VioletaStoimenova/E+ through Getty Pictures

Lincoln Nationwide Company (NYSE:LNC) faces market headwinds, hammering its progress. Nevertheless it stays an business staple, a sturdy big promising a rebound. For now, it should take care of macroeconomic storms and navigate the market. Rate of interest hikes are each a progress driver and a hindrance for the corporate. Fortunately, it has ample money reserves to maintain the operations Additionally, borrowings and dividends keep well-covered with a better-than-market index common yield. Nonetheless, the inventory worth continues to dip. It matches the contracting tangible guide worth and inventory buyback potential of the corporate. However it’s already cut price and should rebound when the corporate’s efficiency and the economic system enhance.

Firm Efficiency

The insurance coverage business has seen a sudden but long-lasting market growth within the final two years. With the elevated hospitalizations and mortalities, life insurance coverage and annuities grew to become a staple. The unprecedented occasions have pushed many individuals to acknowledge their significance. Correct monetary planning and safety have develop into standard developments. And even immediately, extra individuals are turning to the insurance coverage business.

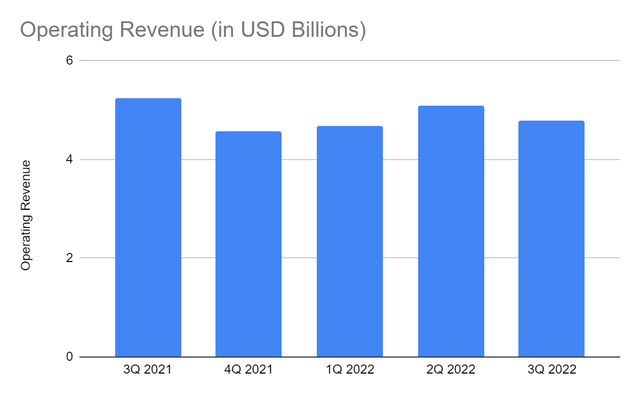

Lincoln Nationwide Company, a Pennsylvanian Large, additionally benefited from the state of affairs. The near-zero costs and rates of interest attracted extra prospects and raised safety yields. Now, it sees combined market influence as rate of interest hikes persist. Its working income is $4.78 billion, a 9% year-over-year lower. It’s beneath the five-quarter common of $4.84 billion. However given the market situations and the near-average worth, revenues stay comparatively steady. Life insurance coverage and annuities stay the first income segments. But, hindrances are seen in them. Varied elements contribute to those adjustments. I’ll concentrate on the 2.

Working Income (MarketWatch)

First, rate of interest hikes convey combined outcomes. Traditionally, insurance coverage has been one of the vital interest-sensitive industries. Though insurers and reinsurers should not created equal, a constructive correlation exists. And Lincoln isn’t an exemption from this. In essence, greater rates of interest imply extra engaging insurance coverage coverage pricing. And because it anticipates greater rates of interest, coverage pricing is extra strategic immediately. We are able to see how pricing and inflows modified in 3Q 2022. In flip, it enjoys greater premiums with an 11% year-over-year progress. Certainly, it’s well-positioned towards potential recessionary headwinds. It continues to optimize its gross sales combine by focusing extra on viable merchandise and segments. Once more, new and renewed coverage pricing is extra strategic, aiming at a mid-single-digit progress price. It offsets coverage decreases as a result of market pessimism, decrease buying energy, and elevated claims of policyholders.

Nonetheless, rate of interest increments don’t at all times work in LNC’s favor. It lowers yields on securities and different belongings, resulting in extra asset inclinations. We are able to observe it within the substantial improve in realized good points. Much more difficult, most of its funding securities should not inflation-linked. As an example, nearly all of investments are AFS securities. Virtually 80% of AFS securities are company bonds. Solely 5% of AFS are government-backed securities and are the one inflation-linked securities. Therefore, LNC cannot hedge safety dangers and decrease valuation, resulting in decrease funding earnings.

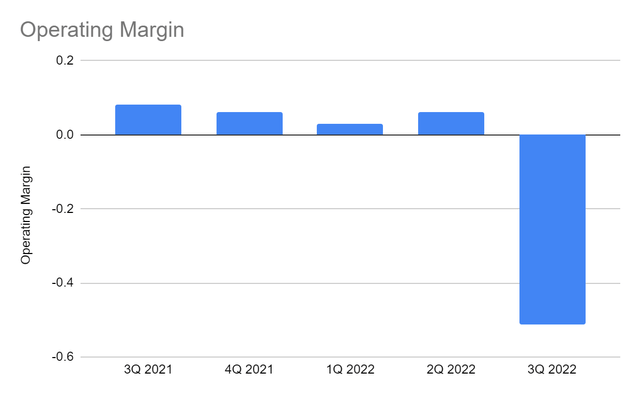

Second, LNC faces lapses within the GUL insurance coverage section, reducing the RBC ratio. Unsurprisingly, there have been substantial adjustments in charges and claims. They drive decrease revenues and an working margin of -51% this quarter. Even so, the remaining portion of core working bills is steady. Additionally, LNC stays well-capitalized, though it should rebuild it to the 400% goal subsequent 12 months.

