JStuij/iStock through Getty Pictures

Expensive readers/followers,

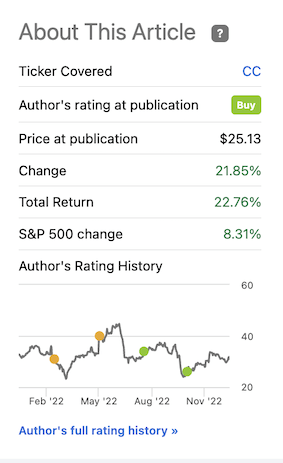

For the previous 12 months and extra, I have been overlaying Chemours (NYSE:CC), and we have seen the corporate decline increasingly more – solely to not too long ago bounce again up. This resulted in some spectacular charges of return for the brief time period, a minimum of when wanting on the outcomes primarily based on my most up-to-date article.

In search of Alpha, Chemours Article (In search of Alpha)

On this article, I will revisit my general optimistic thesis right here, which you’ll see has began to succeed in the value targets and valuations the place I then historically held a extra impartial stance on the enterprise.

So is it time to revisit that impartial stance?

An replace on Chemours Firm

Chemours has been on an absolute tear. From a really unfavourable return from my first bullish article, this latest one roughly recovered elements of these losses. Not many different contributors nonetheless cowl this firm – even when there was a minimum of one article about it as of late. I can perceive the reasoning behind this. It is a dangerous firm. It is a firm that does not precisely fulfill my calls for within the context of fundamentals and historic security.

Nonetheless, let’s wrap right here for a second – as a result of Chemours is fascinating – each to you and to me, and the very fact is that presently, the full long-term RoR since my first article again nearly a 12 months in the past, has outperformed the S&P 500 by nearly 20%, even when I used to be impartial again at first.

Chemours is an fascinating enterprise. It does Titanium Tech, Thermal & Specialised options, Efficiency supplies and Chemical options. Competitors does exist in nearly each firm section – together with friends corresponding to INEOS AG, Tronox (TROX), Honeywell (HON), Daikin Industries (OTCPK:DKILF)(OTCPK:DKILY), 3M (MMM), Cyanco Corp, and plenty of others, relying on what section you are .

The corporate continues to be junk-rated. No enchancment there in any respect – it is BB-rated – though the development we will see from a minimum of a 12 months in the past is that the enterprise has managed to take away the unfavourable mark, from BB- to BB. A slight enchancment, however nonetheless methods to go earlier than IG-rating.

To be completely clear right here, seasonality and volatility are expressed within the firm’s share worth, the place buyers since 2015 have been handled typically to market-beating returns, however with a whole lot of volatility in between – and admittedly, would have been higher off promoting at overvaluation.

However on the identical time, there’s a lot to love about this firm. Gross sales are extremely specialised services and products to industrial clients, with only a few middlemen. The corporate does function a distributor community for particular product strains and geographies, and gross sales are made both by means of one-time buys/spot buys or long-term contracts.

Additionally, dividend progress has been good, with double-digit CAGR progress over the previous few years, and the corporate nonetheless go lower than 50% of its earnings in dividends underneath present ranges.

Finish markets for key segments are very enticing…

CC IR (CC IR)

…and moreover, the corporate’s merchandise are utilized by nearly each section of consumers on the planet, making for an interesting type of fundamentals.

We’ve got 3Q22 which got here out in November because the latest set of outcomes – and these outcomes are actually what pushed the corporate upward as a lot as we have seen over the previous few weeks and months, producing double digit returns. Regardless of monitoring beneath its steerage vary when it comes to adjusted EBITDA and FCF, the corporate’s operational stability is spectacular – regardless of unsure market demand as a consequence of macro outlooks.

4Q seasonality stays a factor – and we should always count on for 4Q22 to essentially be extra risky. The corporate can also be taking value actions to mitigate the extra critical volatility we may be experiencing right here.

The corporate’s targets stay clear.

