Brandon Bell/Getty Photographs Information

Introduction

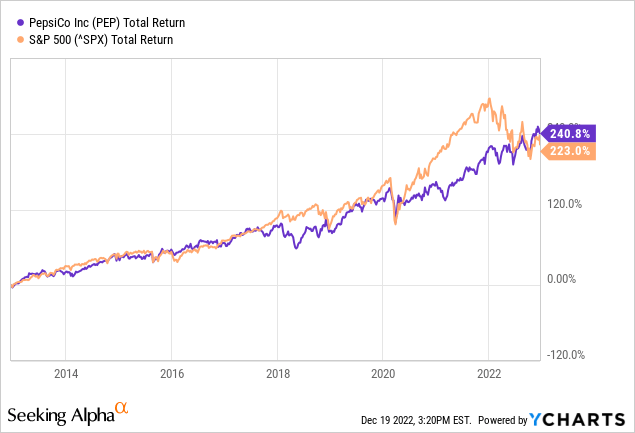

PepsiCo, Inc. (NASDAQ:PEP) is the mother or father firm of well-known manufacturers similar to Lay’s, Pepsi, Tropicana, Quaker and the like. The share value rose consistent with the S&P 500 (SP500), it caused a 13% common return over the previous decade. The inventory remains to be rising strongly, whereas the S&P500 and the Nasdaq are in a declining market.

It is usually noteworthy that the inventory’s volatility may be very low. PepsiCo’s beta is 0.59 (5-year month-to-month foundation), which implies the inventory trades with decrease volatility than the overall market.

The patron staples sector is a defensive sector. Firms like PepsiCo can move on larger uncooked materials prices because of inflation of their merchandise. This enables them to keep up their revenue margins. PepsiCo looks like the proper inventory, however its valuation is simply too excessive to justify its progress. Which might traders reasonably select: PepsiCo with a fiscal 2024 ahead earnings yield of three.7% (rising 8% on common over the following few years), or a authorities bond with 5% yield?

Third Quarter Earnings Have been Sturdy

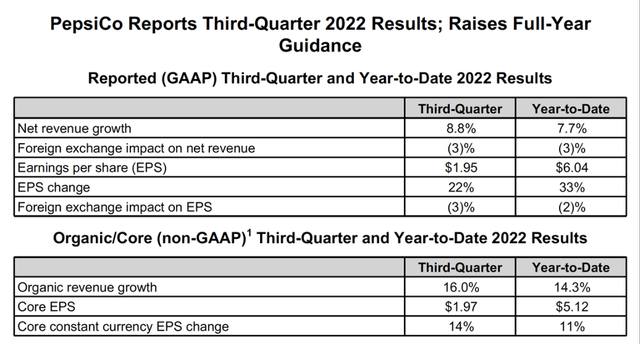

PepsiCo, Inc. third-quarter outcomes had been sturdy, with internet gross sales progress of 8.8% year-over-year, and earnings per change elevated 22% over the identical interval.

Monetary highlights (PepsiCo’s third quarter 2022 outcomes)

Revenues in North America grew strongly. Frito-Lay gross sales elevated 20%, Quaker Meals gross sales elevated 15%, and PepsiCo gross sales elevated 4% in North America. The rise in income was primarily because of value will increase, whereas volumes fell 2% and 4%, respectively. PepsiCo beverage volumes had been up 1% in North America.

Revenues in Latin America additionally rose sharply, by 20%, as comfort meals and beverage volumes elevated 3% and seven%, respectively. Volumes in Europe declined probably the most of any area, whereas revenues had been up 1% and working revenue was up 28%.

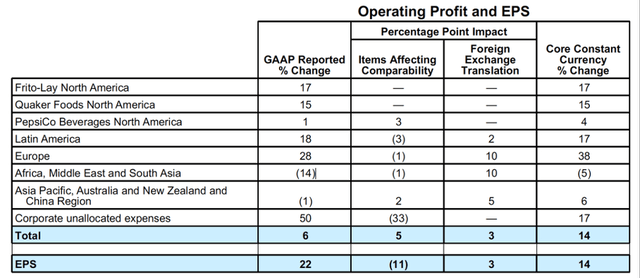

Working revenue and EPS (Pepsi’s 3Q22 outcomes)

PepsiCo raised its full-year outcomes to 12% natural gross sales progress and 10% core earnings per share progress at fixed forex.

On Dec. 5, Pepsi introduced that it’ll scale back its workforce by lots of to simplify the group and function extra effectively, affecting its headquarters in Chicago and Plano, Texas. The workforce discount may very well be the start of extra layoffs to comply with. This could lead to decrease prices and elevated income within the brief time period.

Dividends, Share Repurchases and Debt Maturities

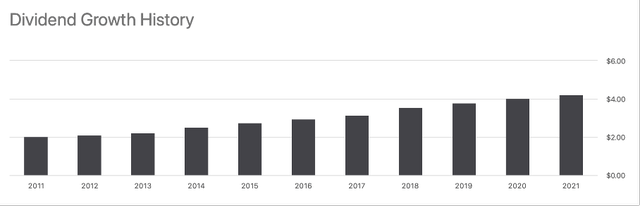

PepsiCo’s administration may be very shareholder-friendly, because the dividend has been rising steadily for years. Over the previous ten years, the dividend per share has elevated a median of seven.7% per yr. At present, the dividend is listed at $4.60, representing a dividend yield of two.6%.

