Basic Evaluation of JSW Metal: Metal is without doubt one of the most vital commodities that touches our lives day by day. Whether or not it’s the automobile we use, the home that we stay in, or the water bottle we use, there’s some type of metal in it.

Nonetheless, metal doesn’t happen naturally. It’s made by combining coke and iron at very excessive temperatures. This requires fairly an funding. The metal business principally has outdated and big firms which are concerned within the making of metal.

Basic Evaluation Of JSW Metal

On this article, we will do a elementary evaluation of JSW Metal, one of many greatest metal firms in India. We’ll check out the business that it features in, the enterprise that it does, its financials, and extra. Preserve studying to search out out

Trade Dynamics

The metal business is cyclical. Demand and provide pull the strings relating to the value of this commodity. When the demand is strong, steelmakers broaden their capability. And when the demand ticks decrease, they incur appreciable losses because of large investments.

As well as, manufacturing dynamics hassle the business. Coking coal and iron ore are key uncooked supplies that go into making metal. India is sort of completely depending on imports of coking coal from Australia. Each time there’s a disruption within the provide or a rise within the value of coking coal, the price of manufacturing shoots up.

The gamers face cut-throat competitors as their merchandise have available substitutes. Because of this, margins evaporate into skinny air as steelmakers can not cross on the price to clients.

Then again, India is residence to the fifth-highest reserves of iron ore on the planet. The truth is, it exports some to different international locations. Nonetheless, not all steelmakers have the sources to mine it. Big gamers like Tata Metal and JSW Metal have a bonus right here. They’ll mine the ore and management their enter prices to a sure extent.

India is the second-largest producer of crude metal. China comes first, and it accounts for over 50% of the world’s manufacturing. Most of their factories are immediately owned by the Chinese language state. Subsequently they’ve entry to low-cost credit score. Because of this they will export metal at low costs and hurt the home markets in numerous international locations.

These international locations, together with India, can impose import duties. Nonetheless, China can nonetheless handle to have an enormous impression and push international costs decrease. Generally home producers must slash costs and even promote metal beneath their value.

Trade Overview

India’s completed metal consumption is anticipated to extend to 230 MT by 2030-31 from 133.596 MT in FY22, based on an IBEF report. On the similar time, the manufacturing is anticipated to exceed 300 million tonnes by 2030–2031. The business is witnessing a consolidation of gamers, resulting in funding by entities from different sectors. The truth is, it’s attracting international gamers to enter the market.

The federal government has taken numerous initiatives to spice up the sector. This consists of the Nationwide Metal coverage 2017 and permitting 100% International Direct Funding (FDI) within the metal sector beneath the automated route. The Indian metallurgical industries attracted FDI inflows of US$ 17.1 billion between April 2000-March 2022, based on the info launched by the Division for Promotion of Trade and Inside Commerce (DPIIT).

The federal government introduced pointers for the accepted specialty metal production-linked incentive (PLI) scheme in October 2021. It had allotted a finances of ₹ 6,322 crores for disbursals to be made to candidates who’re chosen beneath the scheme.

In regards to the Firm

JSW Metal is the flagship firm of the JSW group. It’s a main built-in metal producer and one of many fastest-growing firms in India, with a presence in additional than 100 international locations. It was the primary firm to fabricate high-strength and superior high-end metal merchandise for its automotive segments.

The corporate presents quite a lot of metal merchandise like Sizzling Rolled, Chilly Rolled, Naked & Pre-painted Galvanized & Galvalume, TMT Rebars, Wire Rods, and Particular Metal.

Manufacturing Services

JSW Metal had a single manufacturing facility within the early ’80s and it has grown to turn out to be India’s main built-in metal firm. It has a steel-making capability of 28 MTPA in India and the USA, together with capacities beneath joint management. A brand new capability is to be commissioned at Dolvi this 12 months. Its manufacturing facility in Vijaynagar, Karnataka is the most important single-location steel-producing facility in India with a capability of 12 MTPA.

Initiatives

JSW metal has labored on initiatives with organizations like SoftBank Photo voltaic Challenge, Yamuna Expressway, Mumbai monorail, Devoted freight hall Delhi Mumbai, Chennai Metro, Mumbai Worldwide Airport, Grand Hyatt Innovation Centre, ITC Grand, ISRO and extra.

Distribution & Clientele

JSW Metal’s Distribution community consists of greater than 11,000 unique and non-exclusive stores. It has export footprints in over 100 international locations throughout 5 continents and a powerful presence in South and West India. Amber Enterprises, Bajaj Group, Bharat Heavy Electricals Ltd, Cummins India, Drive Motors, Havells India, Mahindra Intertrade, and Tata Motors are a few of its purchasers.

Opponents & Moat

JSW Metal’s opponents embody Tata Metal, Metal Authority of India, APL Apollo Tubes, Ratnamani Metals & Tubes, Tata Metal BSL and Jindal Stainless.

JSW Metal has a facility strategically positioned within the iron ore-rich Bellary Hospet belt in Karnataka. It’s well-connected to each Goa and Chennai ports. It’s the solely metal plant in India with pair cross-technology and twin-stand reversible chilly rolling mills. Its versatile operations permit for product combine as per market necessities.

On this article on Basic Evaluation of JSW Metal, we took a take a look at the business dynamics business overview, and details about the corporate, its manufacturing services, initiatives, distribution community, opponents and moat. Allow us to now check out its financials.

