Peter Fleming/iStock Editorial by way of Getty Photos

Expensive readers/followers,

On this article, I am going to check out SSE plc (OTCPK:SSEZY), a UK-based power firm with operations in manufacturing, distribution, and metering. The corporate has strong operations in key, conservative geographies throughout UK and Eire. The parts making up SSE have been Scottish Hydro-Electrical and Southern Electrical, they usually merged again in 1998.

I will actually have a look at what we have now right here, to see what we will think about a horny valuation for a utility out of the UK.

SSE PLC – Presenting an awesome utility

I like investing in utilities. After all of the articles I’ve accomplished on US ones like Pinnacle West (PNW), and European ones like Fortum (OTCPK:FOJCF), E.ON (OTCPK:EONGY), and Enel (OTCPK:ENLAY), this should not be a shock to anybody. I personal inventory in plenty of them as a result of I like proudly owning essentially essential companies that do not present plenty of seasonal, or financial volatility.

Whereas utilities will be risky, their underlying asset-based money flows are sometimes very protected.

You additionally know (or will know after this text), that utilities are sometimes regulated, and the best way that utilities work with progress is both via non-regulated service-based add-on companies.

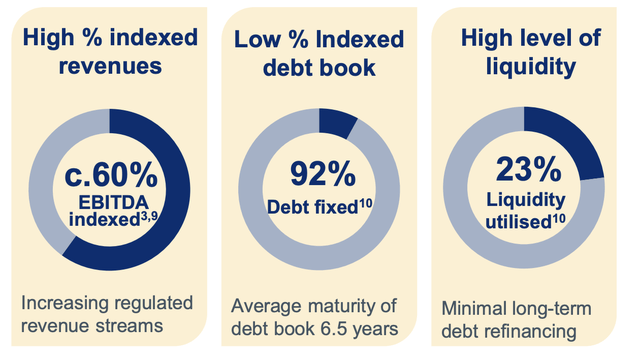

Now, SSE is a little more atypical right here, in that 60% of its enterprise is listed and controlled – and that’s growing – however 40% is not, which is larger than another typical utilities I cowl. Nevertheless, the corporate has a really low charge of debt, and excessive liquidity, and what debt it does have is mounted with maturities of over 6 years.

SSE PLC IR (SSE PLC IR)

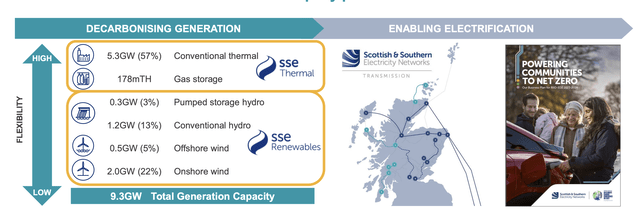

The corporate carries a formidable renewables portfolio of round 4 GW, which is usually hydro and wind. The corporate has a versatile Thermal portfolio of round 5.3GW, and owns round 40% of the UK’s onshore underground fuel storage capability.

SSE has excessive conservative safeties, coming in at BBB+ from S&P International. It has a market cap of $22B, and the present native yield based mostly on the GBX ticker SSE is 5.27%, which is on the upper aspect on a worldwide comparative foundation. The corporate’s leverage is lower than 4.6x internet/EBITDA. The corporate additionally has a Baa1 from Moody’s

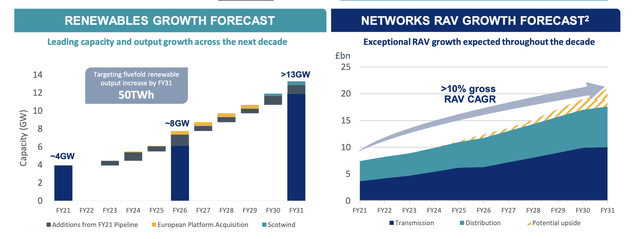

Like seemingly all utilities right here, SSE is engaged on a net-zero carbon program. It has a totally funded funding plan that encompasses CapEx of £12.5B, which is slit 40% into networks, 40% into renewables, 20% thermal, and a few minor sums in others. Present plans are to extend the renewables pipeline with onshore and offshore wind property, in addition to extra hydro property, whereas additionally pushing extra investments into electrical energy networks.

The corporate at present expects a longer-term pattern of round 7-10% EPS CAGR.

SSE IR (SSE IR)

The corporate’s renewable pipeline is anticipating to see vital progress or the following 9-10 years, greater than doubling the present obtainable capability via each natural and inorganic progress/acquisitions.

SSE PLC IR (SSE PLC IR)

So, the best way the enterprise operates is that SSE thermal operates a sequence of UK energy stations, whereas the SSE renewables arm builds, operates, and maintains each onshore and offshore wind farms throughout the UK and Eire. Its hydro operations are present in Scotland, and it has some JVs with NA corporations that function multi-fuel energy stations in West Yorkshire

The corporate’s present outcomes are wonderful – and we have now outcomes from late November, which make them very current total. The present EU and worldwide power markets are advanced, and all transferring in the identical course, which means internet zero. The corporate’s combine could be very resilient – check out these renewables specifics and the place they’re situated.