PepsiCo’s dividend progress historical past (PepsiCo’s Ticker Web page on Searching for Alpha)

The rise in dividends per share is principally because of share repurchases, as free money move has remained roughly flat over the previous 4 years.

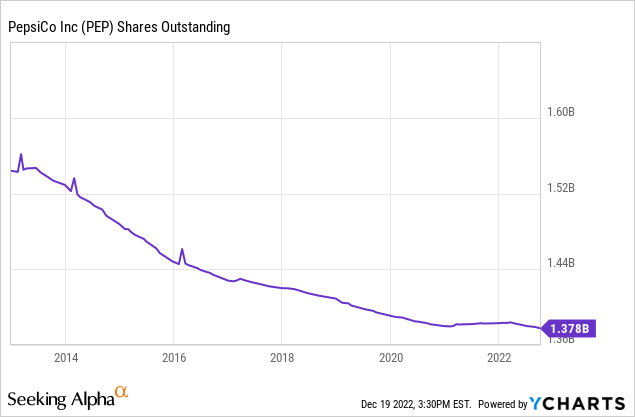

The numerous share repurchase program led to a discount in shares excellent from 1.5 billion in 2013 to 1.4 billion at present (a median discount of 1% per yr).

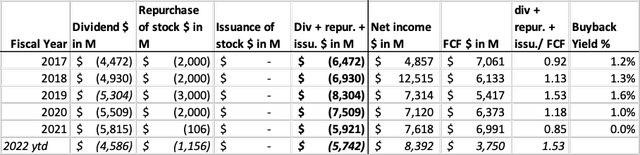

PepsiCo partially funds its dividend distribution plus share repurchases with money on its stability sheet. PepsiCo returns money generously to shareholders. Between 2018 and 2020, it returned more money to shareholders than got here in in free money move. At present, the corporate has returned 53% more money to traders than it generated in free money move. This isn’t sustainable for the long run as internet debt will increase.

PepsiCo’s money move highlights (SEC and writer’s personal calculation)

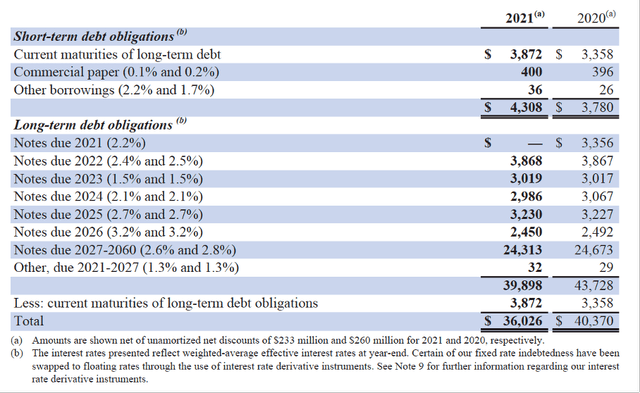

In 2017, internet debt was $28.7B. At present, internet debt elevated to $32.9B. Trying on the debt maturities, we see that the corporate has a whole lot of debt excellent between 2027 and 2060. That’s far sooner or later. That is excellent news because the Fed goals to boost rates of interest to five%; newly issued bonds have larger coupon charges.

By way of 2027, PepsiCo has a complete of about $11.7 billion in debt excellent (assuming the debt maturing in 2022 is already paid off). The debt will both be refinanced at a better rate of interest or PepsiCo will proceed with out refinancing.

I anticipate PepsiCo is not going to refinance its debt, however will scale back the dimensions of its share buybacks, which impacts dividend per share progress. Nonetheless, PepsiCo continues to develop strongly in gross sales and earnings, so I do not anticipate any short-term issues with their dividend per share progress.

The desk under reveals PepsiCo’s excellent debt maturities as of January 2022.

PepsiCo’s debt maturities (2021 annual report)

Valuation Appears to be like Costly

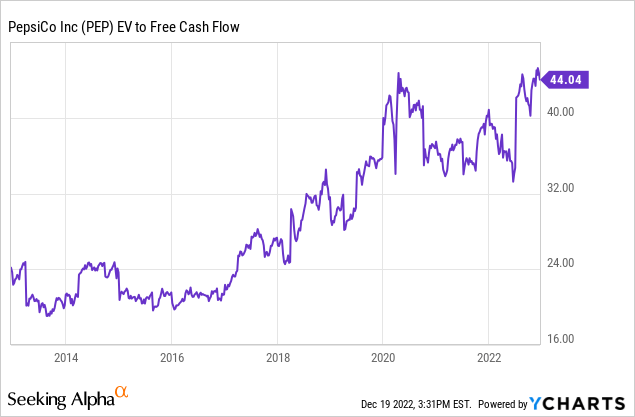

Lastly, we come to the inventory’s valuation. Since PepsiCo distributes dividends and has a sturdy share repurchase program, I select the EV to Free Money Move (“FCF”). The chart reveals a surprisingly excessive EV/FCF ratio of 44, almost an all-time excessive over the previous 10 years.