CC IR (CC IR)

At its coronary heart, CC even in 2022-2023 and ahead stays a play on Titanium Dioxide. The corporate’s foam, refrigerant and fluoropolymers are collectively lower than 50% of the general income. Over 51% of the corporate’s annual gross sales comes from numerous types of Titanium Dioxide and different minerals, with a geographic tilt in direction of NA with 42% of firm gross sales. Firm EBITDA outcomes have been actually reasonably unfavourable for many of the firm, however once more, there are causes for this that the corporate actually cannot management.

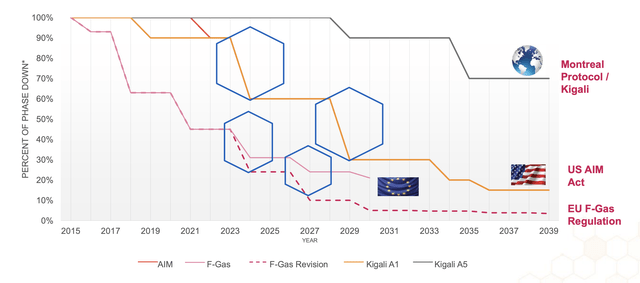

At its coronary heart although, this firm stays a stable type of enterprise, and a number one supplier of the product it really works with. Regardless of being smaller when it comes to gross sales of refrigerants, the corporate is amongst the world-leading firms in refrigerants, and is a class chief with its next-gen low GWP expertise and co-developed HFO tech. Regulatory developments stay totally in favor of Opteon adoption.

CC IR (CC IR)

And there’s a world TAM that’s many instances as massive as the corporate is at present working with – so loads of room to develop right here.

Demand developments for Chemours stay, regardless of some points in macro right here, comparatively stable. Chemical firms have seen these types of optimistic demand developments for over a 12 months now.

Firms, which additionally embody Chemours, have been in a position to push worth will increase with a view to retain their margins and offset the associated fee will increase that we’re at present seeing throughout all the market.

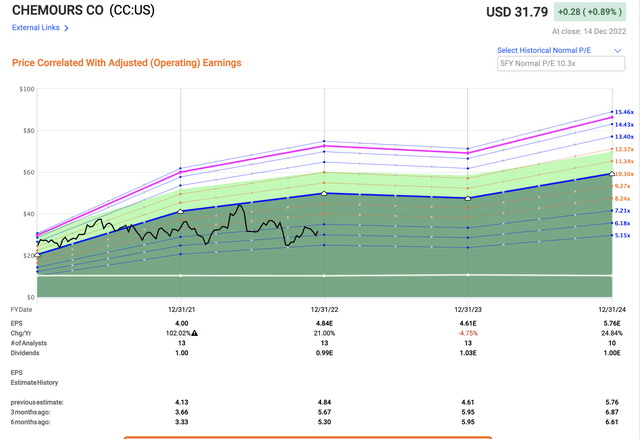

These developments stay, and these developments are why the analysts following the corporate expect an adjusted EPS progress for 2022 of 21% YoY, regardless of a 102% EPS progress in 2021. So regardless of these forecasts being famous down by about 10-15% over the previous few months, the general anticipated developments are nonetheless optimistic.

The corporate’s major challenges stay macro-focused. And macro is not one thing Chemours can actually affect. What we will say for the following couple of years is that earnings will possible see extra progress in 2024, however that 2023 will possible stay considerably impacted – barely unfavourable or flat in comparison with 2022.

These latest quarterlies mark what I imagine to be a “new regular” for the corporate when it comes to EPS from which I do not imagine we’ll see a large near-term decline right here. 1Q22, 2Q22, and 3Q22 all delivered outcomes that decision for EPS to develop in 2022.

The corporate is doing this on the again of Opteon growth, web gross sales improve, and its elevating FCF steerage to $575M+ for the 12 months – or extra.

The chance presently that ought to be checked out, to offer a good image of the corporate, is the general affect of the gross sales slowdown. The corporate had a TiO2 slowdown again in 2019 as nicely, and the affect within the following years on EPS was brutal – nonetheless, the distinction from again then is that the corporate’s enterprise and contracts have been structured in a different way. The corporate additionally characterizes 2019 as extra of a share loss, because of the firm implementing processes on the time, and since then, Chemours has regained many of the misplaced market share.