SSE IR (SSE IR)

Some great benefits of the corporate are well-known – and there are extra we will have a look at. The corporate has a really low total comparative price of debt – under 4%, and the near-term maturities are completely minimal with nothing above 10% till 2027 and past.

The corporate’s renewable hedges present secure earnings to the corporate – and secure safety for the customers, whereas possession in storage infrastructure hedges provide throughout vital instances – reminiscent of the present one we’re in proper now.

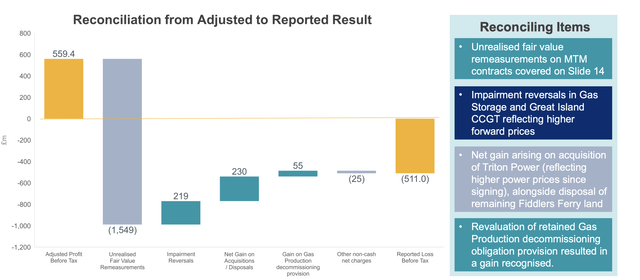

The present developments for 1H22, which go to September of 2023, present a major improve in adjusted working revenue, and revenue numbers. Nevertheless, we’re getting into SSE at a time when the corporate is adjusting with large unrealistic honest worth measurement as a result of M&A of Triton Energy, reflecting the upper energy costs, in addition to disposal of a number of the land that was nonetheless in firm possession. These changes are at present large, and that is why we should always look extra at normalized ranges and over time, than at particular present outcomes.

SSE IR (SSE IR)

The corporate has hedged wind and hydro costs all the best way till 2025 – the unhedged costs for these do not come into play till 2026 and past, at which level we’ll seemingly be in a really totally different scenario.

The corporate is additional working to divest its minorities and non-core property in a sequence of disposals.

Straight segment-specific outcomes for 1H23 have been strong. Thermal noticed a major earnings improve on account of costs, which resulted in nearly a 3x larger YoY. adjusted EBIT, however there have been additionally some outage losses. The corporate’s renewable outcomes would have been very strong, however on account of a hedge buyback, truly got here in barely under YoY. The hedge was a pricey buy-back on account of climate results and building delays.

Distribution outcomes have been, as you would possibly anticipate, way more secure with slight progress, however nonetheless under par in accordance with the corporate’s personal expectations on account of some timing points. There additionally hasn’t been a restoration on the extent that the corporate would have anticipated – as of but. Transmission is as secure as distribution, with larger revenues, however the identical under-recovery and value will increase. For now, the P&Ls are weighted up by top-line gross sales outcomes and outcomes are strong – however we’ll need to maintain a detailed eye on these margins.

Firm steerage is strong. The corporate expects its HY23 outcomes to come back according to earlier expectations, with an EPS steerage of a minimum of 120p, or £1.2, with a progress expectation after that of about 7-10% CAGR till 2026, based mostly on elevated property and enlargement and higher earnings.

The dividend, in the meantime, can be anticipated to remain secure. We have now an interim dividend of 29p, with the FY23 dividend persevering with to focus on that RPI will increase – and we already know the FY24 dividend, as a result of the corporate has communicated and rebased it to 60p, or £0.6/share.

SSE, subsequently, joins different corporations like E.ON and Enel in “guaranteeing” a payout and dividend for the following few years, growing readability and what you might on the very least get on your cash. That 60p dividend signifies that the yield for the corporate is round 3.5% on the present share worth – which is on the decrease aspect, nevertheless it’s rising after that.

So the dividend is the rationale you do not see me pushing SSE forward of Enel or E.ON. All of those corporations have good dividends that the businesses have primarily signed on for – besides within the case of SSE, for business-related causes, the corporate has capped the scrip dividend at 25%. The best alternative? Effectively, time will inform – it is by far essentially the most conservative, perhaps needlessly so.

Nevertheless it provides us good visibility of the present developments.

The present dividend is nearer to 5-6%.

However in a yr, it’s going to be minimize to three.5% based mostly on right now’s share worth. Know that.

Let us take a look at the corporate valuation.

SSE’s valuation

So, SSE performs the sector with different utilities in Europe. Its closest friends, as issues stand, are corporations you understand that I cowl. I imply companies like Iberdrola (OTCPK:IBDRY), E.ON, Enel, Discussion board, Orsted (DNNGY), and others. The problem is that this can be a checklist filled with high quality corporations – and I truly personal inventory in most of them greater than I do in SSE. SSE is not by any measure massively dearer, or cheaper than the typical right here. Its NTM native P/E is round 12.5x – Fortum and Enel are cheaper, however Iberdrola is dearer right here. The corporate’s income multiples, gross sales multiples, and EBITDA multiples are nothing actually wonderful by way of undervaluation from a peer common both.