But this isn’t significant; The Coca-Cola Firm (KO) had an EV to FCF ratio that was additionally 44 in 2018. Shortly thereafter, the inventory fell about 15%, after which it recovered. Coca Cola’s EV to FCF ratio fell to 22 early this yr; Coca Cola’s free money move has elevated 85% from 2018 up to now.

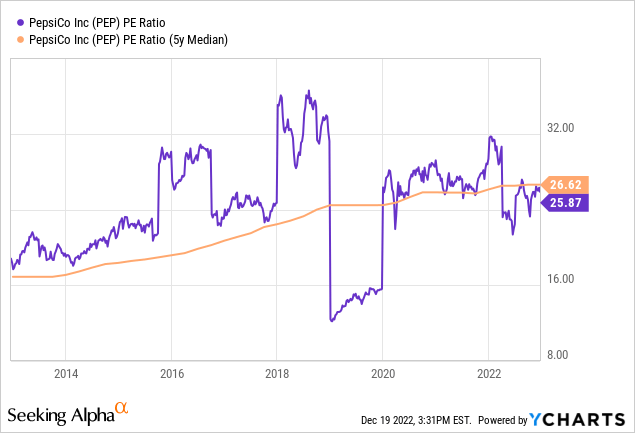

One other method to acquire perception within the inventory’s valuation is to chart the P/E ratio. PepsiCo’s GAAP PE ratio is 26 and is barely under the 5-year common of 27. The inventory is extra expensively valued than the S&P500, with a P/E ratio of 21. Nonetheless, income and earnings expectations for the approaching years are sturdy.

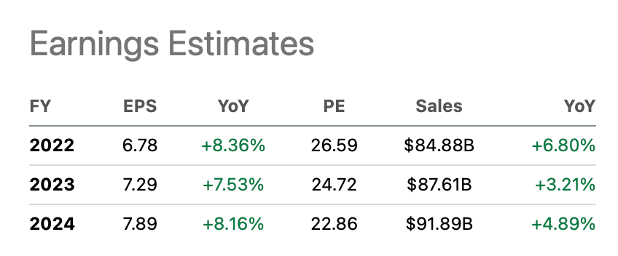

18 analysts on the Searching for Alpha PepsiCo ticker web page have raised their earnings estimates for the approaching years. Revenues are anticipated to extend by a median of 4% per yr and earnings per share by a median of 8%. These are sturdy progress figures.

The ahead P/E ratio quotes 22.9 for fiscal yr 2024. If we multiply the 5-year common P/E ratio of 27 by the earnings per share for fiscal yr 2024 of $7.89, we arrive at a share value of $213. The present share value is $181, giving a median annual progress price of 8.5%. Added to that’s the dividend yield of two.6%, bringing the full pre-tax return to 11.1% yearly.

PepsiCo’s earnings estimates (Searching for Alpha PEP ticker web page)

The anticipated complete return of 11.1% might sound rosy, however the P/E ratio of 27 for fiscal yr 2024 is extraordinarily excessive. The earnings yield is the inverse of the P/E ratio (=3.7%). The issue is that the Fed goals to boost rates of interest to five%. What would traders reasonably select: PepsiCo with a fiscal 2024 ahead earnings yield of three.7% (rising 8% on common over the following few years), or a authorities bond with 5% yield? The inventory presently appears very expensively valued and is a maintain.

Conclusion

PepsiCo is the mother or father firm of well-known manufacturers similar to Lay’s, Pepsi, Tropicana, Quaker and the like. The inventory is a low-beta inventory, which means its volatility is decrease than that of the overall market.

The corporate confirmed sturdy income and earnings per share progress of 8.8% and 22% within the third quarter of 2022. Firms like PepsiCo can move on larger uncooked materials prices because of inflation of their merchandise. The corporate raised its full-year outlook and introduced cost-cutting measures to enhance short-term profitability.

PepsiCo distributes dividends and repurchases shares. Dividends per share have elevated a median of seven.7% yearly over the previous decade. PepsiCo funds dividend distribution plus share repurchases partly with money on its stability sheet. That’s not sustainable in the long term, as a result of the debt pile is rising. The Fed goals to boost rates of interest, so I anticipate PepsiCo to cut back the quantity of share repurchases within the close to future.

The valuation of the inventory appears costly when trying on the ratio of EV to free money move and the P/E ratio. 18 analysts have revised upward earnings estimates for the following few years. If we multiply anticipated earnings per share for fiscal yr 2024 by PepsiCo’s 5-year common P/E ratio (and embody dividends), we arrive at an annual pre-tax return of 11.1%. However PepsiCo’s common P/E ratio of 27 is sort of excessive, particularly because the Fed seeks to hike rates of interest to five%. Traders might select: PepsiCo with a fiscal 2024 ahead earnings yield of three.7% (rising 8% on common over the following few years), or a authorities bond with a 5% yield? PepsiCo, Inc. inventory presently seems expensively valued and is a maintain.