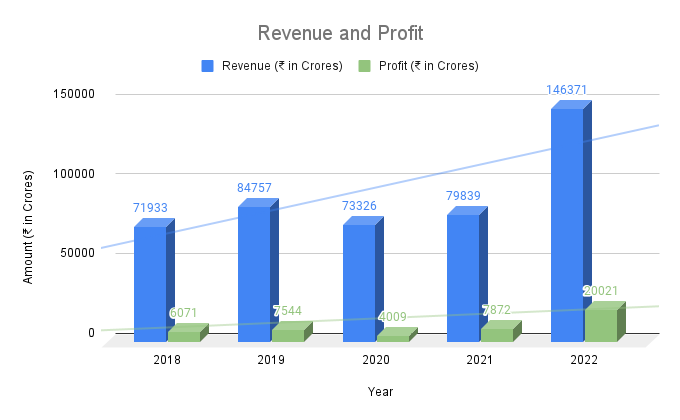

Income & Profitability

JSW Steels’ income and profitability present an rising development over a interval of 5 years. There was a lower in its income and profitability in 2020 and 2021 due to the pandemic.

There was an financial slowdown in India even earlier than the pandemic. The car business and the actual property business that are among the many main shoppers of metal weren’t doing nice. The pandemic added to the woes. Nonetheless, India turned the online exporter of metal to China after the preliminary months of the pandemic. This was unlikely, however it gave a much-needed enhance to the business.

Metal exports accounted for greater than ₹ 19,267 crores whereas imports had been at ₹ 16,369 crores by December of 2021. As soon as the lockdowns eased in India, the demand began gaining momentum.

There may be an rising development within the firm’s web revenue margin, from 8.44% in 2018 (FY19) to 13.68% in 2022 (FY23). Its income grew at a 3-year CAGR of 19.98% and its web revenue grew at a 3-year CAGR of 39.34%.

Current developments

The Finance Ministry not too long ago scrapped the 15% export tax that it had beforehand imposed on a number of metal merchandise to enhance its availability within the home market and tame costs. This comes as an enormous aid to the gamers within the metal business. As well as, the responsibility on high-grade iron ore has been minimize from 50% to 30% whereas utterly withdrawn for decrease grades beneath 58% iron content material.

Nonetheless, the notification mentioned that coking coal and ferronickel will entice an import responsibility of two.5%, whereas coke and semi-coke will entice a 5% import responsibility.

Seshagiri Rao, joint MD, JSW Metal & Group CFO commented on this improvement. He mentioned that will probably be an enormous sentimental booster to revive home metal demand significantly when the worldwide metal demand is on a steep decline.

Basic Evaluation Of JSW Metal – Key Metrics

JSW Metal is a large-cap firm with a market capitalization of ₹ 1,71,247.98 crores as of November 21, 2022. It has earnings per share of ₹31.36, indicating that ₹ 31.36 is allotted to each particular person share of the inventory. A excessive EPS signifies good profitability. It has a great dividend yield of two.37%.

Its shares had been buying and selling at a price-to-equity ratio (P/E) of twenty-two.59 which is larger than the business P/E. This might imply that the corporate’s inventory is overvalued or its traders predict excessive progress sooner or later.

Return Ratios

The corporate has a wonderful return on fairness of 35.62%. This means that the corporate generates larger earnings on the fairness that’s employed within the firm. Additional, it has a return on capital employed of 27.34%, indicating that it generates ₹ 27.34 for each ₹ 100 that’s deployed in its enterprise.

Debt

JSW Metal has a barely excessive debt-to-equity ratio of 1.04, nevertheless, firms on this business are capital-intensive and normally have excessive money owed. On the brilliant aspect, it has a high-interest protection ratio of 6.8, indicating its capability to comfortably present for curiosity funds.

Liquidity

JSW Metal has a present ratio of 1.14. This means that its present property are larger than its present liabilities. In a latest company presentation, it talked about that it has money and money equivalents of ₹ 13,291 crores.

Credit score Scores

Amongst Worldwide credit standing companies, Moody’s has a Ba1 (Secure outlook) score and Fitch has a BB (Secure Outlook) score. Home credit standing company CARE Scores, ICRA, and IndRA have an AA score indicating a secure outlook.

Shareholding

The corporate’s promoters maintain a forty five.19% stake in it. Retail traders maintain a 34.30%% stake, FIIs maintain 10.75% and DIIs maintain 9.76%. Nonetheless, there’s a pledge of 15.21 towards the promoters’ holding. On the brilliant aspect, its promoters have been rising their stake within the firm. Their holding elevated from 44.09% in September 2021 to 45.19% in September 2022.

JSW Metal is planning to speculate ₹ 47,457 crores (US$ 6.36 billion) to extend Vijayanagar’s metal plant capability by 5 MTPA and set up a mining infrastructure in Odisha, within the subsequent three years, ranging from June 2021. For the subsequent part of progress, it plans to realize 37.5 MTPA metal capability by FY25. Additional, it’s taking a look at realizing full advantages from 5mt Dolvi-II enlargement, BPSL enlargement, and expanded downstream capacities.

In Closing

On this article, we did a elementary evaluation of JSW Metal. We took a take a look at the corporate’s business dynamics business overview, and details about the corporate, its manufacturing services, initiatives, distribution community, opponents, and moat. Then we took a take a look at the corporate’s income, earnings, key metrics, and future plans.

That’s all for this text of us. We hope to see you round. Completely satisfied investing till subsequent time!

Now you can get the most recent updates within the inventory market on Commerce Brains Information and you may as well use our Commerce Brains Screener to search out the very best shares.

Begin Your Monetary Studying Journey

Need to study Inventory Market and different Monetary Merchandise? Ensure to take a look at, FinGrad, the training initiative by Commerce Brains. Click on right here to Register at present to Begin your 3-Day FREE Path. And don’t miss out on the Introductory Provide!!