Working Margin (MarketWatch)

Lincoln Dangers And Alternatives

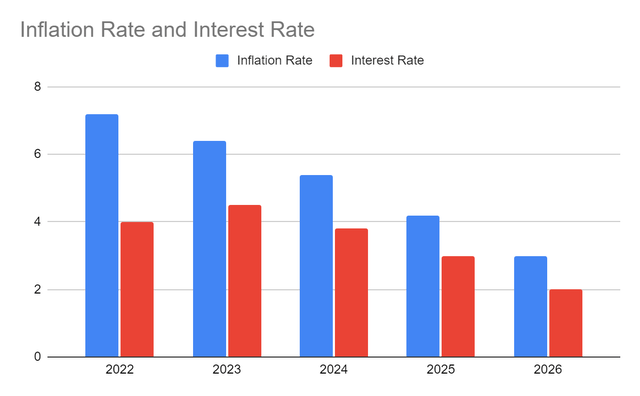

Inflation and rate of interest hikes are each progress drivers and hindrances to LNC. Nonetheless, they hamper the corporate’s progress greater than drive it. Even when we exclude the influence of claims, the effectivity ratio will nonetheless be decrease at 41% versus 48% in 3Q 2021. It should enhance safety yields, keep strategic coverage pricing, and stabilize bills. So, it’s a good factor that inflation has been cooling down because it dropped to 7.1% just lately. Hopefully, it signifies that the 9.1% inflation is the height. It may well decelerate rate of interest increments to keep away from racing 5% within the subsequent twelve months. My estimation can also be optimistic, anticipating a continued lower.

Inflation Price And Curiosity Price (Creator Estimation)

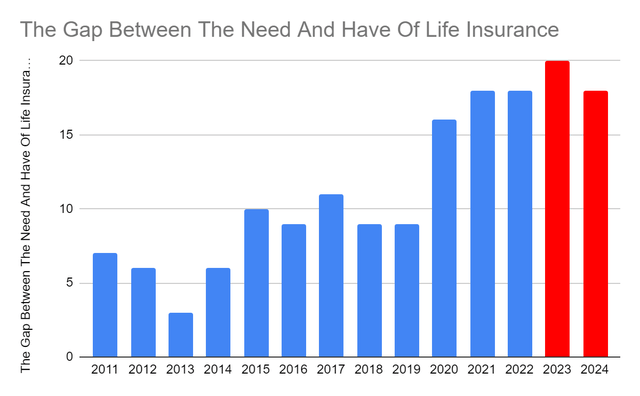

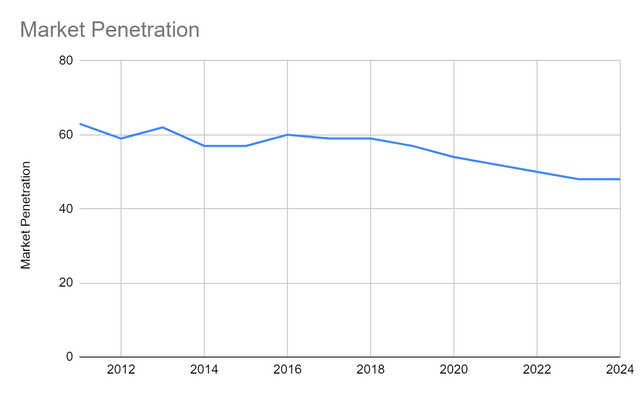

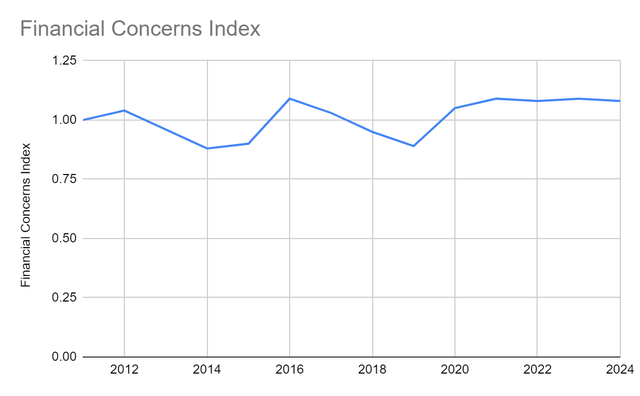

Furthermore, LNC has extra challenges and alternatives to face and take. The hole between the insurance coverage ‘want and have’ stays large. It was in a lull in 2015-2019. We are able to attribute it to the US financial restoration and earnings stability after the Nice Recession. However in 2020, the 9% hole nearly doubled to 16%. Immediately, it’s even greater at 18%, twice as a lot as pre-pandemic ranges. It reveals that extra folks want insurance coverage and annuities with a low policyholder inhabitants. Recessionary headwinds, pandemic fears, decrease buying energy, and overestimation of prices are the contributors. Additionally, the market penetration of life insurance coverage and annuities stays low at 50%. The identical elements will be attributed to the lower in percentages. However, it reveals alternatives for the insurance coverage business to seize extra prospects. I count on a extra sluggish business hole and penetration in 2023 for a similar purpose. However rebounds could happen in 2024 as I count on a extra manageable economic system. Even higher, there may be elevated monetary literacy and considerations throughout all demographics. Earlier than the pandemic, the monetary concern index was solely 0.89-0.95. Immediately, it’s approach greater at 1.08%, exhibiting the elevated significance of insurance coverage and annuities. Regardless of being a large, Lincoln nonetheless has a protracted solution to go however extra alternatives to grab. It may well seize extra policyholders.