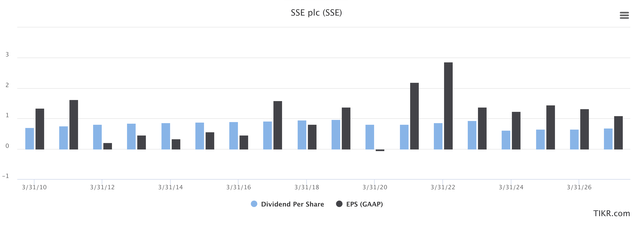

For historicals, the corporate has an attention-grabbing historical past based mostly on a number of structural adjustments which have influenced how the corporate’s EPS and the dividend has appeared over time. In contrast to a number of the different utilities, This firm has been on a considerably worrying dividend trajectory for the previous 10+ years.

We have had dividends which are slowly rising, solely to then abruptly get minimize – and develop again, however by no means once more to the extent we have seen earlier than. Once more, there are explanations for this. The corporate’s P&L’s are rocky and risky, with GAAP EPS developments that go up and down and are anticipated to proceed to take action.

SSE PLC (TIKR.com/S&P International)

Investor developments are nothing to jot down residence about both – most likely a superb purpose why they do not showcase the 10-year whole RoRs right here, as a result of they don’t seem to be excellent.

SSE Valuation (TIKR.com/S&P International)

Lower than 2% per yr – ouch.

However there are upsides. I might say that analysts and forecasts listed here are 100% right – the long run for SSE will not be as risky and poor as we have seen in some years. I imagine in future stability for the corporate, and with that stability comes some allowances for valuation. In the intervening time, a 2-4% progress in earnings is the least we will justify, I believe (nearly half the corporate’s personal forecast), and contemplating the corporate’s low price of capital and its wonderful capital planning, credit standing and safeties, there’s something to “get right here”, on the proper worth.

After I say that the upside on this utility is “respectable”, I imply the next.

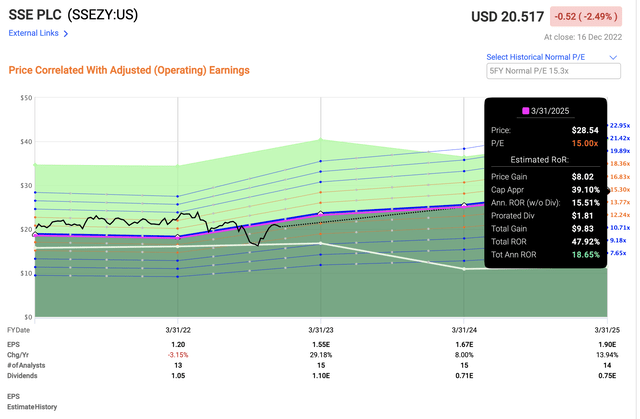

SSE sometimes trades at a mean of 12.9x P/E for the 10-15-year interval. It is at present at 12.7x for the native. The ADR is nearer to 14.5x on the 10-year, and the SSEZY ADR is at present at 14.2x – so that you see, there is perhaps a slight upside right here, which along with anticipated EPS progress, turns into respectable.

At present developments, the corporate is predicted to ship a good EPS progress after dividend normalization.

So what you would want to do is settle for the rebalanced dividend, in addition to have a look at the potential upside to a 14-15x P/E, which for SSEZY right here may very well be as excessive as 15-18% per yr if these circumstances materialize.

SSE Upside ADR (F.A.S.T Graphs)

After I began my place in SSE, the corporate was cheaper – not by a lot, however cheaper. I might say that the businesses Iberdrola, Enel, and E.ON are “higher” by way of stability and dividend reliability, and forecastability. That is additionally why I am absolutely invested in Enel, nearly in Iberdrola, and have positions in E.ON.

Nevertheless, SSE is one purchase I might make above Fortum right now – which is why my SSE is greater than Fortum right now.

SSE is not the very best utility on the block right now. However for me, it serves the aim of FX Diversification on account of GBP publicity, and a strong return, regardless of it being decrease than 5% yield subsequent yr.

That is “ok” as I see it, and for that purpose, I give this firm my stamp of “BUY”.

Present analyst avenue targets are as follows. 18 analysts observe the corporate at a £16.5 to £24 vary, with a mean PT of £19.71. Observe that even the bottom is near the present share worth. Out of 18 analysts, 15 are at a “BUY” or equal ranking, with a mean upside of 16.7%.

I might go considerably decrease than this, and cap the discounted PT at round £18/share for the native.

Right here is my thesis for SSE.

Thesis

SSE is an effective utility out of the UK and Eire. It is not class-leading, and there are higher gamers on the market – nevertheless it’s nonetheless a strong asset portfolio with a 3.5-5% yield. There are far worse locations to place your cash than the businesses that warmth folks’s properties and supply for his or her primary wants, and that is why my utility investments are at present one of many greatest ones I make. I might say that SSE is a “BUY” at something under a 15x P/E on a normalized foundation for the ADR, and 13.5x for the native London ticker. My present native PT for SSE involves £18/share.

Bear in mind, I am all about:

Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime. If the corporate goes properly past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1. If the corporate does not go into overvaluation however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is essentially protected/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low-cost. This firm has a sensible upside that’s excessive sufficient, based mostly on earnings progress or a number of enlargement/reversion.

The corporate subsequently fulfills all however ONE of my funding standards, which to me is nice sufficient.