Inventory markets suffered by means of a tough yr in 2022. Main indices just like the S&P 500 (SPY) and NASDAQ 100 had been down double digits throughout the board. But this straightforward technique confirmed a stable double-digit acquire by taking worthwhile positions in each good AND dangerous shares. One of these balanced strategy will seemingly proceed to outperform in what seems wish to be a troublesome 2023. Learn on under to search out out extra.

shutterstock.com – StockNews

2022 is shaping as much as finish as one of many worst years for shares in fairly some time. At the moment the S&P 500 is down about 15% thus far this yr. The NASDAQ has suffered a worse destiny whereas the Dow Jones Industrial Common has fared slightly higher.

Regardless, shares are typically down throughout the board.

What occurs in 2023 is anybody’s guess. The current rise in rates of interest together with slowing earnings progress will seemingly be a headwind for fairness costs, particularly within the first a part of subsequent yr.

The common annual return for shares (S&P 500) over the previous 150 years is roughly 9%, together with dividends. With out dividends it drops to simply over 4.5%. Inflation shaves about half off these returns.

A return again in direction of extra historic returns might look fairly good within the coming 12 months. Inventory choice shall be crucial to performing properly in 2023, somewhat than simply shopping for any inventory -which was seemingly the best way to straightforward features up till 2022.

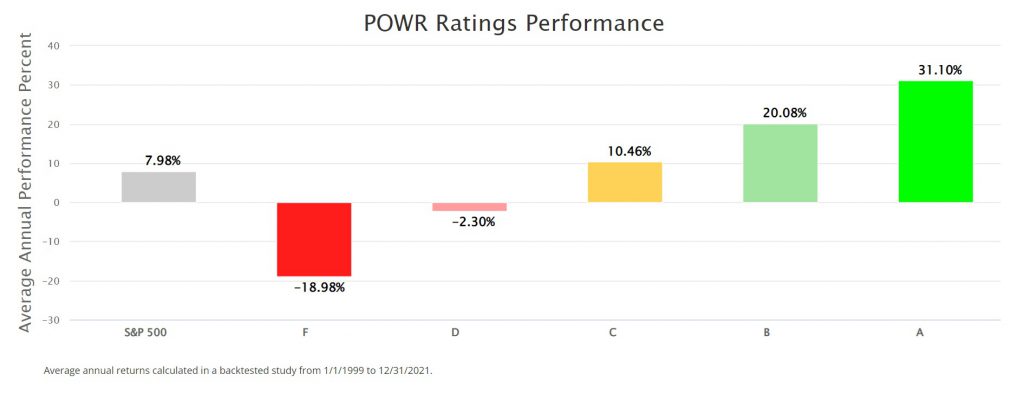

The POWR Rankings can definitely present traders and merchants with a transparent edge when choosing shares. Over the previous 20 plus years, the A rated Robust Buys names within the POWR Rankings have outperformed the S&P 500 by over 23% yearly.

Whereas this degree of outperformance is actually eye-opening, promoting the F rated Robust Promote names would have overwhelmed the general market by a good higher diploma.

These lowest rated shares truly fell nearly 19% per yr whereas the S&P 500 gained almost 8% yearly. This equates to an underperformance of roughly 27%! This implies the dangerous shares fell slightly bit worse than the nice shares rose compared to the S&P 500.

Many traders and merchants are usually not snug shorting shares. Limitless potential loss will increase the concern issue much more. Fortunately, the choices market offers an outlined danger resolution to revenue from a pullback in shares. Places.

Proudly owning a put choice provides you the flexibility to promote a inventory at a particular value earlier than a sure time. The put purchaser pays cash upfront – referred to as the choice premium.

As an illustration, shopping for the Apple March $125 put at $5.20 provides the customer the best to promote AAPL inventory at $125 till expiration on 3/17/2023 (the third Friday in March).

The value of those bearish put choices will enhance because the inventory goes down and reduce if the inventory rises. Probably the most in danger is $520 ($5.20 premium x 100)

Shopping for put choices is an easy, however very efficient method, to take a bearish stance on dangerous shares.

It’s a technique we use efficiently day in and time out within the POWR Choices Portfolio to take a extra balanced strategy by combining bearish places with bullish calls. It labored very properly in 2022 and will definitely be a part of our buying and selling toolbox in 2023.

A current instance of utilizing the facility of the POWR scores for bearish put performs might assist shed some mild on issues. Beneath is a current commerce completed within the POWR Choices Portfolio on Lithium Americas (LAC) inventory.

LAC was an F rated -Robust Promote – inventory in an F rated business. Ranked nearly on the backside within the business group as properly, so just about the worst of the worst.

Shares, nonetheless, had rallied sharply (over 30%) off the lows close to $21 in mid-October earlier than working into severe resistance on the $29 space. The inventory was getting overbought on a technical foundation.

LAC additionally had a key reversal day, buying and selling as much as new current highs solely to reverse and shut again close to the lows of the day.

This arrange ideally for a bearish put buy. It additionally helped that implied volatility (IV) was solely on the 19Th percentile-meaning choice costs had been properly under common. The POWR Choices Portfolio purchased the February $30 places for $5.00, or $500 per put choice bought.

That proved to be the highest for LAC inventory because it fell again 25% from the $8 space to simply underneath $21. Shares, nonetheless, had been now oversold and nearing the help space round $21. POWR Choices closed out the put play at $8.50 for a acquire of 70%. Commerce took nearly a month from begin to end.

Notice how whereas the inventory dropped 25%, the choices gained nearly thrice that quantity. Highlights the facility of leverage that choices have. Plus, the loss is all the time restricted at most to the entire premium paid—on this case $500.

This marked the third consecutive time that POWR Choices was capable of notice a acquire on LAC places primarily based on a loss in LAC inventory value.

The flexibility to say nimble and be extra impartial served the POWR Choices Portfolio properly in 2022. Our buying and selling confirmed stable features over the previous 12 months versus deep losses for shares in that very same time-frame.

Utilizing the POWR scores to assist us choose the very best of the very best shares to be bullish on with name buys, together with the worst of the worst shares to be bearish on with put purchases, will seemingly proceed to show worthwhile in 2023.

What To Do Subsequent?

Whereas the ideas behind choices buying and selling and put shopping for are less complicated than most individuals notice, making use of these ideas on the proper time to persistently make successful trades isn’t any straightforward activity.

The answer is to let me do the exhausting give you the results you want…by beginning a no-obligation 30 day trial to my POWR Choices publication.

With the quantitative muscle of the POWR Rankings as my start line, I’ve uncovered among the greatest choices trades within the robust markets we’ve skilled this yr.

That’s as a result of I benefit from each name and put choices trades to generate massive features in ALL market situations.

In truth, since launching the service in November 2021 I’ve delivered a market beating +65.44% return for my subscribers.

The excellent news is that you could turn into a subscriber at present for simply $1.

Throughout your $1 trial you’ll get full entry to the present portfolio, my weekly market insights and each commerce alert by textual content & electronic mail.

Plus, I’ll be including the subsequent 2 thrilling choices trades when the market opens this Tuesday morning (closed Monday for Vacation), so begin your trial at present so that you don’t miss out!

About POWR Choices & $1 Trial >>

Right here’s to good buying and selling! Tim BiggamEditor, POWR Choices Publication

Tim BiggamEditor, POWR Choices Publication

SPY shares had been buying and selling at $375.38 per share on Thursday afternoon, down $10.85 (-2.81%). Yr-to-date, SPY has declined -19.68%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

Extra…

The submit Revenue Selecting the Worst Shares… appeared first on StockNews.com