The Hole Between The Want And Have Of Life Insurance coverage (LIMRA And Life Occurs)

Market Penetration (LIMRA And Life Occurs)

Monetary Considerations Index (LIMRA And Life Occurs)

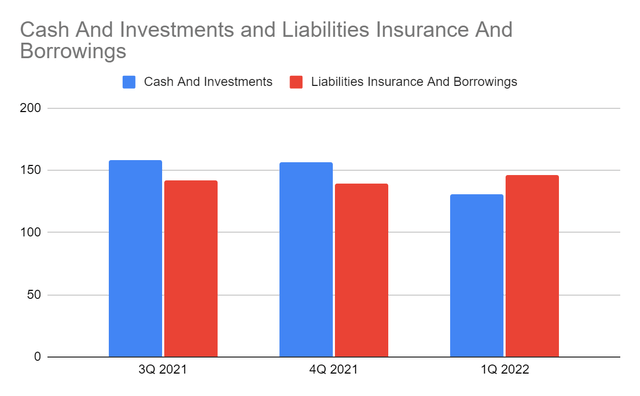

On a lighter be aware, LNC is well-capitalized, with a stellar Stability Sheet as its cornerstone. It may well stand up to market blows and take alternatives to its benefit. Money and investments stay excessive regardless of the decrease worth as a result of decrease funding yields and better claims reserves. They comprise 41% of the entire belongings, permitting LNC to cowl liabilities. It nonetheless has huge funds to cowl insurance coverage claims and borrowings. Money inflows are additionally constructive, exhibiting spectacular working capital administration. Certainly, it is aware of tips on how to alter to sudden adjustments, such because the lapsed habits of policyholders. It stays a liquid and sustainable firm. However once more, progress could keep hammered because the economic system has but to bounce again.

Money And Investments And Borrowings (MarketWatch)

Inventory Worth Evaluation

The inventory worth of Lincoln Nationwide Company stays hammered after shedding about half its worth. I imagine it’s adherent to fundamentals, pushed by the 3Q efficiency. At $29.17, it has already been reduce by 57% from the beginning worth. With the present PE Ratio of 9x, the worth seems affordable. If we multiply it by the NASDAQ EPS estimates, the goal worth will stay low. Its present PTBV of 4.5x is greater than thrice as a lot because the 1.4x common within the earlier years. If we use this to search out the goal worth, the worth will drop by over thrice.

In the meantime, dividends are enticing for a dividend investor. They’ve a yield of 5.9%, which is approach higher than the S&P 500 common of 1.84%. They’re well-covered by ample money reserves. Additionally, the money inflows are sufficient to suffice dividend funds.

The EV/Income of two.4x agrees with the reasonability of the inventory worth. If we alter the inventory worth to the utmost best ratio of 3x, the very best worth it could actually attain is $35.58. The EV/EBITDA Ratio adheres to it. After utilizing the (EV-Web Debt)/Frequent Shares Excellent, the derived worth will increase to $36.95. Given all these, we will see contrasting findings as we delve into the earnings and intrinsic worth of LNC. Nonetheless, we additionally need to take its potential to repurchase shares. Given its reducing tangible guide worth and customary shares, share buybacks could contract. It could be one other driving pressure to hinder the inventory worth from bouncing again. We are able to now observe the adherence of the inventory worth to earnings and intrinsic worth. And even when it stays well-capitalized, it should nonetheless rebuild its capital to its 400% RBC ratio goal. Till then, shares could keep at a reduction, and market confidence might not be regained. Regardless of all these, I’m optimistic in regards to the capability of the corporate to rebound. The basics of the corporate and the untapped market potential can stimulate additional progress. They could repay as soon as the economic system turns into extra steady. The present inventory worth could also be entry level to make a place.

Backside Line

Lincoln Nationwide Company faces hammered progress and should take a while to rebound. Regardless of this, it stays a sustainable and well-capitalized firm. It should nonetheless enhance to rebuild its capital base goal and regain market confidence. Nevertheless it has ample reserves to suffice the enterprise and borrowings. Additionally, dividends have spectacular yields and are well-covered by the steady FCF. Though there’s extra to a inventory than dividends, LNC is one thing to carry on to. The inventory worth is an effective cut price, given its capability to bounce again and the market alternatives. The advice is that Lincoln Nationwide Company is a purchase.