As we mentioned early within the 12 months, about 80% or so of our enterprise was contracted. And so we count on that ratio to remain roughly in line. It varies from quarter-to-quarter. However our contracted enterprise is nice. And clearly, the worth proposition with TVS is we reply to the market demand indicators of our clients, and we’re seeing that throughout the portfolio. As we mentioned in our information in September, we’re already seeing this extra so in Europe and in Asia, particularly in Mainland China. And volumes and demand proceed to do nicely within the Americas, North America and Latin America.

(Supply: Mark Newman, 3Q22 Earnings Name)

So, it is not precisely the identical story as again then. CC is responding this time by dialing down manufacturing the place wanted. My very own suggestion right here is reasonably than wanting on the P&Ls of the quarterlies, I might have a look at the TTM numbers, as these considerably extra non-seasonal developments have a tendency to offer a fairer perspective on the corporate’s outcomes.

Over to valuation.

Chemours Valuation

Regardless of some enchancment, Chemours stays a really conservatively valued enterprise at a low a number of. We’re at present buying and selling the corporate at a blended P/E of round 6.62x – no larger than that, regardless of the restoration. That is considerably beneath the typical of round 9.5x. The corporate now yields 3.15%, and Chemours stays a close-to-$5B market cap chemical firm with loads of merchandise and developments getting into its favor.

Additionally, the corporate stays to commerce able that is very unfavorable, and utterly against the place the following few years of developments are anticipated to go.

F.A.S.T. Graphs Chemours Upside (F.A.S.T. Graphs)

Even buying and selling flat at not more than 6.18x, the upside for this firm continues to be there. At such outcomes you’d be RoR’ing about 9% yearly, or shut to twenty% till 2024E – and achieve, that is decrease than the corporate is at present buying and selling when it comes to P/E-multiples.

I will not be calculating the corporate at 10x – the typical is 9.5x, and at such a risky type of sample, I need to keep conservative. So at 9.27x ahead P/E, the potential RoR for Chemours continues to be 31.22% per 12 months, or near 75% till 2024E.

That is a really excessive type of upside, purchased at a really low valuation, for an organization that regardless of BB is not actually going anyplace. That is how I see it.

Analyst valuation for this enterprise stays principally optimistic. Road targets listed here are decrease because of the impacted 3Q22 demand scenario – however we’re nonetheless at near $34/share, which is an upside of a minimum of 6-7% right here at this worth, and I view this goal to be considerably too conservative from the 12 analysts following the enterprise as issues at present stand. The actual fact is, 8 analysts thought of the corporate a “BUY” when it traded at 33.56 a 12 months again, however that quantity is down to three now, regardless of the corporate being cheaper.

Chemours has not turn into much less qualitative within the time – the market has modified. Properly, I make investments past market cycles and for the long run. For that cause, I stay with my Chemours targets presently, and that is my present thesis for Chemours.

Present Thesis

My present thesis for Chemours Firm is the next:

The corporate is essentially interesting as a consequence of its chemical portfolio however is hounded by potential authorized points and dangers – each future and historic, in addition to an unappealing legal responsibility profile. This must be discounted for, nevertheless it’s solely potential to take action – simply maintain your targets beneath 11-13x P/E and a share worth of $40/share. Improved outlooks have confirmed my preliminary bearishness to be exaggerated. I modify accordingly and provides the corporate allowance for future outperformance. I bump my worth goal right here. I maintain CC as a “BUY” and “Bullish” ranking, with an general worth goal of $35, beneath the present analyst common, however thought of honest on a peer and danger/reward comparability.

Bear in mind, I am all about:

Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime. If the corporate goes nicely past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

This firm is general qualitative. This firm is essentially secure/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low cost. This firm has a sensible upside that’s excessive sufficient, primarily based on earnings progress or a number of growth/reversion.

As issues stand now, the corporate continues to be a “BUY”, and it fulfills each standards that I’ve besides one – the standard, as a consequence of its non-IG-rating.