%. Some acquisitions pointed to a probably shiny future for the corporate – and that allowed MSFT to justify the rise in its a number of from a median P/E of 15.9x in 2014 to 31.2x in 2015.

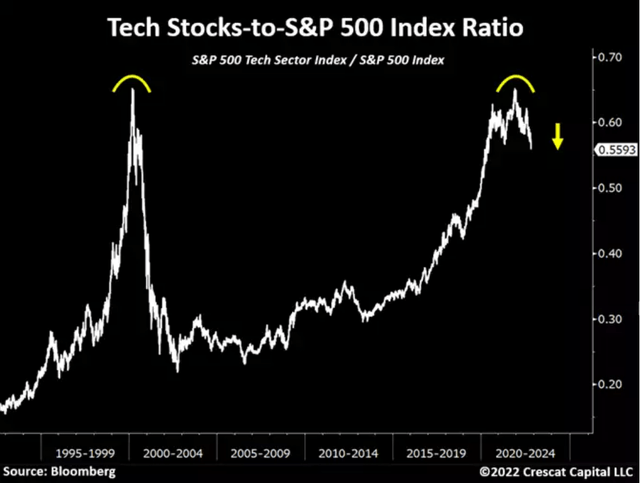

I rightly anticipate 2023 to be like no different. Nevertheless, my impression is that MSFT inventory, which together with different greatest expertise corporations takes up too giant a share of the general market, is prone to shrink as liquidity is blown away out there – this image appears to be like too unsustainable to stay related within the occasion of downward revisions to EPS numbers:

Crescat Capital Goldman Sachs, 2023 US Fairness Outlook [December 5th, 2022], creator’s notes

![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710126621894996.png)

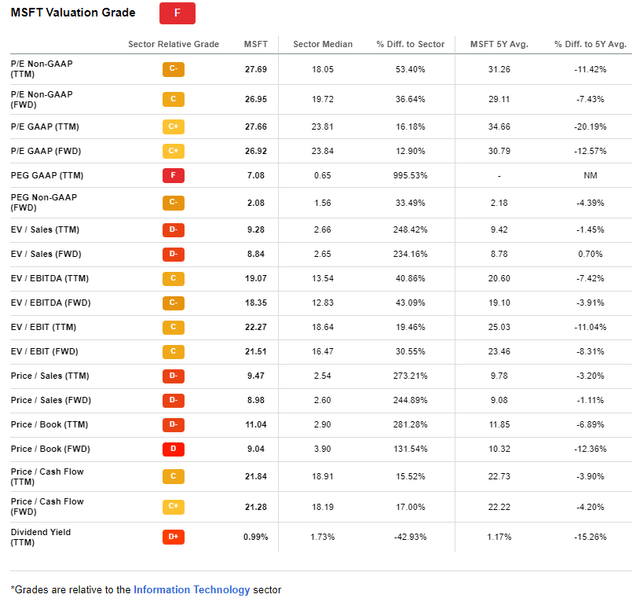

In my view, many of the firm’s a number of is just not because of upside potential – EPS development of solely 17.5% is projected for the following 2 years – however to the liquidity that the Fed has pumped into the market over the previous few years. Why? As a result of when the corporate was rising at 20-30% per 12 months (by way of earnings per share), its common annual P/E ratio was solely 15-20x, and now it is 27.7x, making the corporate grossly overvalued in comparison with all the IT sector:

Looking for Alpha, MSFT, Valuation

The difficulty of market liquidity was lately addressed by Tony Pasquariello, world head of hedge fund shopper protection at Goldman Sachs [below is his Dec. 9 note]:

I can’t see the argument for lasting, important upside: with QT and unfavorable earnings revisions simply beginning to actually kick in — alongside cash market charges which might be assuredly heading greater — we’re going into 2023 with a inventory market that expenses an 18 a number of for the prospect of … 0% earnings development.

MSFT’s EPS has been revised 36 occasions within the final 3 months – all revisions have been to the draw back. I anticipate analysts to maintain revising their worth targets within the subsequent few quarters based mostly on even decrease EPS numbers or multiples – this isn’t only a drawback for MSFT, however for all the inventory market. In any case, the macroeconomic fashions [provided by Alf from The Macro Compass, November 24, 2022] point out the inevitability of this course of:

Alf from The Macro Compass [November 24, 2022]![Alf from The Macro Compass [November 24, 2022]](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710146534760742.png)

Subsequently, I need to advocate promoting the rips in MSFT inventory (or no less than holding the inventory) for the following 6 months and never including at present ranges.

Backside Line

Within the very long run, I stay optimistic due to Microsoft’s distinctive market place – greater than 70% of OS’s market share and greater than 1/5 of the entire cloud market share enable the corporate to speculate intelligently and diversify accrued money flows into applied sciences reminiscent of OpenAI’s ChatGPT, which stunned everybody just some days in the past. SA fellow Livy Funding Analysis even known as this expertise the corporate’s “prescient funding,” which it more than likely is.

I additionally like the corporate’s improvement within the gaming house – turning into the market chief with a projected long-term CAGR of 9% appears to be like fairly fascinating as this development will be leveraged by way of synergies from the mixing of the corporate’s different merchandise.

Nevertheless, I anticipate a pointy decline in earnings per share in 2023 – or no less than a P/E a number of contraction to mirror slowing development [compared to the 2021-22 high base] – so MSFT will seemingly turn into undervalued once more someday in mid-2023. Then we’ll all want plenty of dry powder to purchase the dip – however now, Microsoft inventory is a robust Maintain for me.

Thanks for studying!